What Is The Fuel Tax Credit For Farmers The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return

Purpose of Form Partnerships Additional Information Recordkeeping Including the Fuel Tax Credit in Income Specific Instructions How To Make a Claim Amount of credit Exported taxable fuel Type of Use Table Types of use 13 and 14 Line 1 Nontaxable Use of Gasoline Claimant Allowable uses Line 2 Nontaxable Use of Aviation Gasoline FUEL TAX CREDITS AND REFUNDS FOR FARMERS INTRODUCTION Farming can be a fuel intensive business Both the federal and state governments impose an excise tax fuel tax on each gallon of fuel purchased The amount of fuel tax can become substantial if the farming operation uses thousands of gallons of fuel to plant and harvest its crops

What Is The Fuel Tax Credit For Farmers

What Is The Fuel Tax Credit For Farmers

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

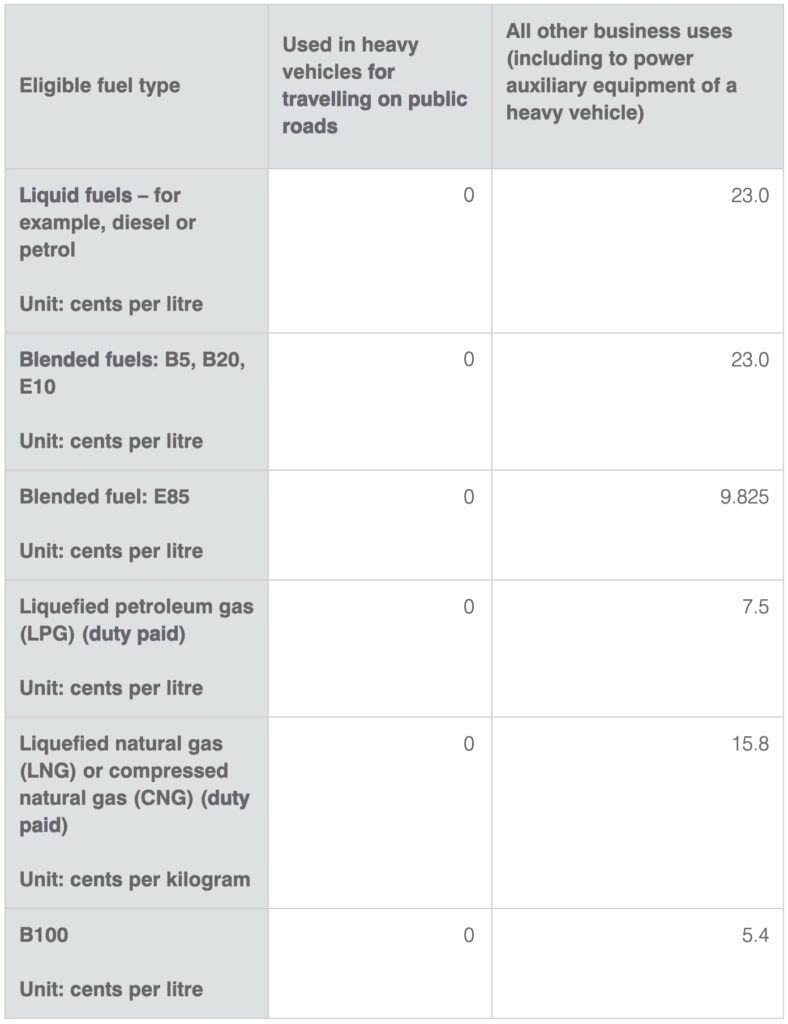

