What Is The Investment Tax Credit For Renewable Energy Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already

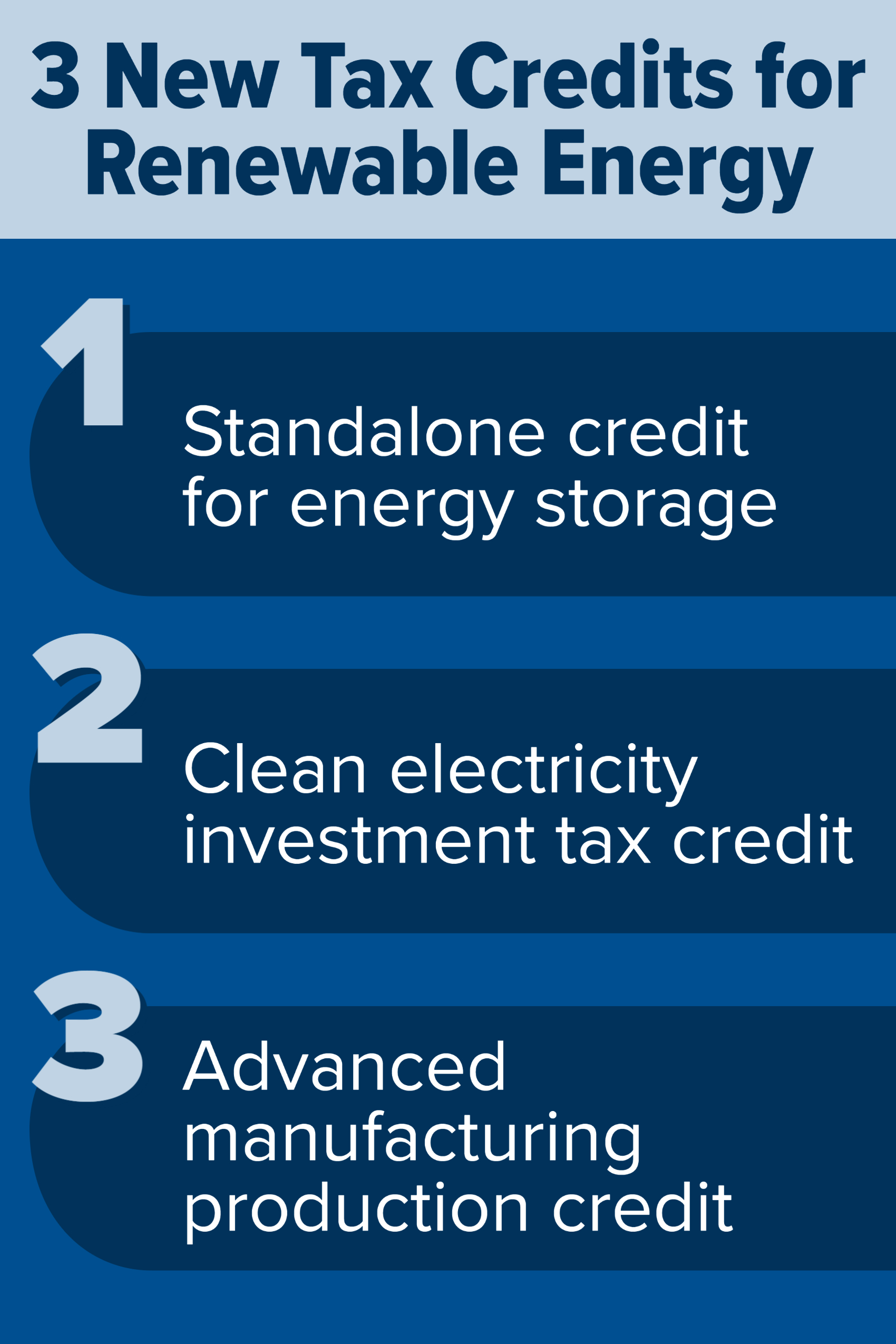

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy

What Is The Investment Tax Credit For Renewable Energy

What Is The Investment Tax Credit For Renewable Energy

https://bloghost0.orowealth.com/wp-content/uploads/2019/03/types-of-investments-898x1024.jpg

