What Is The Gst Rate On Clothes The following are the GST rates on clothing as of 2023 Note Despite being relevant to the majority of clothing kinds there are certain exceptions For instance khadi cotton fabrics and clothing made on a handloom are free from the GST on clothes

From January 2022 the GST rate on fabrics has been raised to 12 from 5 and the GST rate on garments of any value has been raised to 12 compared to the previous rate of 5 on items priced up to INR 1 000 Q 2 What is the GST rate on clothes A The GST rate on clothes depends on the type of cloth and the selling price As of 2021 there is no GST on clothes with a sale price below Rs 1 000 5 GST on clothes with a sale price of Rs 1 000 or more 12 GST on ready made garments and 18 GST on synthetic and man made fibers and fabrics

What Is The Gst Rate On Clothes

What Is The Gst Rate On Clothes

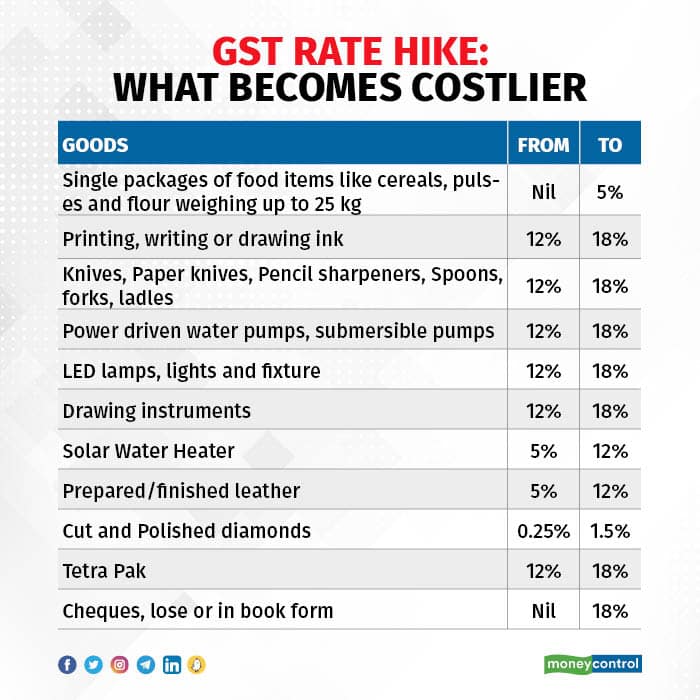

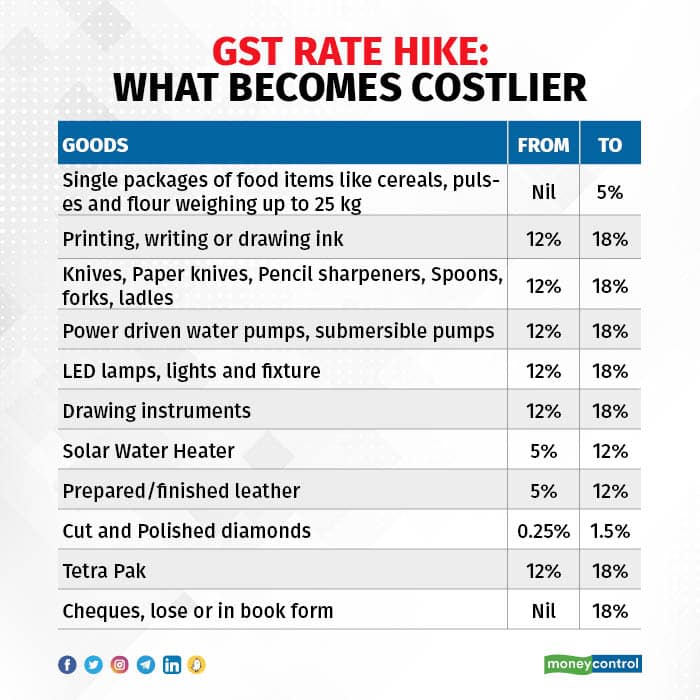

https://images.moneycontrol.com/static-mcnews/2022/07/GST-Rate-Hike-What-Becomes-Costlier.jpg

