What Is The Ira Tax Credit For Ev Cars The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

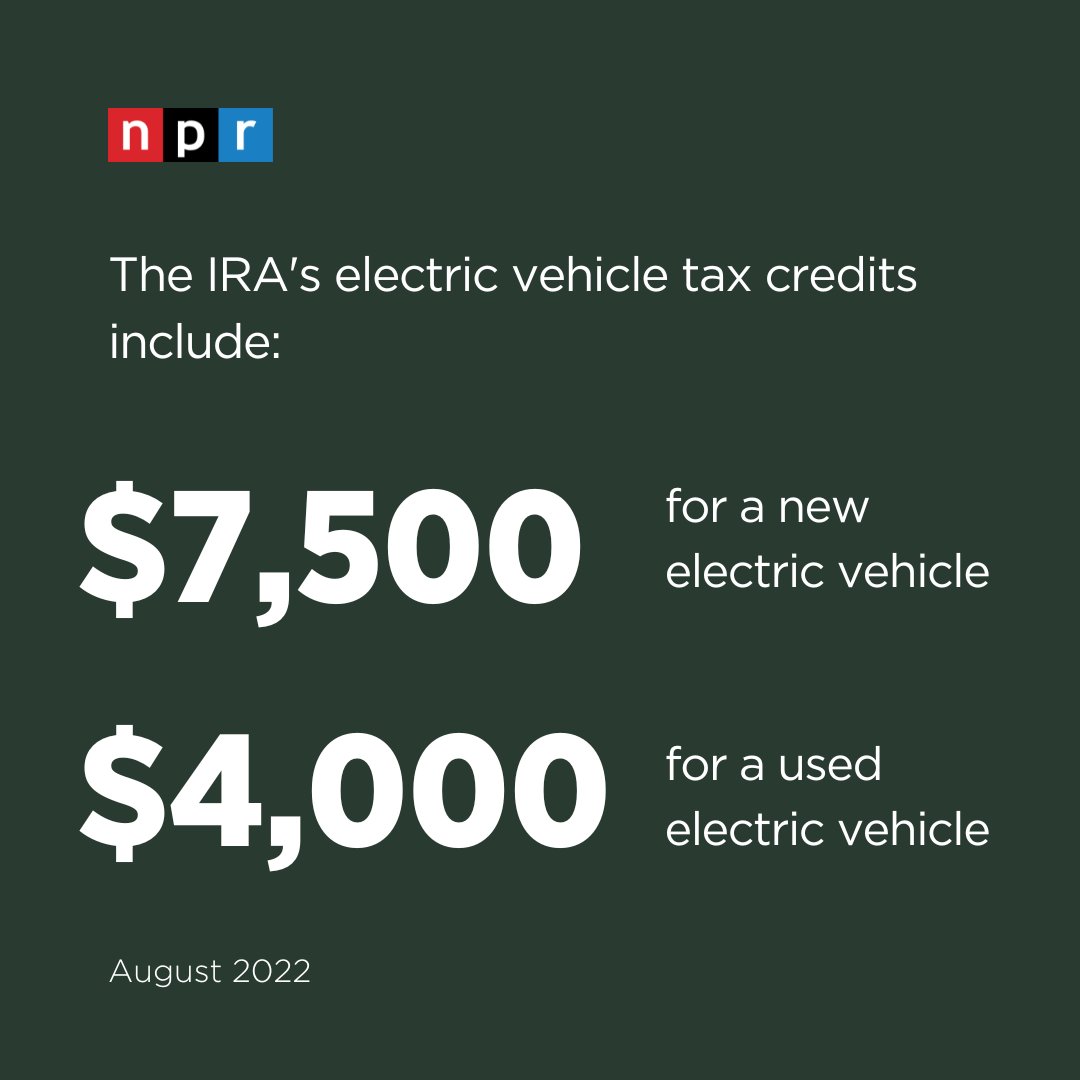

T he Inflation Reduction Act of 2022 IRA enacted several provisions concerning electric vehicles Recently the Treasury and IRS issued guidance in the form of frequently asked questions FAQs on changes regarding which vehicles qualify for the IRA s new EV credits How EY can help A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain electric

