What Is The Income Limit For Rental Loss Deduction 2022 The rental real estate loss allowance is what the IRS allows you to deduct in passive losses from real estate each year from your earned income It can be used to offset up to 25 000 in earned income as

The rental real estate loss allowance is a federal tax deduction available to taxpayers who own and rent property in the U S Up to 25 000 may be deducted as a If your rental expenses exceed rental income your loss may be limited The amount of loss you can deduct may be limited by the passive activity loss rules and the

What Is The Income Limit For Rental Loss Deduction 2022

What Is The Income Limit For Rental Loss Deduction 2022

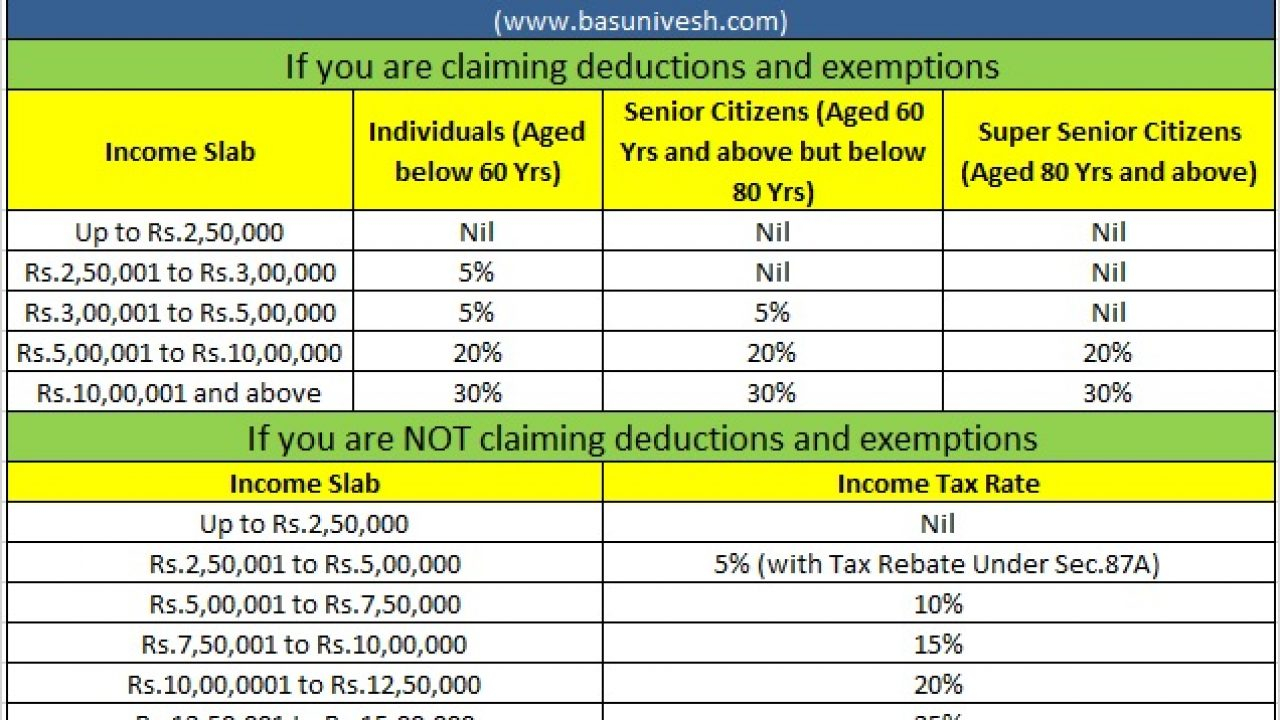

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Capital Loss Tax Deduction Up To 3 000 YouTube

