What Is The Federal Tax Credit For Solar Panels If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page

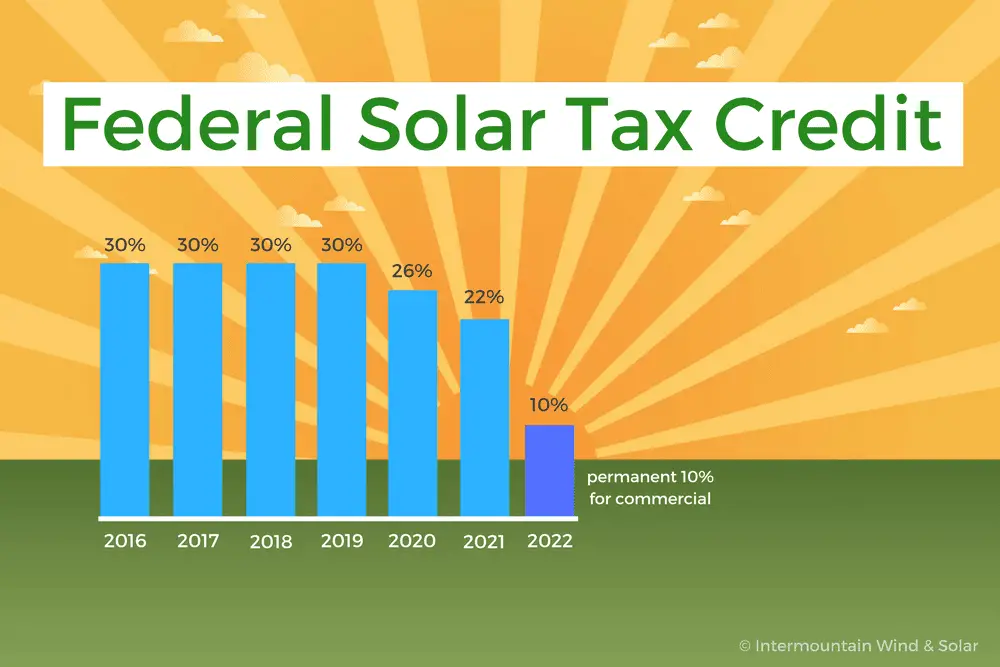

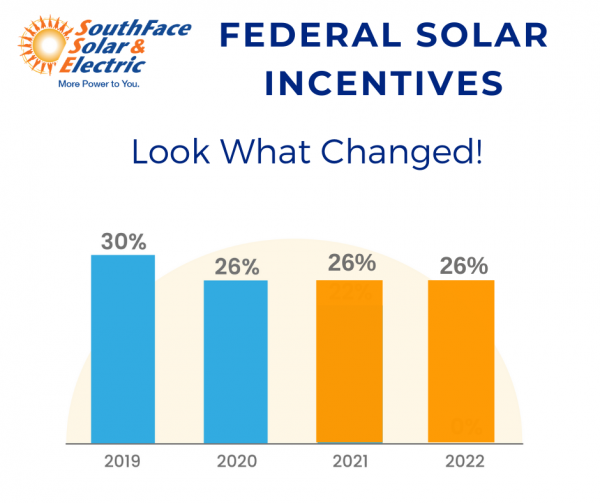

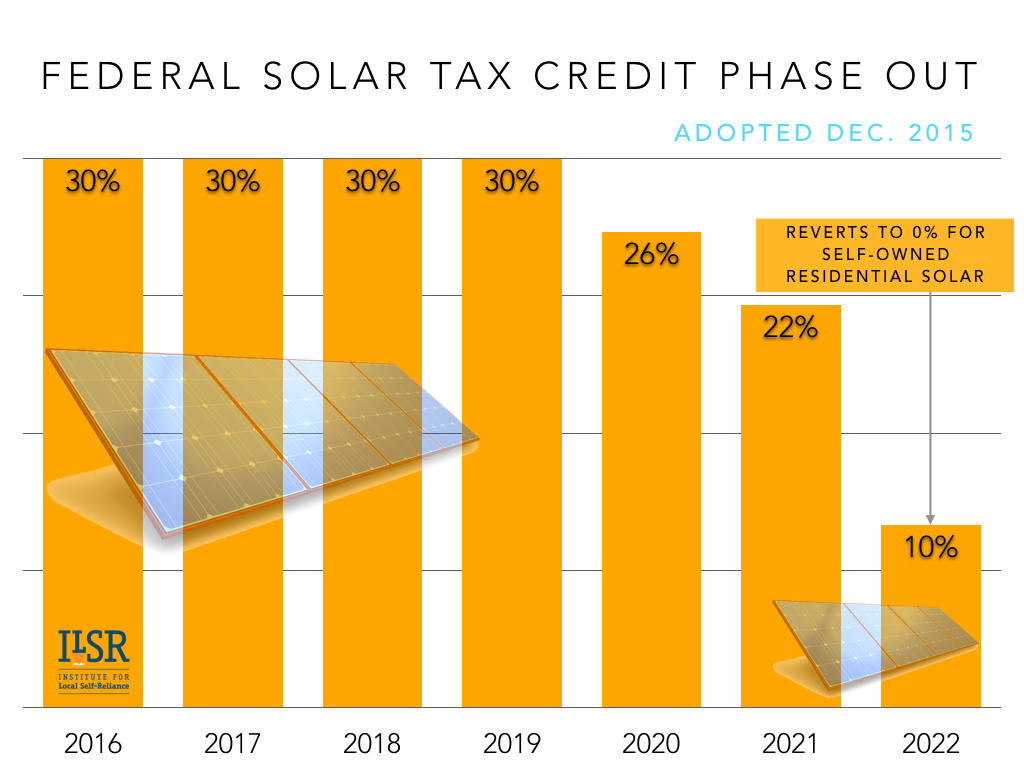

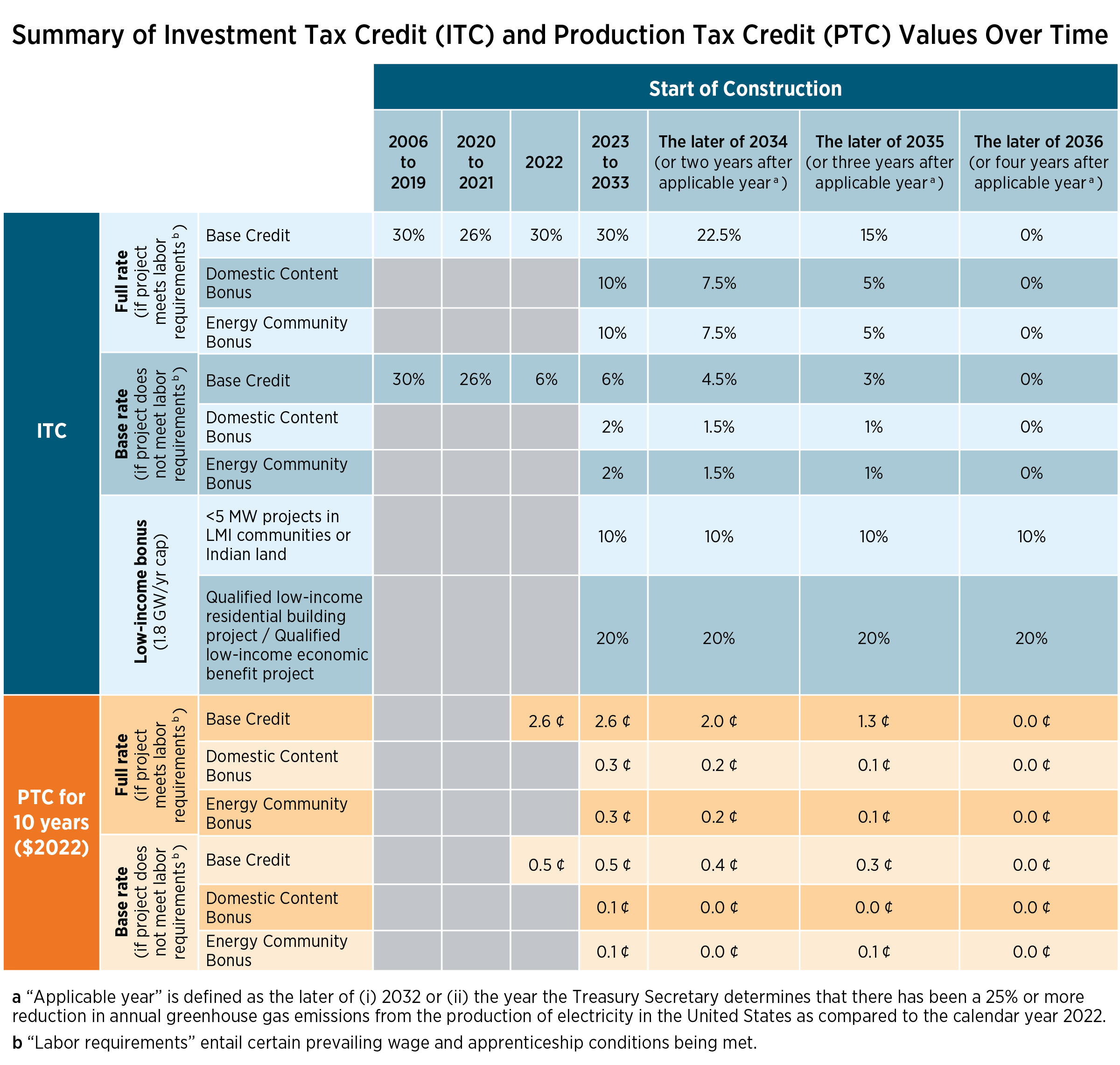

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 through 2032

What Is The Federal Tax Credit For Solar Panels

What Is The Federal Tax Credit For Solar Panels

https://nickiandkaren.com/wp-content/uploads/2019/12/photo-1566093097221-ac2335b09e70.jpeg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Understanding The Federal Tax Credit For Solar Panels

