What Is The Income Limit For The Federal Solar Tax Credit Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an

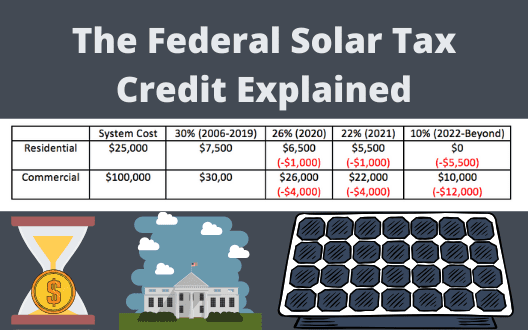

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax Your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave you a one

What Is The Income Limit For The Federal Solar Tax Credit

What Is The Income Limit For The Federal Solar Tax Credit

https://massachusetts.revolusun.com/wp-content/uploads/sites/2/2019/10/capital-building.jpg

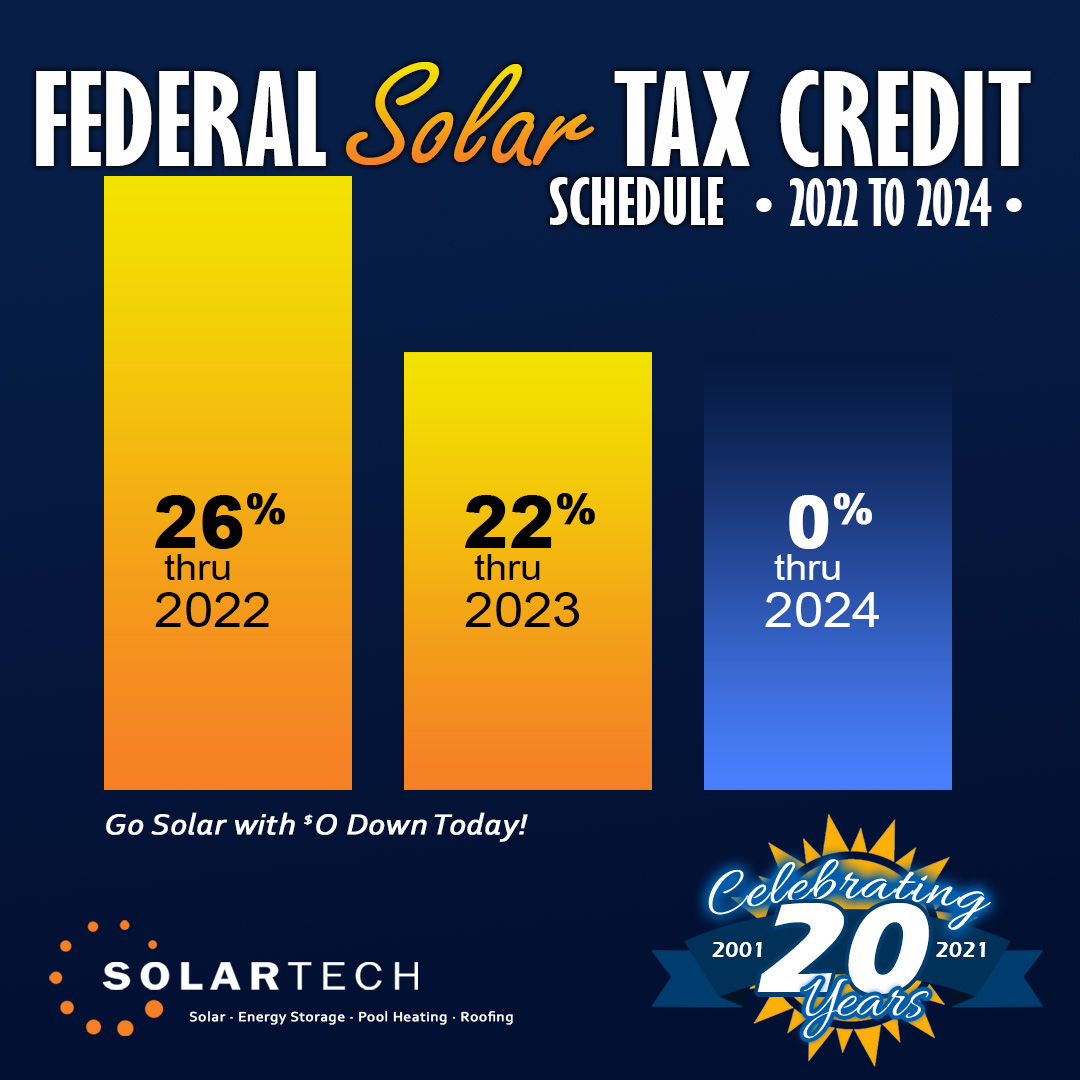

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax What is the income limit for the federal solar tax credit There is no income limit for the federal solar tax credit However you need a large enough taxable income