https://i.ytimg.com/vi/-w0PsG2Vnho/maxresdefault.jpg

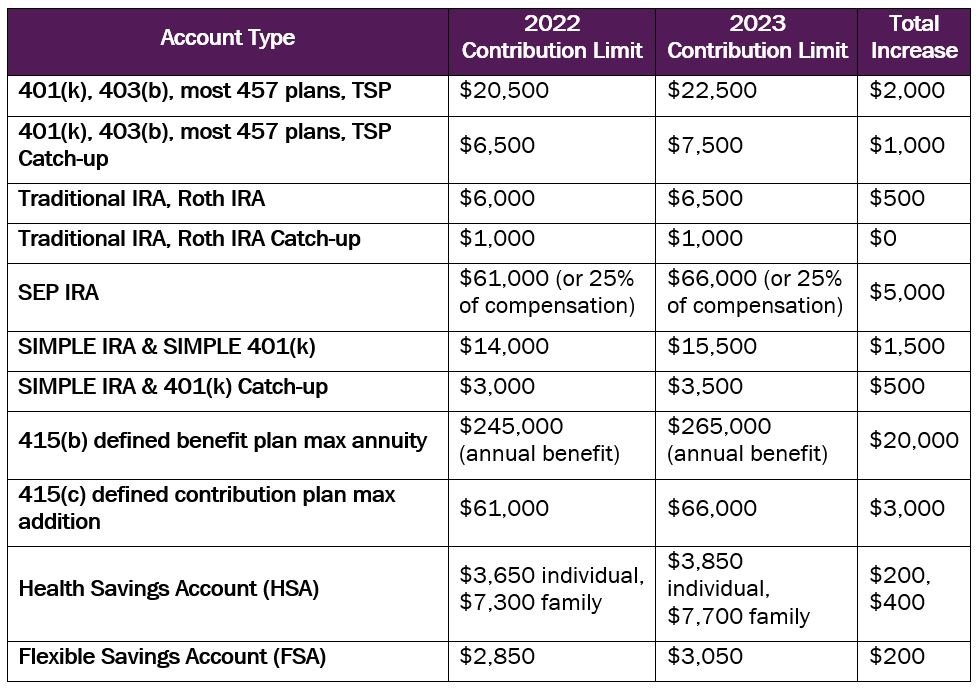

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

Income and expenses from rental activity For tax purposes the net rental loss for the year will be limited to 0 with 10 500 of PALs carried over to 2024 The If you or your spouse actively participated in a passive rental real estate activity the amount of the passive activity loss that s disallowed is decreased and you therefore can deduct

Before I do the other option for addressing the losses is to bring your income below the 100 000 threshold for joint filers to be able to take up to 25 000 in losses If IRC Sec Section 469 i provides that taxpayers with a MAGI modified adjusted gross income of less than 200 000 can deduct up to 25 000 of rental

Download What Is The Income Limit For Rental Loss Deduction 2022

More picture related to What Is The Income Limit For Rental Loss Deduction 2022

The Complete Charitable Deductions Tax Guide 2023 2024

https://daffy.ghost.io/content/images/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Arkansas Medicaid Income Chart Free Download Nude Photo Gallery

https://lh5.googleusercontent.com/proxy/ghKXjdkYfqGqyYaykfNnZyNZscrpuaEuHzsUE2S8H02-7eO7wWa14U-_BJ3brWXjSusLKdmag1dSMyndP21AkIV57CfCJEPfq_q67LVTP1iEWDPBpQrVJLbG9RK2BTgbmYqp15v7DUrKoCtTXW6PIOetEGa_A4k=s0-d

Here s where the limit comes in the IRS only permits the deduction of passive losses from passive income You may have a job not related to your investment 1 min read Share Yes you must claim the income even if you are reporting loss on rental property The payment is a rent payment If the payment is for the fair rental value of

July 7 2020 Economic fallout from the COVID 19 crisis will cause many rental real estate properties to run up tax losses in 2020 and possibly beyond Here s a summary of The amount of rental losses that you can write off is proportionately phased out between 100 000 and 150 000 For example if your adjusted gross income is

