What Is The Employer Contribution In Nps Employer contribution to NPS enhances retirement savings and provides tax benefits for employees Discover the benefits of NPS employer contributions including tax savings under Section 80CCD 2

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the Central Government under Section 80CCD 2 beyond the Rs 1 5 lakh limit provided under Section 80CCE Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling of Rs 1 50 lakh under Sec 80 CCE

What Is The Employer Contribution In Nps

What Is The Employer Contribution In Nps

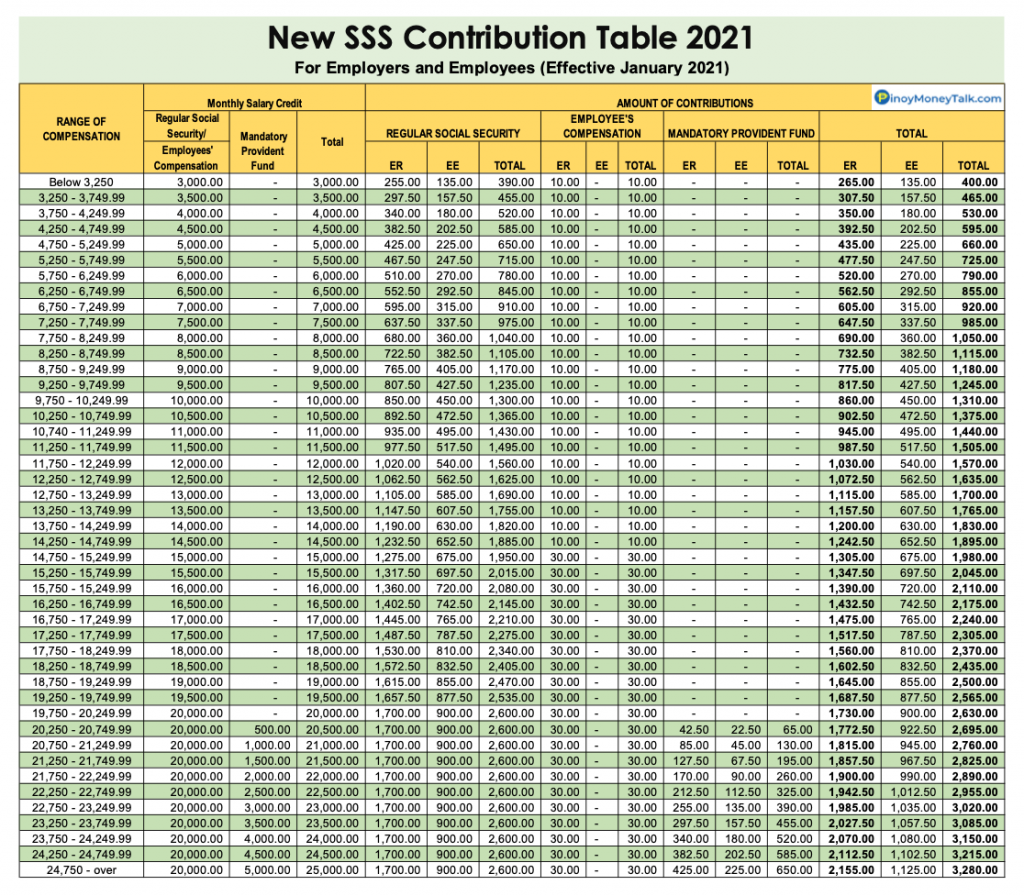

https://www.qne.com.ph/wp-content/uploads/2021/05/SSS_Contribution_Table-scaled.jpg

