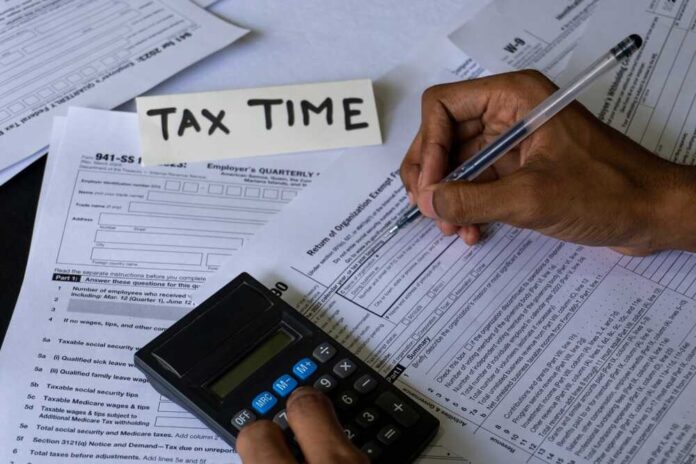

What Is The Business Tax Break The government always passes laws concerning a tax break and how it functions Any alterations in tax laws regarding federal income tax Federal Income Tax Federal income tax is the tax system in the United States and is levied and governed by Internal Revenue Services IRS It helps determine the tax charged on the income earned by individuals

7 Earned income tax credit This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges The chairmen of the top tax policy committees in Congress announced a bipartisan agreement on Jan 16 2024 to enhance the child tax credit and revive a variety of tax breaks for businesses

What Is The Business Tax Break

What Is The Business Tax Break

https://image.cnbcfm.com/api/v1/image/104910009-GettyImages-896192830.jpg?v=1532563709&w=1920&h=1080

Small Businesses Get A Permanent Tax Break On Buying Equipment The

https://static01.nyt.com/images/2015/12/24/business/24ebiz-web2/24ebiz-web2-superJumbo.jpg?quality=75&auto=webp

Tax Advice And Consulting Quadrant

https://www.quadrantaccounting.ca/wp-content/uploads/2021/12/tax-1.jpg

A tax break is a popular way to refer to federal tax credits and deductions because they help you get a break on how much you owe in taxes A tax credit reduces how much you owe in taxes and may be delivered in the form of a tax refund The bill would incrementally raise the amount of the credit available as a refund increasing it to 1 800 for 2023 tax returns 1 900 for the following year and 2 000 for 2025 tax returns

WASHINGTON Jan 31 Reuters The U S House of Representatives on Wednesday overwhelmingly approved a 78 billion bipartisan package of tax breaks for businesses and low income families What is a tax break A tax break is a rule law or policy that can lower your tax bill whether it be a tax deduction tax credit tax exclusion or tax exemption The most common are tax credits and tax deductions Put simply a tax deduction decreases your taxable income while a tax credit cuts your tax bill directly dollar for dollar

Download What Is The Business Tax Break

More picture related to What Is The Business Tax Break

20 000 Small Business Tax Break Explained Integrity One

https://www.integrityclients.com.au/wp-content/uploads/2017/05/small-business-tax-break-1.jpg

Is Your Business Getting A Tax Break Raila Associates P C

https://railapc.com/wp-content/uploads/2013/11/Business-Image.jpg

Why The Small Business Tax Break Could Pay For Itself

https://images.theconversation.com/files/83336/original/image-20150529-12358-fp0lb8.jpg?ixlib=rb-1.1.0&q=45&auto=format&w=1356&h=668&fit=crop

The limit on interest expense deductions has been fine tuned in 2023 to align with the income generation a shift aimed at balanced tax liability So if you borrowed money to grow your bakery and Catie Dull NPR The House has overwhelmingly approved a bipartisan tax package that pairs a temporary expansion of the child tax credit with business tax breaks and credits to develop more low

While the total spending on business tax credits and tax breaks over the 10 year period of 2024 to 2033 would be about 32 8 billion according to an analysis by the Congressional Budget Office There are many tax breaks for small businesses and you probably want to know all of them to help reduce your tax liability and keep more money in your small business We ve pared down 23 of the highest impact and most generous tax deductions and write offs available to small businesses in 2024 examples of each and how much

Reduce Your Business Taxes With Section 179 Business Funding Working

https://www.mulliganfunding.com/wp-content/uploads/2017/12/NO-TEXT-FEATURED_179-TAX-BREAK.png

Business Tax Certification

https://uploads-ssl.webflow.com/646ba104c3c85c96f27d201c/646bbdfee4fba9ef9032cf72_Business Tax Certification.png

https://www.wallstreetmojo.com/tax-break

The government always passes laws concerning a tax break and how it functions Any alterations in tax laws regarding federal income tax Federal Income Tax Federal income tax is the tax system in the United States and is levied and governed by Internal Revenue Services IRS It helps determine the tax charged on the income earned by individuals