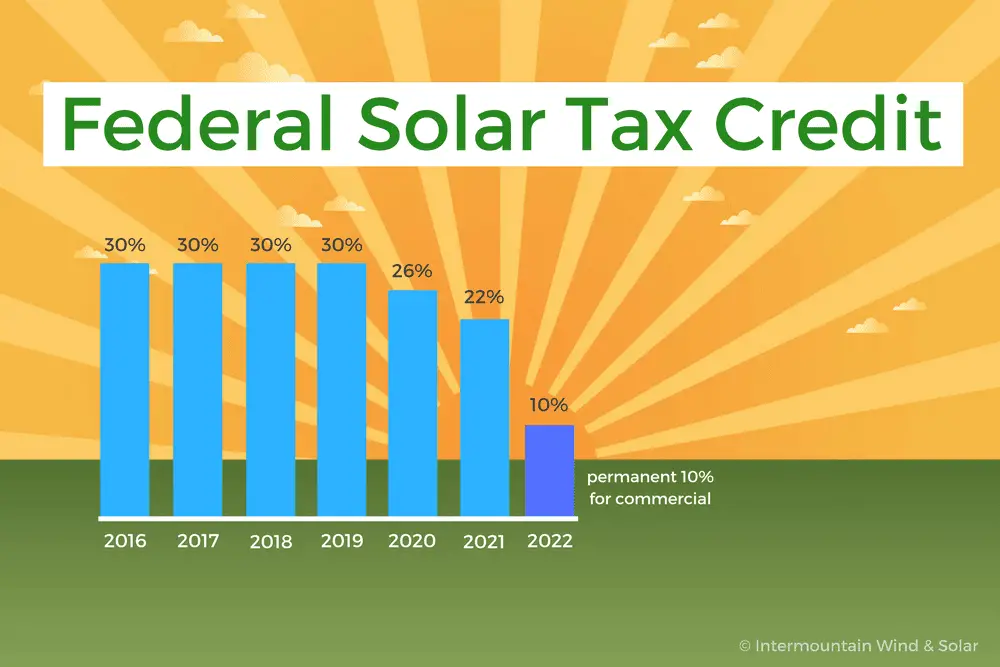

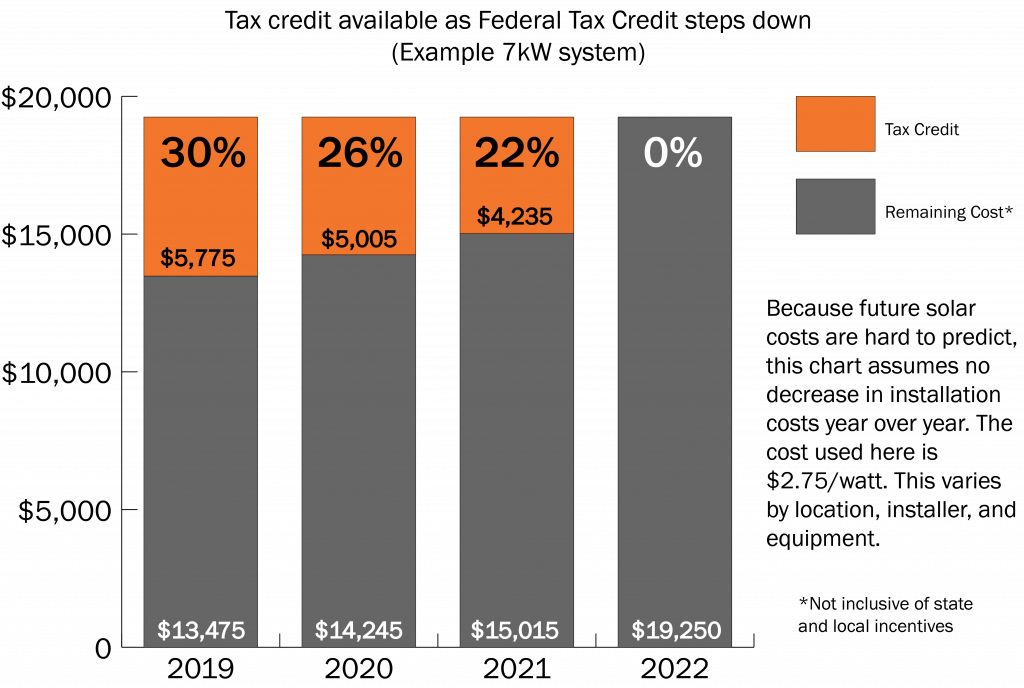

The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable In 2024 eligible homeowners can claim a federal income tax credit valued at up to 30 of solar installation costs parts labor permits etc through December 31

Download What Is The Income Limit For The Federal Solar Tax Credit

More picture related to What Is The Income Limit For The Federal Solar Tax Credit

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

The Federal Solar Tax Credit What You Need To Know 2022

https://sandbarsc.com/wp-content/uploads/2017/07/solar-tax-credit.jpg

Dollar for dollar the federal solar tax credit is the greatest economic incentive for homeowners to invest in solar panels and or battery storage With a little If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal

Calculating the amount of your federal solar tax credit is very simple Take the total cost your system and multiply it by 0 30 For example if you spent 25 000 all Is there an income limit for the federal solar tax credit There is no income limit but the amount you can receive from the tax credit is limited to how much you would pay in

