What Is The Income Limit For Federal Ev Rebate 2024 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but

What Is The Income Limit For Federal Ev Rebate 2024

What Is The Income Limit For Federal Ev Rebate 2024

https://canadianautodealer.ca/wp-content/uploads/2022/08/1-BC-government-revamps-EV-rebate-program-to-target-lower-income-buyers_1200.jpg

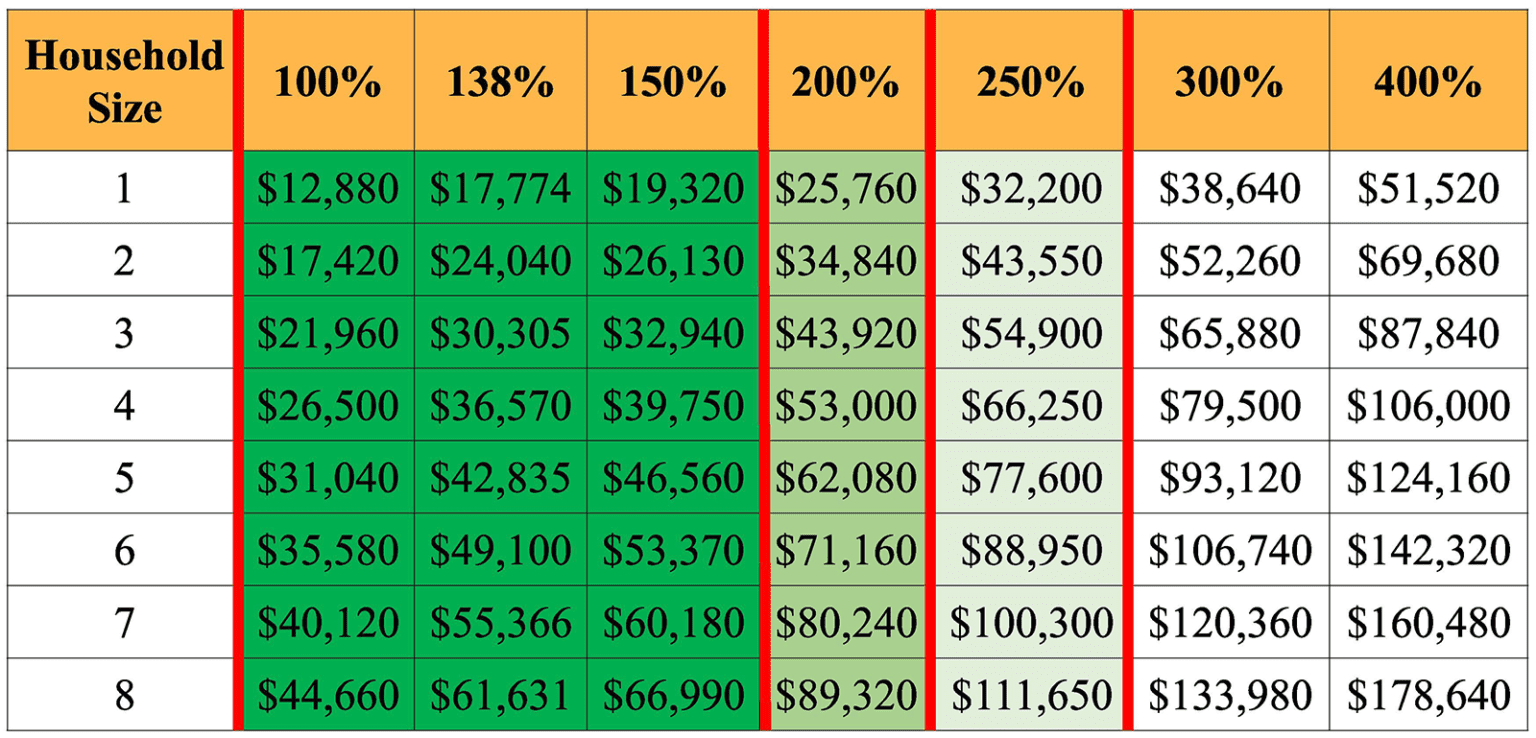

