What Is The Exemption Limit For Interest Income Interest earned on 529 plans is usually exempt from federal taxes Money held in retirement accounts such as traditional IRAs or 401 k s are usually tax exempt until funds are withdrawn

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits For a residential individual age of 60 years or less or HUF interest earned upto Rs 10 000 in a financial year is exempt from tax The deduction is allowed on interest income earned from savings account with a bank savings account with a co operative society carrying on the business of banking or savings account with a post office

What Is The Exemption Limit For Interest Income

What Is The Exemption Limit For Interest Income

https://www.pdffiller.com/preview/50/825/50825271/large.png

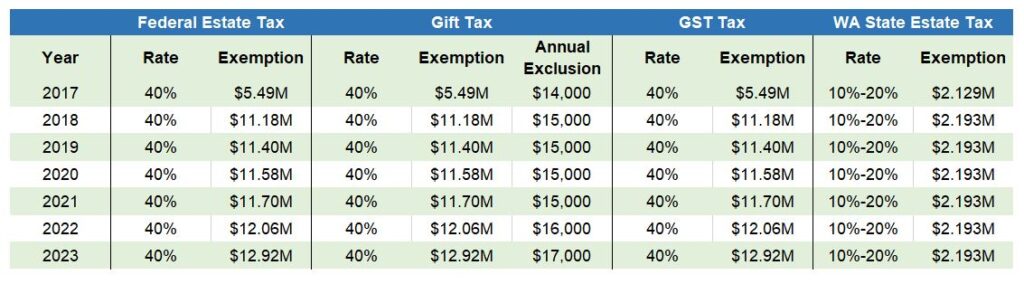

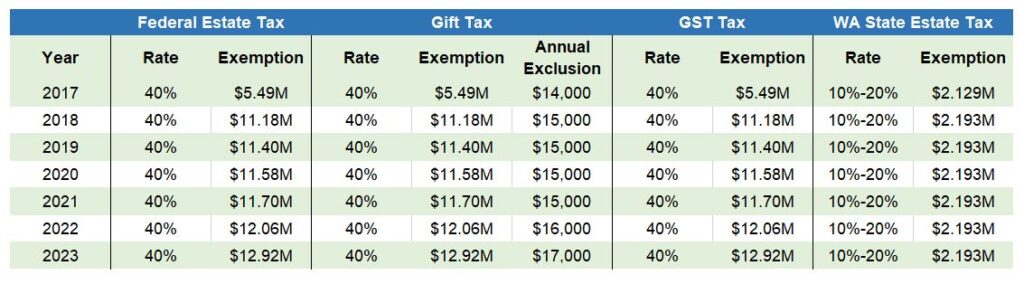

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

https://www.helsell.com/wp-content/uploads/23-EP-Table-1024x284.jpg

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

https://www.pdffiller.com/preview/541/304/541304812/large.png

Forms 15G and 15H can be submitted to receive interest without tax deduction but your income should be below the basic exemption limit of Rs 2 5 lakhs or Rs 3 5 lakhs respectively and the tax payable should be zero If you earn interest income from a Public Provident Fund PPF you are not required to pay any taxes as it is fully exempt PPF falls under the Exempt Exempt Exempt EEE scheme Accordingly the deposit the interest earned and the withdrawal amount are

Tax exempt interest is interest income that is not subject to federal income tax In some cases the amount of tax exempt interest a taxpayer earns can limit the TDS 10 is deducted if interest income exceeds Rs 40 000 Rs 50 000 for resident senior citizen during the financial year But if PAN details are not provided TDS 20 is deducted from the interest income

Download What Is The Exemption Limit For Interest Income

More picture related to What Is The Exemption Limit For Interest Income

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

What Is The Exemption Limit For Transport Allowance Conveyance

https://bankingschool.co.in/wp-content/uploads/2020/08/qtq80-dnJtKx-2160x1080.jpeg

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

Exemption Limit The tax exemption on interest earned from savings accounts is capped at 10 000 per annum Eligibility This deduction is available only to individuals and Hindu Undivided Families HUFs who hold savings accounts Yes the interest income earned on bank post office Fixed Deposits or Recurring deposits is a taxable income The interest income is taxable as per individual s tax slab rate for AY 2024 25 The slab rate is dependent on which type of

You must report all taxable and tax exempt interest on your federal income tax return even if you don t receive a Form 1099 INT or Form 1099 OID You must give the payer of interest income your correct taxpayer identification number otherwise you may be subject to a penalty and backup withholding For taxable years beginning after December 31 2017 the limitation applies to all taxpayers who have business interest expense other than certain small businesses that meet the gross receipts test in section 448 c exempt small business see Q A 3 4

