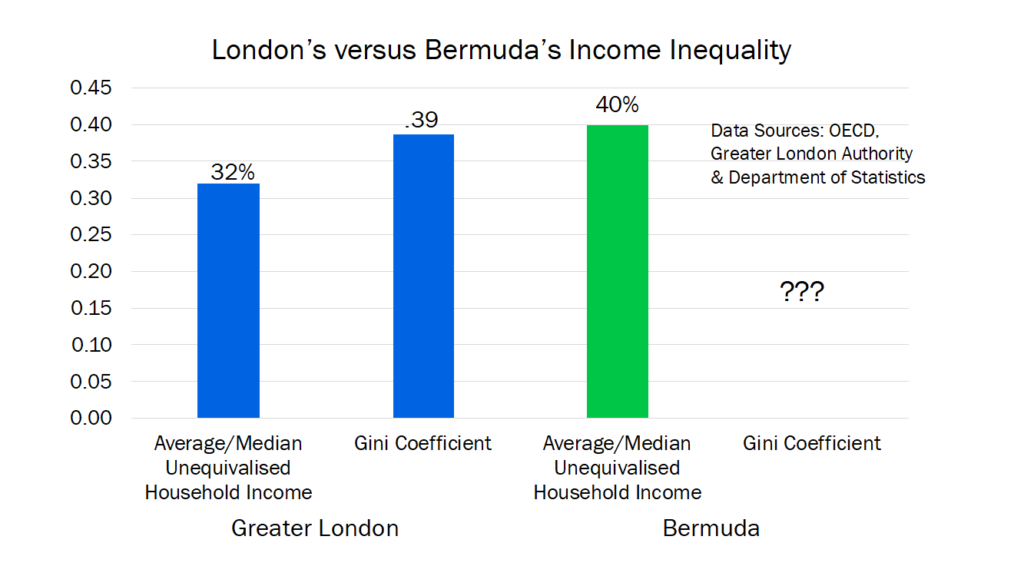

What Is The Income Limit For Homestead Credit In Ohio Ohio Revised Code initially established a maximum Ohio Adjusted Gross Income OAGI of the applicant and the applicant s spouse of 30 000 This maximum is to be indexed for inflation

House Bill 187 increases the income eligibility amount from 36 100 to 75 000 Increasing the exemption amount and expanding eligibility will provide direct tax relief to those most impacted by rising property valuations The limit for tax year 2020 payable 2021 is 33 600 Ohio adjusted gross income line 3 on tax return For 2021 payable 2022 the limit is 34 200 Homestead recipients prior to 2014 are

What Is The Income Limit For Homestead Credit In Ohio

What Is The Income Limit For Homestead Credit In Ohio

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

What Is The Income Limit For Chapter 7 Ella Rice

https://ascentlawfirm.com/wp-content/uploads/2021/04/What-Is-The-Income-Limit-For-Chapter-7.jpg

Income Definition Types Examples And Taxes 45 OFF

https://www.media4math.com/sites/default/files/library_asset/images/Definition--FinancialLiteracy--IncomeTax.png

Total income is defined as the combined income of the owner and the owner s spouse if they are legally married If you do not file Ohio income taxes you will need to provide a federal income Those making 40 000 or less in 2025 of Ohio Adjusted Gross Income can qualify for the Homestead Credit which will take effect for tax bills in 2026 Additionally the value which is

The homestead may include up to one acre of land Under the changes made by the Ohio Legislature and beginning with applications for tax year 2014 new participants in the program To qualify for the Homestead Credit you must be 65 years of age by December 31 2025 and meet the income requirement I urge you to take advantage of this program To apply for the Homestead Exemption please fill out the application

Download What Is The Income Limit For Homestead Credit In Ohio

More picture related to What Is The Income Limit For Homestead Credit In Ohio

Fillable Online Form M1PR Homestead Credit Refund Fax Email Print

https://www.pdffiller.com/preview/102/13/102013958/large.png

How To Apply For Homestead Credit n owa

https://www.aklinizdakiler.com/wp-content/uploads/2023/06/2451-how-to-apply-for-homestead-credit-in-iowa.jpg