What Is The Ira Tax Credit For Ev Cars

What Is The Ira Tax Credit For Ev Cars

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

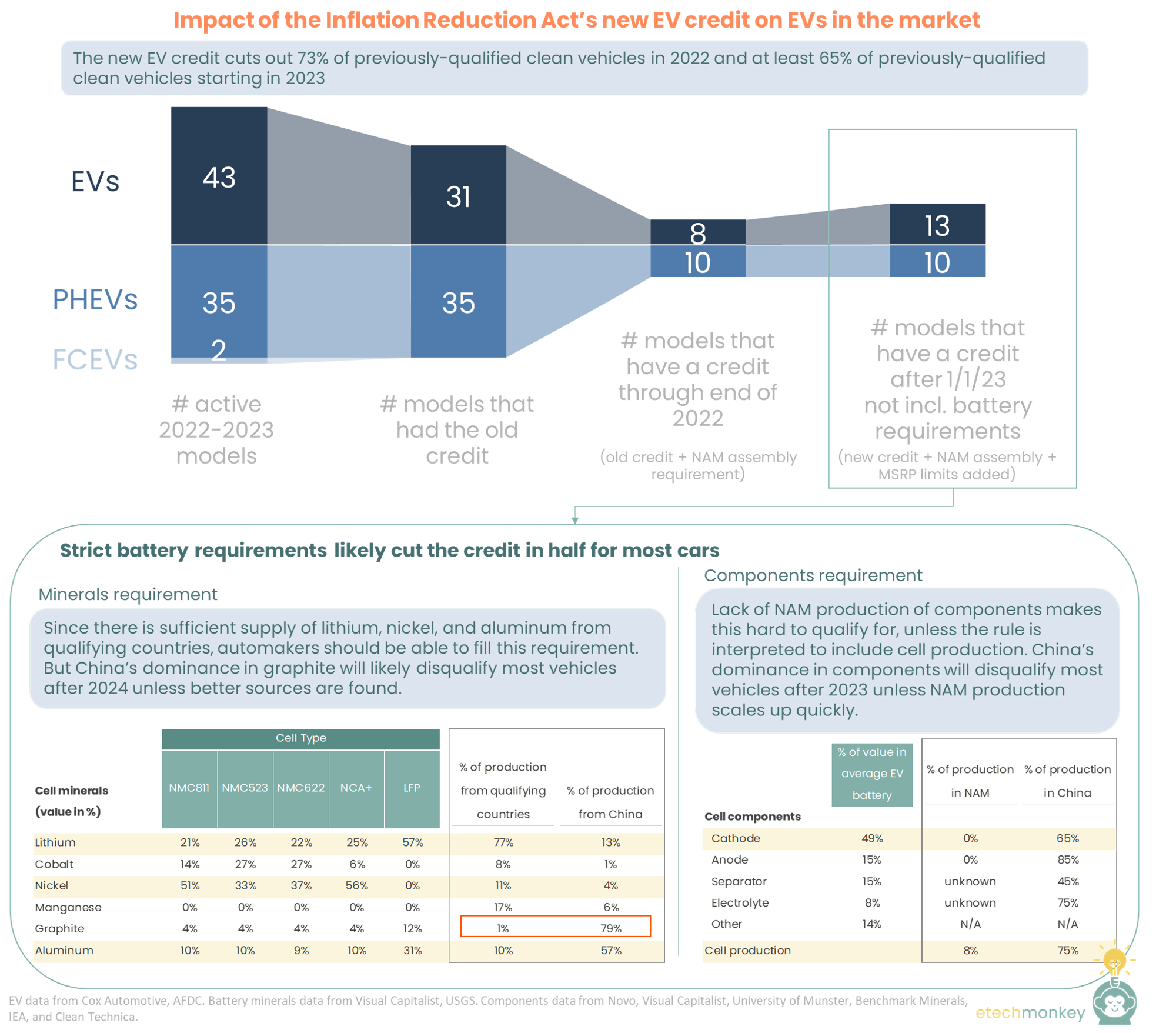

You Don t Get A Credit And You Don t Get A Credit The Impact Of IRA s

https://etechmonkey.com/wp-content/uploads/2022/08/ETM-IRAEVimpact.png

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

The IRA establishes a new tax credit for purchases of previously owned EVs with a model year at least 2 years earlier than the calendar year in which the taxpayer acquires the vehicle This credit will be the lesser of 4 000 and 30 of the sales price of the vehicle which cannot be more than 25 000 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

