What Is The 2024 Homeowner Tax Rebate Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit Published November 13 2023 The Biden 15k First Time Homebuyer Tax Credit Explained The First Time Homebuyer Act is a congressional bill to grant first time home buyers up to 15 000 in refundable federal tax credits The program s official name is H R 2863 and is known by several names which we use interchangeably throughout this review

What Is The 2024 Homeowner Tax Rebate

What Is The 2024 Homeowner Tax Rebate

https://www.pdffiller.com/preview/585/571/585571881/large.png

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

What HVAC Tax Incentives Are Available for Homeowners Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between January 1 2023 and December 31 2034 The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older This program is supported by funds from the Pennsylvania Lottery and gaming How Much Money Can I Receive

For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line 10 Tax Breaks You Have as a New Homebuyer Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market

Download What Is The 2024 Homeowner Tax Rebate

More picture related to What Is The 2024 Homeowner Tax Rebate

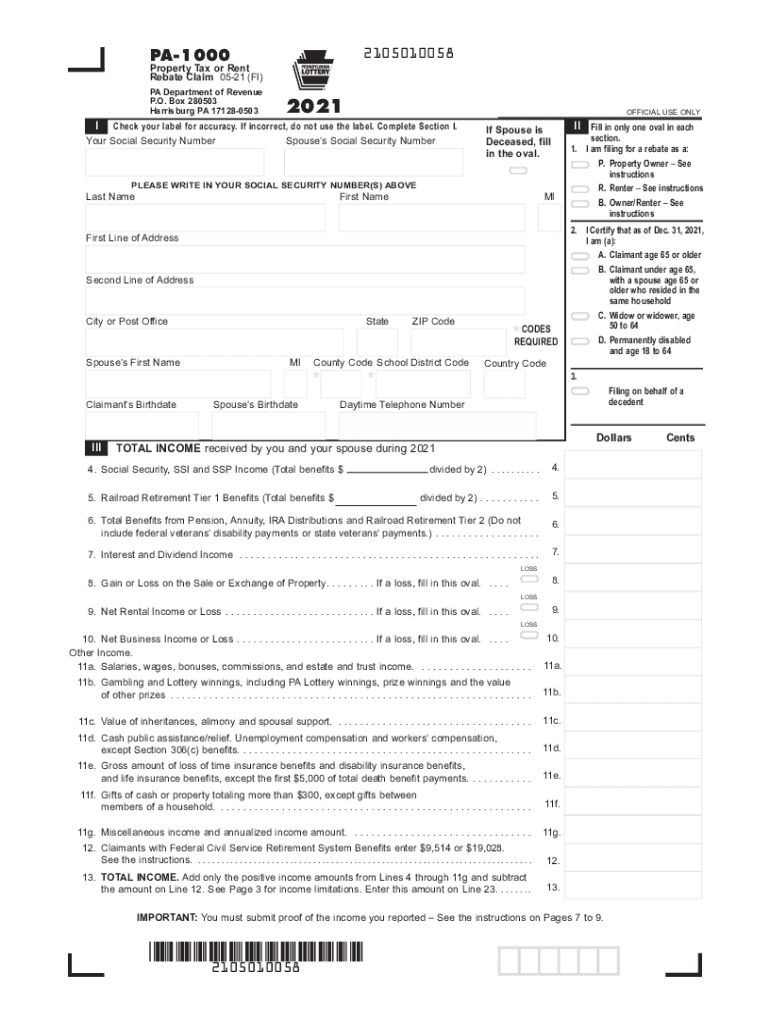

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Low income Homeowner Tax Rebate Applications Now Available The Rhino Times Of Greensboro

https://www.rhinotimes.com/wp-content/uploads/2023/04/house-arrow-e1681753550696-1280x640.png

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married

The rebates are available to households earning less than 150 of the area s median income If your household income falls Below 80 of the area median income you can claim rebates for 100 of 1 Angi Task Type HVAC Estimation Fee None Free Estimates Response Time Excellent Get Free Estimates

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax Rebate

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tolminator 2024

Tolminator 2024

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

What Is The 2024 Homeowner Tax Rebate - 10 Tax Breaks You Have as a New Homebuyer Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market