Energy Tax Credits Armanino

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit Press Releases U S Department of the Treasury IRS Propose New Rules to Drive Clean Energy Investments November 17 2023 Guidance to clarify underlying

For example claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 The federal tax credit is sometimes referred to as an Investment Tax Credit or ITC though is different from the ITC Overview The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV

Download What Is The Investment Tax Credit For Renewable Energy

More picture related to What Is The Investment Tax Credit For Renewable Energy

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Solar Tax Credit How To Claim It Bright Solar IO

https://brightsolarpower.io/wp-content/uploads/2020/01/How-To-Claim-The-Solar-Tax-Credit.png

What Are Franking Credits and How They Can Help Australian Investors

https://plato.com.au/wp-content/uploads/Screen-Shot-2022-06-02-at-3.23.45-pm-2048x1148.png

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage The US Internal Revenue Service IRS and US Department of the Treasury Treasury released proposed regulations on November 17 2023 addressing the

The Investment Tax Credit ITC is currently a 30 percent federal tax credit claimed against the tax liability of residential under Section 25D and commercial and utility under Internal Revenue Code IRC Section 48 provides an investment tax credit ITC for certain energy related property This In Focus summarizes the current

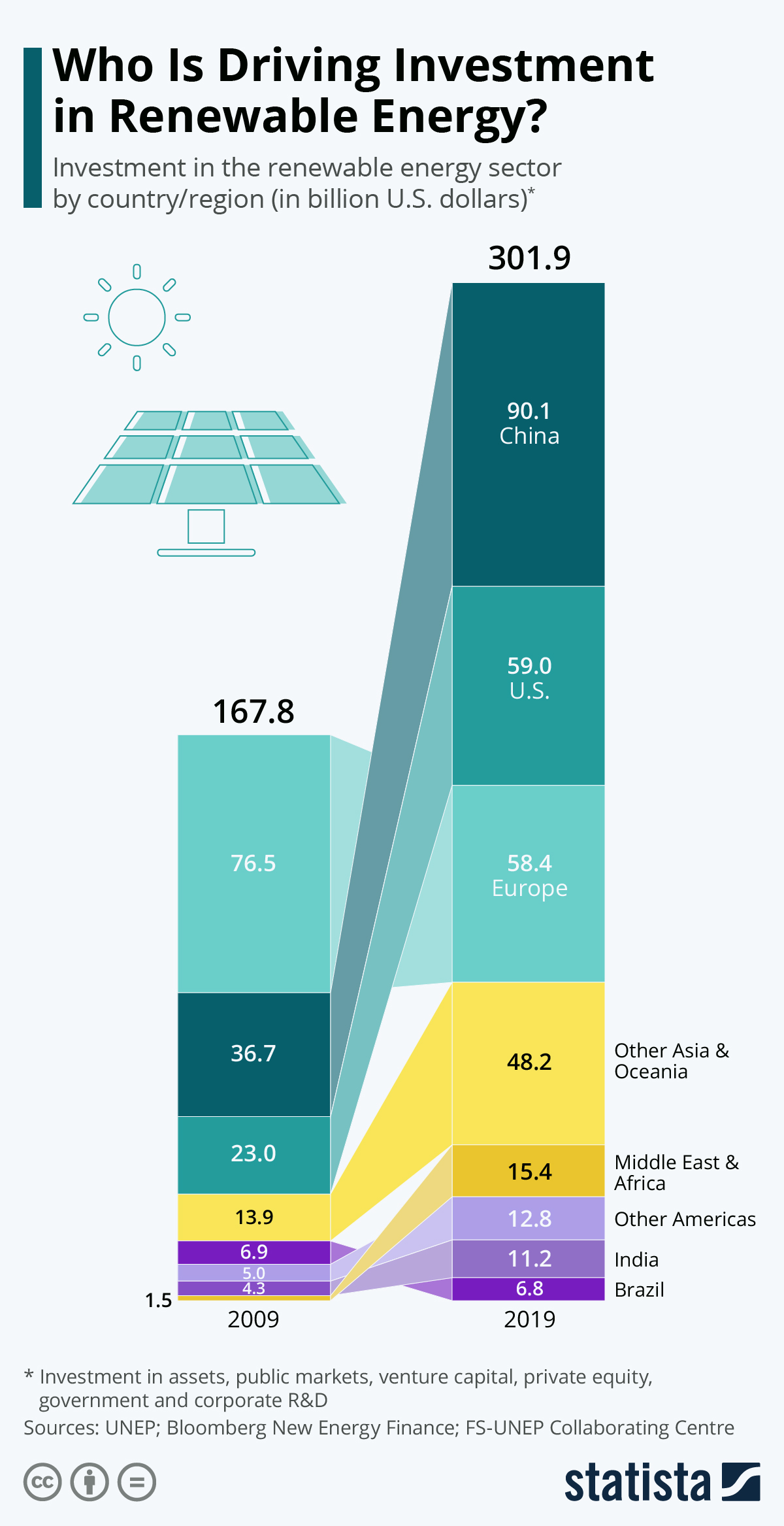

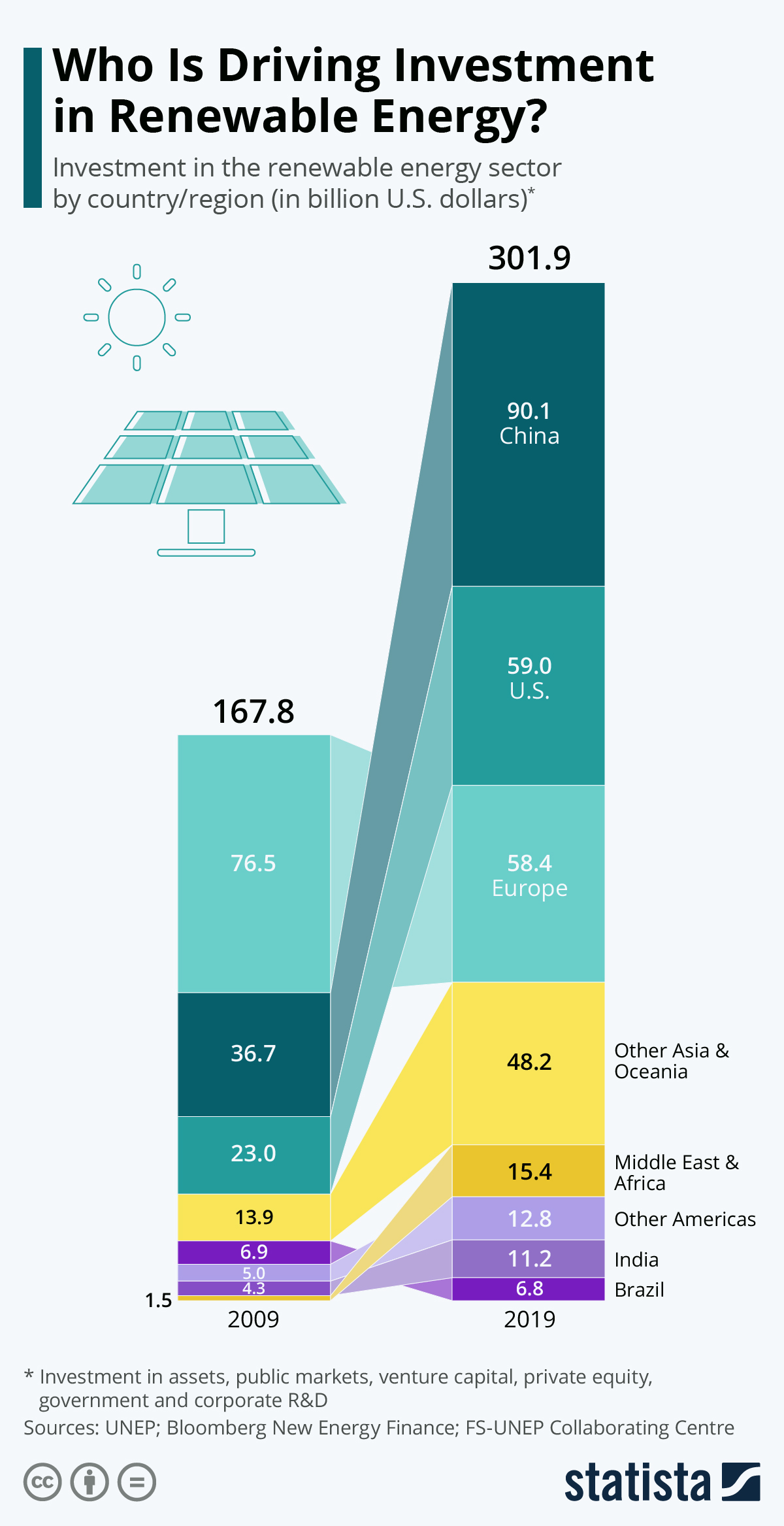

Chart Who Is Driving Investment In Renewable Energy Statista

https://cdn.statcdn.com/Infographic/images/normal/22877.jpeg

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

https://phantom-marca.unidadeditorial.es/ac74621e18bc098b394c3393658acfb3/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/17/16739726135614.jpg