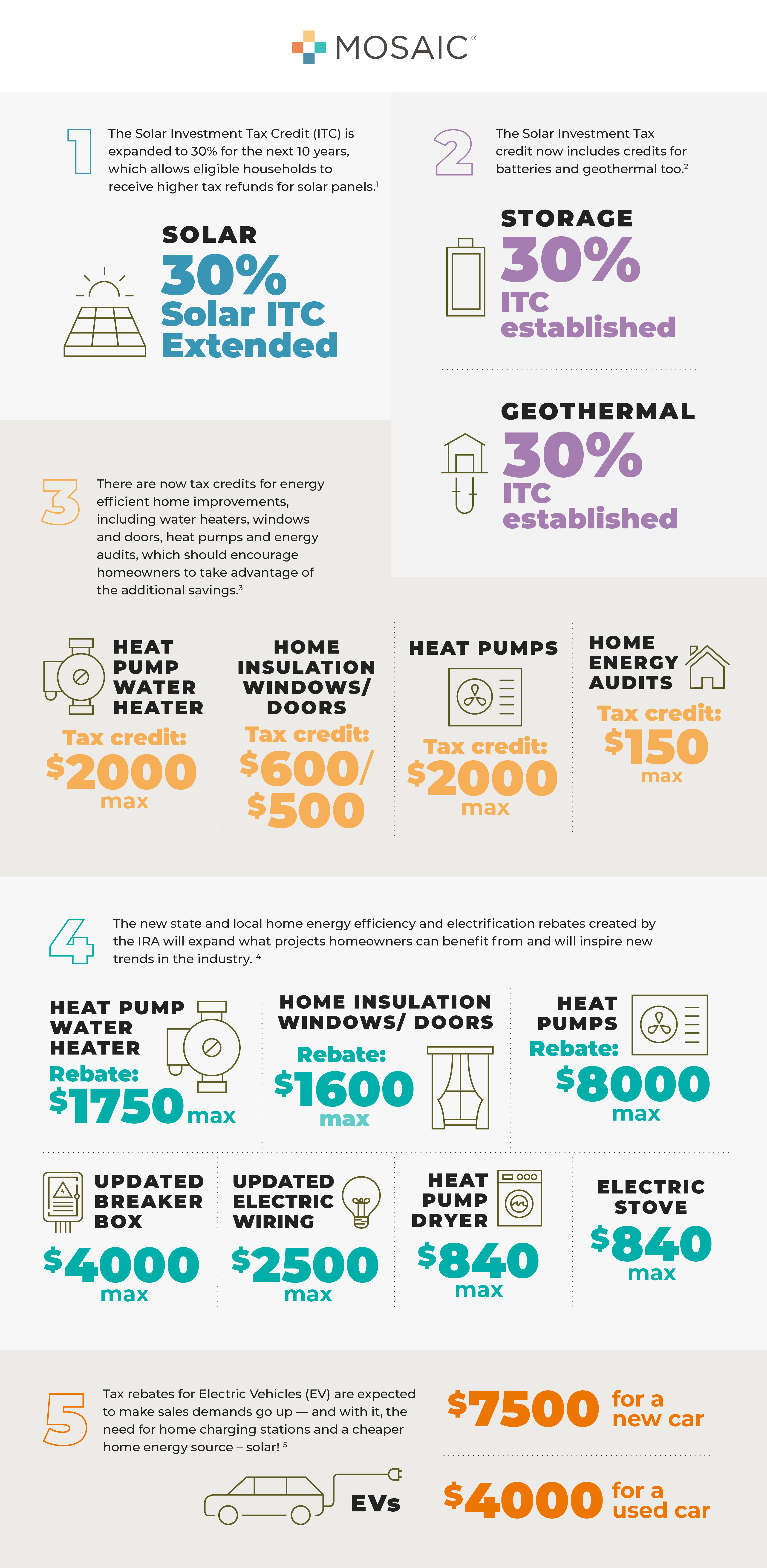

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers

Download What Is The Ira Tax Credit For Ev Cars

More picture related to What Is The Ira Tax Credit For Ev Cars

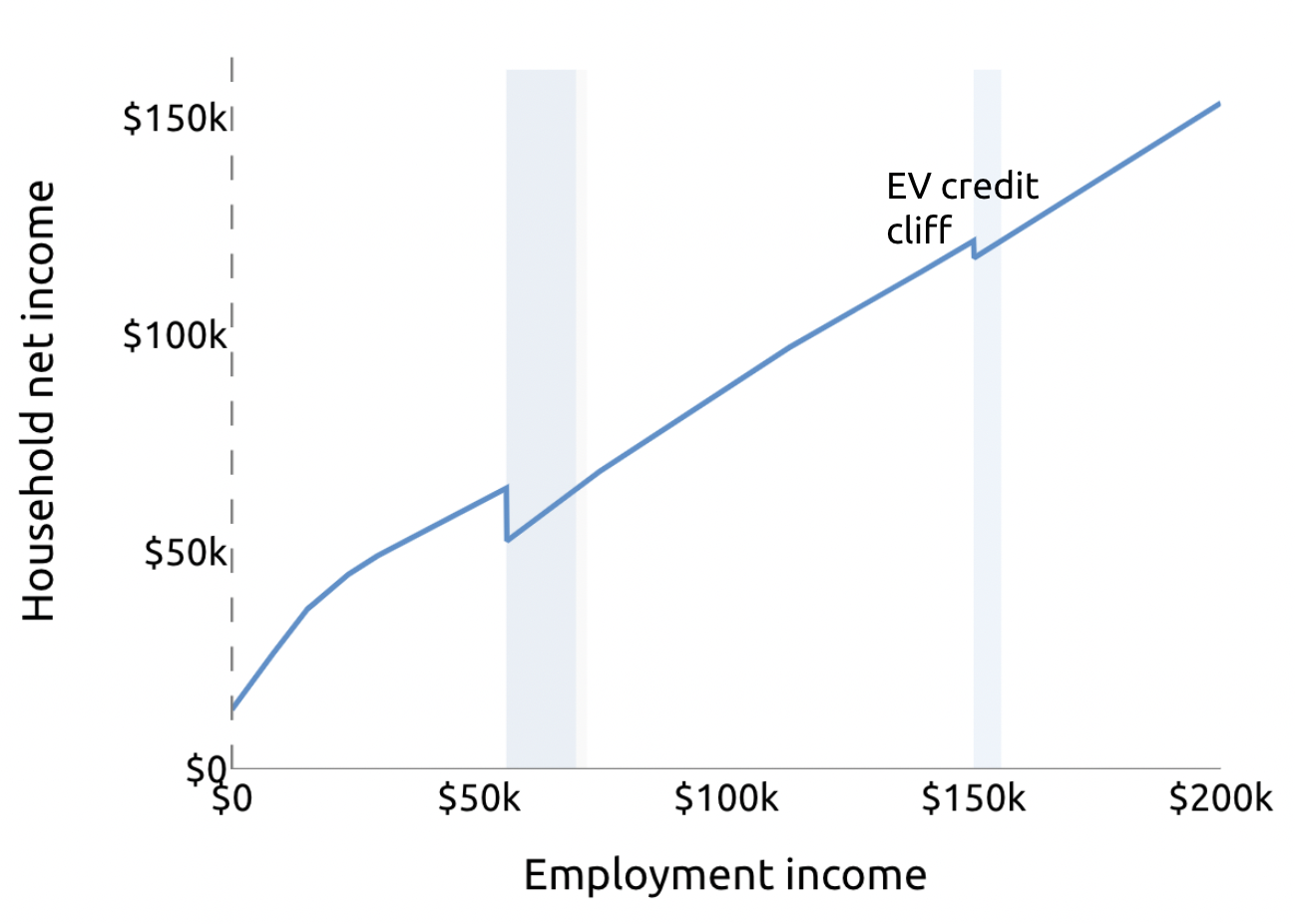

The Inflation Reduction Act Discourages Electric Vehicle Buyers From

https://www.ubicenter.org/assets/images/2022-08-03-ira-ev-credit-cliff/ev_cliff.png

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

The IRA added IRC Section 25E to allow taxpayers who acquire a used clean vehicle i e at least two years old before January 1 2033 to claim a federal tax credit during the tax year the vehicle is placed in service Here Is the EPA s List of EVs Eligible for the Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit By

The Inflation Reduction Act IRA included a 7 500 consumer tax credit for electric vehicle EV purchases renewing and modifying the existing tax credit EV sales substantially increased their market share in recent years rising from 3 2 of all vehicles sold in the U S in 2021 to 5 8 in 2022 Under the new rule consumers can get up to 7 500 back in tax credits on eligible cars More than a dozen new models and some of their variations are eligible for all or half of the new

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

https://www.investopedia.com/thmb/OTXhzNcsVMVY3QOBPLosp1fRGgo=/6000x4000/filters:no_upscale():max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png

https://www.irs.gov/newsroom/topic-b-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

https://www.ey.com/en_us/insights/tax/guidance...

T he Inflation Reduction Act of 2022 IRA enacted several provisions concerning electric vehicles Recently the Treasury and IRS issued guidance in the form of frequently asked questions FAQs on changes regarding which vehicles qualify for the IRA s new EV credits How EY can help

A Complete Guide To The New EV Tax Credit

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Spike On Twitter Ok Credits For Used EVs Is Exciting

Spike On Twitter Ok Credits For Used EVs Is Exciting

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Roth IRA Vs Traditional IRA How To Know What Is Best For You

Learn More About The Inflation Reduction Act IRA Mosaic

What Is The Ira Tax Credit For Ev Cars - Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023