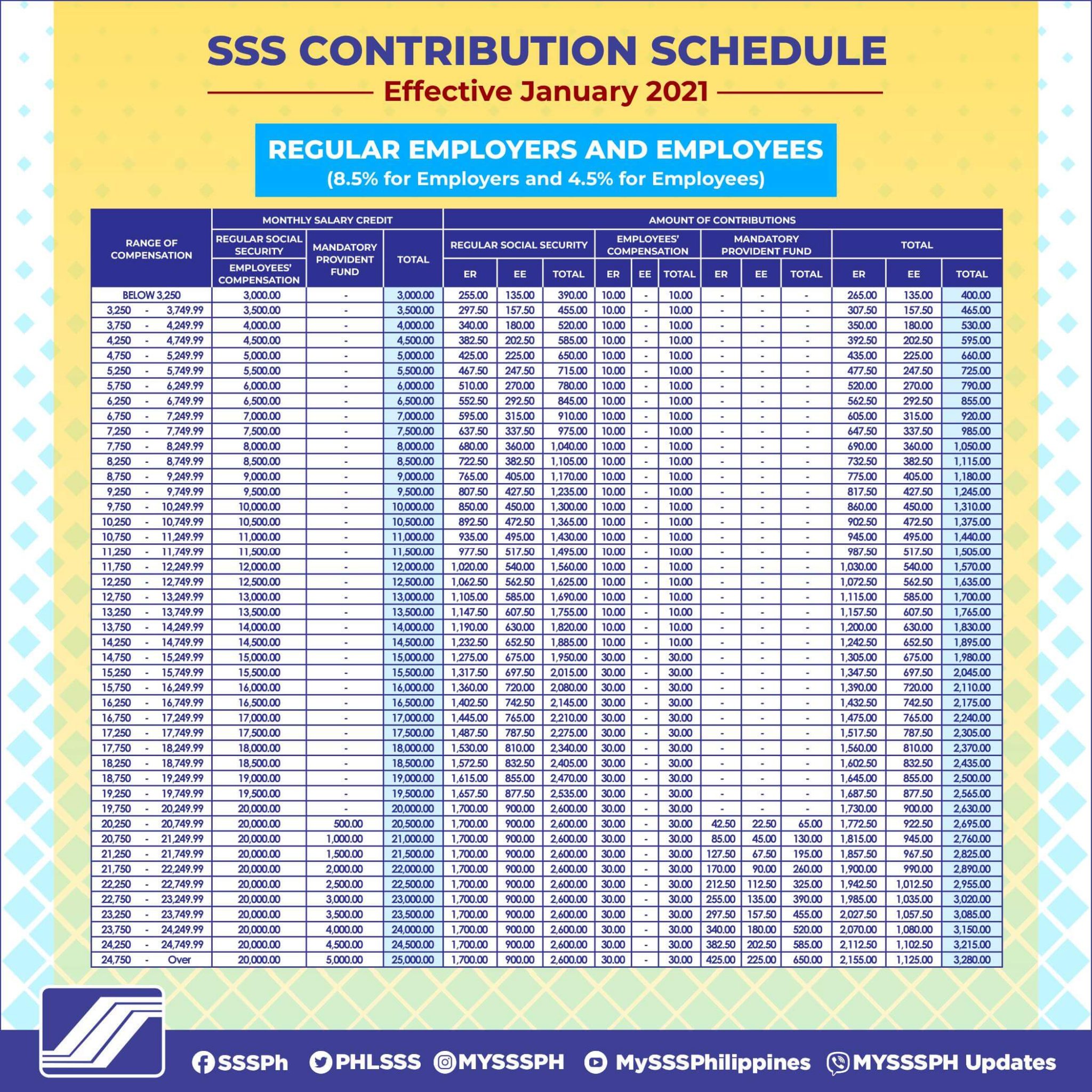

Sss Contribution Archives NewsToGov

https://newstogov.com/wp-content/uploads/2023/02/SSS-Contribution-Regular-Employers-Employees.jpg

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://cdn.freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction of upto 0 of your salary Basic DA Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Contribution towards NPS up to 10 of salary Basic DA can be deducted as Business Expense from their Profit Loss Account

NPS is an easily accessible low cost tax efficient flexible and portable retirement savings account Under the NPS the individual contributes to his retirement account and also his employer can also co contribute for the social security welfare of the individual NPS is With your employer s contribution to NPS you get an additional retirement savings boost while minimising your tax liability By taking advantage of employer contributions you can optimise your tax savings and bolster your retirement fund

