What Is The Additional 50000 Tax Benefit Under Nps Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C

An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over and above Story outline The existing Section 80CCE allows individuals to deduct up to Rs 1 5 lakh from their gross total income before calculating tax payable if this Rs 1 5 lakh is

What Is The Additional 50000 Tax Benefit Under Nps

What Is The Additional 50000 Tax Benefit Under Nps

https://savemoremoney.in/wp-content/uploads/2022/04/Tax-Benefit-On-NPS.png

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Income Tax Savings How To Claim Additional 50 000 Deduction

https://updatedyou.com/wp-content/uploads/2020/01/1-547.jpg

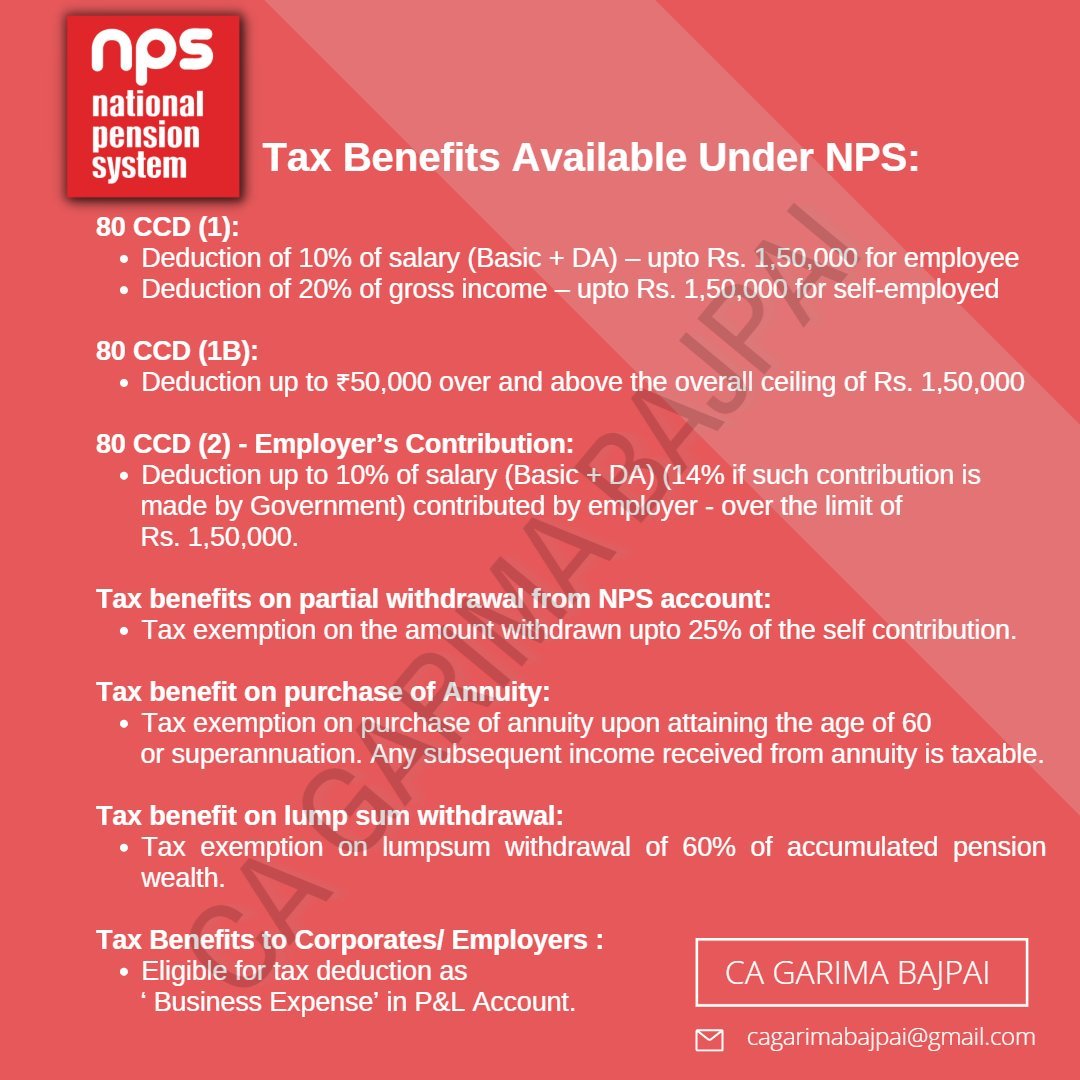

Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in Contributions towards Tier 1 accounts of the NPS are eligible for 50 000 income tax deduction under Section 80CCD 1B NPS helps get extra income tax deduction beyond 1 5 lakh