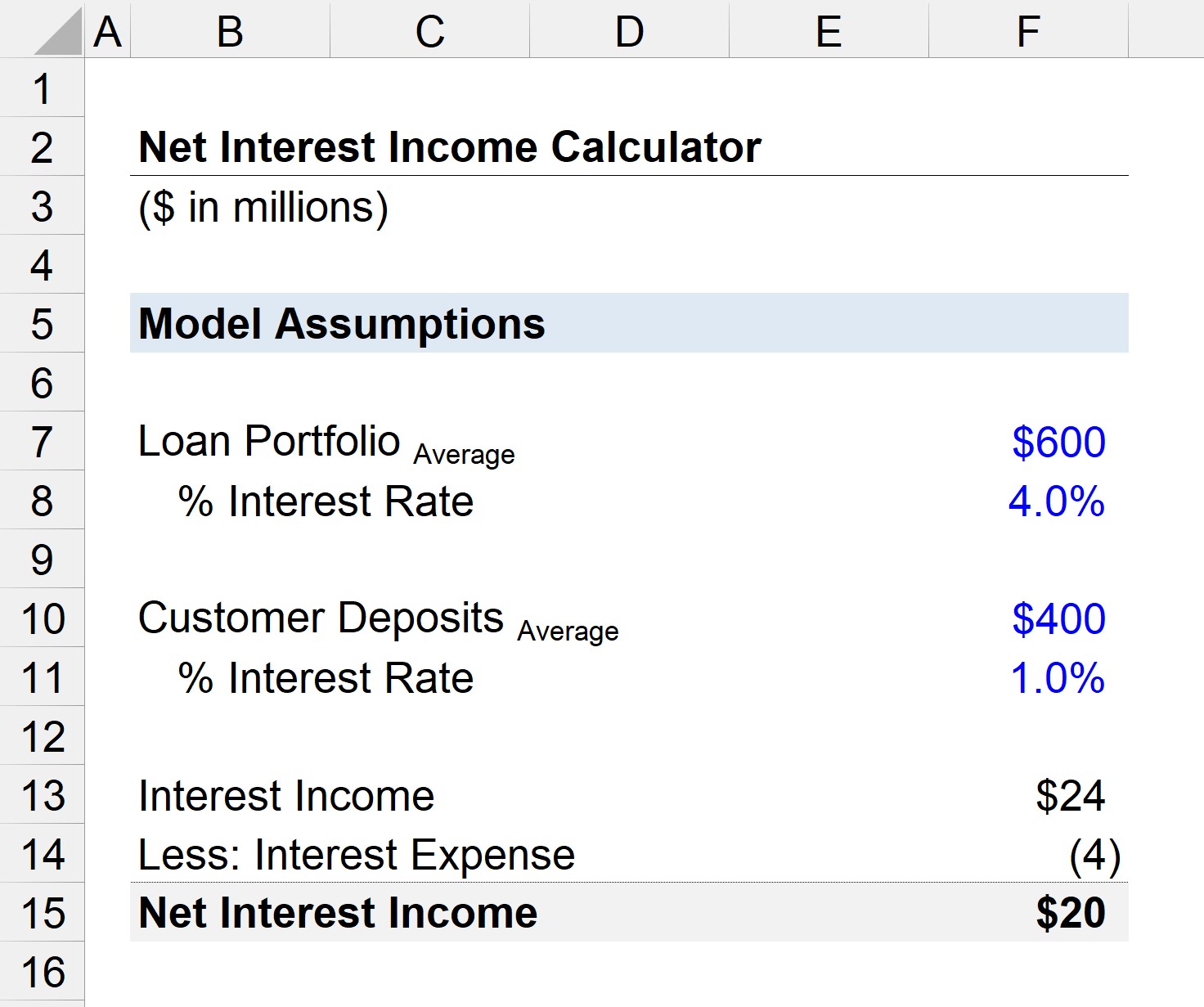

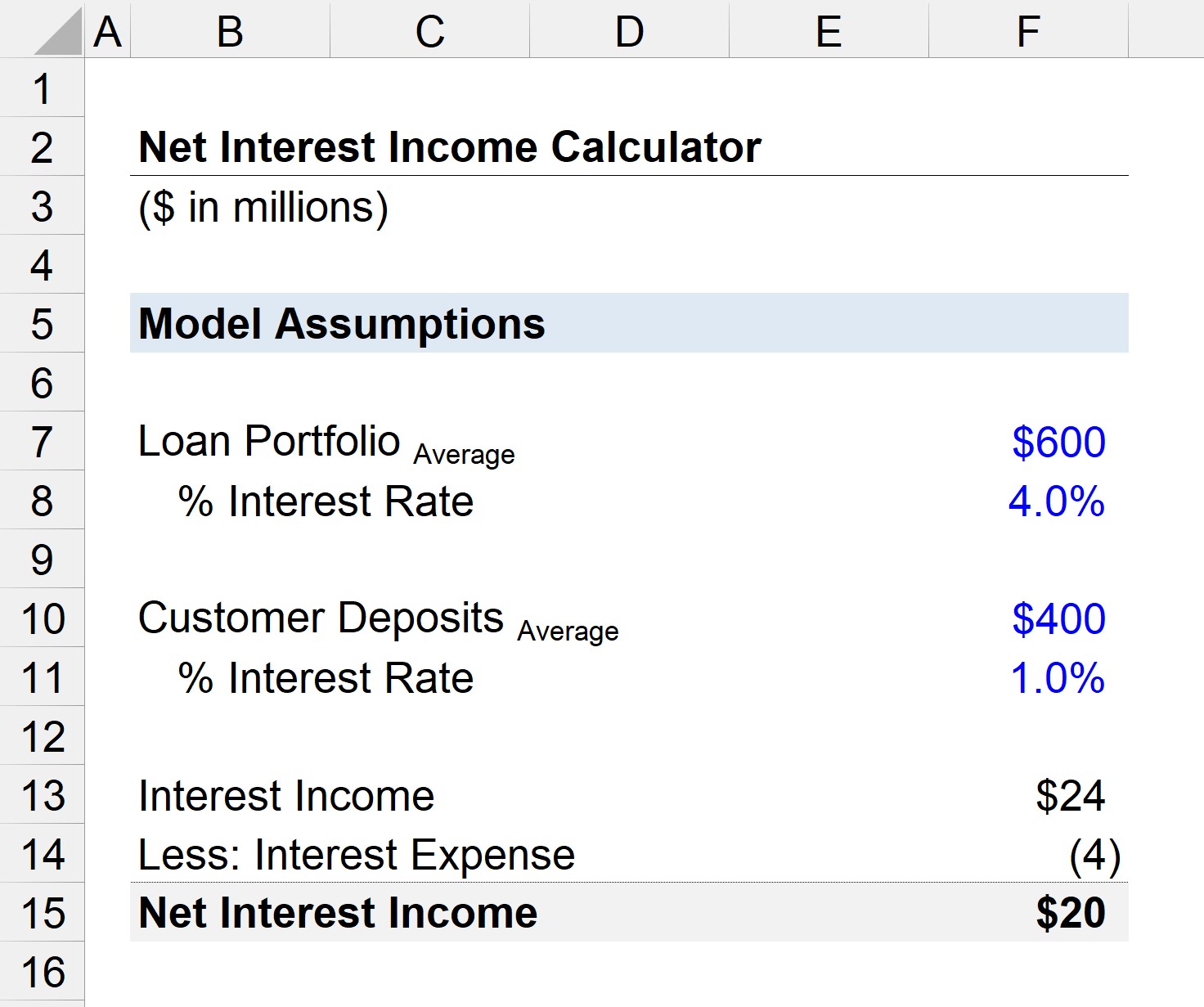

Net Interest Income NII Formula Calculator

https://media.wallstreetprep.com/uploads/2022/04/07203545/Net-Interest-Income-Calculator.jpg

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

https://www.investopedia.com/articles/tax/10/interest-income.asp

Interest earned on 529 plans is usually exempt from federal taxes Money held in retirement accounts such as traditional IRAs or 401 k s are usually tax exempt until funds are withdrawn