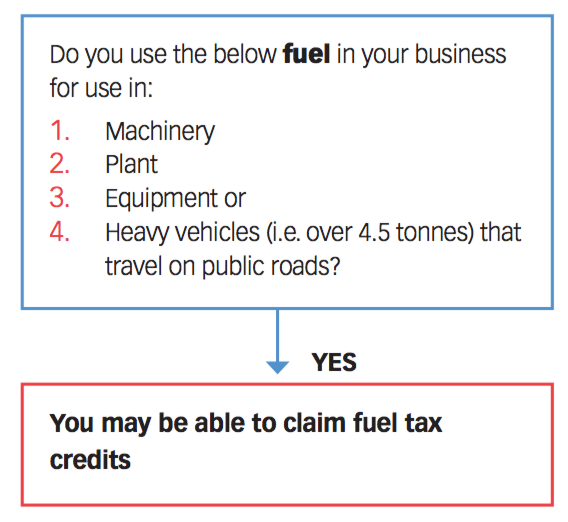

Are You Eligible To Claim Fuel Tax Credits FTC SPS Consultants

https://spsconsultants.com.au/wp-content/uploads/2019/10/Using-Heavy-Vehicles-in-Your-Business-Understand-your-fuel-tax-credits.jpg

Fuel Tax Credit UPDATED JUNE 2022

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 IRS Form 4136 Tax Credits for Fuel Purchases for Landscapers and Farmers Jason D Knott 15 8K subscribers Join Subscribe 68 Share 7 7K views 2 years ago IRS Forms Schedules For

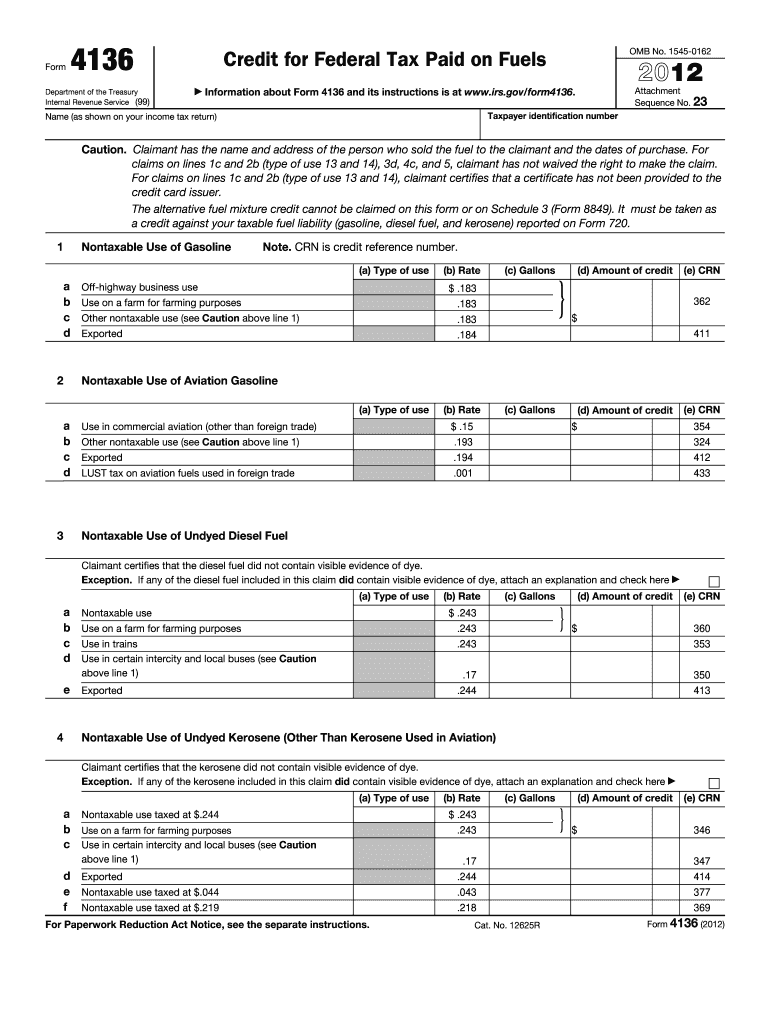

About Form 4136 Credit For Federal Tax Paid On Fuels Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The alternative fuel credit Aa credit for blending a diesel water fuel emulsion Current Revision Form 4136 PDF Instructions for Form 4136 Print Version PDF Recent Developments The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Download What Is The Fuel Tax Credit For Farmers