Download What Is The Employer Contribution In Nps

More picture related to What Is The Employer Contribution In Nps

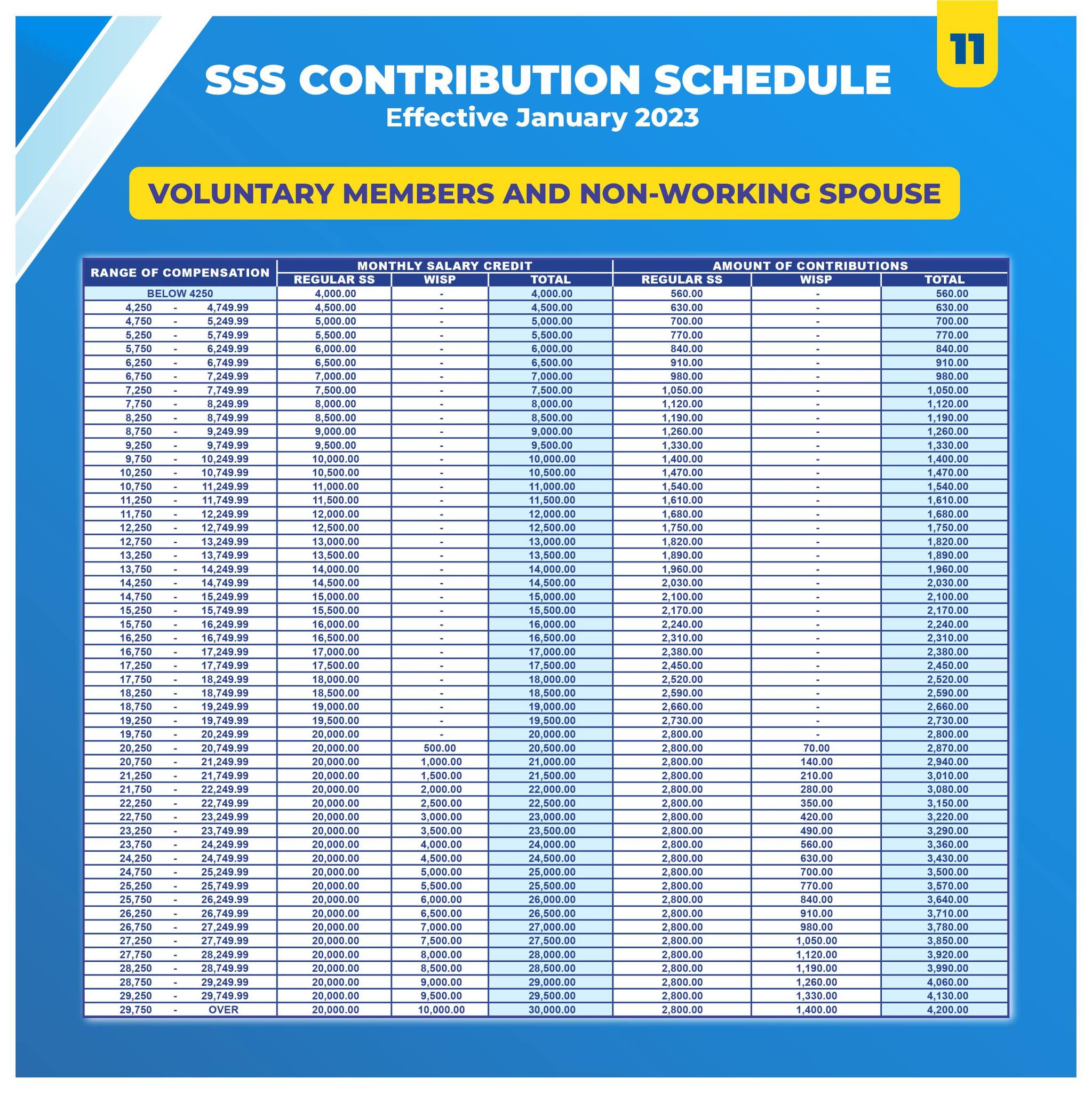

New Sss Contribution Table 2023 Schedule Effective January Porn Sex

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhcKolUL1kpAxXoCNCrDttBik73Re-z9lnh7mw7AUQKtqYbLR1y0b-ZSkTMPZtBlKp7sN4yvkj08aTrWxRfeU7ftKmZb18BbZEauHbKrlFM0P6o043P9aTJsNzPhfRjTIVlSJEn07N9npcJflph2nyUioerxfnsex3vZ8xKfu3-a-_HJpHtkk8Q-ANhjQ/s2048/SSS Contribution Table - Voluntary and Non-Working Spouse.jpg

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

https://cdn.statically.io/img/www.401kinfoclub.com/f=auto/wp-content/uploads/retirement-plan-contribution-limits-will-increase-in-2020-ward-and.jpeg

Sss Contribution Schedule 2021 Sss Inquiries CLOUD HOT GIRL

https://mattscradle.com/wp-content/uploads/2015/07/sss-contribution-table-effective-2021-for-self-employed-members.jpg

What is NPS Contribution The National Pension System NPS is a market linked investment instrument specifically designed to provide investors with retirement income All Indian citizens including NRIs who are above 18 years of age can make NPS contributions Also employers can make contributions to NPS accounts of What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA

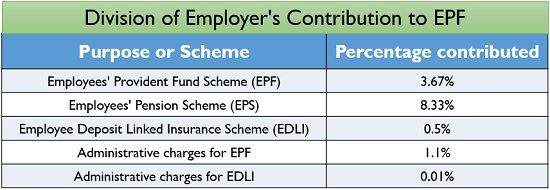

How is employer s contribution to NPS treated in income tax calculation of salaried employee Is it deductible within the overall limit of Rs 1 50 lakhs under Section 80C The balance 8 33 is the contribution towards Employees Pension Scheme EPS account Further note that the EPS contribution is calculated on the threshold of Rs 15 000 This means that an employer can contribute maximum Rs 1 250 towards EPS and the balance is deposited into the EPF account

