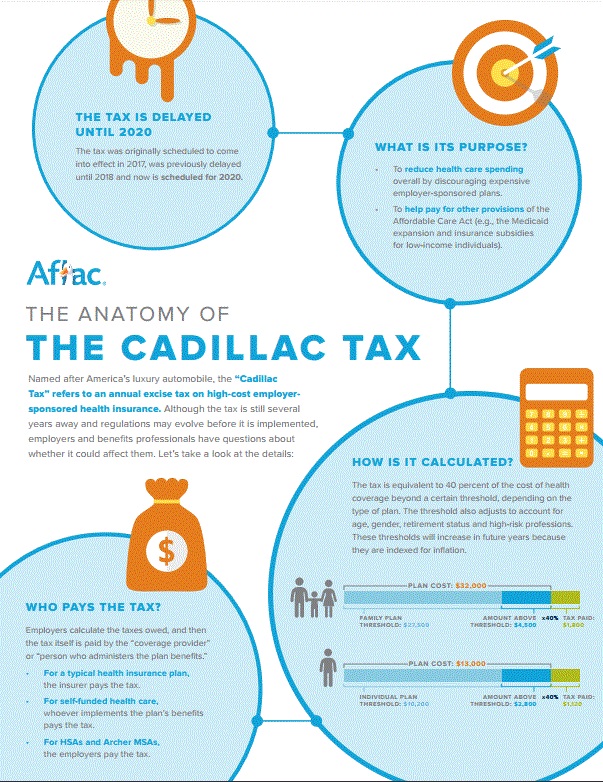

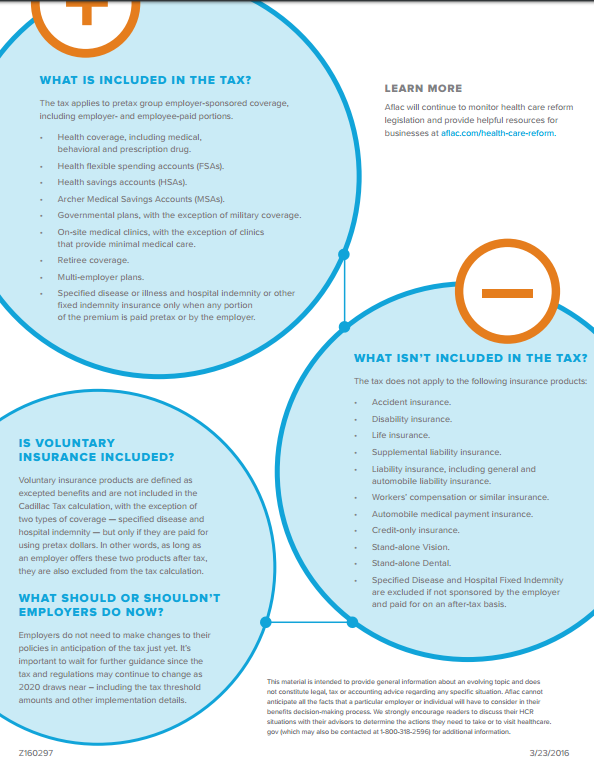

What Is The Cadillac Tax The Cadillac Tax is a 40 percent tax on employer sponsored health care coverage that exceeds a certain value The aim to curb health care cost growth

The Cadillac tax rate is 40 percent when stated in tax exclusive form But when converted to tax inclusive form the rate is just 29 percent 40 100 40 where Oct 5 2015 The so called Cadillac tax is one of those rare taxes whose primary purpose is not to raise revenue The tax which is scheduled

What Is The Cadillac Tax

What Is The Cadillac Tax

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2014/11/assets1411040111.jpg

EXPLAINED What Is The Cadillac Tax On Health Care

https://bizpedia.co/wp-content/uploads/2022/10/What-is-the-Cadillac-Tax.png

What Is The Cadillac Tax YouTube

https://i.ytimg.com/vi/VSTdG3klQ74/maxresdefault.jpg

The Cadillac tax has been reduced significantly since it first appeared in the Senate passed health bill which defined a high cost health plan as costing more What is the Cadillac tax Employer sponsored health benefits whose value exceeds legally specified thresh olds will be subject to a 40 percent excise tax starting in

Beginning Jan 1 2018 the law levies a hefty excise tax on health insurance plans worth more than 27 500 per family or 10 200 per individual This has been dubbed the Cadillac tax What is the Cadillac tax A Employer sponsored health benefits whose value exceeds legally specified thresholds will be subject to a 40 percent excise tax starting in

Download What Is The Cadillac Tax

More picture related to What Is The Cadillac Tax

What Is The Cadillac Tax AIS Inc

https://aiservicesinc.com/wp-content/uploads/2016/04/The-Cadillac-Tax.jpg

The Cadillac Tax U S Corporations On A Collision Course With An

https://imageio.forbes.com/blogs-images/joeharpaz/files/2015/08/cadillac-tax.png?format=png&width=1200

Used 2017 Cadillac XT5 In Frisco TX For Sale CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/339000/800/339863.jpg

The Cadillac tax is a 40 tax on the most generous employer provided health insurance plans those that cost more than 11 200 per year for an individual The Cadillac tax is intended to Encourage companies to choose lower cost health plans for their employees and Raise revenue to fund other ACA provisions

The Cadillac tax which doesn t go into effect until 2018 places a 40 percent tax on health benefits above a certain threshold encouraging employers to A fact sheet about the ACA Cadillac Tax 40 excise tax on high cost employer medical plans Learn about the latest developments and who will be affected

Review 2017 Cadillac XT5 Challenges Best Luxury SUVs

https://www.gannett-cdn.com/-mm-/2fc33101353c7a5ba4845dad451c0ae3ca4011ef/c=0-277-2996-1970/local/-/media/2016/06/01/DetroitFreePress/DetroitFreePress/636004007245007763-2017-Cadillac-XT5-24.jpg?width=2996&height=1693&fit=crop&format=pjpg&auto=webp

Cadillac Tax Repeal On The Horizon Benefits Compensation Blog

https://www.usbenefits.law/wp-content/uploads/sites/18/2019/03/Cadillac.jpg

https://taxfoundation.org/research/all/federal/...

The Cadillac Tax is a 40 percent tax on employer sponsored health care coverage that exceeds a certain value The aim to curb health care cost growth

https://www.brookings.edu/articles/how-to...

The Cadillac tax rate is 40 percent when stated in tax exclusive form But when converted to tax inclusive form the rate is just 29 percent 40 100 40 where

Cadillac Tax And Employer Health Clinics Elation Health EHR

Review 2017 Cadillac XT5 Challenges Best Luxury SUVs

/cdn.vox-cdn.com/uploads/chorus_image/image/47033790/shutterstock_290271440.0.0.jpg)

Obamacare s Cadillac Tax Explained Vox

Cadillac Tax Repeal CorpStrat HR Payroll Employee Benefits

The Cadillac Tax May Finally Be Repealed ScriptSourcing

What Is The Cadillac Tax AIS Inc

What Is The Cadillac Tax AIS Inc

What Is The Cadillac Tax YouTube

Cadillac Logo Automarken Motorradmarken Logos Geschichte PNG

The Cadillac Tax Companies Are Still Wondering Will Ever Take Effect

What Is The Cadillac Tax - What is the Cadillac tax A Employer sponsored health benefits whose value exceeds legally specified thresholds will be subject to a 40 percent excise tax starting in