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

https://www.mondaq.com/images/article_images/1132100a.jpg

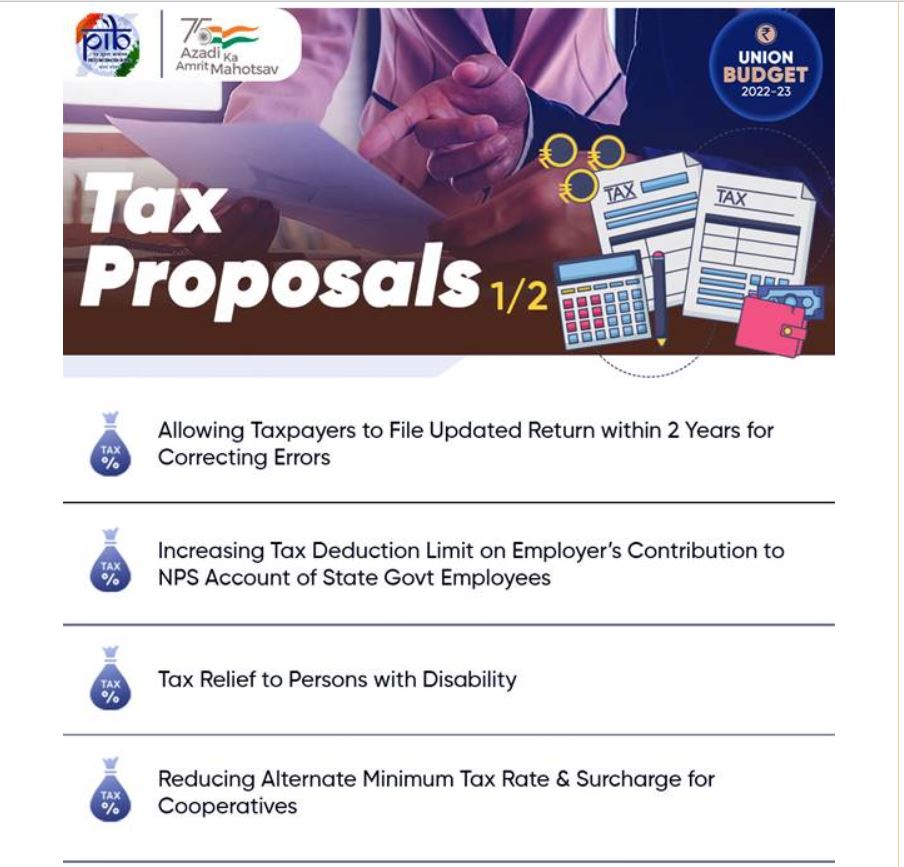

Income Tax Return Deduction Limit In Budget 2022 23

https://gservants.com/wp-content/uploads/2022/02/1.jpg

https://www.thebalancemoney.com/what-is-th…

The rental real estate loss allowance is what the IRS allows you to deduct in passive losses from real estate each year from your earned income It can be used to offset up to 25 000 in earned income as

https://www.investopedia.com/terms/r/rentalreal-estate-loss-allowance

The rental real estate loss allowance is a federal tax deduction available to taxpayers who own and rent property in the U S Up to 25 000 may be deducted as a