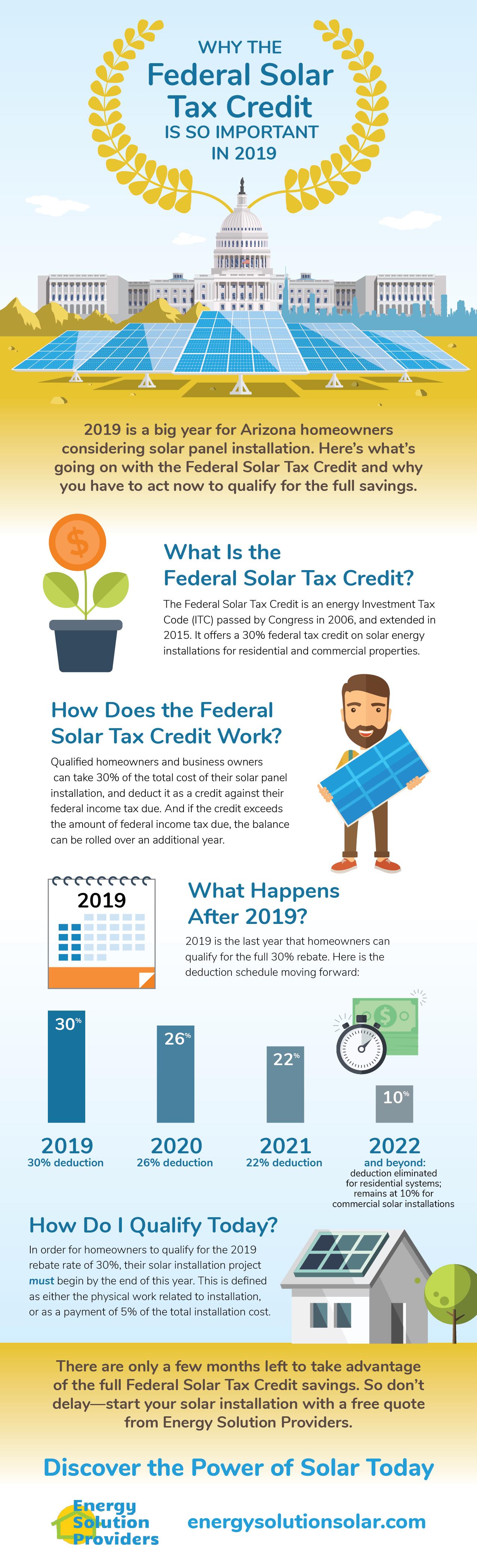

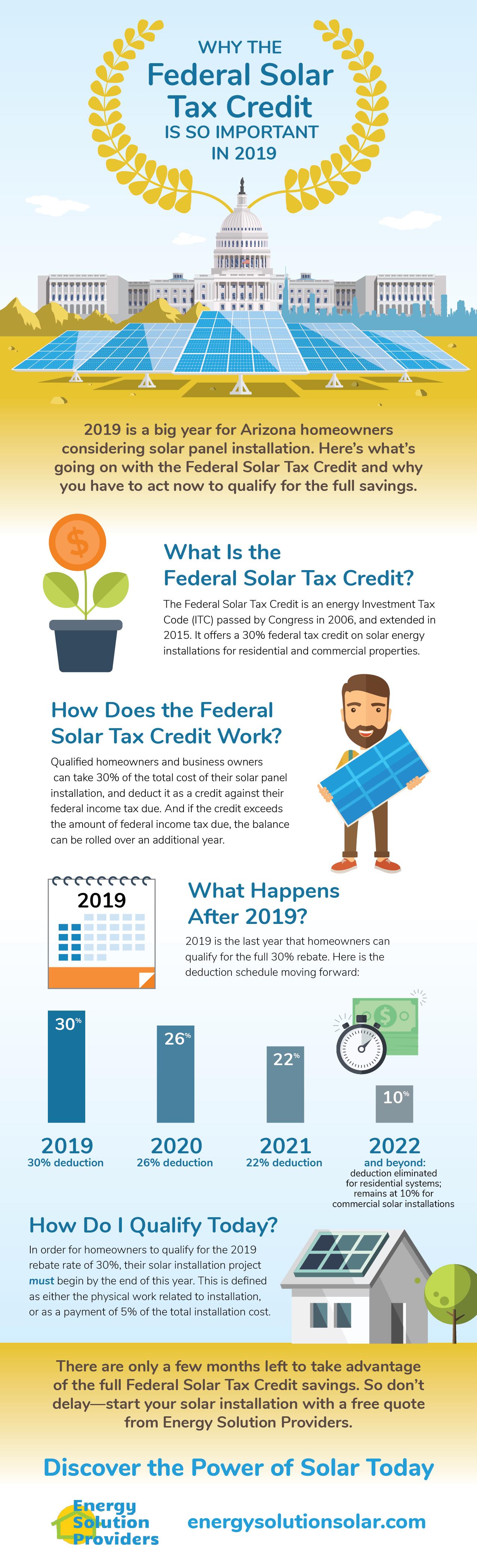

The Federal Solar Tax Credit In 2019 Arizona Energy Solution Providers

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax-02.jpg?itok=mRmVKKaq

Federal Solar Tax Credit 2022 How Does It Work ADT Solar

https://www.goadtsolar.com/wp-content/uploads/2022/08/Solar-Tax-Credit_graph-01.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an

https://www.energy.gov/sites/default/files/2023-03/...