https://cleartax.in/s/claiming-deduction-on-interest-under-section-80tta

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits

What Is Net Interest Income NII Formula Calculator

Net Interest Income NII Formula Calculator

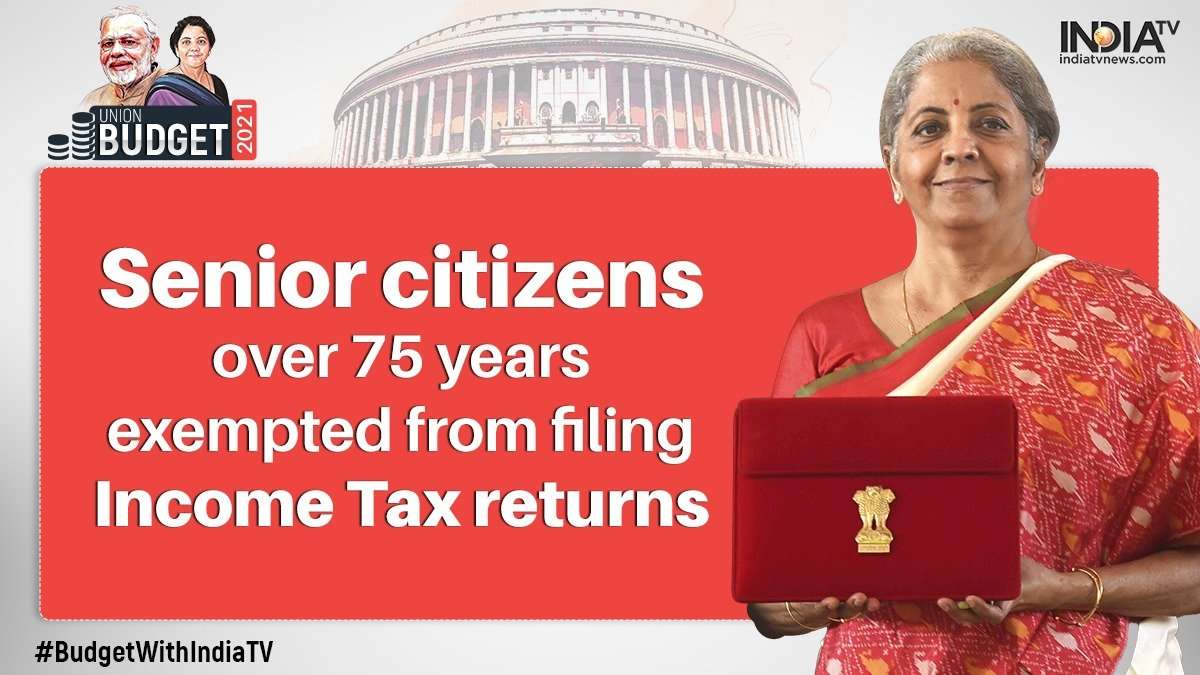

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

Getting A Religious Exemption To A Vaccine Mandate May Not Be Easy

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

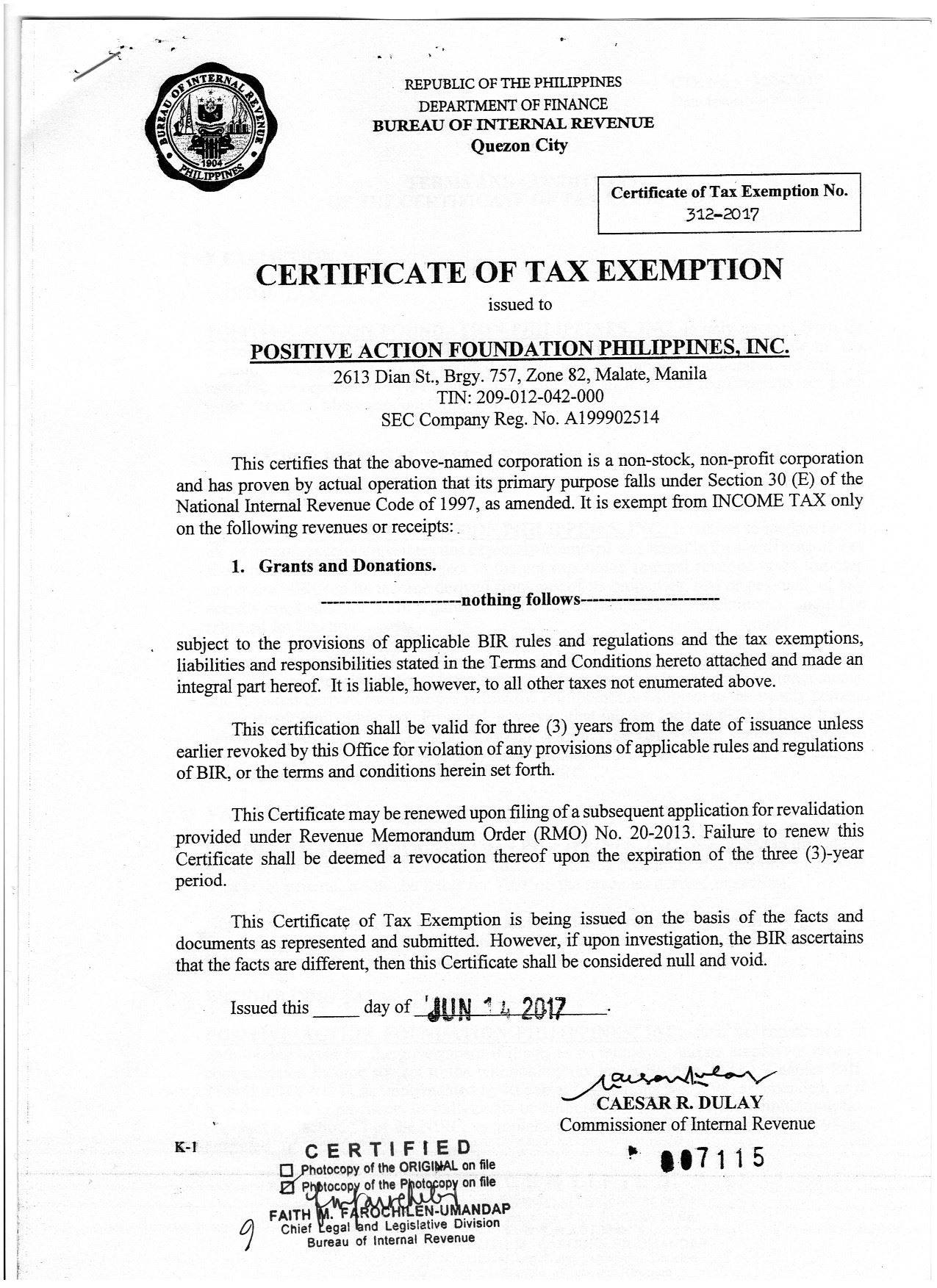

2017 PAFPI Certificate of TAX Exemption Certificate Of