Under this section one can claim deductions for investment in NPS for up to Rs 50 000 This is over and above the Section 80C deductions In other words one can claim a tax deduction of up to Rs 2 Tax saving investment date for FY2019 20 extended up to July 31 2020 Contribution towards NPS tier 1 account allows you to claim an exclusive deduction

Download What Is The Additional 50000 Tax Benefit Under Nps

More picture related to What Is The Additional 50000 Tax Benefit Under Nps

NPS Tax Benefit Save Additional Rs 50 000 Tax Above 1 5 Lakh Limit

https://imgk.timesnownews.com/story/Tax_recovery_getty.jpg

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

Attention Tax Payers ONLY 3 DAYS LEFT To Plan Your Taxes For The FY

https://pbs.twimg.com/media/FsXIhN7akAEJ_4b.jpg

NPS tax benefits Currently investment of up to 50 000 in a financial year in Tier I NPS account qualifies for tax deduction under Section 80CCD 1B of the Investing in NPS becomes more rewarding with the exclusive additional tax benefit of Rs 50 000 according to the Pension Fund Regulatory and Development Authority PFRDA

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS The additional deduction of Rs 50 000 under Section 80CCD 1B is Additional Contribution NPS subscribers also have an option to claim further tax benefits on investments up to INR 50 000 which is over and above the limit of INR 1 5 lakh under section

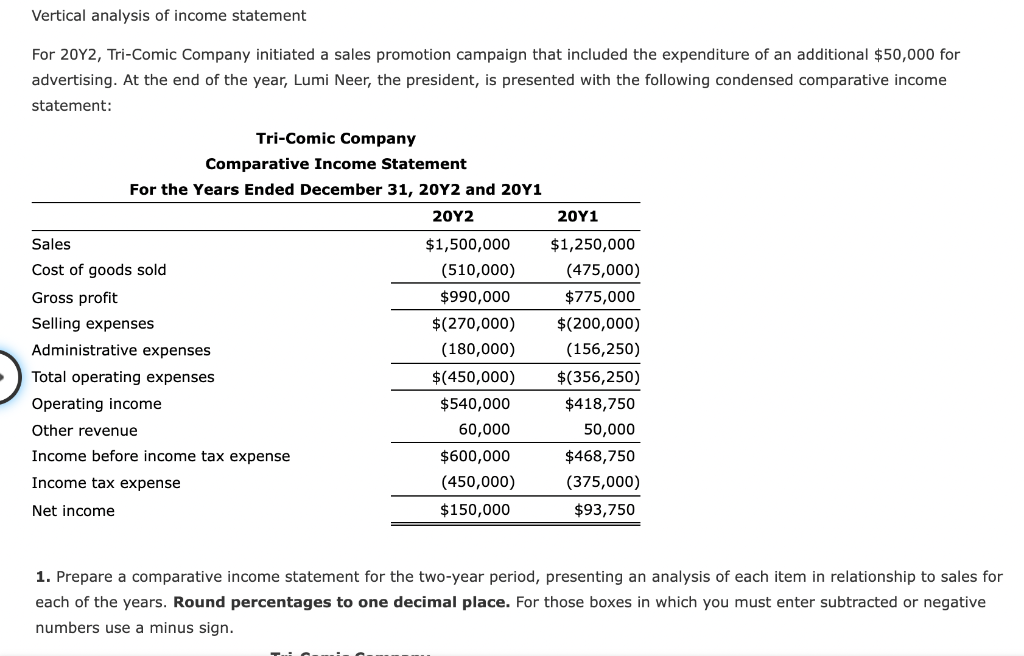

Solved Vertical Analysis Of Income Statement For 20Y2 Chegg

https://media.cheggcdn.com/media/f2f/f2f1e421-134a-4cf9-92f2-1cda605cb8a3/phpjce1KF