https://www.energy.gov/eere/solar/articl…

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind

How The Inflation Reduction Act Changes Tax And Healthcare Laws

Chart Who Is Driving Investment In Renewable Energy Statista

19 Affordable Ways To Increase The ROI Of Your Rental Property Today

Optimizing Energy Storage For Performance And ROI DEPCOM Power

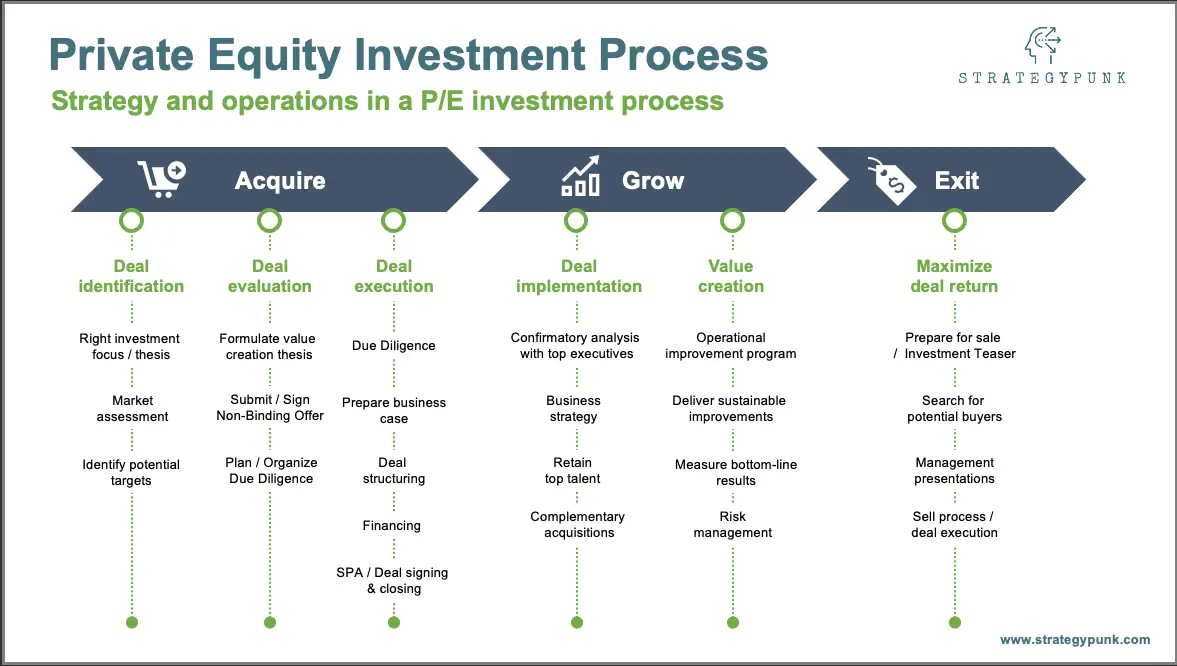

Private Equity Investment Process Free PowerPoint Template

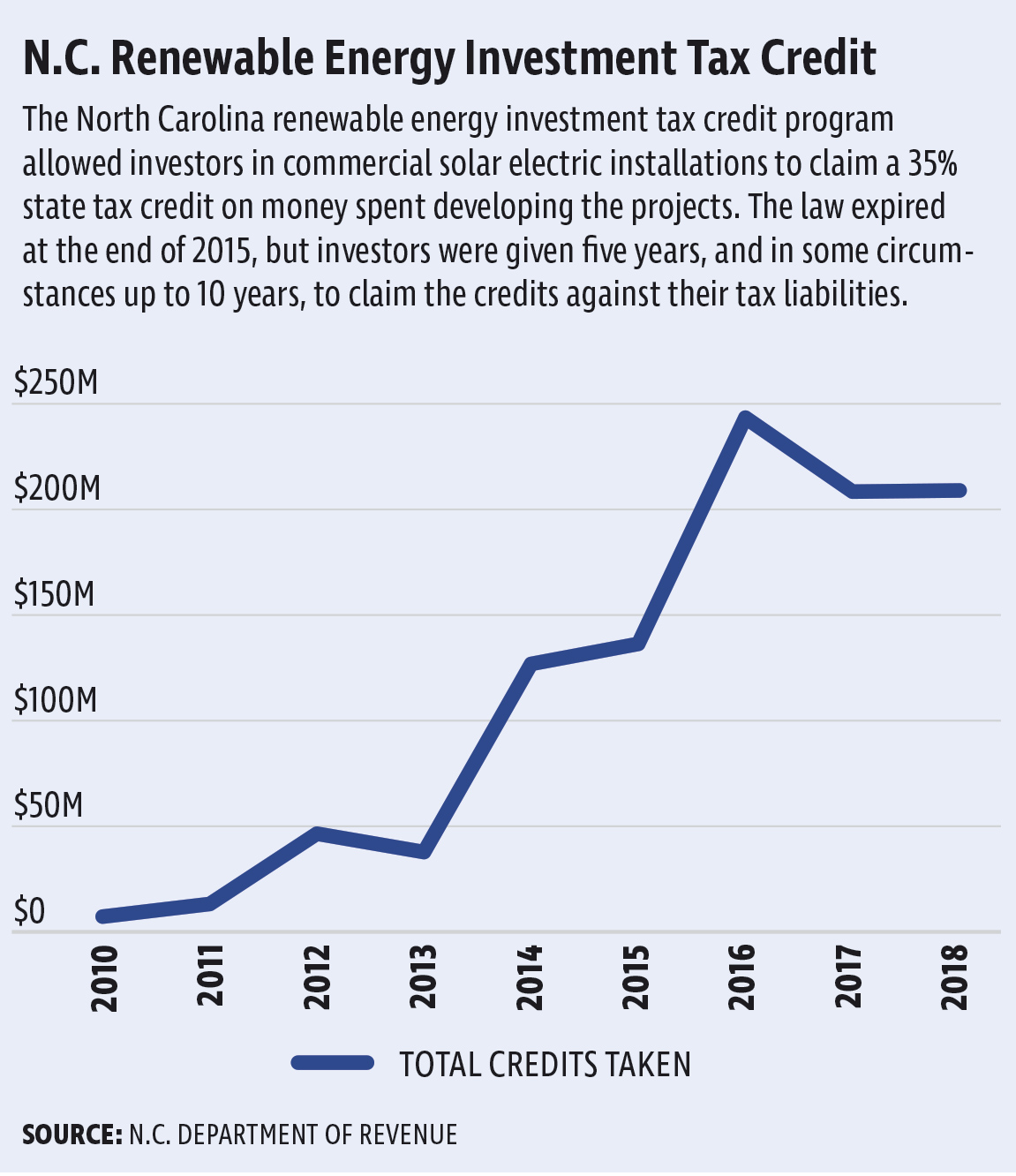

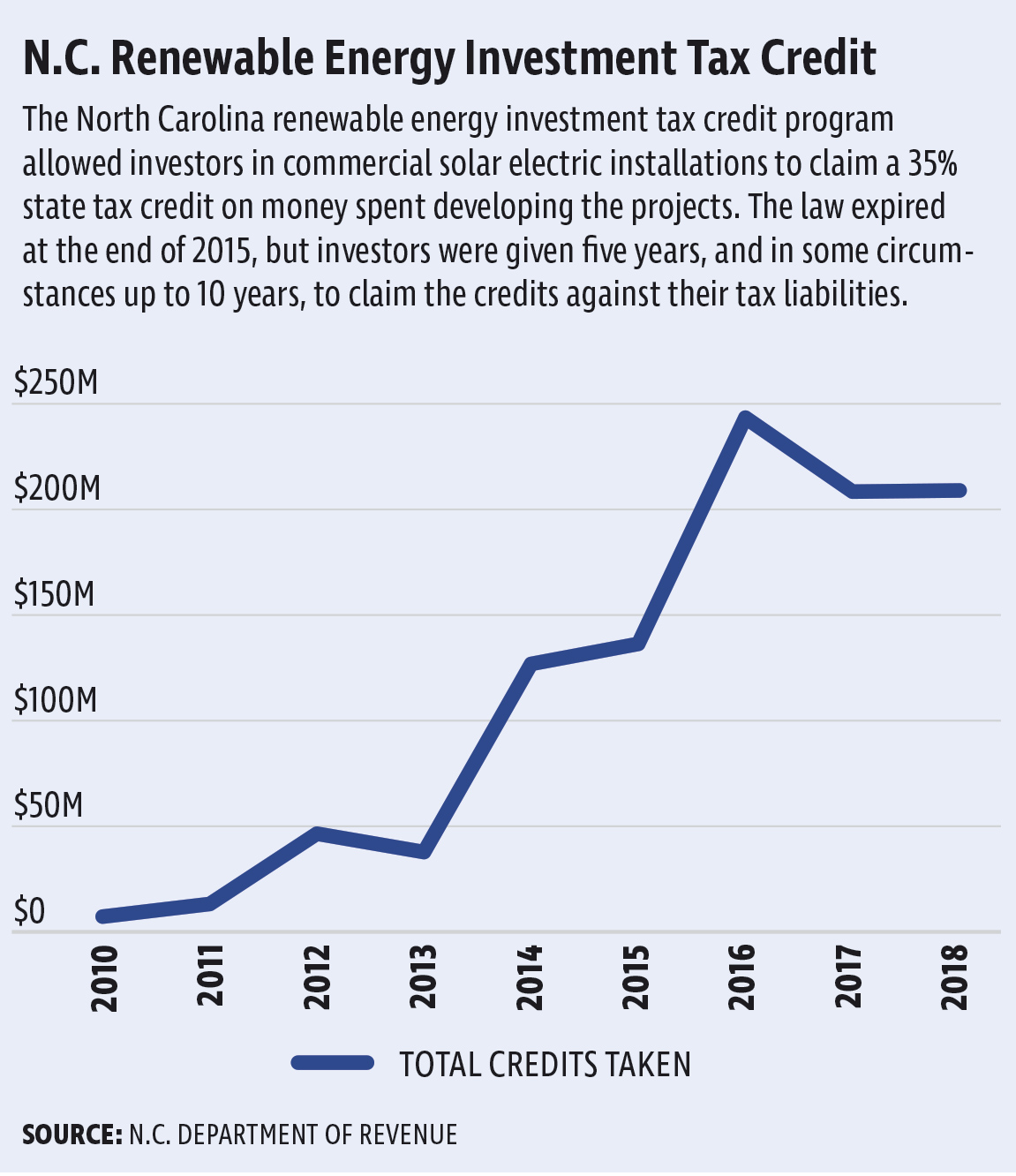

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

30 Federal Tax Credit Palomar Solar And Roofing

Tax Deadlines Extended Due To COVID 19 Minnesota Solar Installers

How The Solar Tax Credit Works California Sustainables

What Is The Investment Tax Credit For Renewable Energy - The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit