What Is Tax Rebate In Income Tax Verkko A tax rebate also known as tax refund is a refund of tax that has already been paid by a person This refunds the tax that has usually been already paid in advance or in excess and for which the citizen is now eligible for a refund Comparison between Income Tax Deduction Rebate and Relief Image Courtesy Image Courtesy Image Courtesy

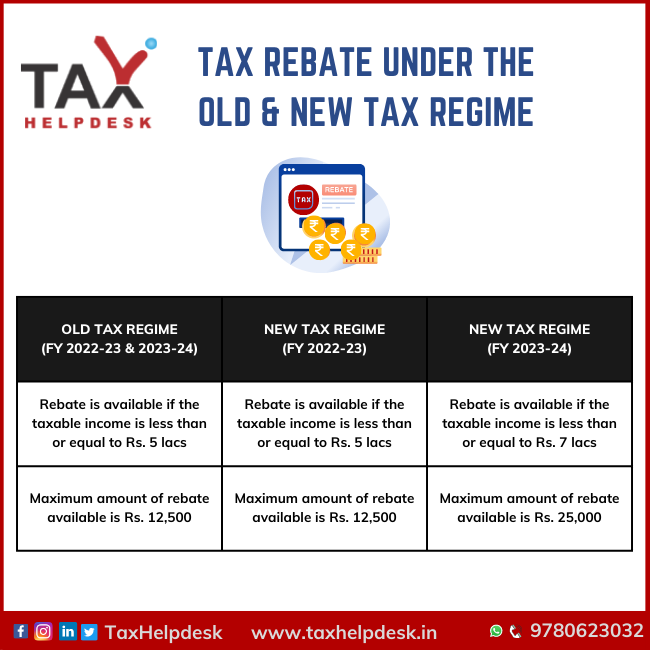

Verkko Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 2 500 is available for taxpayers with an annual income of up to Rs 3 5 lakh as applicable to the financial year 2018 19 This limit has been increased to Rs 12 500 for the taxpayers with an annual Verkko 27 kes 228 k 2020 nbsp 0183 32 Here is the 3 most common Term and language use in Tax planning Tax Exemption Tax Deduction and Tax Rebate here you will learn difference between them

What Is Tax Rebate In Income Tax

What Is Tax Rebate In Income Tax

https://static.imoney.my/articles/wp-content/uploads/2021/03/12012330/claim-tax-rebate.jpg

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Verkko 11 huhtik 2023 nbsp 0183 32 Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to reduce their total tax liability It is the reduction in the amount of tax to the taxpayers by the government in order to promote savings and investment Verkko 25 toukok 2021 nbsp 0183 32 Income Tax rebate is the refund or reduction amount offered by the Income Tax when you file your taxes All you need to know about an Income Tax Rebate In the most generic terms an income tax rebate is a refund that you as a taxpayer are eligible for in case the taxes you pay exceed your liability

Verkko So on taxable income of Rs 5 lakh the income tax outgo is nil Tax calculation after claiming deductions and exemptions Total Taxable income Rs 5 lakh Income Tax A Up to Rs 2 5 lakh 0 5 on Rs 2 5 lakh Rs 5 lakh Rs 2 5 lakh Rs 12 500 Rebate under section 87A B Rs 12 500 Verkko United States According to the Internal Revenue Service 77 of tax returns filed in 2004 resulted in a refund check with the average refund check being 2 100 1 In 2011 the average tax refund was 2 913 2 3 For the 2017 tax year the average refund was 2 035 and for 2018 it was 8 less at 1 865 reflecting the changes brought by

Download What Is Tax Rebate In Income Tax

More picture related to What Is Tax Rebate In Income Tax

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

https://www.newburytoday.co.uk/_media/img/XWR3OS658K3AP70S77XD.jpg

Verkko 16 elok 2022 nbsp 0183 32 What is Tax Rebate A tax rebate refers to a tax refund when the actual tax liability is lower than the taxes paid For example if your actual tax liability is Rs 40 000 but your employer has deducted a TDS of Rs 50 000 you are eligible for a refund of Rs 10 000 The rules and regulations pertaining to tax rebates are specified in Verkko TAX REBATE definition 1 an amount of money that is paid back to you if you have paid too much tax 2 a reduction in Learn more

Verkko What is Income Tax Rebate A tax rebate is a refund that you are eligible for if the taxes paid by you exceed your tax liability For example if your tax liability is amounting to Rs 20 000 but if the bank pays the Government a TDS that amounts to Rs 30 000 on your behalf you are eligible for a tax rebate Verkko Tax rebate is a refund on taxes when the tax liability is less than the taxes the individual has paid Taxpayers usually get a refund on their income tax if they have paid more than what they owe The tax refund money is given back at the end of the financial year

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

http://www.differencebetween.info/difference-between-income-tax-dedu…

Verkko A tax rebate also known as tax refund is a refund of tax that has already been paid by a person This refunds the tax that has usually been already paid in advance or in excess and for which the citizen is now eligible for a refund Comparison between Income Tax Deduction Rebate and Relief Image Courtesy Image Courtesy Image Courtesy

https://cleartax.in/s/difference-between-tax-exemption-vs-tax...

Verkko Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 2 500 is available for taxpayers with an annual income of up to Rs 3 5 lakh as applicable to the financial year 2018 19 This limit has been increased to Rs 12 500 for the taxpayers with an annual

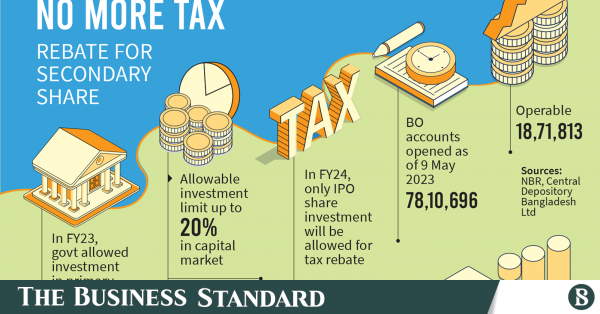

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

How To Get Tax Rebate In Income Tax

What Is A Tax Rebate How To Claim It

How To Deal With An Income Tax Notice Wealthzi

How To Calculate Tax Rebate In Income Tax Of Bangladesh

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Small Business Hub Taxes Invoice2go

Tax Rebate Under The Old New Tax Regime

Income Tax Rebate Astonishingceiyrs

What Is Tax Rebate In Income Tax - Verkko 25 toukok 2021 nbsp 0183 32 Income Tax rebate is the refund or reduction amount offered by the Income Tax when you file your taxes All you need to know about an Income Tax Rebate In the most generic terms an income tax rebate is a refund that you as a taxpayer are eligible for in case the taxes you pay exceed your liability