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

The Federal Solar Tax Credit In 2019 Arizona Energy Solution Providers

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

Federal Investment Solar Tax Credit Guide Learn How To Claim The

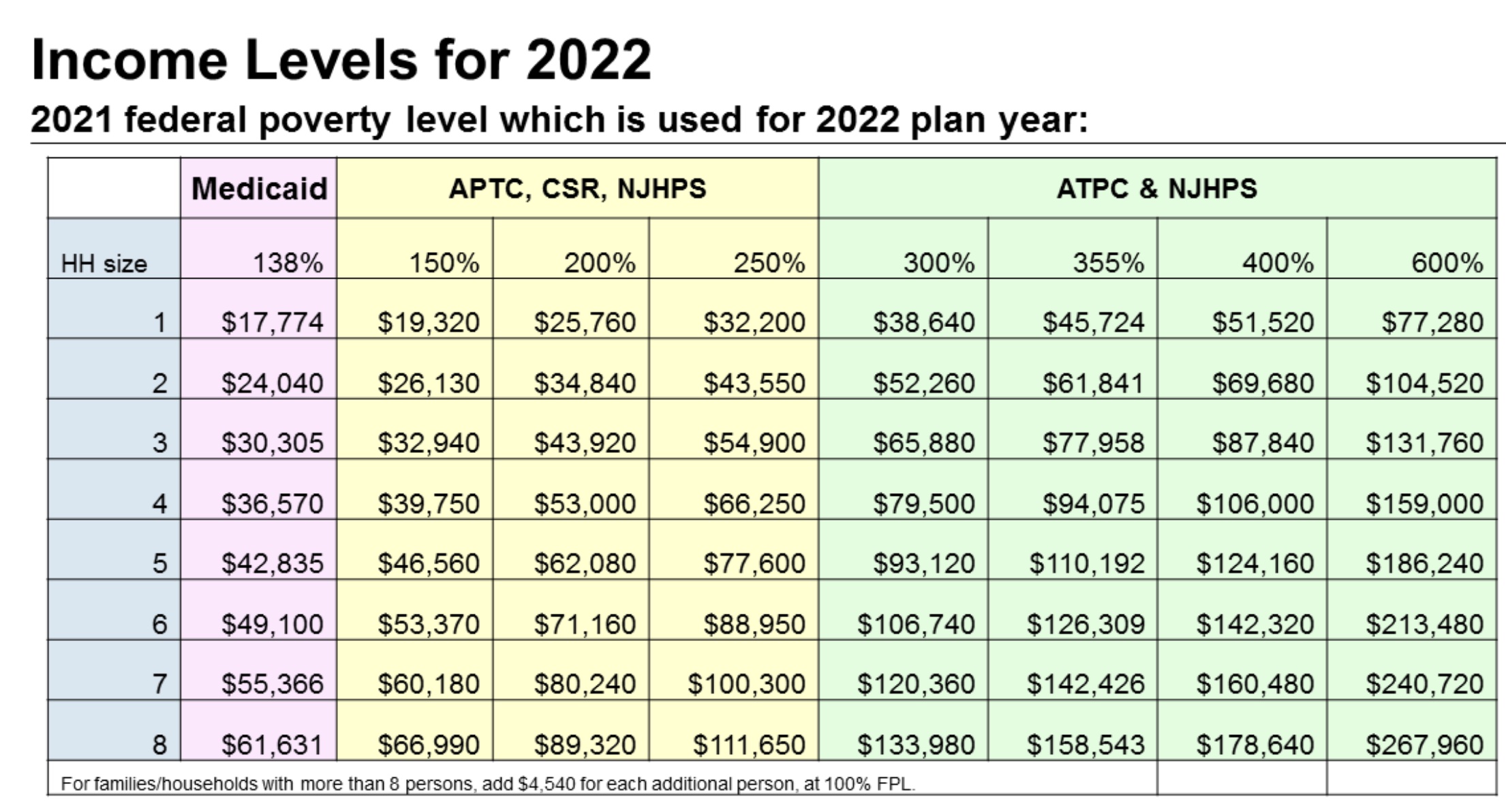

What Are The 2022 Federal Poverty Levels For The New Jersey Marketplace

Federal Solar Tax Credit Increases Microgrid Media

Federal Solar Tax Credit Increases Microgrid Media