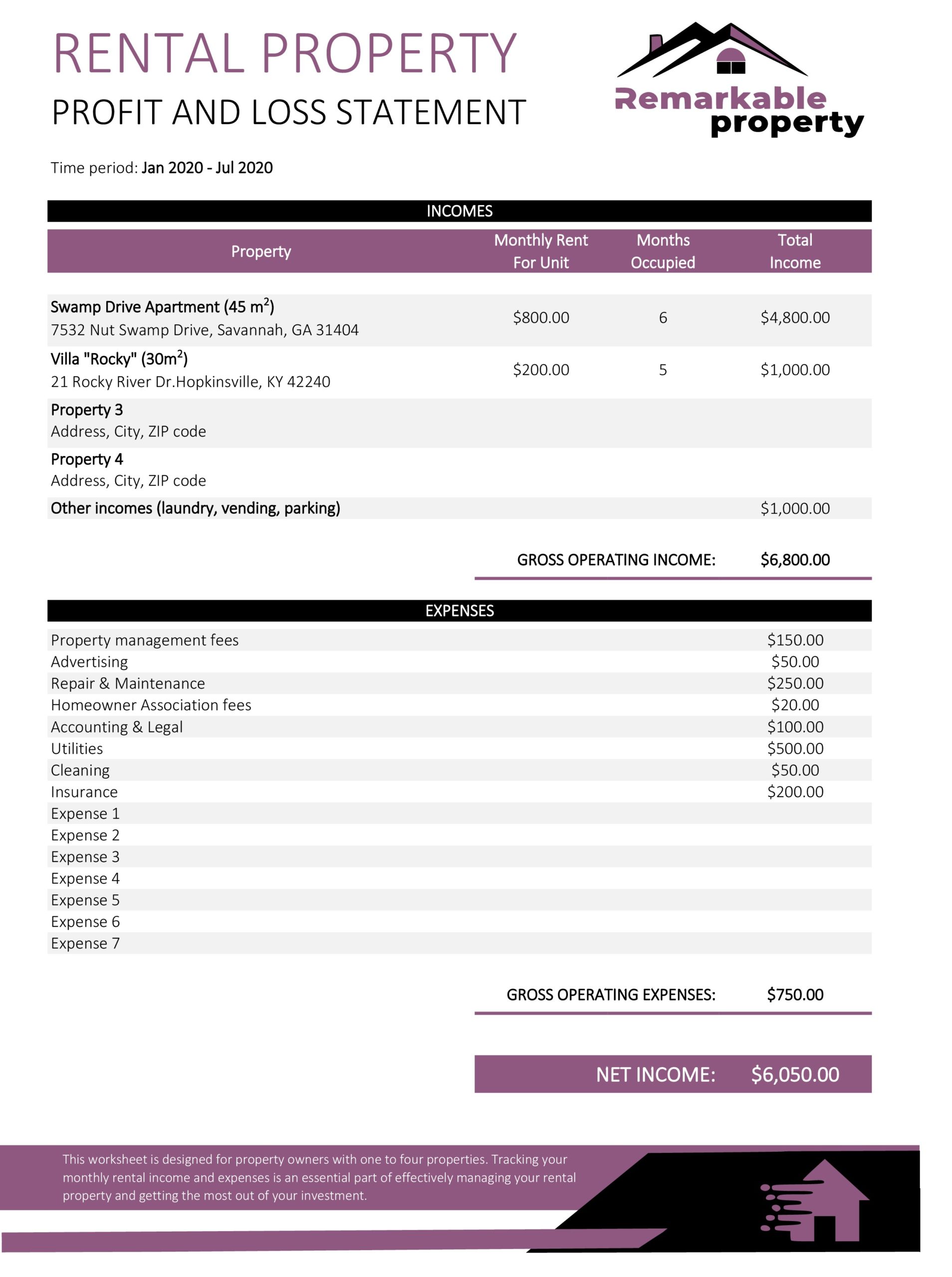

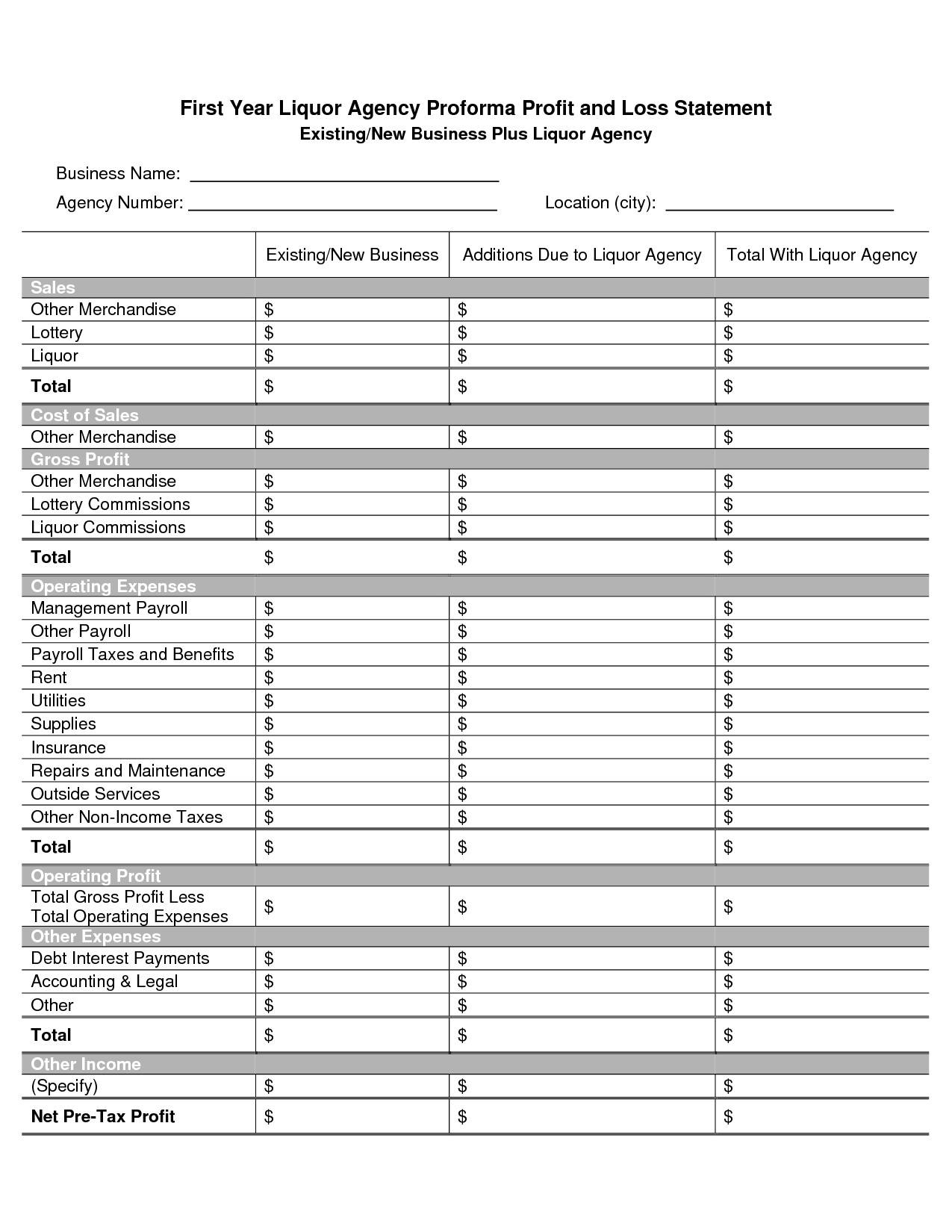

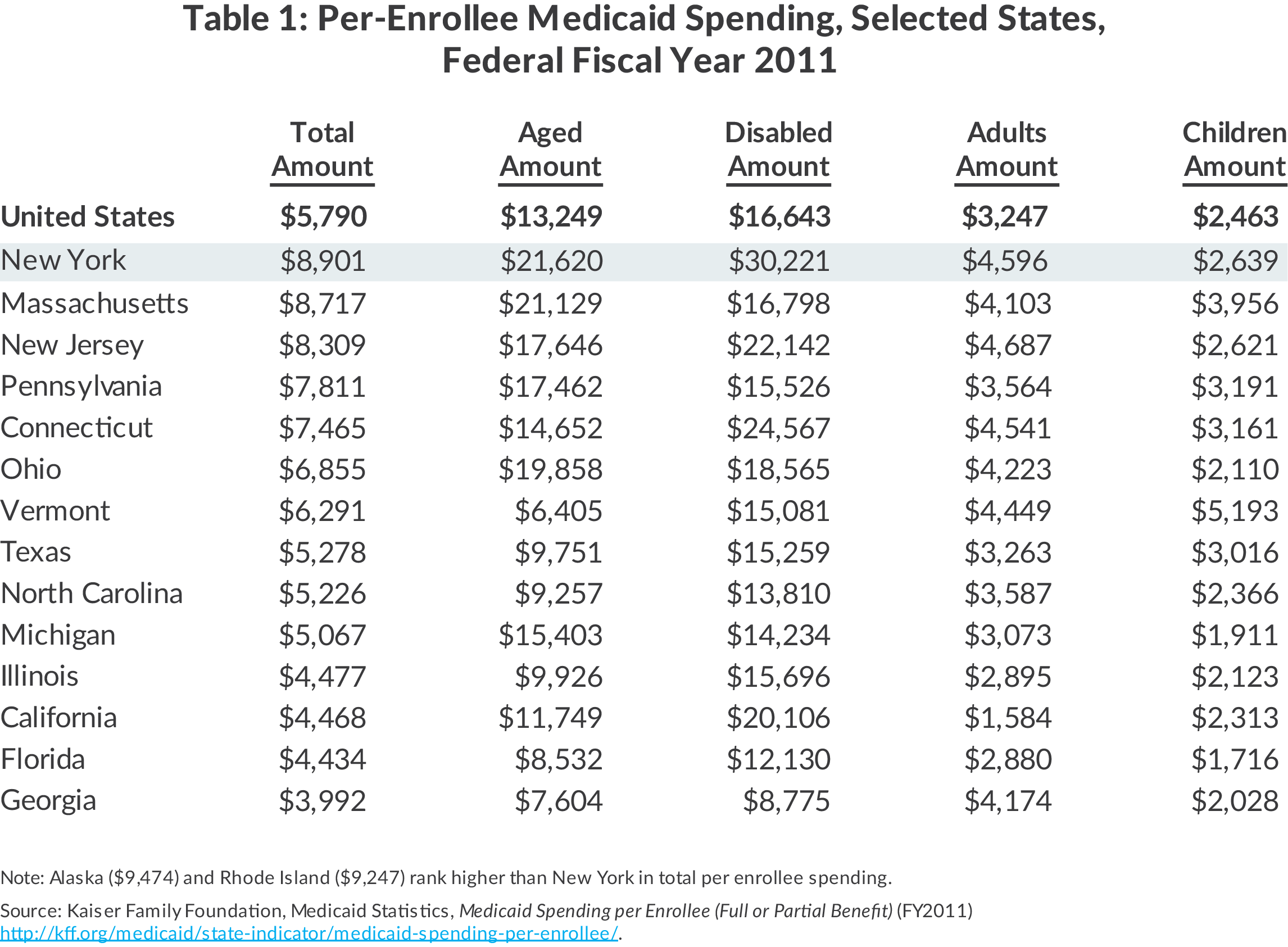

53 Profit And Loss Statement Templates Forms Excel PDF

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