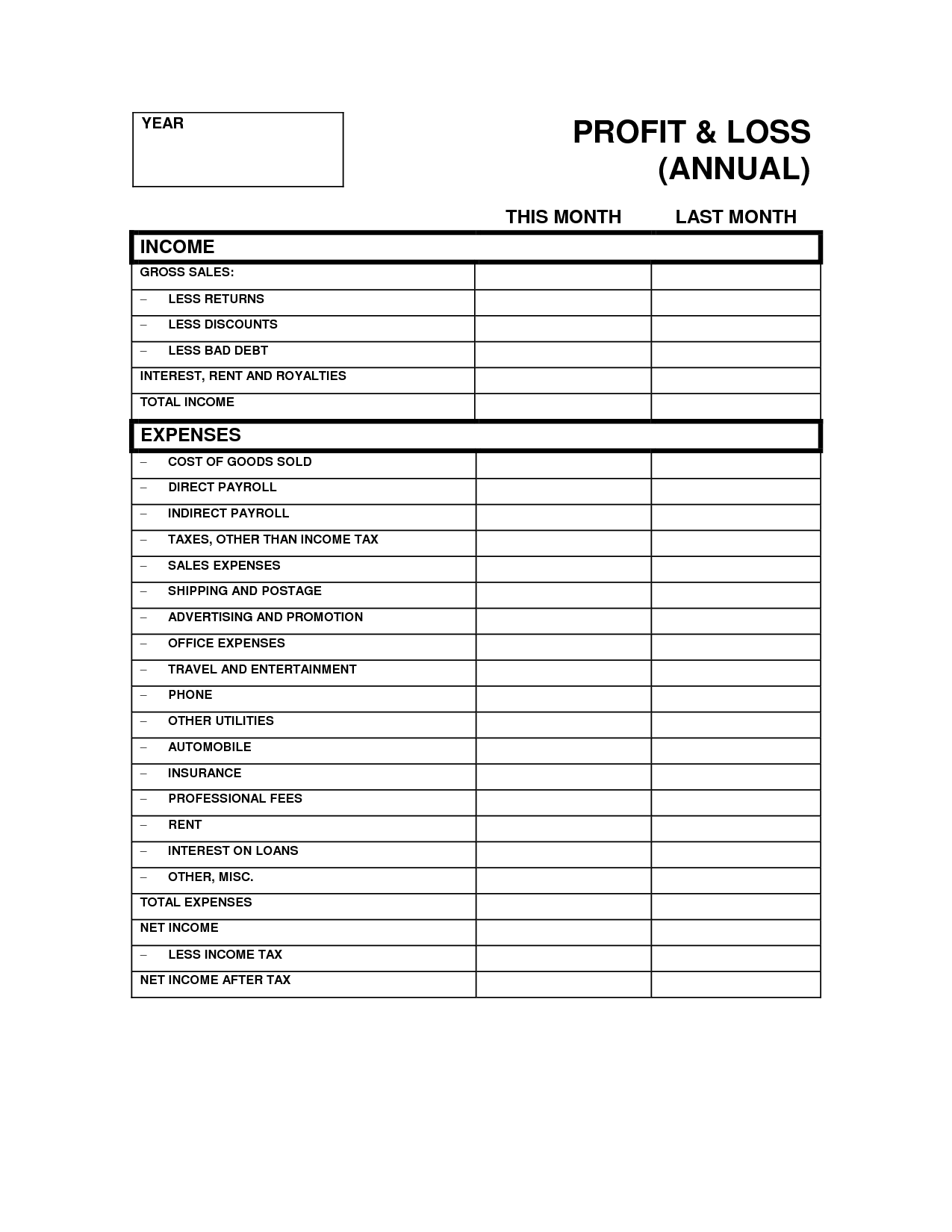

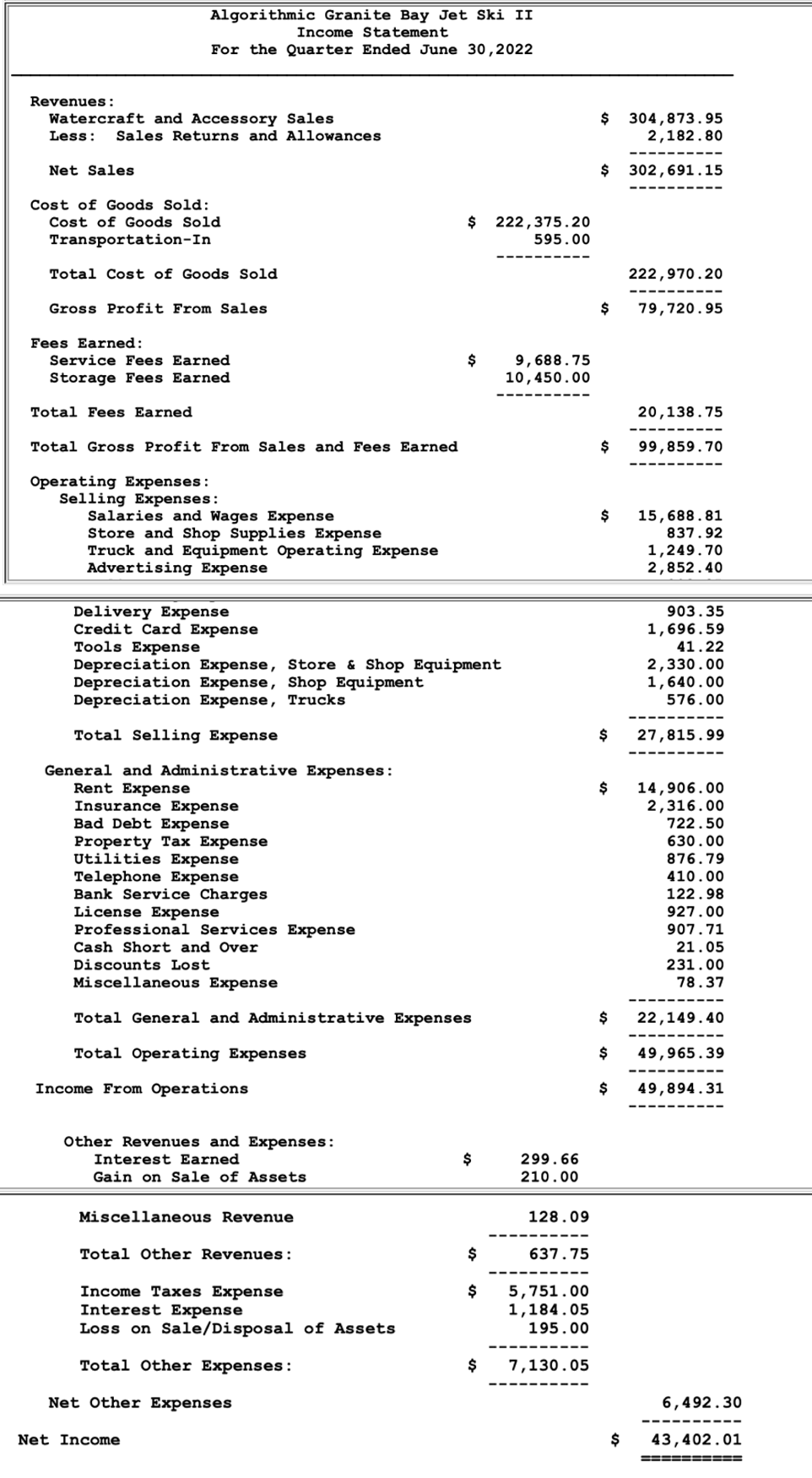

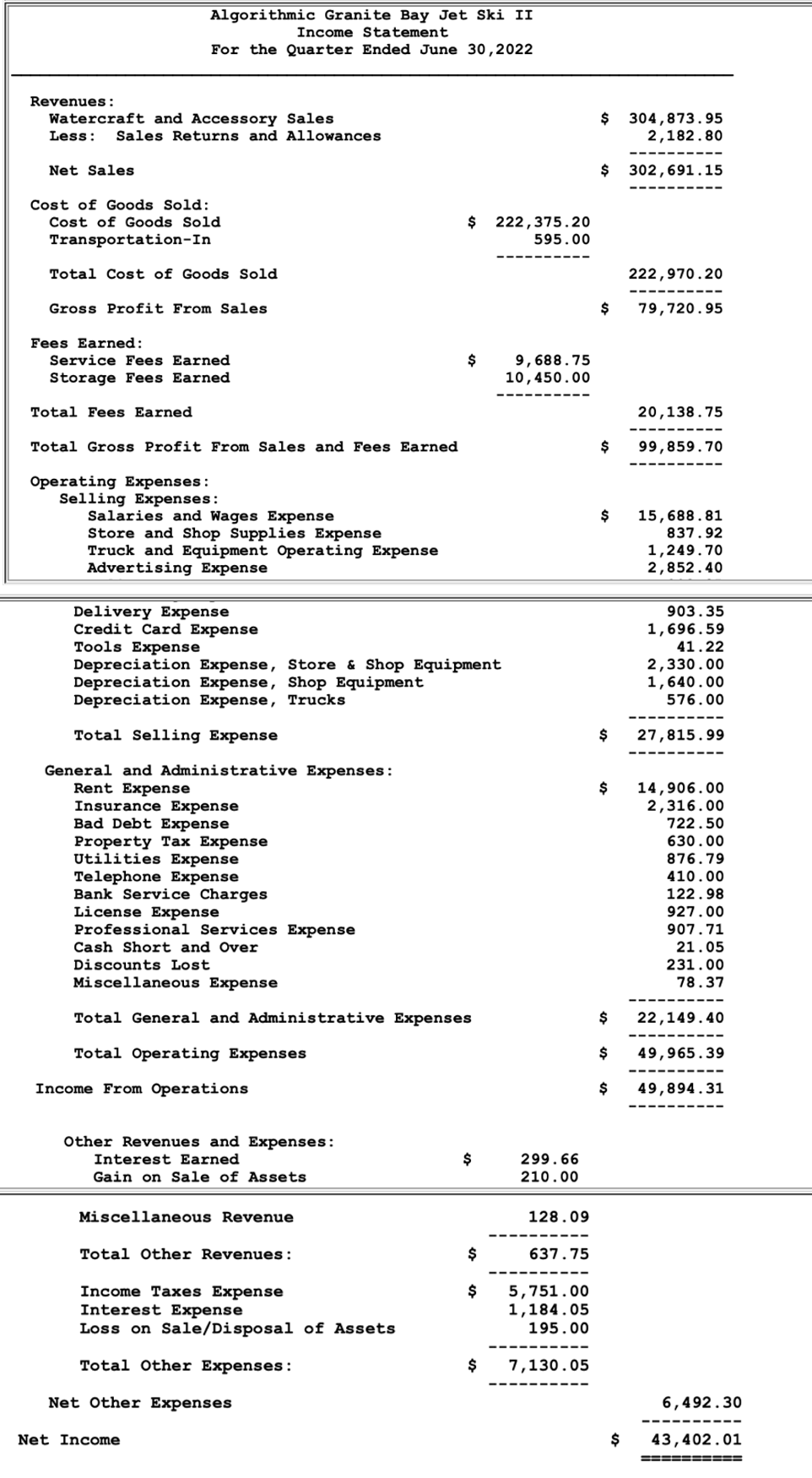

What Is The Income Statement Ratio Remote Books Online

https://www.remotebooksonline.com/blog/wp-content/uploads/income-statement-6.jpg

The homestead exemption is a statewide program which reduces the property tax burden of qualified senior citizens permanently and totally disabled homeowners disabled veterans and You may qualify for the homestead exemption for your property if You own the home you live there and it s your primary residence You are 65 or older and have lower income or you are the surviving spouse and were at