Pin On SHAMEEM

https://i.pinimg.com/originals/8b/7e/db/8b7edb31af96123669ec70a6833b8174.jpg

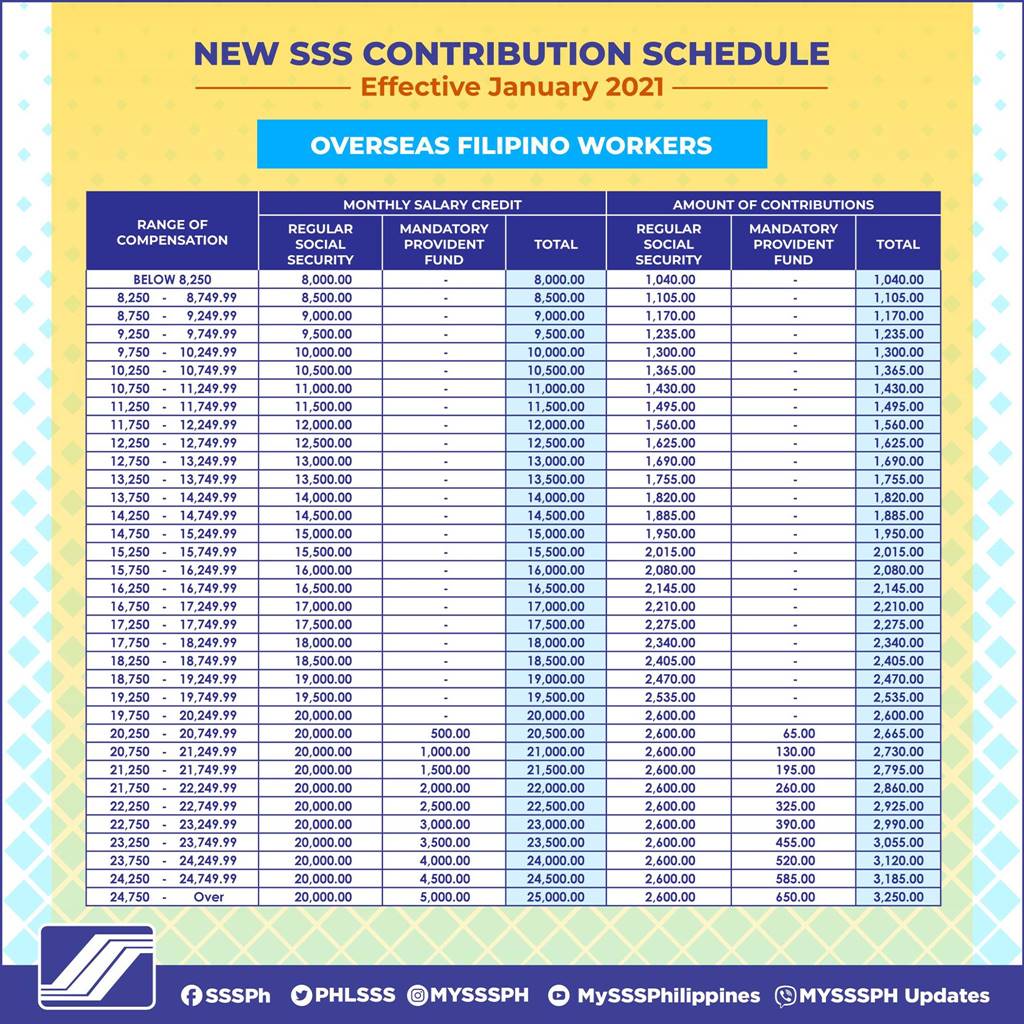

SSS Monthly Contribution Table Amp Schedule Of Payment 2022 The Pinoy OFW

https://thepinoyofw.com/wp-content/uploads/2020/01/SSS-contribution-table-for-OFWs.jpg

https://www.kotak.com/en/stories-in-focus/national...