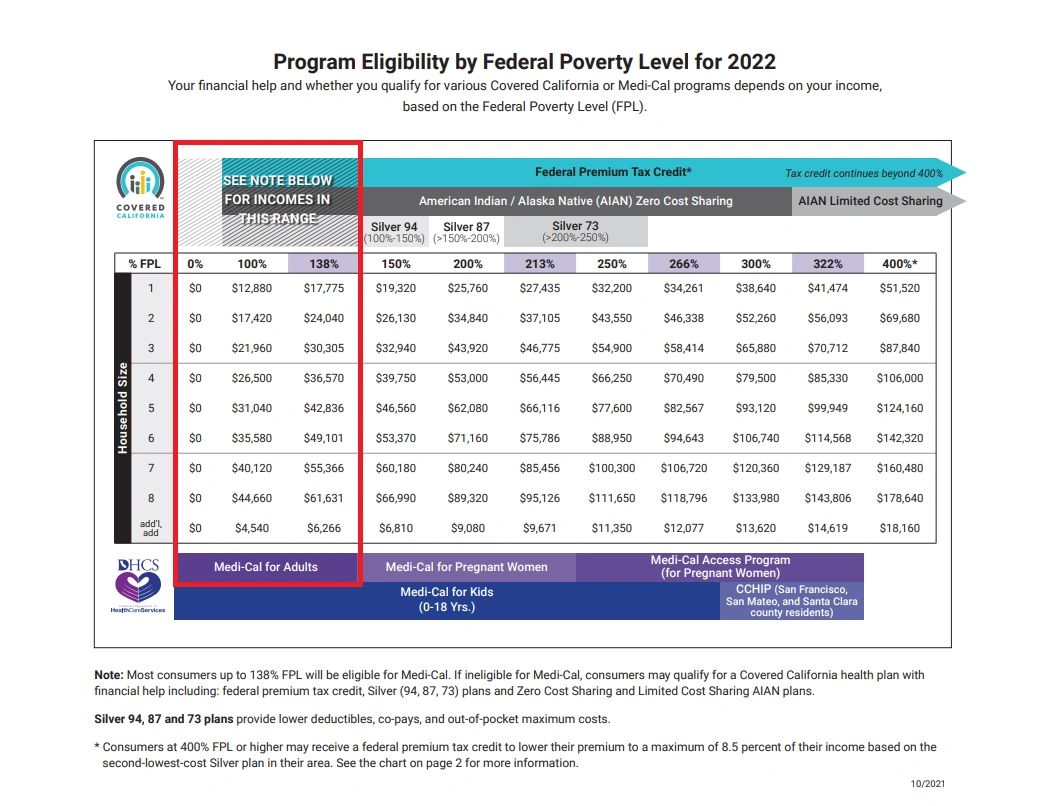

Health Insurance Income Limits For 2022 To Receive ACA Premium S

8 Tax Preparation Organizer Worksheet Worksheeto

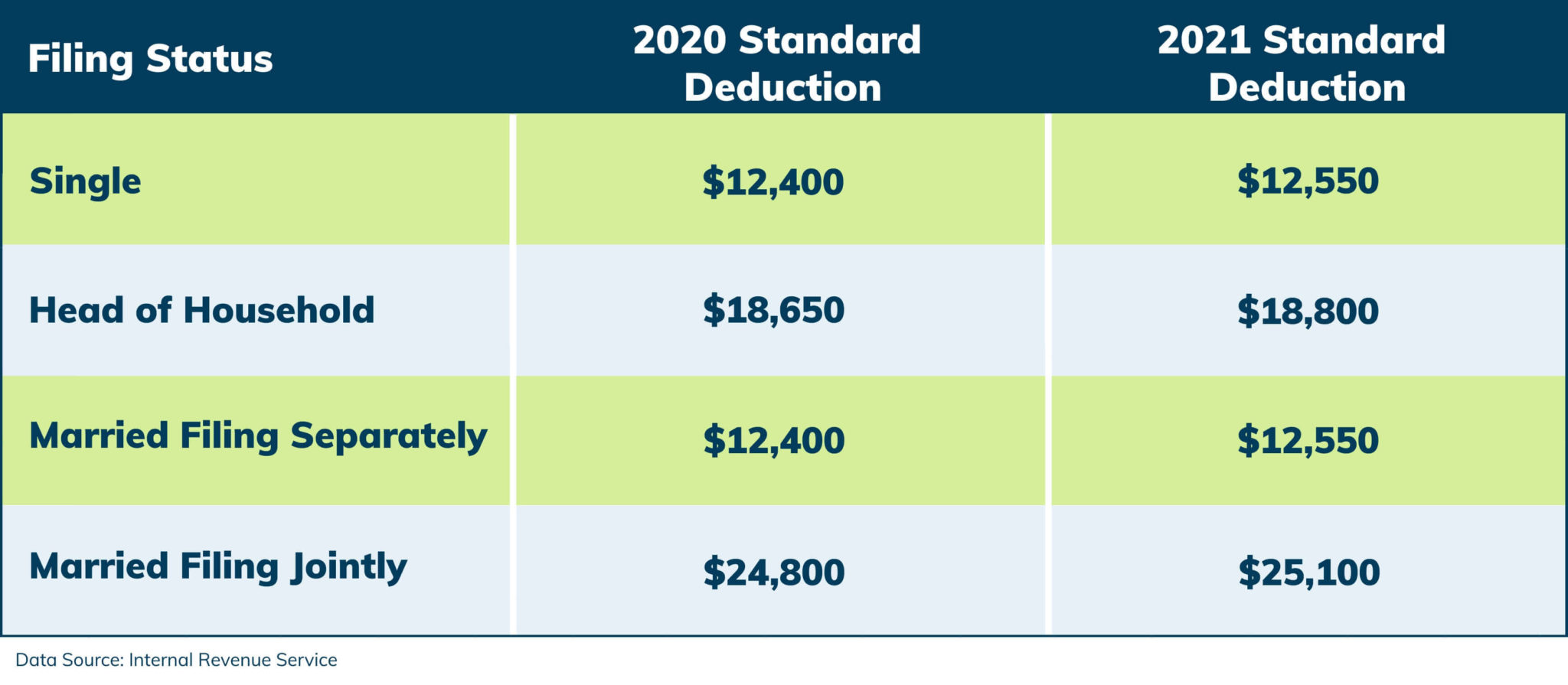

2021 Tax Changes And Tax Brackets

15 Profit Loss Statement Worksheet Worksheeto

15 Profit Loss Statement Worksheet Worksheeto

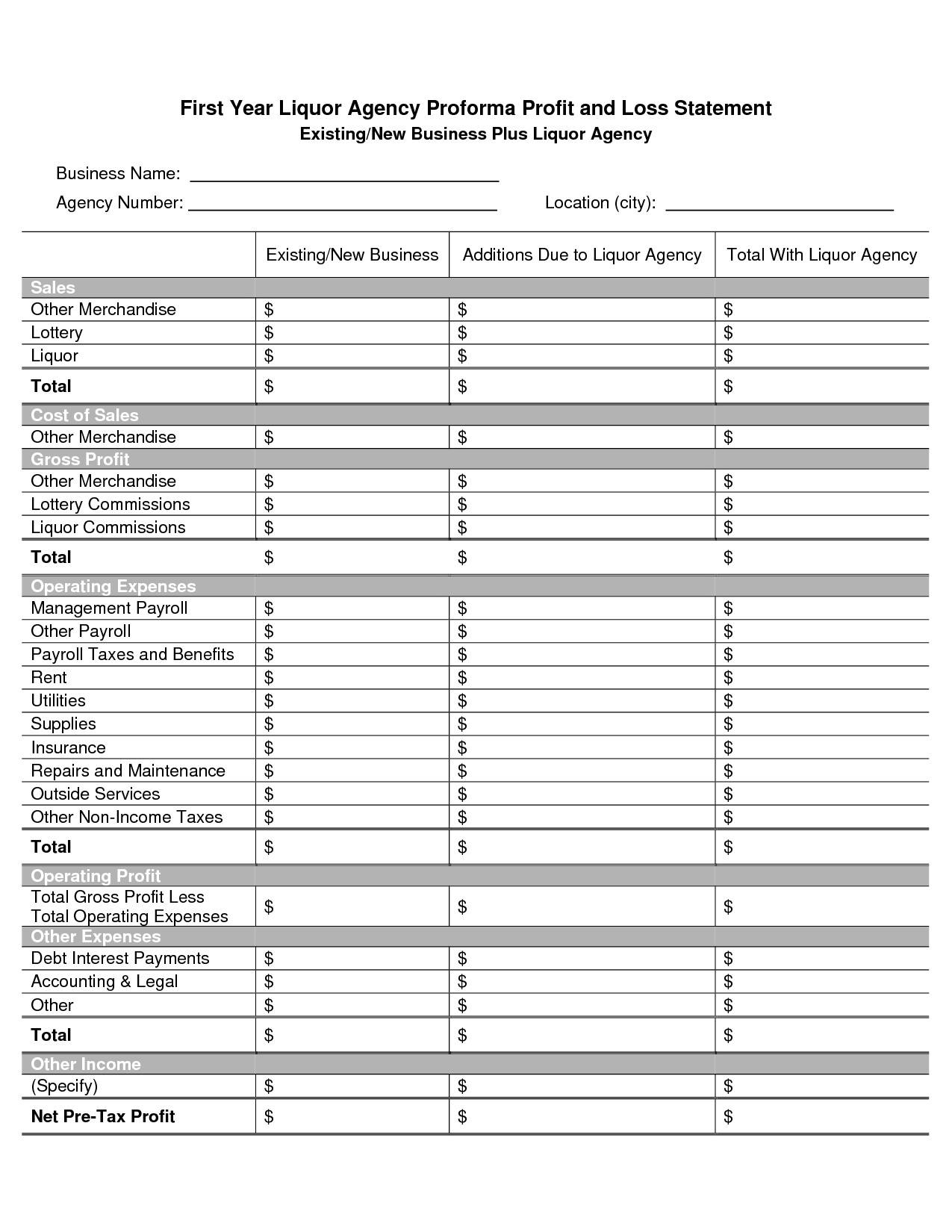

