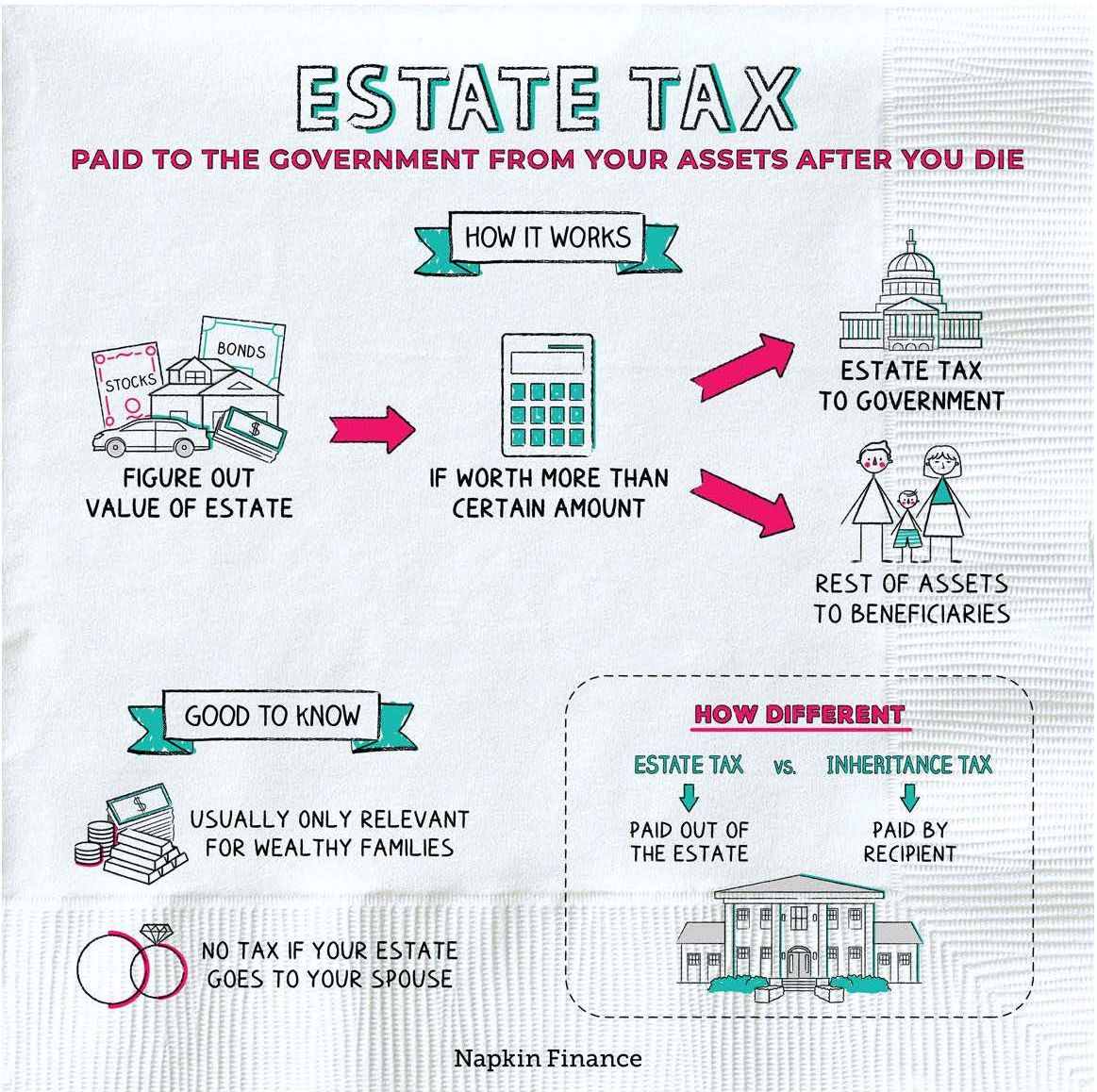

What Is The Current Lifetime Estate Tax Exemption In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a person s cumulative taxable gifts and taxable estate to arrive at a net tentative tax Any tax due is determined after applying a credit based on an applicable exclusion amount