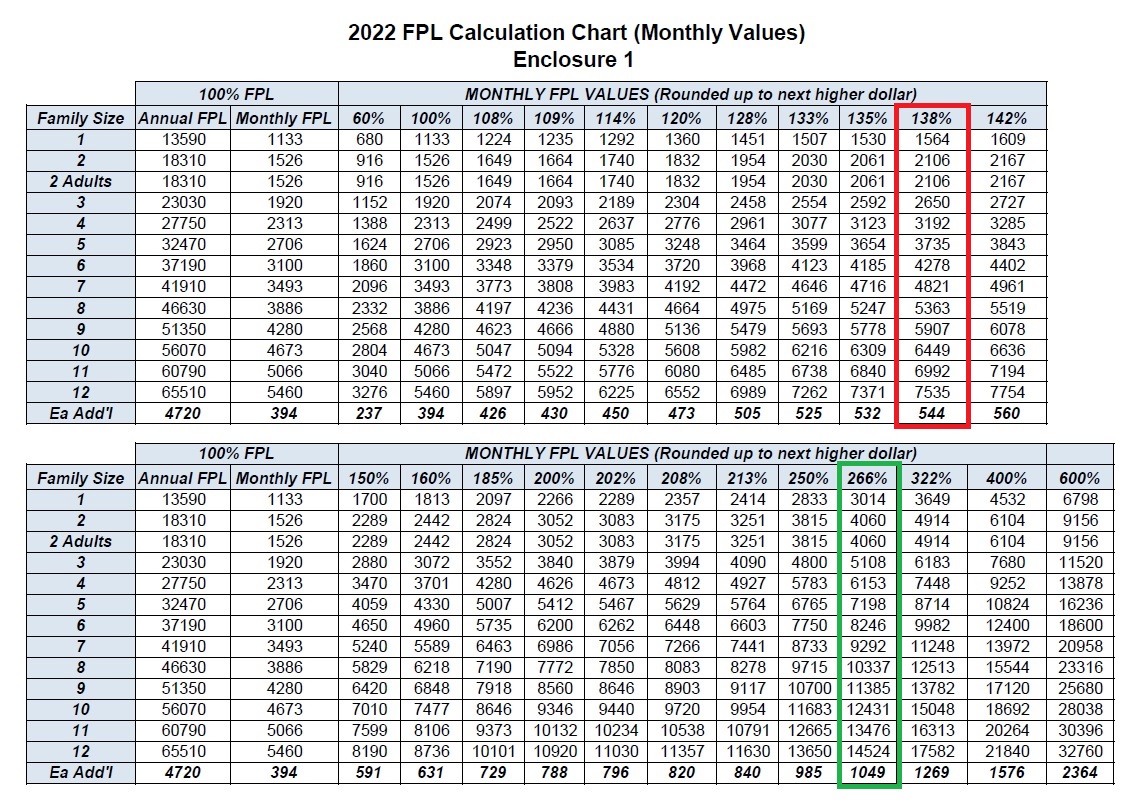

Big Increase For The 2022 Medi Cal Income Amounts

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

The Federal Solar Tax Credit Explained Sunshine Plus Solar

What Is The Income Limit For The Federal Solar Tax Credit - In 2024 eligible homeowners can claim a federal income tax credit valued at up to 30 of solar installation costs parts labor permits etc through December 31