What Is The Current Sales Tax In Massachusetts The base state sales tax rate in Massachusetts is 6 25 Local tax rates in Massachusetts range from 6 25 making the sales tax range in Massachusetts 6 25 Find your Massachusetts combined state and local tax rate

Updated Feb 5 2024 03 00 pm You have reached the right spot to learn if items or services purchased in or brought into Massachusetts are taxable For example is clothing subject to sales tax and why is a use tax is due on that new computer you just purchased in New Hampshire The Massachusetts sales tax rate is 6 25 as of 2024 and no local sales tax is collected in addition to the MA state tax Exemptions to the Massachusetts sales tax will vary by state Tax Rates The 2023 2024 Tax Resource

What Is The Current Sales Tax In Massachusetts

What Is The Current Sales Tax In Massachusetts

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

Sales Tax How Sales Tax Is Calculated Pipedrive

https://www-cms.pipedriveassets.com/Sales-Tax.png

Amazon May Soon Be Collecting Sales Tax In Massachusetts Masslive

https://www.masslive.com/resizer/XqFaHTTv4TrEJ4I09e_i_B-T_mg=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.masslive.com/home/mass-media/width2048/img/politics_impact/photo/online-sales-tax-92812jpg-1bf3e2fecc40ddb6.jpg

Get a quick rate range Massachusetts state sales tax rate 6 25 Base state sales tax rate 5 6 Total rate range 6 25 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates 2024 List of Massachusetts Local Sales Tax Rates Lowest sales tax 6 25 Highest sales tax 6 25 Massachusetts Sales Tax 6 25 Average Sales Tax With Local 6 25 Massachusetts has state sales tax of 6 25 and allows local governments to collect a local option sales tax of up to N A

