What Is The 20 Business Income Deduction The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly

Your taxable income multiplied by 20 minus net capital gains and qualified dividends In total your QBI can t be more than 20 of your taxable income The Qualified Business Income Deduction QBI is a recently established tax deduction allowing businesses to deduct as much as 20 of their earnings This

What Is The 20 Business Income Deduction

What Is The 20 Business Income Deduction

https://assets-global.website-files.com/5ed52ac6f155f416aff0df23/5f04ecd48c50607613625b23_records-p-2000.jpeg

What Is The 20 Pass Through Deduction QBID Who Qualifies

https://fitsmallbusiness.com/wp-content/uploads/2023/05/FeaturedImage_Qualifying-Business-Income-Deduction.jpg

Complete Guide Of Section 199A Qualified Business Income Deduction

http://theusualstuff.com/wp-content/uploads/2018/09/Section-199A-Deductions-Qualified-Business-Income-Easy-Guide-min-768x427.jpg

The Qualified Business Income QBI Deduction is a tax deduction for pass through entities Learn if your business qualifies for the QBI deduction of up to 20 The qualified business income QBI deduction also known as Section 199A allows owners of pass through businesses to claim a tax deduction worth up to 20 percent of their qualified business income It was

This deduction created by the 2017 Tax Cuts and Jobs Act allows non corporate taxpayers to deduct up to 20 of their qualified business income QBI plus up to 20 of qualified The qualified business income deduction QBI allows small business owners to take a 20 deduction based on the net income of their business in addition to regular business deductions

Download What Is The 20 Business Income Deduction

More picture related to What Is The 20 Business Income Deduction

Qualified Business Income Deduction Facts And Tips 2022 Lawrina

https://lawrina.org/wp-content/uploads/2022/05/Depositphotos_402184434_XL-scaled.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Roughly 97 of your clients have taxable income under the threshold So their deduction is equal to 20 of domestic qualified business income from a pass through With the QBI deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax but not

The qualifying business income deduction QBID lets pass through entities take 20 off of their qualified business income QBI it essentially reduces the amount The brand new qualified business income deduction allows some small business owners to deduct 20 percent of their qualified business income on their

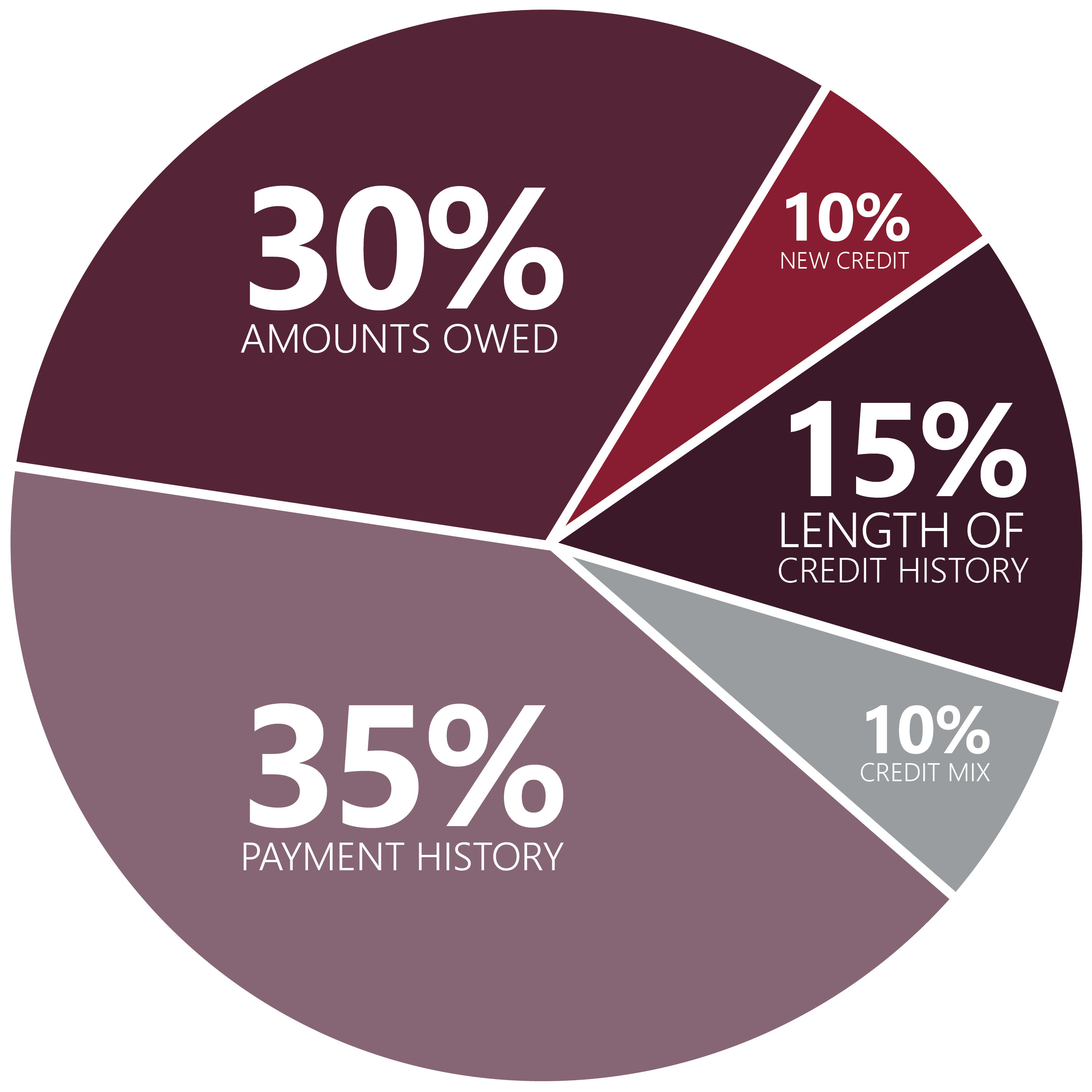

The 20 10 Rule For Debt Management

https://insights.masterworks.com/wp-content/uploads/2022/11/iStock-1355229268.jpg

How To Fully Maximize Your 1099 Tax Deductions Steady

https://assets-global.website-files.com/621d1e290115eacf9e46133d/624df23abd74b382b485fa82_Maximize_Tax_Deductions-01.png

https://www.irs.gov/newsroom/qualified-business...

The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly

https://blog.turbotax.intuit.com/taxes-101/qbi-deduction-83650

Your taxable income multiplied by 20 minus net capital gains and qualified dividends In total your QBI can t be more than 20 of your taxable income

Qualified Business Income Deduction

The 20 10 Rule For Debt Management

What Is The Credit Mix And How Does It Affect Your Credit Score

How The Qualified Business Income Deduction Can Impact Your Return

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

The Section 199A Qualified Business Income Deduction

The Section 199A Qualified Business Income Deduction

Income Tax Deductions For The FY 2019 20 ComparePolicy

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

What Is Qualified Business Income Deduction Fundyourpurpose

What Is The 20 Business Income Deduction - The qualified business income QBI deduction is a tax break that lets business owners with pass through income write off up to 20 of their taxable income