Employer contribution to NPS enhances retirement savings and provides tax benefits for employees Discover the benefits of NPS employer contributions including tax savings under Section 80CCD 2

https://cleartax.in/s/nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the Central Government under Section 80CCD 2 beyond the Rs 1 5 lakh limit provided under Section 80CCE

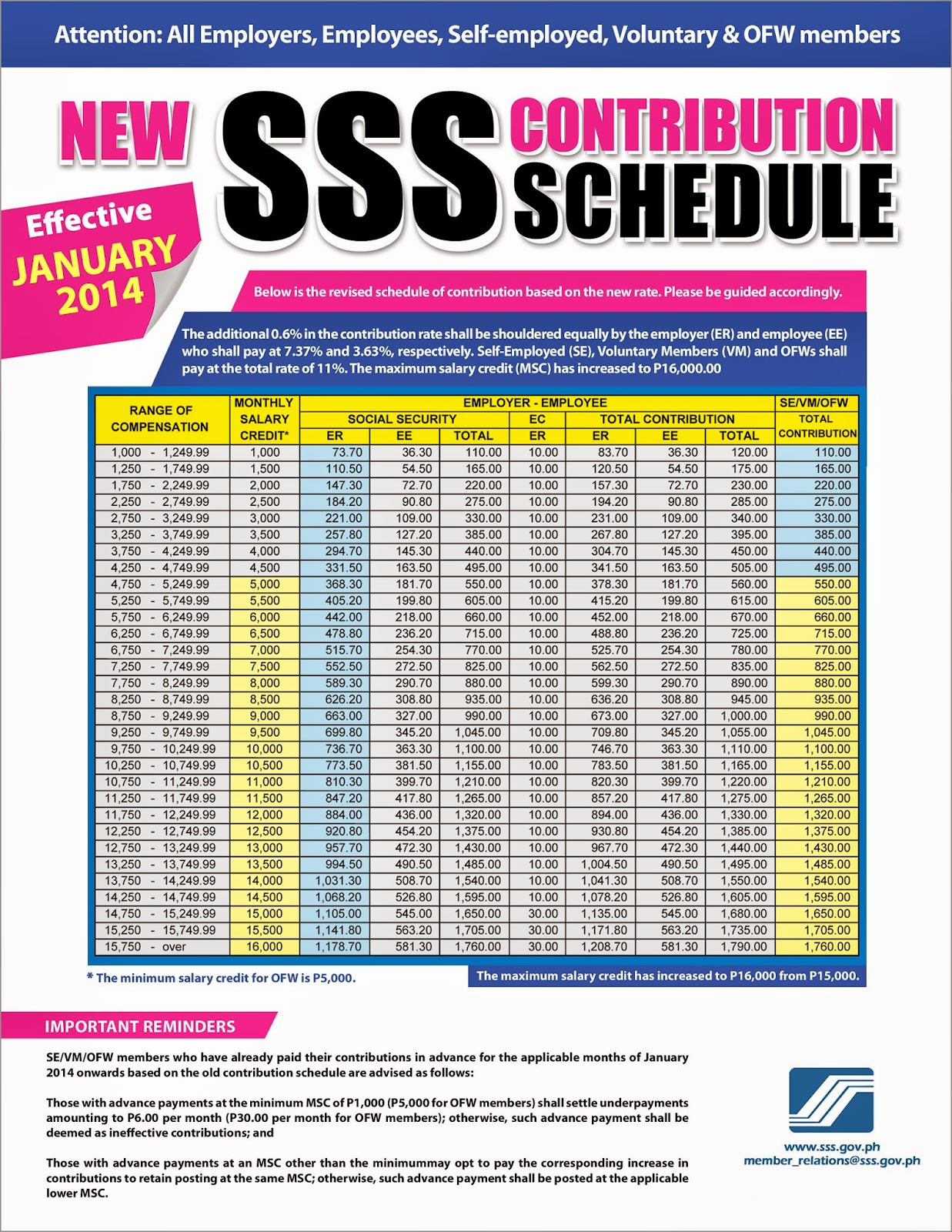

How To Compute For SSS Contribution E PINOYGUIDE

Pin On SHAMEEM

New Sss Contribution Schedule Business Tips Philippines Business Vrogue

Monk Background Door Sss Contribution Table 2018 Virgin Put Away

Your Employer s Contribution To NPS Can Make A Huge Difference

Know About Minimum Contribution In NPS YouTube

Know About Minimum Contribution In NPS YouTube

5 Must Know Facts To Claim Your SSS Unemployment Benefit Cash Mart

New Sss Contribution Table 2021 Sss Contribution Table Gambaran

What Is Employees Provident Fund EPF Contribution Rules Benefits

What Is The Employer Contribution In Nps - NPS is an easily accessible low cost tax efficient flexible and portable retirement savings account Under the NPS the individual contributes to his retirement account and also his employer can also co contribute for the social security welfare of the individual NPS is