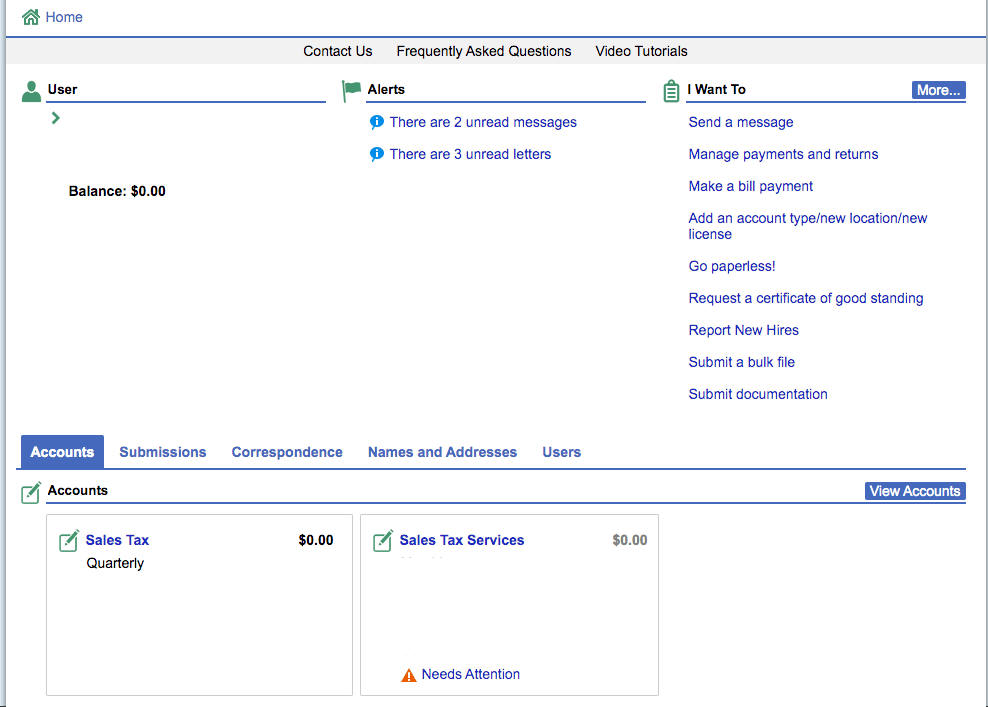

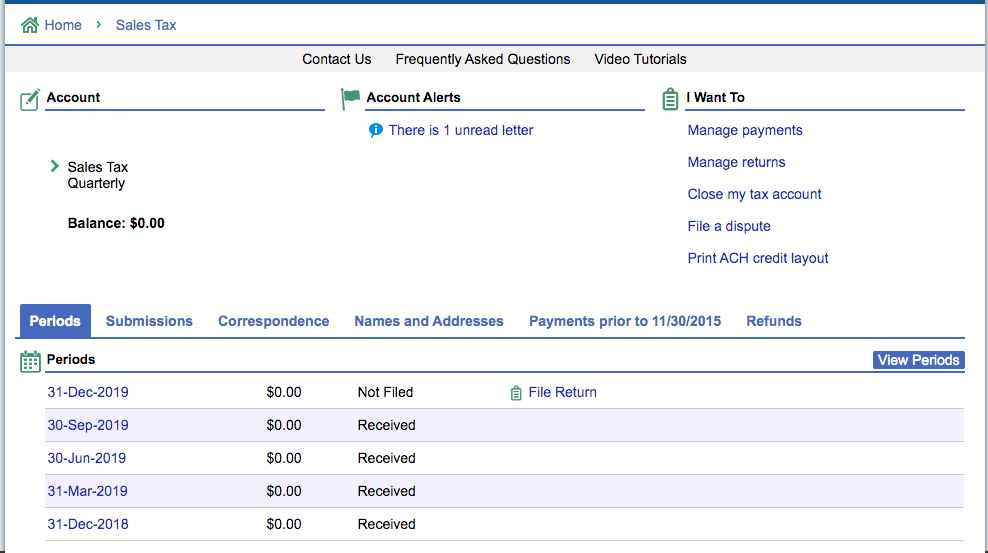

6 25 state sales tax 10 75 state excise tax up to 3 local option for cities and towns Sales tax on meals prepared food and all beverages All restaurant food and on premises consumption of any beverage in any amount 6 25 A city or town may also charge a local sales tax on the sales of restaurant meals Visit TIR 09 13 Register Your Business with MassTaxConnect Updated November 4 2022 The Massachusetts sales tax is 6 25 of the sales price or rental charge on tangible personal property including certain telecommunication services sold or rented in Massachusetts Sales tax is generally collected by the seller

Download What Is The Current Sales Tax In Massachusetts

More picture related to What Is The Current Sales Tax In Massachusetts

Massachusetts Sales Tax Calculator Step By Step Business

https://stepbystepbusiness.com/wp-content/uploads/2022/04/Massachusetts-Sales-Tax-Rate-1024x612.jpg

Massachusetts Sales Tax Rates US ICalculator

https://www.icalculator.com/images/massachusetts-sales-tax-calculator.png

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

Massachusetts has a statewide sales tax rate of 6 25 which has been in place since 1966 Municipal governments in Massachusetts are also allowed to collect a local option sales tax that ranges from 0 to 0 across the state with an average local tax of N A for a total of 6 25 when combined with the state sales tax Sales tax 101 Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services Massachusetts first adopted a general state sales tax in 1966 and since that time the rate has risen to 6 25 percent In many states localities are able to impose local sales taxes on top of the state sales tax

Massachusetts Sales Tax Rates Unlike most states Massachusetts does not allow the addition of county or local tax rates making the state rate of 6 25 applicable for all your in state sales This makes calculating sales taxes on items shipped to customers in Massachusetts especially convenient as many other states require the sales tax on Massachusetts sales tax rate is 6 25 percent for tangible personal property Businesses add sales tax and various other taxes to the purchase price of goods and services then submit the payments to the Massachusetts Department of

Massachusetts Sales Tax Rate Step By Step Business

https://stepbystepbusiness.com/wp-content/uploads/2022/04/Massachusetts-LLC-Sales-Tax-Guide.jpg

Massachusetts Sales Tax Guide

https://blog.accountingprose.com/hubfs/image-40.png

https://wise.com/us/business/sales-tax/massachusetts

The base state sales tax rate in Massachusetts is 6 25 Local tax rates in Massachusetts range from 6 25 making the sales tax range in Massachusetts 6 25 Find your Massachusetts combined state and local tax rate

https://www.mass.gov/sales-and-use-tax-for-individuals

Updated Feb 5 2024 03 00 pm You have reached the right spot to learn if items or services purchased in or brought into Massachusetts are taxable For example is clothing subject to sales tax and why is a use tax is due on that new computer you just purchased in New Hampshire

Taxes Scolaires Granby

Massachusetts Sales Tax Rate Step By Step Business

Massachusetts Tax Free Weekend Spindle

How To File And Pay Sales Tax In Massachusetts TaxValet

Ultimate Massachusetts Sales Tax Guide Zamp

Proposed Massachusetts Sales Tax Cut

Proposed Massachusetts Sales Tax Cut

Sales Tax By State Here s How Much You re Really Paying Sales Tax

How To File And Pay Sales Tax In Massachusetts TaxValet

Sales Tax By State 2023 Wisevoter

What Is The Current Sales Tax In Massachusetts - 2024 List of Massachusetts Local Sales Tax Rates Lowest sales tax 6 25 Highest sales tax 6 25 Massachusetts Sales Tax 6 25 Average Sales Tax With Local 6 25 Massachusetts has state sales tax of 6 25 and allows local governments to collect a local option sales tax of up to N A