More picture related to What Is The Fuel Tax Credit For Farmers

Fuel Tax Credits Sand Stone

https://sandandstone.cmpavic.asn.au/wp-content/uploads/2020/02/tax1-595x1024.jpg

Fuel Tax Credit Rates Fuel Tax Assist

https://www.fueltaxassist.com.au/wp-content/uploads/2022/08/FT-Rates-1-8-2022-788x1024.jpg

Are You Maximising Your Fuel Tax Credit Claim Nexia A NZ

https://nexia.com.au/sites/default/files/editor-uploads/images/News Articles/Fuel Tax Credits.png

You can claim a credit for federal excise tax you paid on fuels you used On a farm for farming purposes Ex fuel used to run a tractor while plowing On a boat used for commercial fishing For off highway business use This is fuel used in a trade or business or in an income producing activity like Using stationary machines like Generators Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving particularly for transportation construction or agriculture businesses where fuel consumption is high

Credit for Federal Tax Paid on Fuels Form 4136 Support TaxSlayer Support Credit for Federal Tax Paid on Fuels Form 4136 Form 4136 is no longer supported in our program Facebook Twitter Looking for more tax information and tips SHOW ME MORE Form 4136 allows taxpayers to claim a credit for certain federal excise taxes paid on fuels including gasoline diesel fuel and alternative fuels like liquefied petroleum gas LPG compressed natural gas CNG and liquefied hydrogen

