What Is The Extended Due Date For S Corporate Tax Returns For individuals that means you can still file for a tax extension right on April 15 2025 The same goes for businesses S corps and partnerships can still get an extension on March 17 and the last day for C corps to file for an extension is

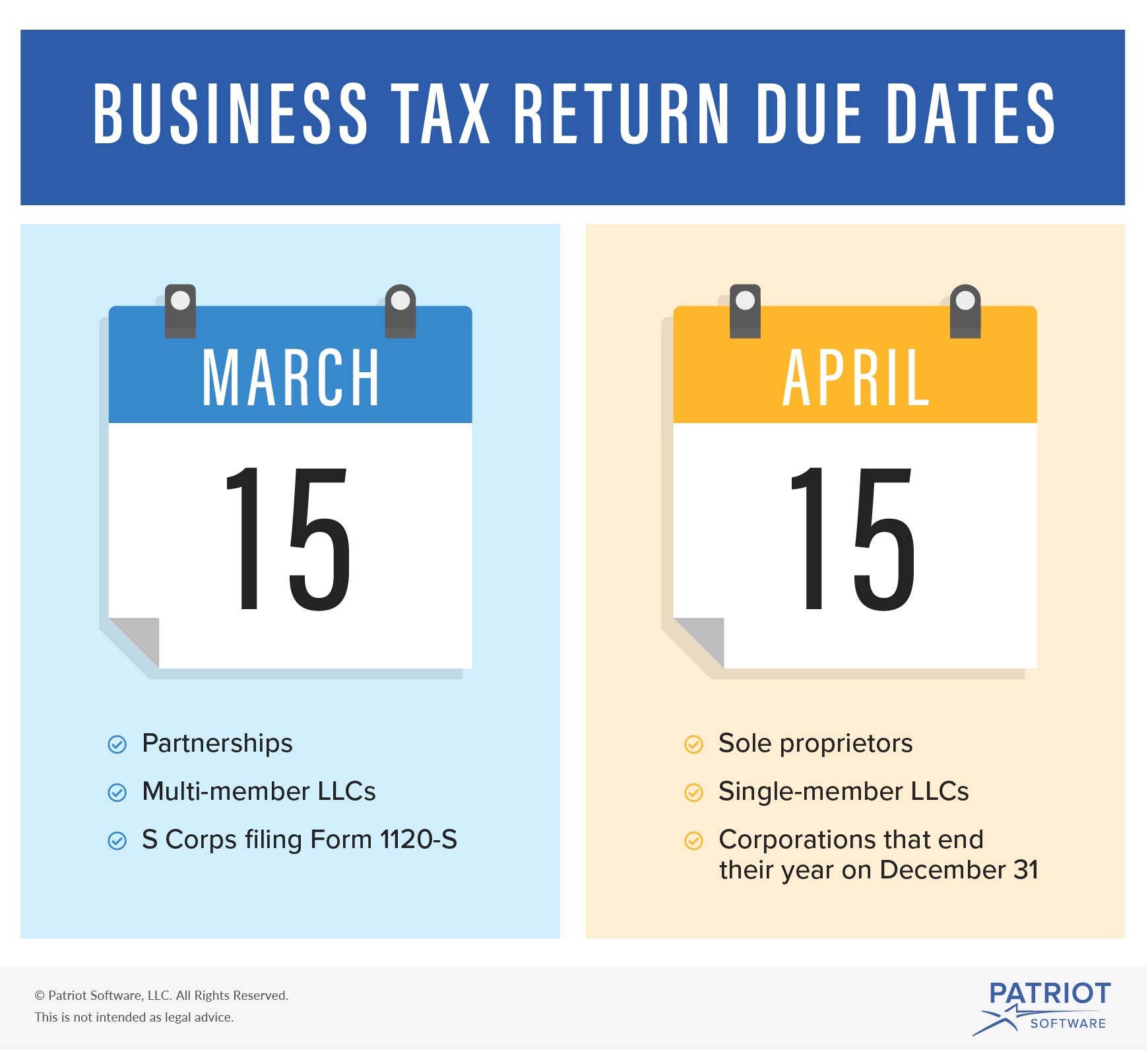

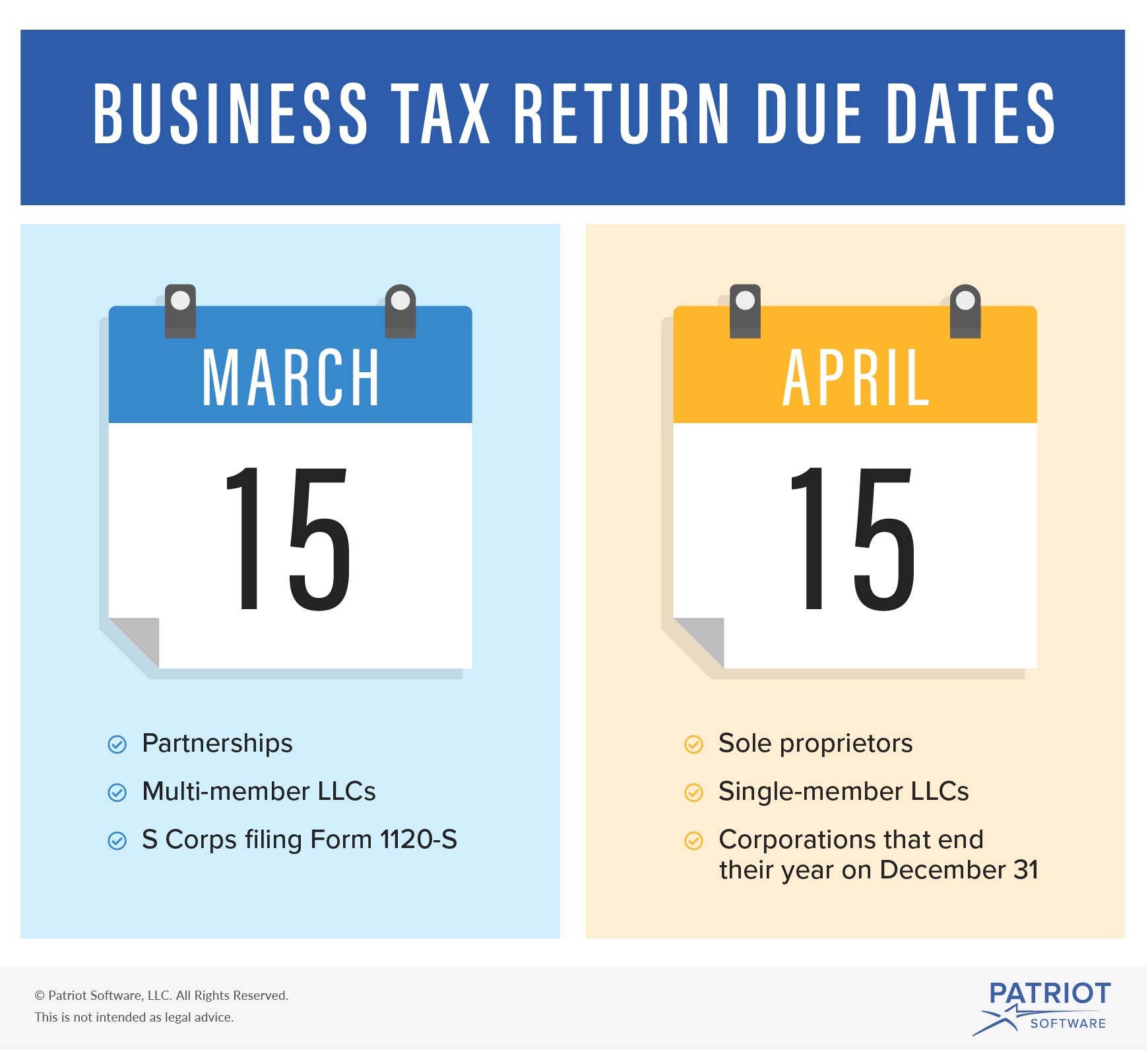

C corporations S corporations partnerships and sole proprietorships all have specific federal income tax return due dates For instance in 2025 sole proprietors and C corporations operating on a calendar year must file by April You do however still have to file a tax return Form 1120 S the income tax return for S corporations and which is due on March 15 2025 if you re a calendar year corporation Here s