Total income is defined in R C 323 151 C to be the Ohio Adjusted Gross Income OAGI of the owner and spouse for the year preceding the year in which a homestead application is made The Homestead Exemption income threshold for tax year 2025 has been raised to 40 000 The exemption allows eligible senior citizens and disabled persons to exempt up to

Common FAQs Related To Income Tax In India MindxMaster

https://mindxmaster.s3.amazonaws.com/wp-content/uploads/2020/07/img_5f0abaf1c17e0.png

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

https://tax.ohio.gov › wps › portal › gov › tax › help...

Ohio Revised Code initially established a maximum Ohio Adjusted Gross Income OAGI of the applicant and the applicant s spouse of 30 000 This maximum is to be indexed for inflation

https://www.delgazette.com › ohio-senate...

House Bill 187 increases the income eligibility amount from 36 100 to 75 000 Increasing the exemption amount and expanding eligibility will provide direct tax relief to those most impacted by rising property valuations

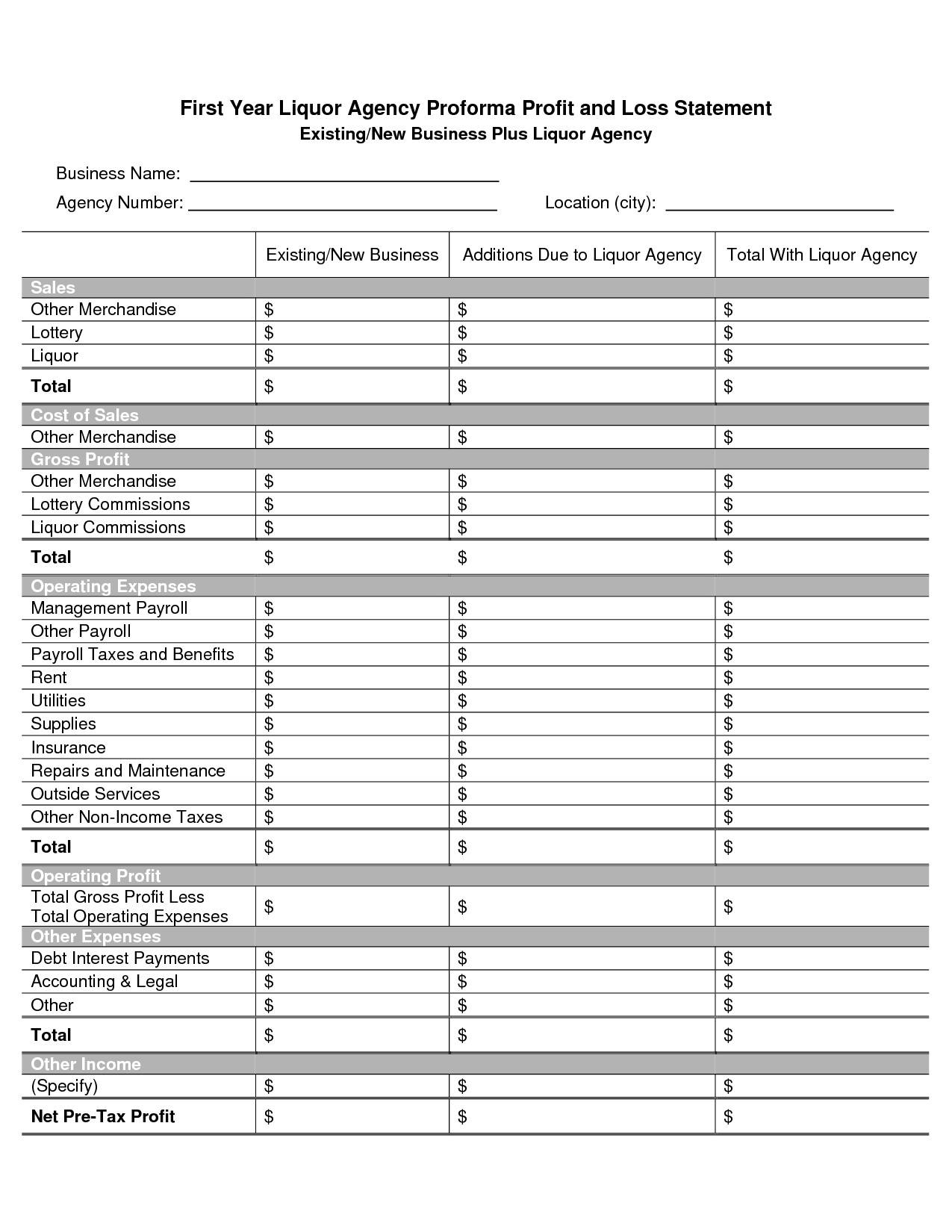

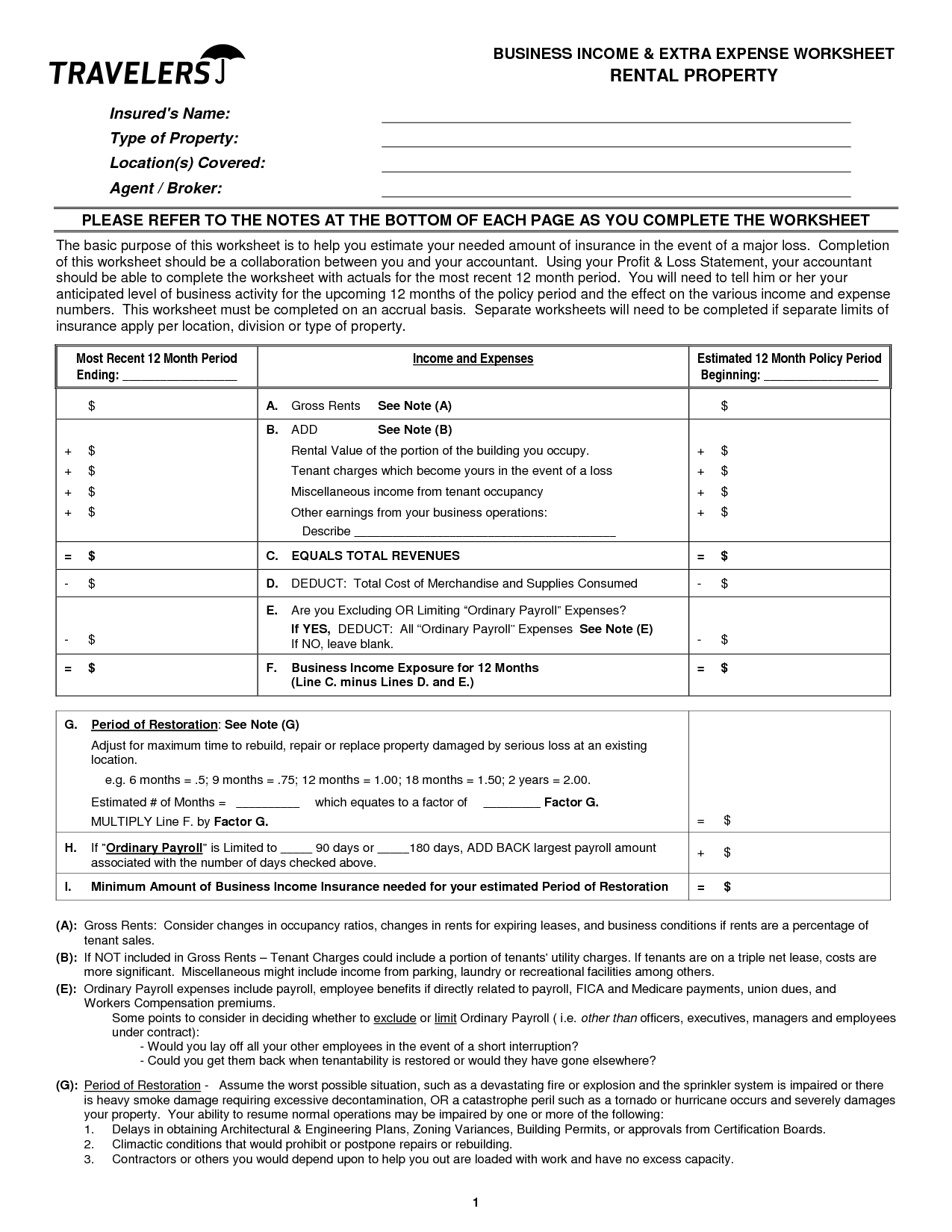

15 Profit Loss Statement Worksheet Worksheeto

Common FAQs Related To Income Tax In India MindxMaster

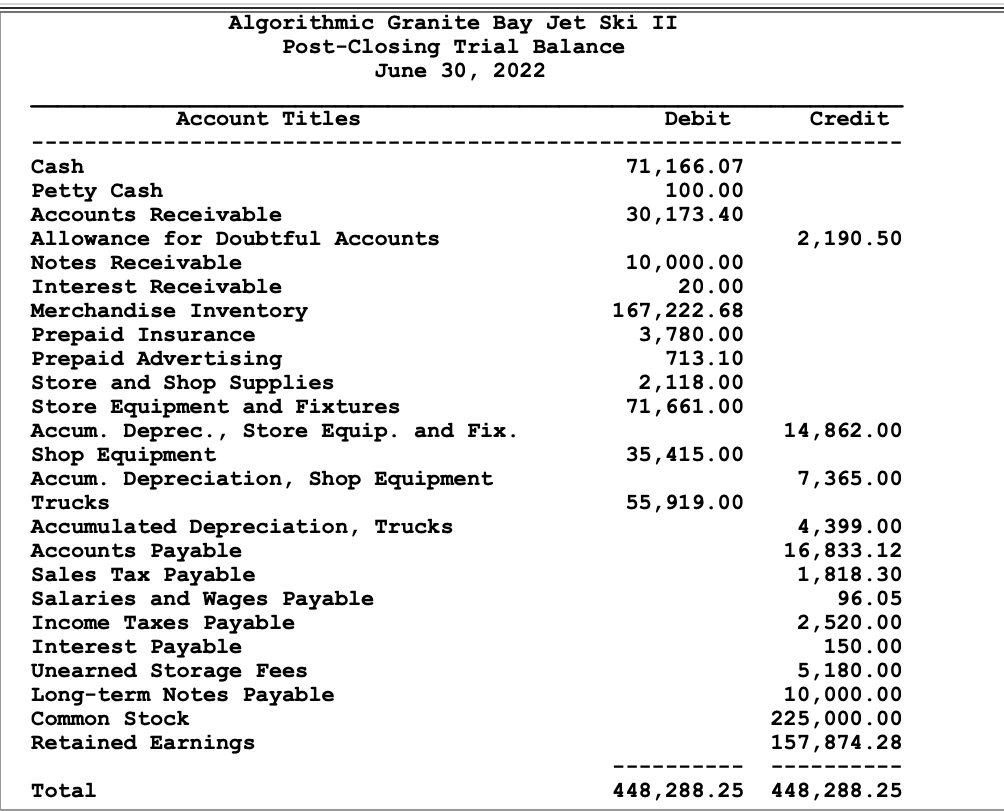

Solved Use The Income Statement To Answer The Chegg

Table Of Contents

Hassan Measure Would Restore Mortgage Insurance Deduction For

Solved Use The Income Statement To Answer The Chegg

Solved Use The Income Statement To Answer The Chegg

15 Profit Loss Statement Worksheet Worksheeto

15 Income Statement And Expense Worksheet Worksheeto

Arkansas Homestead Exemption Form Fill Out Sign Online DocHub

What Is The Income Limit For Homestead Credit In Ohio - To qualify for the Homestead Credit you must be 65 years of age by December 31 2025 and meet the income requirement I urge you to take advantage of this program To apply for the Homestead Exemption please fill out the application