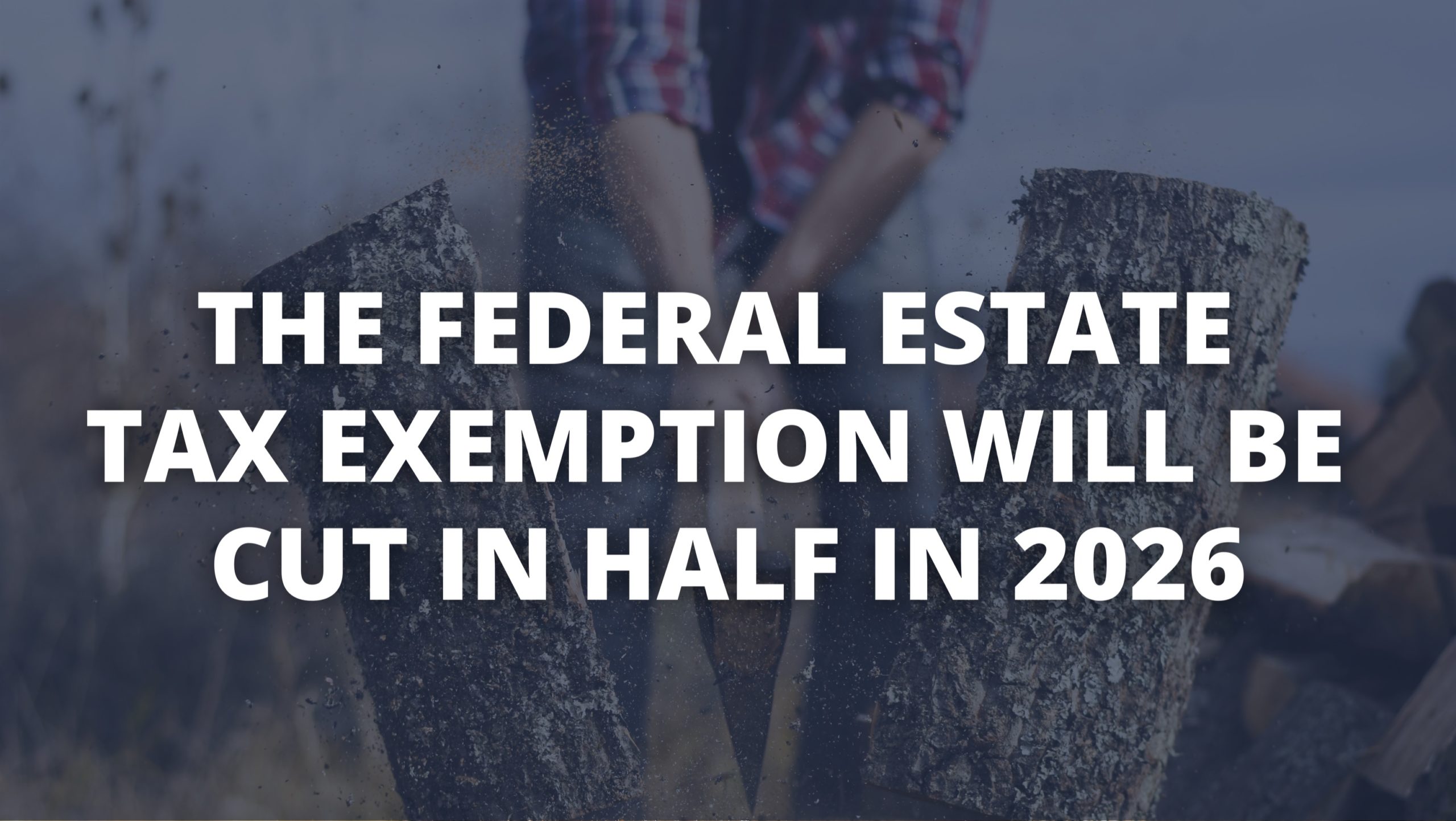

How Can I Maximize the Estate Tax Exemption Before the Tax Cuts and Jobs Act Provisions Expire You can use your remaining lifetime annual exclusion in 2024 and 2025 to gift up to 13 610 000 tax free which will also reduce your taxable estate The federal lifetime estate and gift tax exemption will sunset after 2025 Learn how to prepare now

What Is The Current Lifetime Estate Tax Exemption

What Is The Current Lifetime Estate Tax Exemption

https://plestateplanning.com/wp-content/uploads/2021/06/6355404323_7ec7219643_k.jpg

Current Estate Tax Exemption Federal Estate Tax ProVise

https://www.provise.com/wp-content/uploads/2021/03/shutterstock_1481493986.jpg

Is Estate Tax Exemption Going To Change Kisch Law Firm

https://kischlawfirm.com/wp-content/uploads/Estate-Tax-Diagram-Cropped.jpg

The lowest estate tax rate for 2022 is 18 rising progressively to 40 for taxable estates of more than 1 million Note that these rates apply to amounts that exceed the lifetime estate tax exclusion of 12 06 million The exclusion amount 15 rowsGet information on how the estate tax may apply to your taxable estate at your death The Estate Tax is a tax on your right to transfer property at your death It consists of an accounting of everything you own or have certain interests in