What Is The Extended Due Date For S Corporate Tax Returns

What Is The Extended Due Date For S Corporate Tax Returns

https://faveplus.com/wp-content/uploads/2022/02/tax-returns.jpg

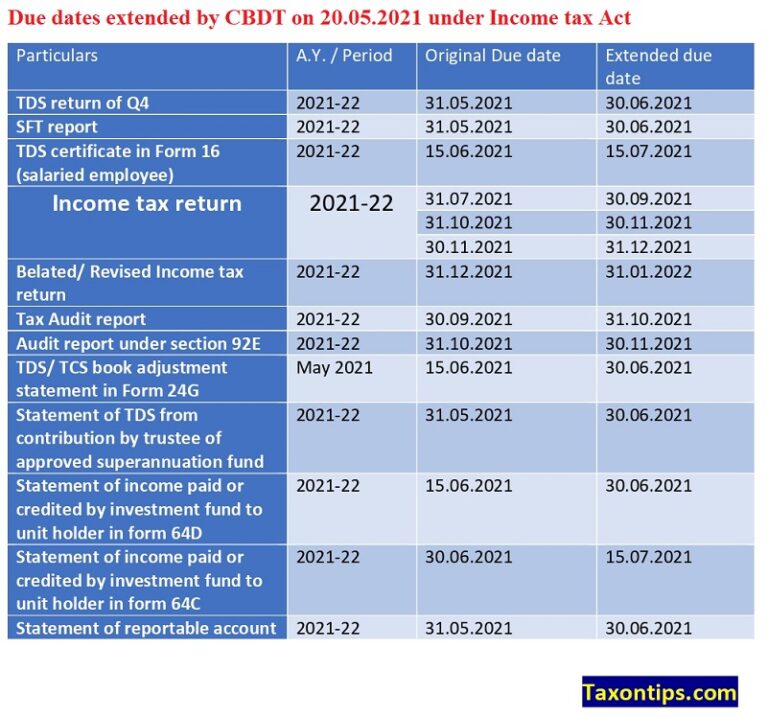

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

Business Taxes 101 E Book Etsy

https://i.etsystatic.com/27591850/r/il/60cd5c/2931738972/il_1588xN.2931738972_qi91.jpg

March 17th is the deadline to file your S corporation tax return Form 1120 S It is also the partnership tax deadline to file your return Form 1065 Note that S corporations and partnerships do not pay taxes on their income If an S Corporation has successfully filed for an extension the new due date would be the 15th day of the ninth month following the end of the corporation s tax year For calendar year S Corps the extended deadline is typically September

Deadline for filing a 2024 calendar year C corporation or calendar year estates trusts tax return or extension Due date for first installment of 2025 estimated tax payments Deadline to claim a S Corp Tax Return Deadline IRS Form 1120S S Corporation tax returns are due no later than the 15th day of the third month following the end of the corporation s tax year For calendar

Download What Is The Extended Due Date For S Corporate Tax Returns

More picture related to What Is The Extended Due Date For S Corporate Tax Returns

FACT CHECK Does The U S Have The Highest Corporate Tax Rate In The

http://mediad.publicbroadcasting.net/p/shared/npr/styles/x_large/nprshared/201805/541800497.jpg

Income Tax Return Quiz AskMoneyGuru The Complete Guide To Personal

https://www.askmoneyguru.com/wp-content/uploads/2018/08/income-tax-return-online-1024x576.jpg?x42341

The 2021 Tax Filing Deadline Has Been Extended Access Wealth

https://access-wealth.com/wp-content/uploads/2021/03/tax-extension-2.jpeg

When considering S Corp status the first deadline to be aware of is March 15th This is the cutoff for electing to be taxed as an S Corp for the current year The process involves submitting Form 2553 which allows businesses to Corporations have a deadline to file their tax returns Form 1065 for partnerships and Form 1120S for S corporations This date was extended to September 17 2018 from March 15

S Corporations follow a different timeline with tax returns due by the 15th day of the 3rd month after the end of the tax year For those operating on a calendar year this means These include filing an S corp income tax return as well as payroll tax returns and in some cases unemployment tax returns Business income taxes Let s start with the

Business Tax Return Due Date By Company Structure

https://www.patriotsoftware.com/wp-content/uploads/2019/12/taxes_due_for_business_75653-01.jpg

Tax Deadline 2021 When Are State Income Taxes Due Check Our List

https://www.gannett-cdn.com/presto/2021/05/12/USAT/f264f2ba-e8fc-4eed-9e0b-7c1693be9e94-GettyImages-1303122114.jpg?crop=2116,1191,x0,y109&width=2116&height=1191&format=pjpg&auto=webp

https://www.bench.co › blog › tax-tips › tax-…

For individuals that means you can still file for a tax extension right on April 15 2025 The same goes for businesses S corps and partnerships can still get an extension on March 17 and the last day for C corps to file for an extension is

https://turbotax.intuit.com › tax-tips › small...

C corporations S corporations partnerships and sole proprietorships all have specific federal income tax return due dates For instance in 2025 sole proprietors and C corporations operating on a calendar year must file by April

Income Tax TDS Due Dates Of April 2021 In 2021 Income Tax Income

Business Tax Return Due Date By Company Structure

Corporation Tax Ambiance Accountants Sheffield Accountants

PERSONAL CORPORATE TAX RETURNS E FILING By Tax Accounting Solutions

Breaking News Due Date For Income Tax Return Tax Audit TDS Return

Due Date For Federal Income Tax Returns And Payments Postponed To July

Due Date For Federal Income Tax Returns And Payments Postponed To July

Income Tax Return Due Date Vonants

Income Tax Return Filing 2021 Last Date Extended

Tax Returns Made High value Transactions Or Large Investments The New

What Is The Extended Due Date For S Corporate Tax Returns - Tax returns for S corporations Form 1120 S and partnerships Form 1065 due Furnish Schedule K 1 to partners shareholders Deadline to elect S corporation status for 2025