What Is The Energy Tax Credit For 2020 You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for

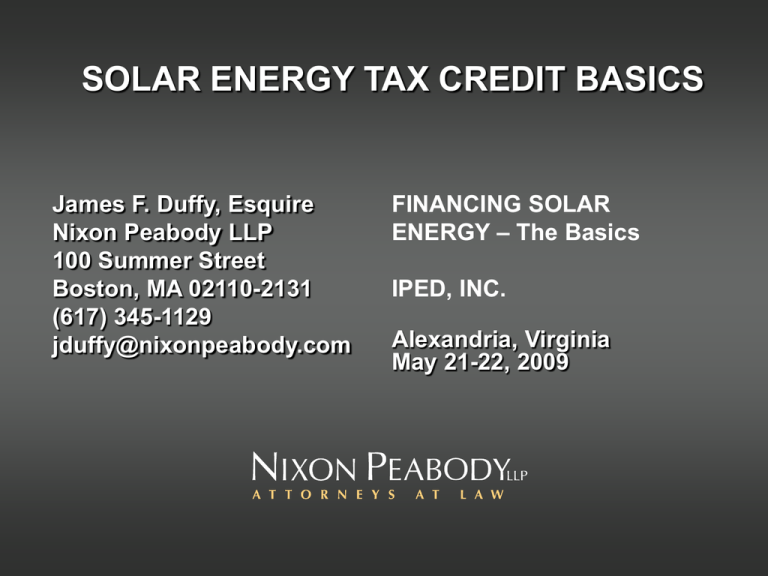

Part I Residential Energy Efficient Property Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2019 For Paperwork The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

What Is The Energy Tax Credit For 2020

What Is The Energy Tax Credit For 2020

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before Making Our Homes More Efficient Clean Energy Tax Credits for Consumers UPDATED JULY 2024 Visit our Energy Savings Hub to learn more about saving money on home energy upgrades clean vehicles and more Q Who is eligible for tax credits

Download What Is The Energy Tax Credit For 2020

More picture related to What Is The Energy Tax Credit For 2020

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

https://stimulusmag.com/wp-content/uploads/2022/12/will-there-be-an-energy-tax-credit-for-2023-1.png

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit reduces your federal As amended by the Inflation Reduction Act of 2022 the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning

The Energy Efficient Home Improvement Credit which is available through 2032 allows households to receive up to 3 200 in tax credits annually for a variety of energy efficient home improvements Improving home energy The residential energy efficient property credit best known as the residential energy credit and most commonly claimed by homeowners is claimed in Part I of Form 5695

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

https://www.improveitusa.com/wp-content/uploads/2023/01/2023_Tax_Credit_Windows.jpg

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

https://www.irs.gov/credits-deductions/how-to...

You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for

https://www.irs.gov/pub/irs-prior/f5695--2020.pdf

Part I Residential Energy Efficient Property Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2019 For Paperwork

Unpacking The New Solar Energy Tax Credit BDO

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

See The EIC Earned Income Credit Table Income Tax Return Income

CitizensAdvice On Twitter The Energy Price Guarantee Came Into Effect

The Federal Electric Car Rebate A Great Way To Save Money And Combat

PPT SOLAR ENERGY TAX CREDIT BASICS PowerPoint Presentation Free

PPT SOLAR ENERGY TAX CREDIT BASICS PowerPoint Presentation Free

Energy Bill Relief Scheme Explained Business Energy Comparison

Solar Tax Credits Solar Tribune

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

What Is The Energy Tax Credit For 2020 - You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property credit