A Complete Guide On GST Rate For Apparel Clothing And Textile Products

https://ebizfiling.com/wp-content/uploads/2021/12/tax-on-texttile.png

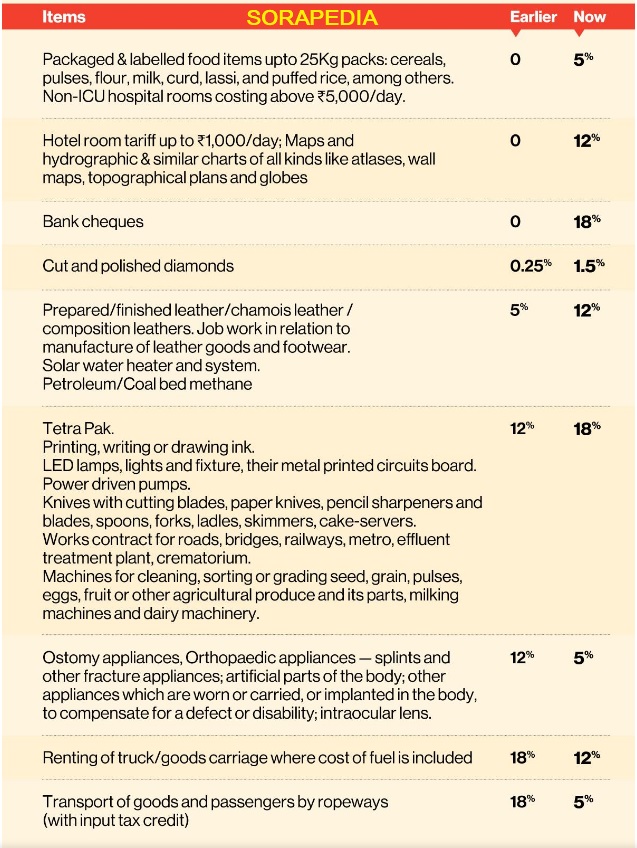

A Complete Guide On GST Rate On Food Items Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/01/gst-on-food.png

GST Rate HSN Code for Articles of apparel and clothing accessories knitted or crocheted Chapter61 GST Rates HSN Codes on Clothing Accessories for Men Women Children Chapter 61 Disclaimer Rates given above are updated up to the GST Rate notification no 05 2020 dated 16th October 2020 to the best of our information GST on Clothing Textiles the Complete Guide Staff Desk 4 April 2024 46 723 4 mins read The Central Board of Indirect Taxes and Customs has imposed a standard goods and services tax rate the rate of 12 GST Goods and Service Tax on textiles apparel and footwear to rectify the inverted duty structure

What is the GST rates for garments stitched or readymade clothes The GST rate for stitched or readymade clothes is 5 as determined by tax regulations in India This percentage represents the Goods and Services Tax applied to the purchase of garments in their finished or ready to wear form Description GST on Clothes Calculated on per piece value 6101 Men s or boys jackets and coats which also covers overcoats carcoats cloaks capes anoraks including Ski Jackets windcheaters wind jackets and other similar articles knitted or crocheted but other than those of heading 6103

Download What Is The Gst Rate On Clothes

More picture related to What Is The Gst Rate On Clothes

GST Rates In 2023 List Of Goods Service Tax Rates Slabs

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

The GST Compensation Cess Issue All You Need To Know Marketfeed news

https://149494764.v2.pressablecdn.com/wp-content/uploads/2020/10/gstblog2.jpg

New GST Rates These Food Items Will Be Costlier

https://www.sorapedia.com/wp-content/uploads/2022/07/New-gst-rate.jpg

Regardless of value the GST rates for clothing as a whole were to be set at 12 beginning in January 2022 This indicates that the GST rate for clothing of any value below Rs 1 000 or above is 12 as opposed to the previous GST rate of 5 for clothing priced up to Rs 1 000 Based on the HSN classification the GST rates for cotton yarn silk wool and nylon range from 0 5 12 18 and 28 These products are covered in different chapters of the HSN code GST on Cotton The HSN code for

HSN Code for Apparel Find the correct GST rate and HSN code for Articles of Apparel and Clothing Accessories in India with our complete guide Last updated December 25th 2023 05 38 pm The GST Council fixed the GST on Textiles and Textile Products Apparel and Clothing after the implementation of GST The Council fixed the GST rates at 0 5 12 18 and 28 in India for both goods and services

