What Is The Home Accessibility Tax Credit The Home Accessibility Tax Credit HATC is a non refundable tax credit designed to help seniors and people with disabilities make necessary modifications to their homes to

What is the home accessibility tax credit HATC For 2016 and subsequent tax years Budget 2015 introduces a non refundable HATC for qualifying expenses incurred for The home accessibility tax credit HATC was introduced by the federal government to help make homes safer and more accessible for people with

What Is The Home Accessibility Tax Credit

What Is The Home Accessibility Tax Credit

https://accessiblerenovation.ca/wp-content/uploads/2022/06/home-accessiblity-tax-credit.jpg

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I

https://www.thesun.ie/wp-content/uploads/sites/3/2018/10/NINTCHDBPICT0004403735981.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

Home Accessibility Tax Credit Edmonton Water Works Bathroom Renovations

https://waterworksrenos.com/wp-content/uploads/2012/07/AccentBar-Healthcraft-Feature-0935-800x800.jpg

The Home Accessibility Tax Credit HATC is a federal nonrefundable credit that currently allows qualifying 65 or older or those who qualify for the Disability Tax Credit or eligible Renovations that make homes safer or more accessible for seniors or the disabled may qualify for the Home Accessibility Tax Credit HATC If you are a senior or

The Home Accessibility Tax Credit HATC is a non refundable tax credit aimed at helping seniors or those with disabilities make necessary home modifications The The Home Accessibility Tax Credit is a non refundable tax credit introduced in the Federal 2015 Budget The credit is for qualifying expenses incurred in 2016 or later for work

Download What Is The Home Accessibility Tax Credit

More picture related to What Is The Home Accessibility Tax Credit

How To Benefit From Home Accessibility Tax Credit YouTube

https://i.ytimg.com/vi/TtNpIzySPoY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBWKEcwDw==&rs=AOn4CLAboZTvtUFdDQM6saKbFtmsjlnA8Q

Home Accessibility Expense Tax Credit Explained By Canwest Accounting

https://canwestaccounting.ca/wp-content/uploads/2021/07/Home-Accessibility-Expense-Tax-Credit-Explained-1799x899.jpg

Get The Most Out Of Your Tax Return This Season The Globe And Mail

https://www.theglobeandmail.com/ece-images/195/globe-investor/personal-finance/taxes/article33023148.ece/binary/iStock-493715012.jpg

The Home Accessibility Tax Credit helps seniors or those with a disability to make their homes safe and accessible Find out the expense limit who qualifies and more The Home Accessibility Tax Credit is for eligible individuals with disabilities qualified for the canadian disability tax credit and people who are 65 years of age or older at the end of the year The

The Federal Home Accessibility Tax Credit HATC plays a crucial role in facilitating home renovations aimed at enhancing safety and accessibility for seniors and Through the federal Home Accessibility Expense tax credit line 31285 on your income tax claim form qualifying and eligible individuals can receive a total tax credit of up to

Senior Home Accessibility Tax Credit A New Article By Still CPA

https://stillcpa.ca/wp-content/uploads/2021/10/senior-home-accessibility-tax-credit.jpg

Accountable Value Financial Services Home Accessibility Tax Credit

https://i0.wp.com/accountablevaluefs.com/wp-content/uploads/2020/07/Home-Reno.png?fit=1200%2C812&ssl=1

https://goodcaring.ca/explainers/home-accessibility-tax-credit-hatc

The Home Accessibility Tax Credit HATC is a non refundable tax credit designed to help seniors and people with disabilities make necessary modifications to their homes to

https://www.canada.ca/.../home-accessibility-tax-credit-hatc.html

What is the home accessibility tax credit HATC For 2016 and subsequent tax years Budget 2015 introduces a non refundable HATC for qualifying expenses incurred for