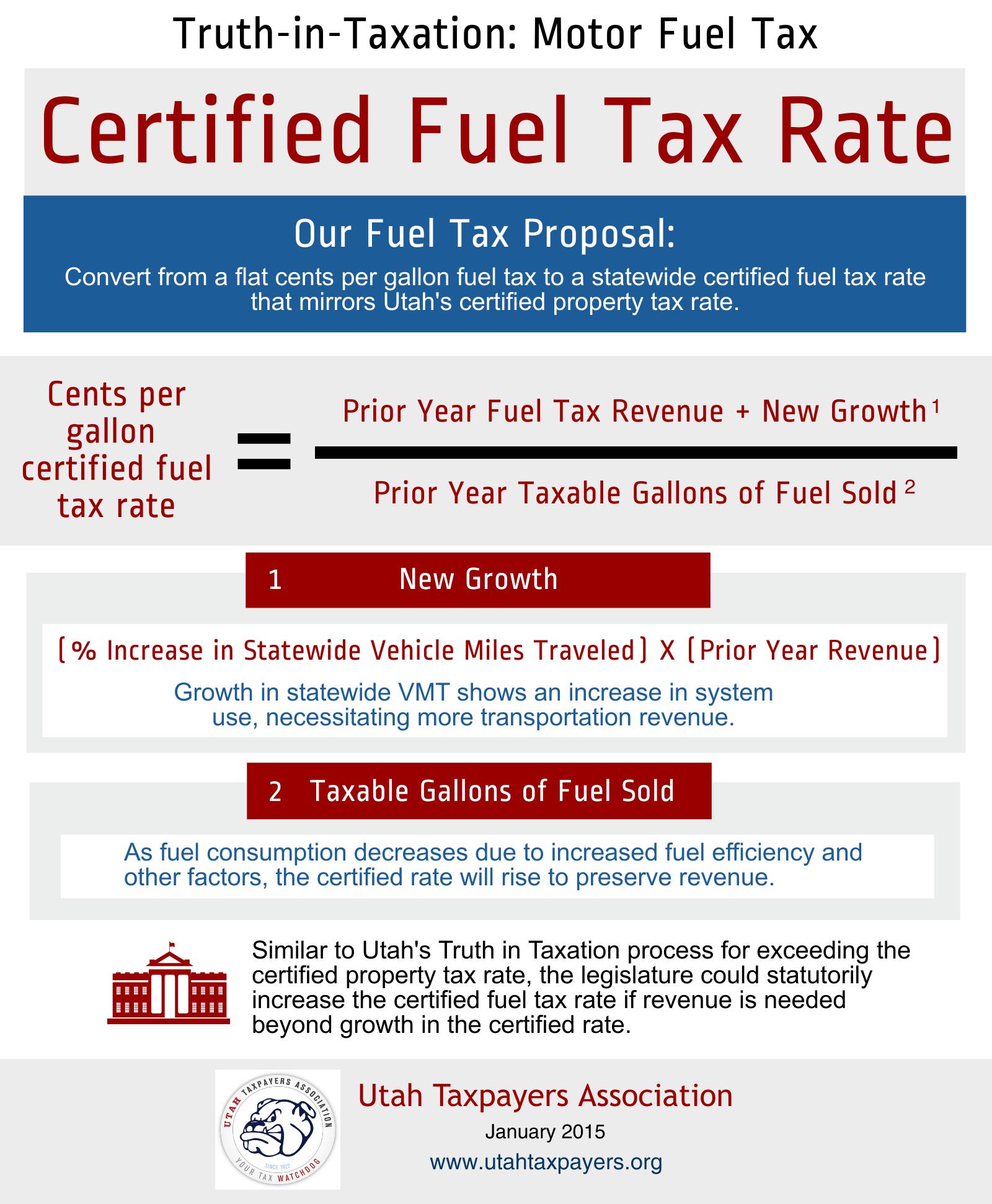

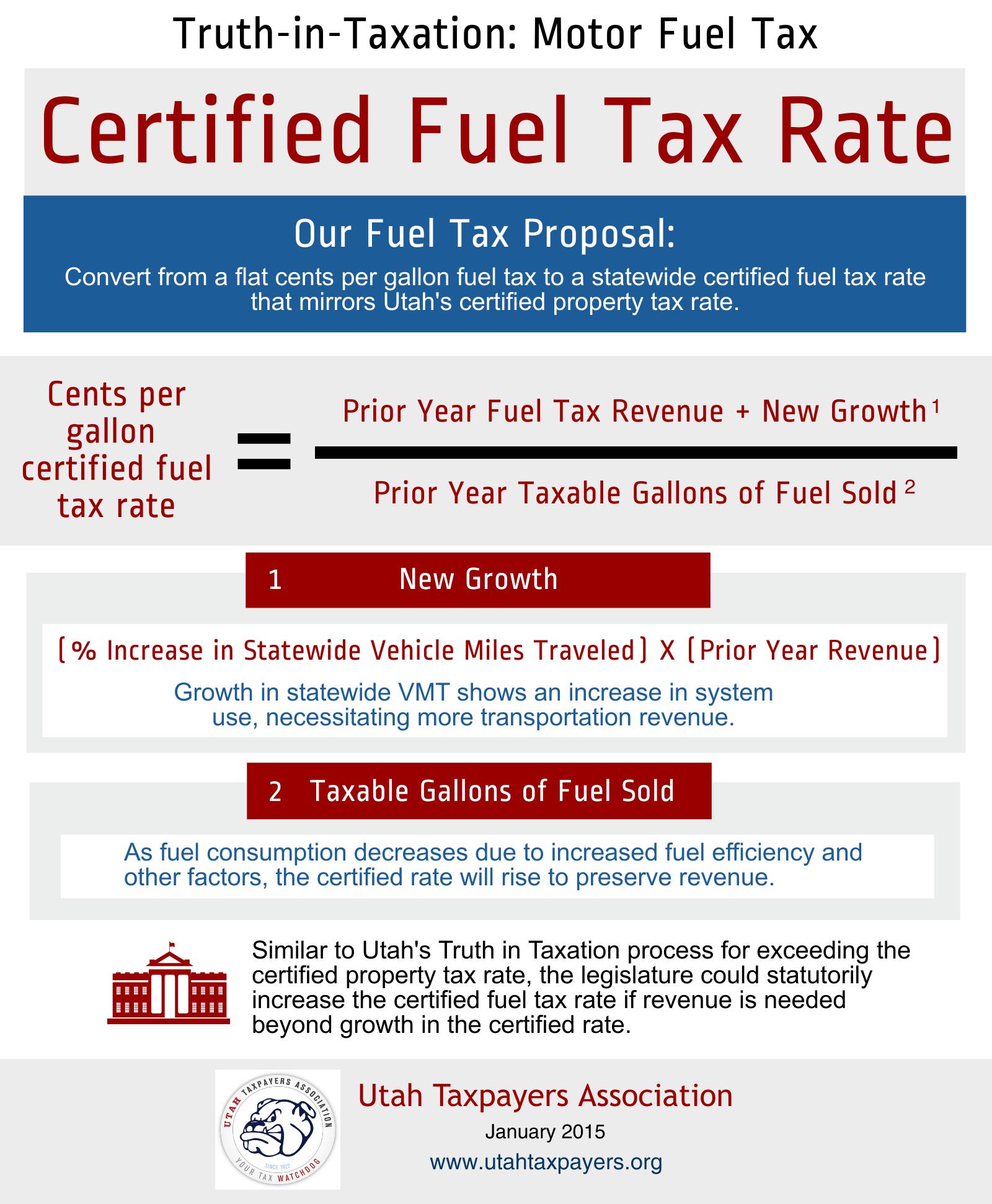

Truth in Taxation For The Motor Fuel Tax Utah Taxpayers

https://utahtaxpayers.org/wp-content/uploads/2015/01/Fuel-Tax-Proposal-1.jpeg

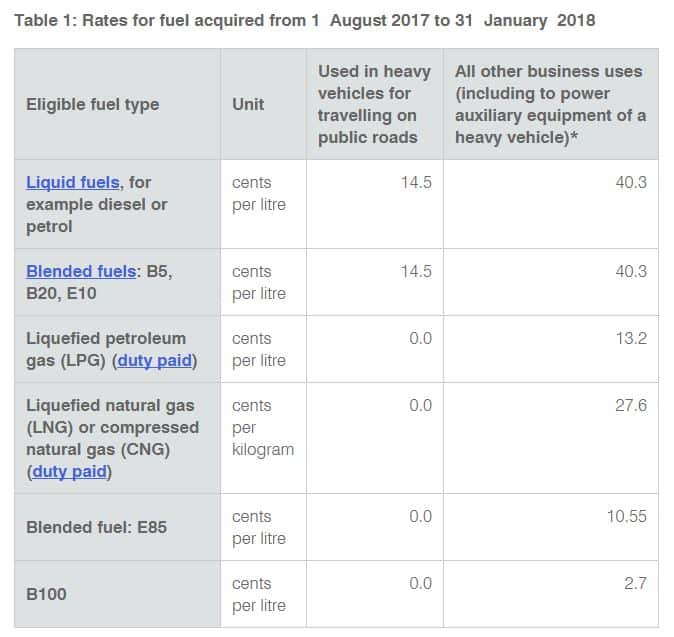

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/06/ftc-1aug2017.jpg

https://www.irs.gov/pub/irs-pdf/i4136.pdf

The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return

https://www.irs.gov/instructions/i4136

Purpose of Form Partnerships Additional Information Recordkeeping Including the Fuel Tax Credit in Income Specific Instructions How To Make a Claim Amount of credit Exported taxable fuel Type of Use Table Types of use 13 and 14 Line 1 Nontaxable Use of Gasoline Claimant Allowable uses Line 2 Nontaxable Use of Aviation Gasoline

Fuel Tax Credit Atotaxrates info

Truth in Taxation For The Motor Fuel Tax Utah Taxpayers

Fuel Tax Credit 2023 2024

Fuel Tax Credit Changes Element Accountants Advisors

Fuel Tax Credit Rates Changes For Australian Businesses AFS

Record keeping Requirements For Fuel Tax IFTA YouTube

Record keeping Requirements For Fuel Tax IFTA YouTube

Fuel Tax Credits CIB Accountants Advisers

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

And The Award For Biggest Fossil Fuel Subsidy Goes To The Fuel Tax

What Is The Fuel Tax Credit For Farmers - The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The