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

7 Earned income tax credit This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges

Tax Advice And Consulting Quadrant

Reduce Your Business Taxes With Section 179 Business Funding Working

Business Tax Credit For Research And Development A Complete Guide

Small Business Tax Break Buy Before June 30 2017 Fantastic Furniture

Tax Course

Understanding The 20k Small Business Tax Break KC Equipment

Understanding The 20k Small Business Tax Break KC Equipment

Business Tax Certification Exam Accounting Analytics LLC

IRS Is Cracking Down On A Popular Small Business Tax Break

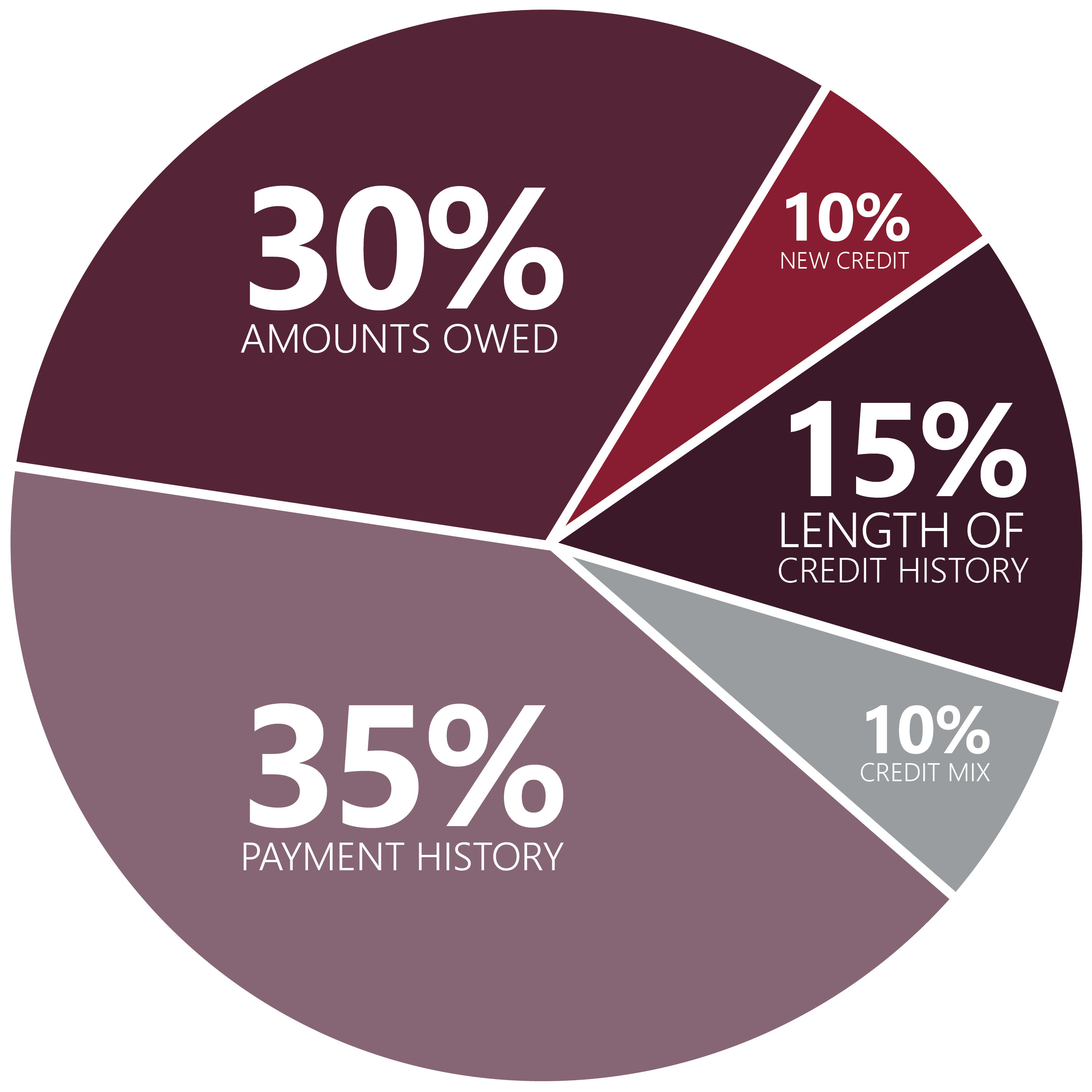

What Is The Credit Mix And How Does It Affect Your Credit Score

What Is The Business Tax Break - A tax break means the government is offering you a reduction in your taxes TABLE OF CONTENTS Reducing your taxes Who creates tax breaks Tax deductions as tax breaks Click to expand Reducing your taxes When the government offers you a tax break it means you re getting a reduction in your taxes