What Is Tax Credit For ADA Compliant Website Lasting Trend

Senior Home Accessibility Tax Credit A New Article By Still CPA

Digital Accessibility Consultant Taoti Creative

How Can You Claim Home Accessibility Tax Credit HATC In Canada

Income Tax Preparation Northern Rebates

Home Accessibility Tax Credit Throughout Canada Home Mortgage Home

Home Accessibility Tax Credit Throughout Canada Home Mortgage Home

How Can You Claim Home Accessibility Tax Credit HATC In Canada

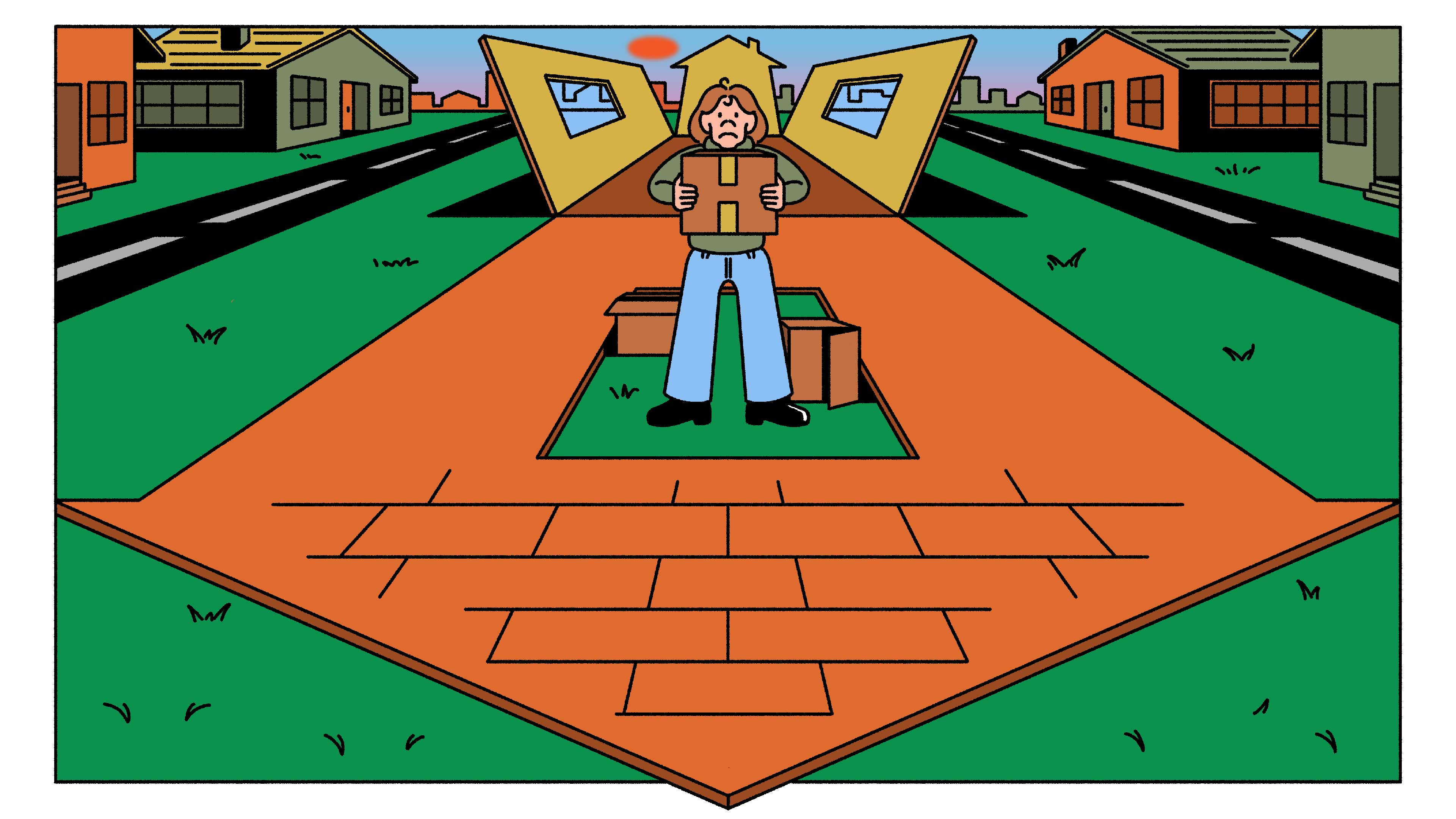

A Dream Deferred Millennials And The Property Ladder Modus RICS

Can I Claim House Repairs On My Taxes SensiBuild Construction

What Is The Home Accessibility Tax Credit - The Home Accessibility Tax Credit is a non refundable tax credit introduced in the Federal 2015 Budget The credit is for qualifying expenses incurred in 2016 or later for work