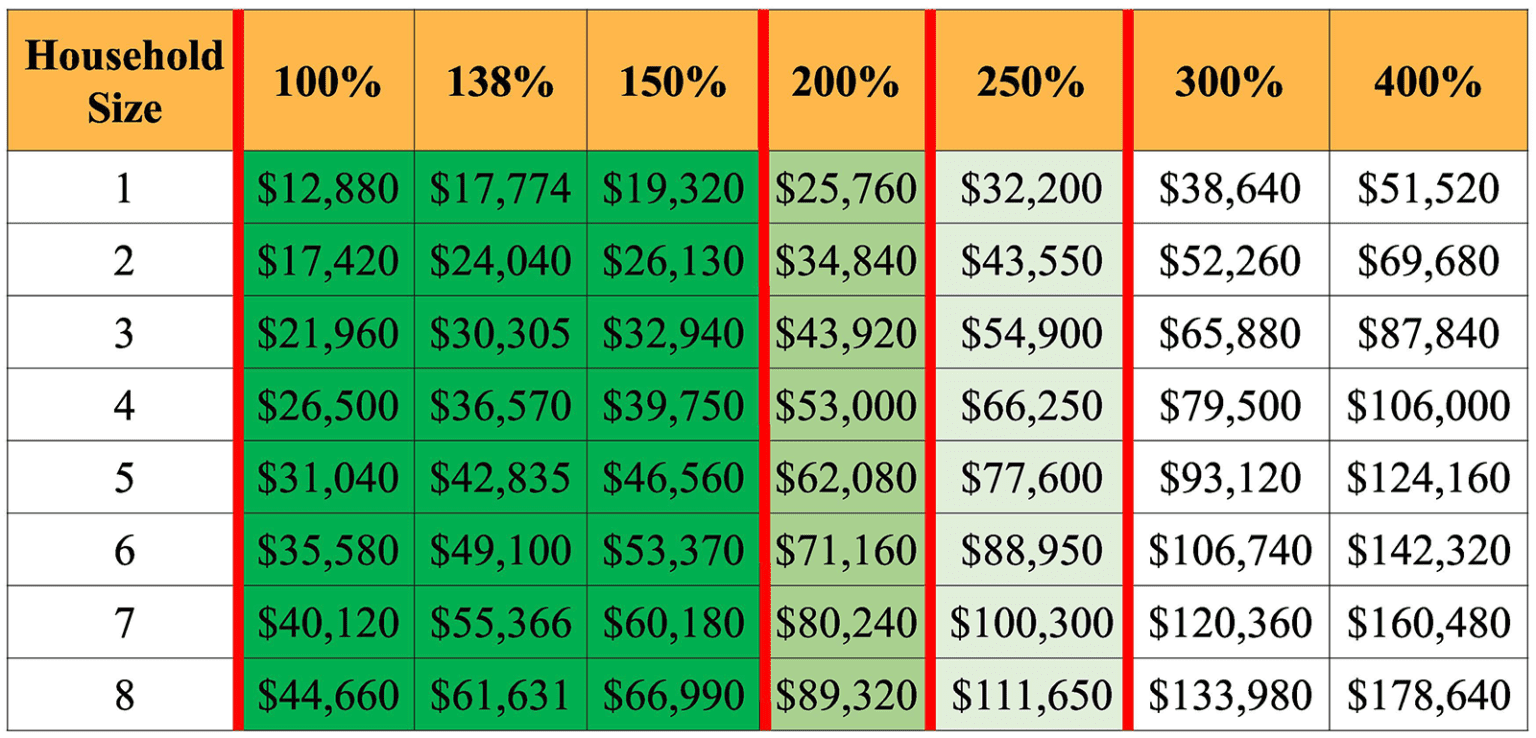

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001-1536x738.png

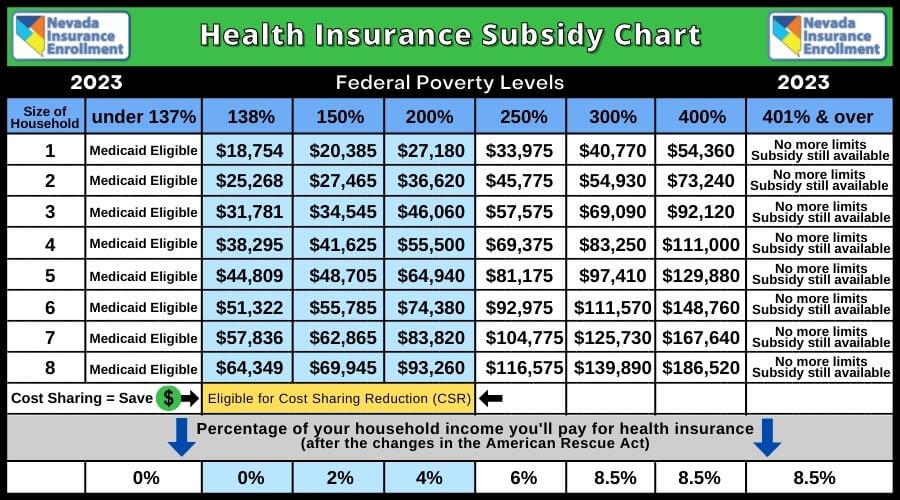

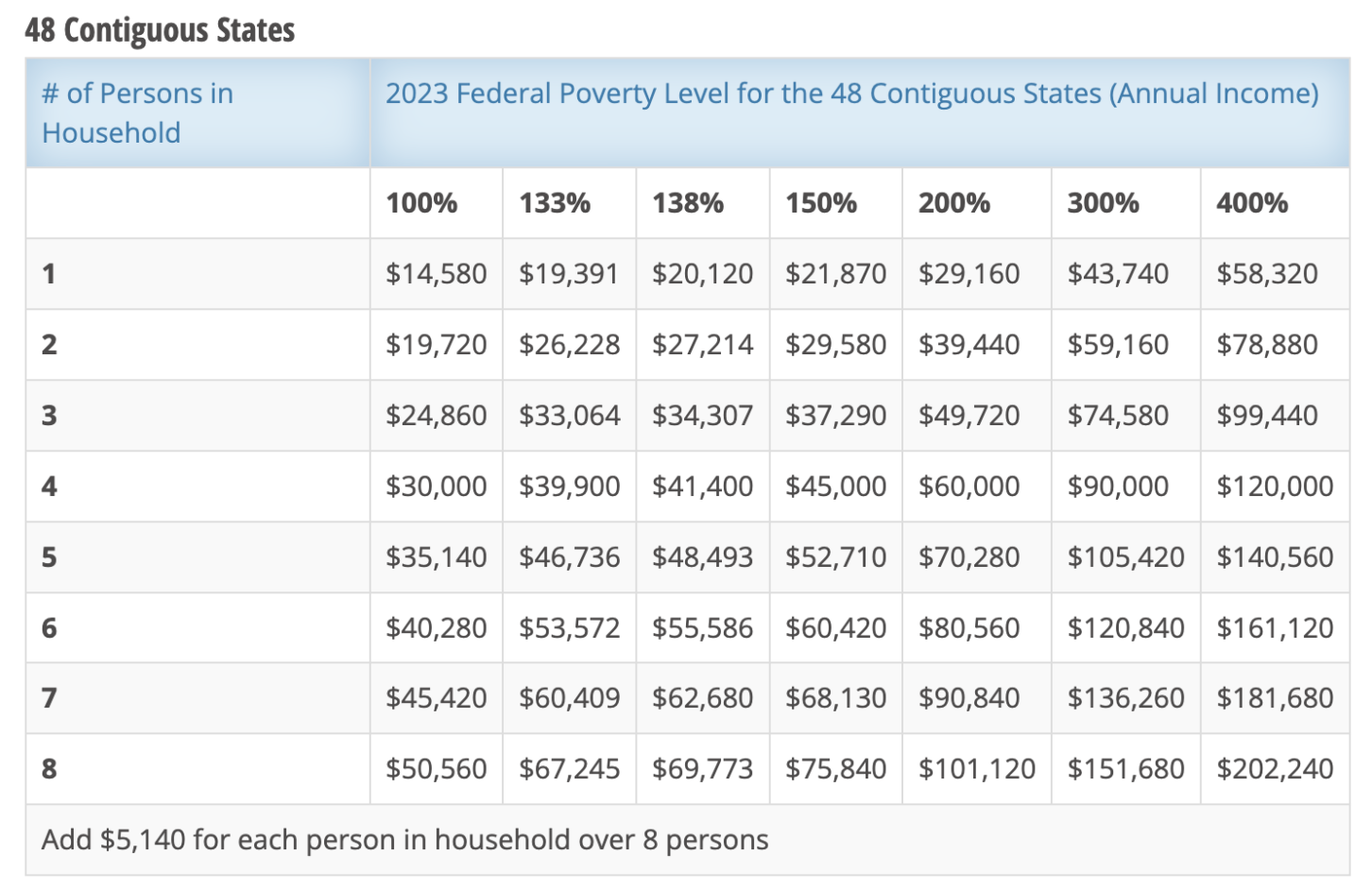

Medicaid Obamacare Professor

https://www.nevadainsuranceenrollment.com/wp-content/uploads/2022/10/2023-Health-Insurance-Subsidy-Chart-Federal-Poverty-Levels.jpg

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return You will need your

Under the IRA the EV tax credit is in place for 10 years until December 2032 for electric vehicles placed into service this year 2023 The tax credit is taken in the year you take Cars that qualify for 7 500 right now may only get 3 250 or no credit at all come March And the IRS is clear When it comes to the timing of a purchase it doesn t matter when you pay for a