How Do I Qualify For Medicare Low Income Subsidy MedicareTalk

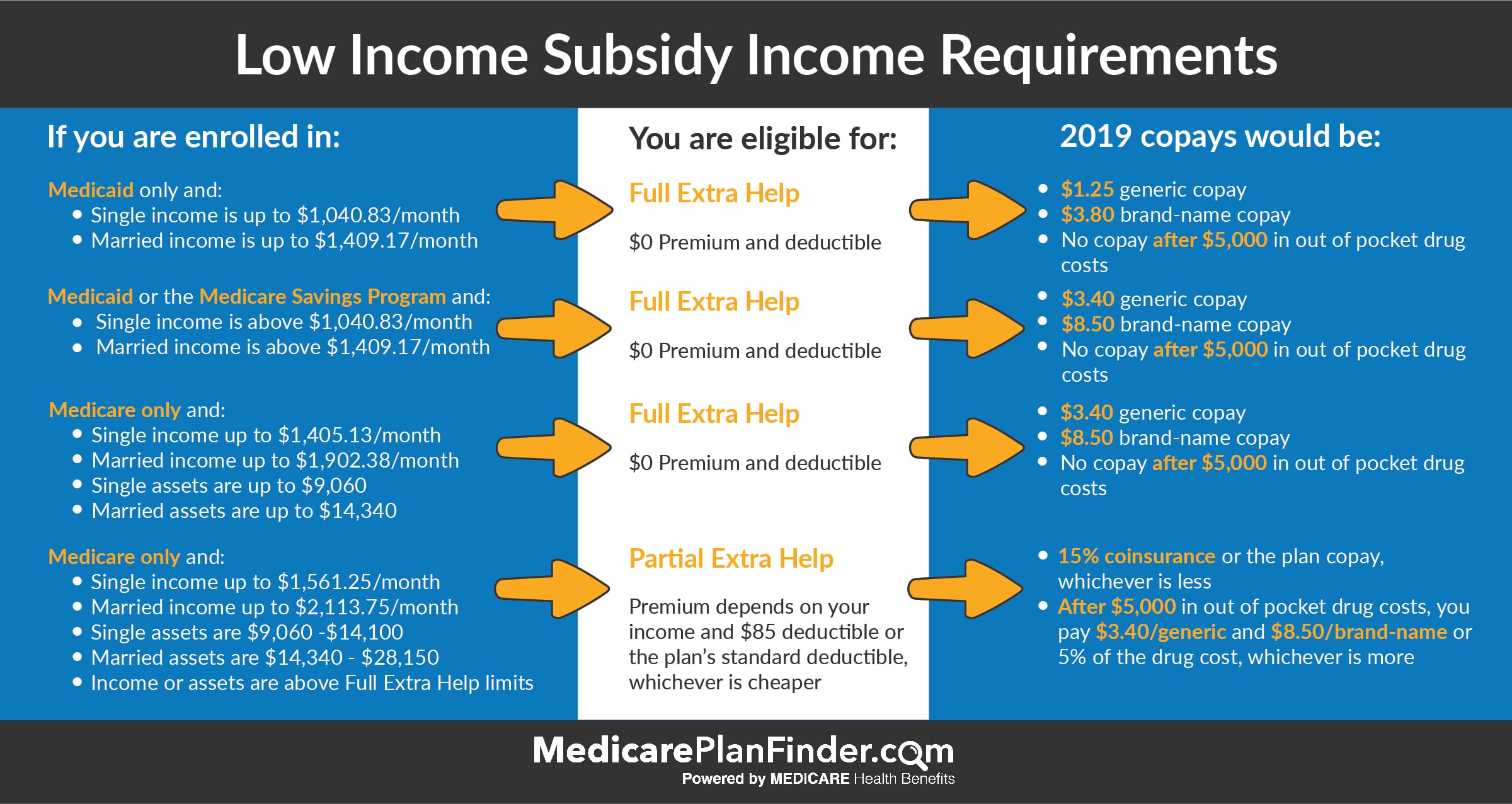

Medicaid Limit For Family Of 2 MedicAidTalk

Qualified Business Income Deduction And The Self Employed The CPA Journal

What Is The Income Limit For Rental Loss Deduction 2022 - Passive Activities Limitations Explained Once you determine that you are indeed an active participant in the business of renting your property you will be eligible