What Is The Hmrc Mileage Rate For Electric Cars Web 20 Okt 2023 nbsp 0183 32 Welcome to our review of the current HMRC electric car mileage rates The 2023 HMRC electric car mileage rate is 9p for company cars If you are driving a personal electric car for business

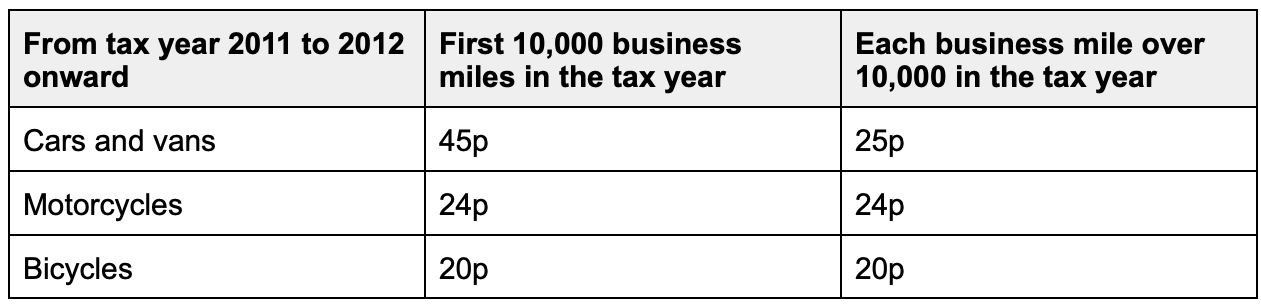

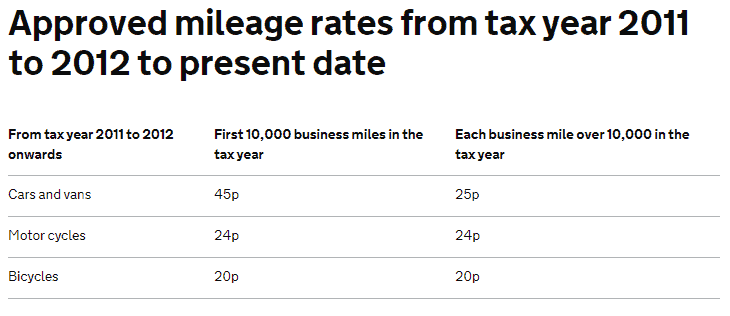

Web Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying Web 1 Juni 2023 nbsp 0183 32 HMRC electric car mileage rates 2024 If your business owns a fleet of fully electric or hybrid vehicles the rate is 9p per mile rising from 8p earlier this year At the

What Is The Hmrc Mileage Rate For Electric Cars

What Is The Hmrc Mileage Rate For Electric Cars

https://electriccarguide.co.uk/wp-content/uploads/2023/03/Nissan-Leaf-charging-in-an-asda-car-park.jpg

HMRC Mileage Rate 2022 What Is The Mileage Rate And How To Use It

https://d2mcx4odt2tts0.cloudfront.net/vite/assets/recording-en-gb.66182cbd.png

HMRC Sets Mileage Reimbursement Rates For Electric Cars Electrive

https://www.electrive.com/wp-content/uploads/2018/07/united-kingdom-uk-london-flag-flagge-pixabay-888x444.png

Web 3 Apr 2023 nbsp 0183 32 Electricity is taxed differently to other fuels and HMRC has a much simpler system for reimbursing electric vehicle drivers The Advisory Electric Rate AER is Web 15 Sept 2023 nbsp 0183 32 From 1 September 2023 the advisory electric rate for fully electric company cars is 10 pence per mile The Advisory Electricity Rate AER is calculated

Web October 6 2022 Zeit 8 Minuten Business travel affects employees entrepreneurs and self employed workers alike And whilst getting out of the office or talking to clients can be pleasant for a change tax related tasks Web In September 2018 HMRC announced that the Advisory Electricity Rate AER to be used for electric company cars is 4p per mile With the current electric company car mileage

Download What Is The Hmrc Mileage Rate For Electric Cars

More picture related to What Is The Hmrc Mileage Rate For Electric Cars

Electric Car Mileage How Good Are Modern EVs Really

https://mlqvmxx6hqrx.i.optimole.com/b2Xr5oE.GU1t~6a37d/w:auto/h:auto/q:mauto/id:978a803ac9ba7014741178d0484ac801/https://justwe-gpi.com/electric-car-mileage.jpg

HMRC Mileage Rates For 2023

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/63bc7ba66407efe4e7aeb5fe_Screenshot 2023-01-09 at 3.39.06 PM.png

HMRC Electric Car Mileage Rates 2023 Electric Car Guide

https://electriccarguide.co.uk/wp-content/uploads/2022/12/IMG_5564-scaled.jpg?x35224

Web The HMRC the U K s tax authority has currently set this rate at 45 pence per mile for the first 10 000 miles and 25 pence per mile for any additional mileage Plus the employee Web 20 Apr 2021 nbsp 0183 32 Mileage allowances The current Advisory Electricity Rate for fully electric cars is 4p per mile Therefore if an employee provides the electricity and travels 1 000

Web From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s Web HMRC issues Advisory Fuel Rates AFRs every three months a per mile rate calculated based on current fuel prices and average efficiency of fleet operated vehicles Hybrids

HMRC Electric Car Mileage Rates 2023 Electric Car Guide

https://electriccarguide.co.uk/wp-content/uploads/2023/03/Porche-charging-in-a-home-garage.jpg

HMRC Mileage Rates UK 2021 2022 Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2021/08/Screenshot-2021-08-12-at-19.38.46-2048x884.png

https://electriccarguide.co.uk/hmrc-electric-…

Web 20 Okt 2023 nbsp 0183 32 Welcome to our review of the current HMRC electric car mileage rates The 2023 HMRC electric car mileage rate is 9p for company cars If you are driving a personal electric car for business

https://www.gov.uk/.../travel-mileage-and-fuel-rates-and-allowances

Web Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying

Mileage Allowance A Simple Guide UK

HMRC Electric Car Mileage Rates 2023 Electric Car Guide

HMRC Mileage Rates 2022 Company Car Allowance Explained

HMRC Approved Mileage Rates From June 2021 ASE Plc

Cardata The IRS Announces A New Mileage Rate For 2023

HMRC Raises The Advisory Electric Rate To 8p Per Mile CBVC

HMRC Raises The Advisory Electric Rate To 8p Per Mile CBVC

The Mileage Rates For Electric Or Hybrid Cars Friend And Grant

HMRC Mileage Rates Tripcatcher

HMRC Mileage Rate 2022 What Is The Mileage Rate And How To Use It

What Is The Hmrc Mileage Rate For Electric Cars - Web October 6 2022 Zeit 8 Minuten Business travel affects employees entrepreneurs and self employed workers alike And whilst getting out of the office or talking to clients can be pleasant for a change tax related tasks