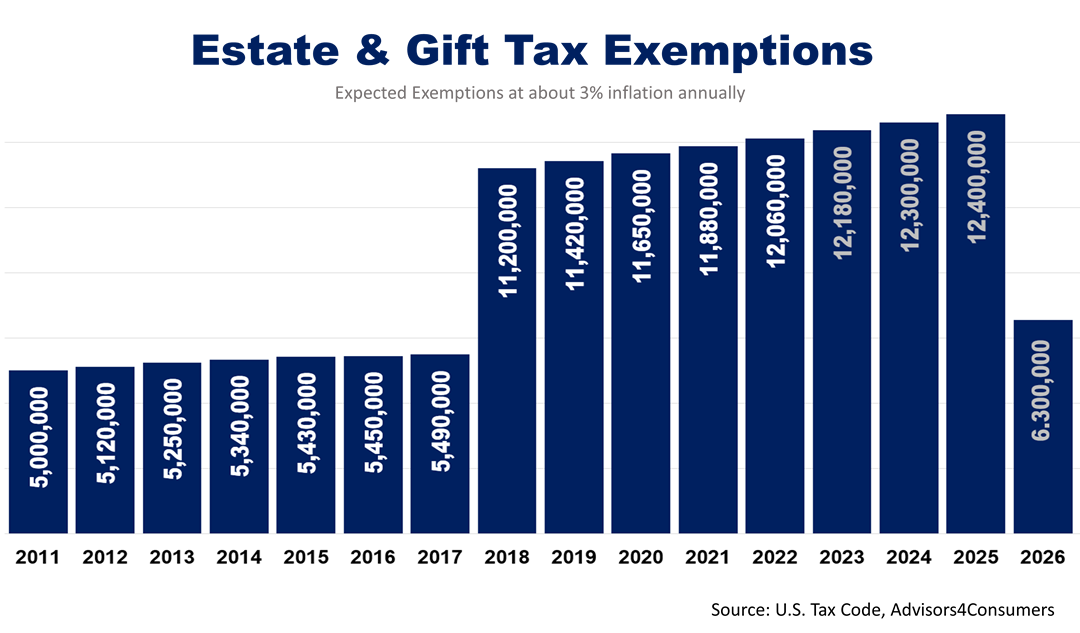

The other big change the lifetime estate and gift tax exemption also known as the unified credit will jump to 12 92 million in 2023 up from 12 06 million in 2022 Since couples share Lifetime gift and estate tax exclusions It s great to give and the government recognizes that But the government does put a lifetime limit on how much you can give before it wants its share For 2024 that is 13 61 million

Download What Is The Current Lifetime Estate Tax Exemption

More picture related to What Is The Current Lifetime Estate Tax Exemption

Historical Look At Estate And Gift Tax Rates Wolters Kluwer

https://assets.contenthub.wolterskluwer.com/api/public/content/d6de8e4f8e0344d3a5fd4dd7c24003ab

Estate Tax Exemption Increased For 2023 Anchin Block Anchin LLP

https://www.anchin.com/wp-content/uploads/2022/10/Estate-Tax-Exemption-300-2.png

IRS Proposes Higher Estate And Gift Tax Exemption ShindelRock

https://www.shindelrock.com/wp-content/uploads/2019/02/estate-tax.jpg

Gift and Estate Tax Exemption The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12 060 000 to 12 920 000 The 2024 lifetime federal gift and estate tax exemption update brings significant changes that can impact your estate planning strategy With the generous increases in exemptions individuals and couples have the chance to pass on more wealth to their heirs without facing hefty estate taxes

The federal lifetime gift and estate tax exclusion will increase from 12 06 million in 2022 to 12 92 million for 2023 There could also be increases for inflation for both 2024 and 2025 Currently you can give any number of people up to 18 000 each in a single year without incurring a taxable gift 36 000 for spouses splitting gifts up from 17 000 for 2023 The recipient typically owes no taxes and doesn t have to

Proactively Transfer Wealth Before Lifetime Exemption Expires

https://www.adviceperiod.com/wp-content/uploads/2023/04/AP-Blog-Image-2.png

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2020/05/federal-estate-tax-rates.png?fit=1456

https://www.irs.gov/newsroom/estate-and-gift-tax-faqs

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a person s cumulative taxable gifts and taxable estate to arrive at a net tentative tax Any tax due is determined after applying a credit based on an applicable exclusion amount

https://www.cohencpa.com/knowledge-center/insights/...

How Can I Maximize the Estate Tax Exemption Before the Tax Cuts and Jobs Act Provisions Expire You can use your remaining lifetime annual exclusion in 2024 and 2025 to gift up to 13 610 000 tax free which will also reduce your taxable estate

Federal Estate Tax Exemption Sunset The Sun Is Still Up But It s

Proactively Transfer Wealth Before Lifetime Exemption Expires

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Estate Tax Exemption Changes Coming In 2026 Estate Planning

17 States That Charge Estate Or Inheritance Taxes Alhambra Investments

Federal Estate And Gift Tax Exemption Set To Rise Substantially For

Federal Estate And Gift Tax Exemption Set To Rise Substantially For

The Retirement Coach The Retirement Coach 2022 Estate Gift Tax

Lifetime Gift Tax Exemption 2022 2023 Definition Calculation

2020 Estate And Gift Taxes Offit Kurman

What Is The Current Lifetime Estate Tax Exemption - The lowest estate tax rate for 2022 is 18 rising progressively to 40 for taxable estates of more than 1 million Note that these rates apply to amounts that exceed the lifetime estate tax exclusion of 12 06 million The exclusion amount