All You Should Know About The GST Council In India Its Functioning

https://okcredit-blog-images-prod.storage.googleapis.com/2020/11/gstnew2.jpg

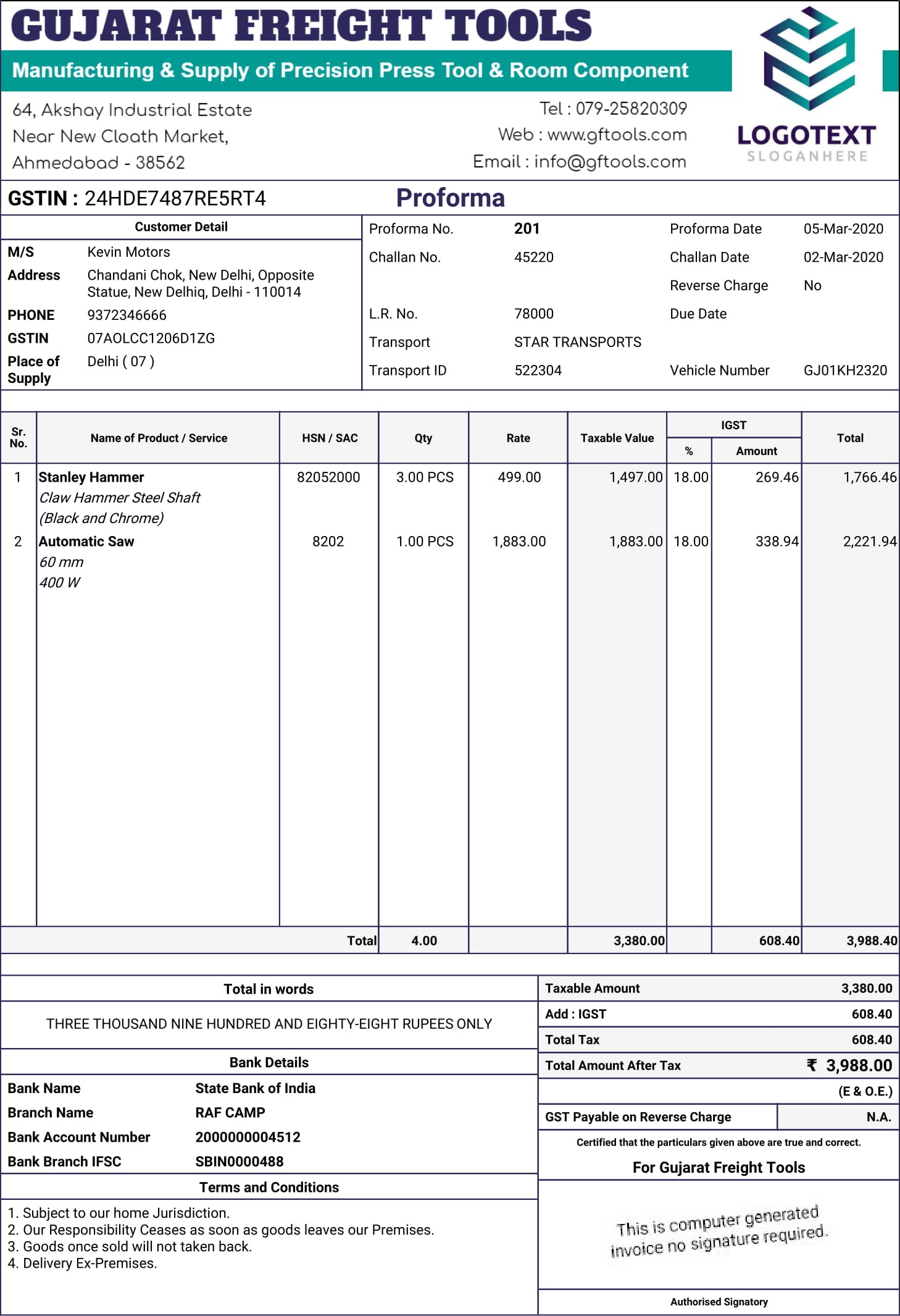

GST Proforma Invoice Format In India 100 Free GST Billing Software

http://gogstbill.com/wp-content/uploads/2020/03/Proforma_201-1.jpg

https://www. aachho.com /blogs/news/gst-on-clothes

The following are the GST rates on clothing as of 2023 Note Despite being relevant to the majority of clothing kinds there are certain exceptions For instance khadi cotton fabrics and clothing made on a handloom are free from the GST on clothes

https:// ebizfiling.com /blog/gst-rate-for-clothing

From January 2022 the GST rate on fabrics has been raised to 12 from 5 and the GST rate on garments of any value has been raised to 12 compared to the previous rate of 5 on items priced up to INR 1 000

5 GST Rate Items HSN Code For Goods Updated 2023 AUBSP

All You Should Know About The GST Council In India Its Functioning

GST Revised Rates Come Into Effect From Today Here s What Gets

GST Advantages And Disadvantages Of GST Explained Kikali in

GST Rates For Goods Goods And Service Tax Goods And Services Content

What Is GST How It Has Been Treating India Read More Here app

What Is GST How It Has Been Treating India Read More Here app

A Quick Guide To India GST Rates In 2017 Indian Legal System

GST Is Not Really A Tax Problem But A Technology Issue

Implementation Of GST And Act Of GST Example TutorsTips

What Is The Gst Rate On Clothes - GST Rate HSN Code for Articles of apparel and clothing accessories knitted or crocheted Chapter61 GST Rates HSN Codes on Clothing Accessories for Men Women Children Chapter 61 Disclaimer Rates given above are updated up to the GST Rate notification no 05 2020 dated 16th October 2020 to the best of our information