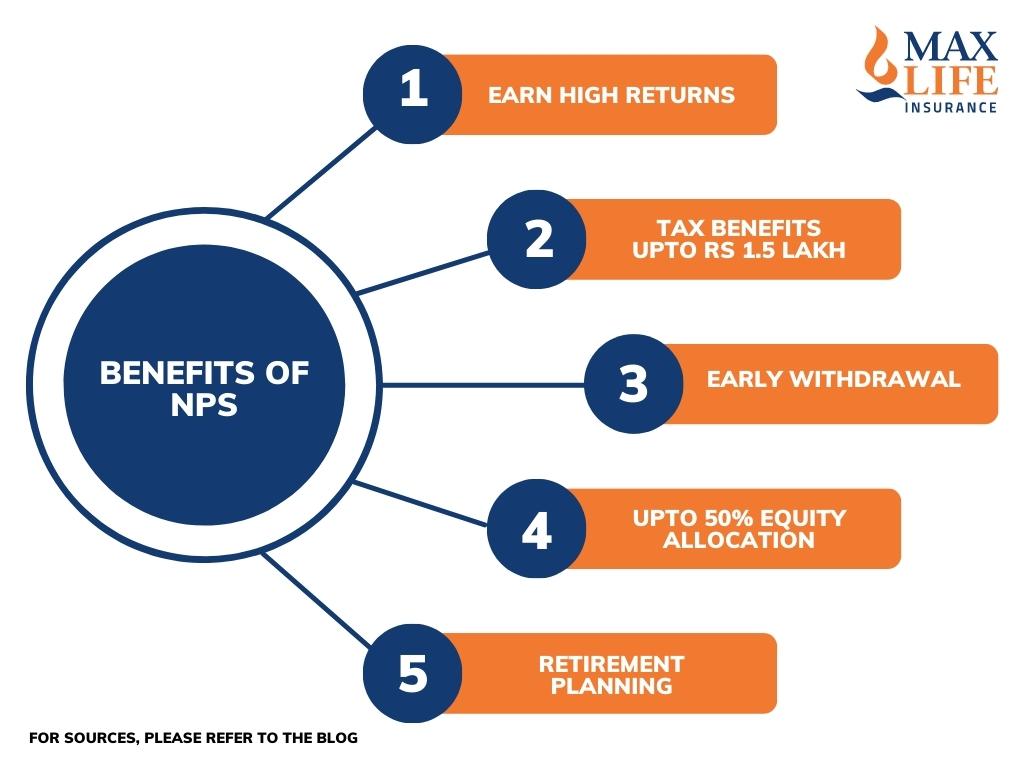

National Pension Scheme Know About NPS Returns Types Benefits

https://www.maxlifeinsurance.com/content/dam/neo/images/NPS/Benefits-of-NPS-Infographic-v2.jpg

https://economictimes.indiatimes.com/wealt…

Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C

https://npscra.nsdl.co.in/tax-benefits-under-nps.php

An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over and above

Should You Invest Rs 50 000 In NPS For The Extra Tax Benefit

Solved Vertical Analysis Of Income Statement For 20Y2 Chegg

NPS How To Avail Tax Benefits On Income Tax Under NPS Trend Talky

Income Tax Saving NPS How To Claim Tax Benefit For Additional Rs

NPS Tax Benefit And How To Withdraw It Times Of India

NPS Gets You Extra 50 000 Income Tax Deduction How To Claim Mint

NPS Gets You Extra 50 000 Income Tax Deduction How To Claim Mint

Which Is Better Save Tax By Investing 50 000 In NPS Or 35 000 In

You Can Claim This NPS Tax Benefit Under The New Income Tax Rates

NPS Tax Benefit U s 80CCD 1 80CCD 2 And 80CCD 1B

What Is The Additional 50000 Tax Benefit Under Nps - Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in