Download What Is The Income Limit For Federal Ev Rebate 2024

More picture related to What Is The Income Limit For Federal Ev Rebate 2024

FAQ WA Tax Credit

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

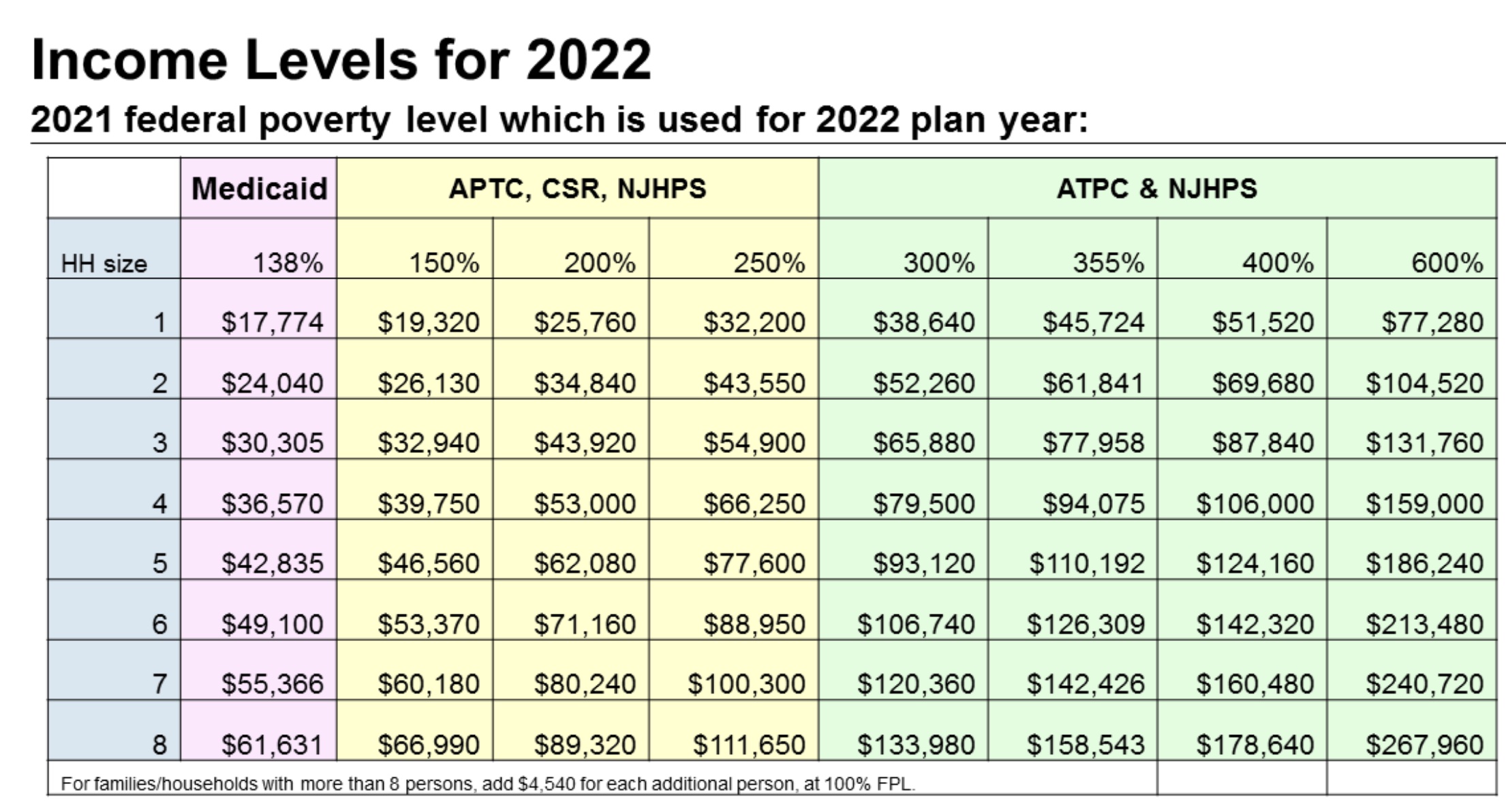

What Are The 2022 Federal Poverty Levels For The New Jersey Marketplace Independent Health Agents

https://help.ihealthagents.com/hc/article_attachments/4410492108055/2022_NJ_Income_Levels.jpg

8 2023 Social Security Tax Limit Ideas 2023 GDS

https://i.pinimg.com/originals/33/55/6b/33556ba693ff68b3c911e28dfacf40c0.png

The Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023 Overall the reforms in the Inflation Reduction Act mean that the tax credit for electric vehicles will evolve Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the automakers themselves take a 7 500 tax credit for EV

Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty Images By Kelley R Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

What Is Poverty Level Income INVOMERT

https://i2.wp.com/comradefinancialgroup.com/wp-content/uploads/2020/09/2020-Federal-Poverty-Level-Chart--1500x710.png

Fortune India Business News Strategy Finance And Corporate Insight

https://images.assettype.com/fortuneindia/2023-02/3b8dd321-a9ba-4a6c-916b-573958eeef52/Tax_03160_copy.JPG?w=1250&q=60

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric-vehicle-tax-credit

As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

Income Tax Rebate Under Section 87A

What Is Poverty Level Income INVOMERT

Medi Cal Qualification Eligibility Magi Income No Asset Test

Ev Car Tax Rebate Calculator 2023 Carrebate

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Payment Agreement How To Set Up A Payment Plan With The IRS Marca

Payment Agreement How To Set Up A Payment Plan With The IRS Marca

2022 app

2022 2023 Income Eligibility Guidelines CDPHE WIC

USCIS Federal Poverty Guidelines For 2023 Immigration Updated

What Is The Income Limit For Federal Ev Rebate 2024 - Cars that qualify for 7 500 right now may only get 3 250 or no credit at all come March And the IRS is clear When it comes to the timing of a purchase it doesn t matter when you pay for a