2017 PAFPI Certificate of TAX Exemption Certificate Of

Mandatory ITR Filing Even If The Income Is Below The Basic Exemption Limit

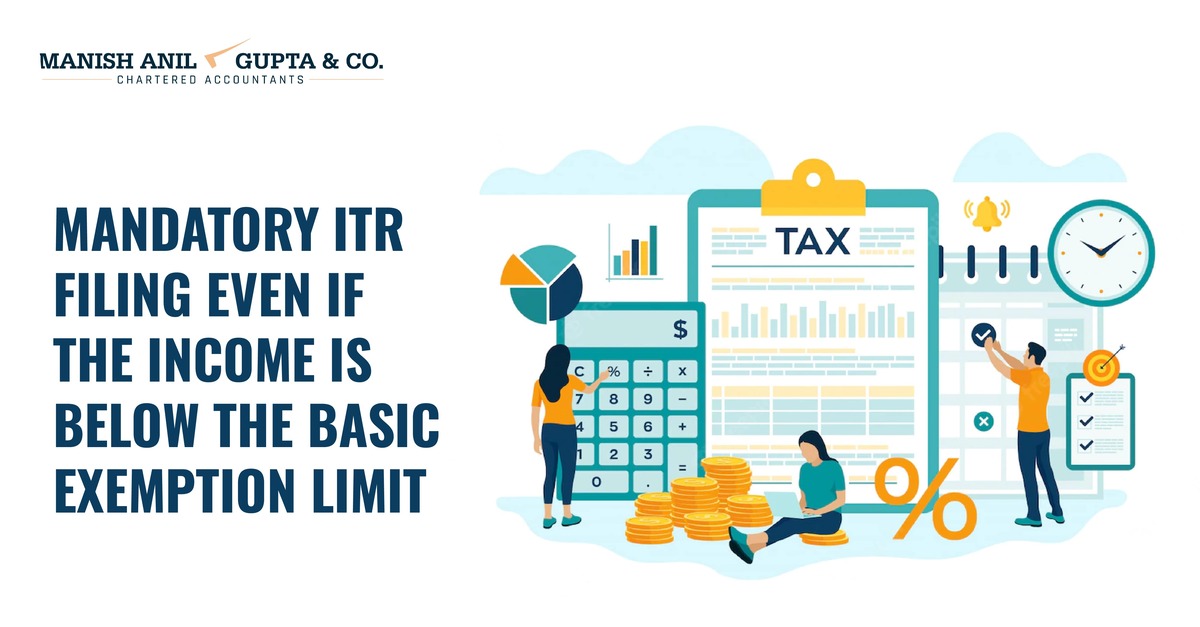

Pa Tax Exempt Form 2023 ExemptForm

2023 Federal Tax Exemption Form ExemptForm

What Is The Exemption Limit For Interest Income - If you earn interest income from a Public Provident Fund PPF you are not required to pay any taxes as it is fully exempt PPF falls under the Exempt Exempt Exempt EEE scheme Accordingly the deposit the interest earned and the withdrawal amount are