https://static.wixstatic.com/media/208893_ac7845951fc0446bbf545cb1d878b21d~mv2.png/v1/fill/w_968,h_493,al_c,lg_1,q_90/208893_ac7845951fc0446bbf545cb1d878b21d~mv2.png

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems

Download What Is The Federal Tax Credit For Solar Panels

More picture related to What Is The Federal Tax Credit For Solar Panels

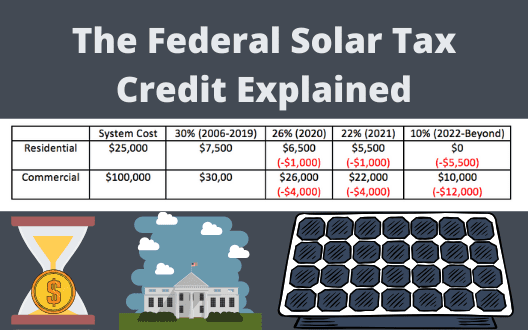

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

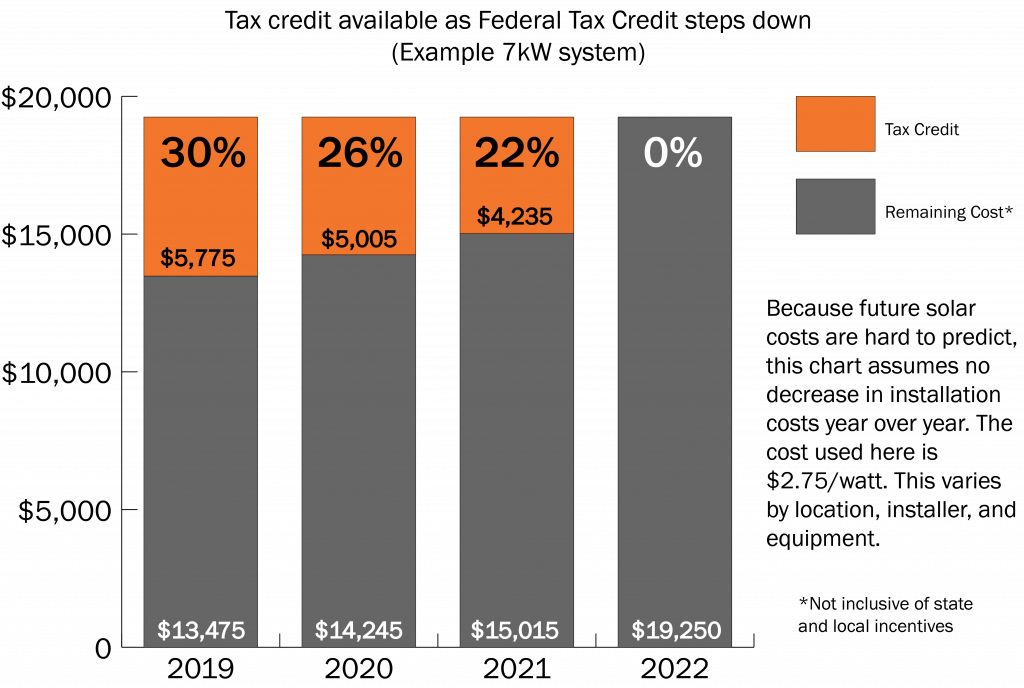

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

https://www.solarunitedneighbors.org/wp-content/uploads/2018/12/Solar-tax-credit-graph-without-header-1024x688.png

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035

6 min Print Your guide to the solar tax credit How you can use this tax credit to cut the cost of adding solar power to your home Fidelity Viewpoints Key takeaways The federal Residential Clean Energy Credit is commonly known as the solar tax credit because it can help defray the considerable costs of adding solar panels to The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

https://www. irs.gov /credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page

https://www. energy.gov /sites/default/files/2023-03/...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Understanding The Federal Tax Credit For Solar Panels 2023 Update

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Federal Tax Credit For Solar Panels In 2023

Congress Gets Renewable Tax Credit Extension Right Institute For

A Guide To The Federal Solar Panel Tax Credit BestInfoHub

A Guide To The Federal Solar Panel Tax Credit BestInfoHub

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Solar Tax Credits For Businesses Department Of Energy

How Do I Claim The Federal Solar Tax Credit

What Is The Federal Tax Credit For Solar Panels - Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also