What Is The Journal Entry For Income Tax Paid Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows Step 1 When Tax is Paid Paying tax via the bank Step 2 When Adjustment of

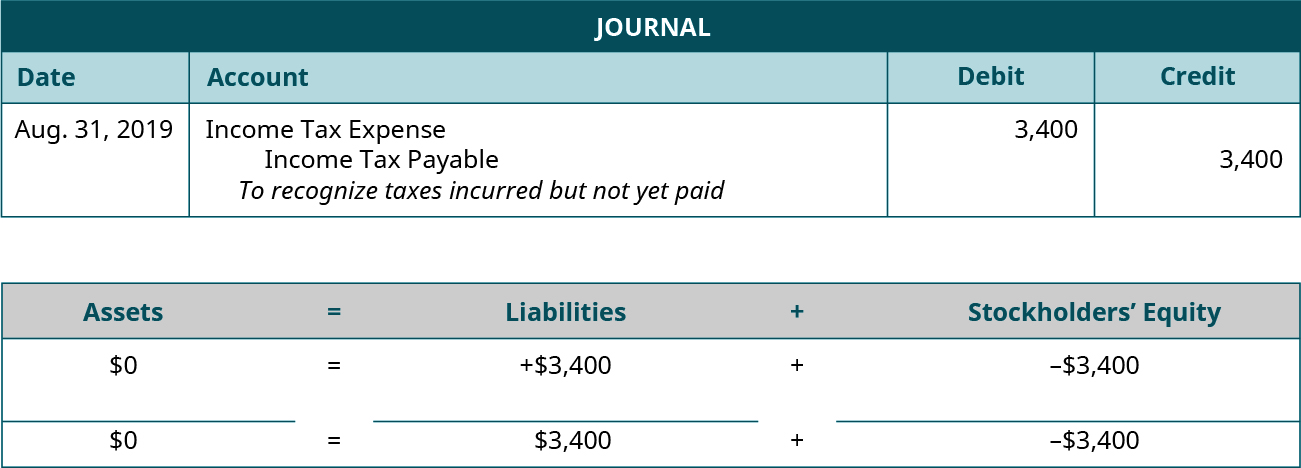

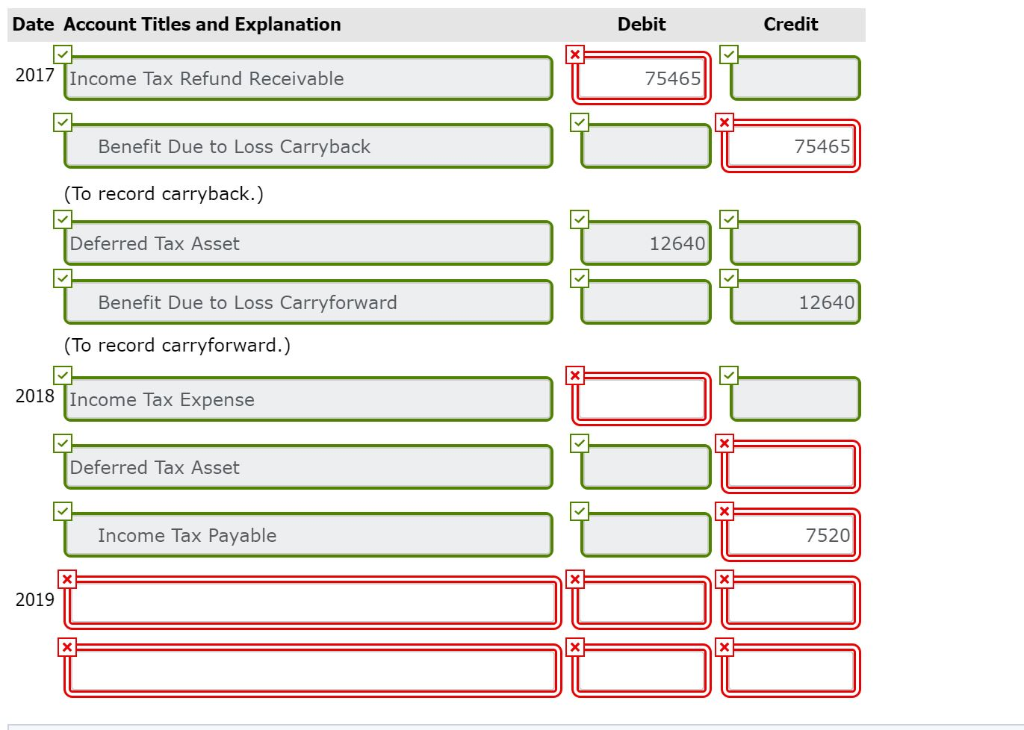

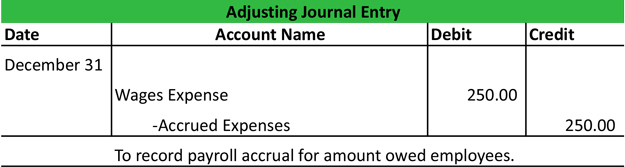

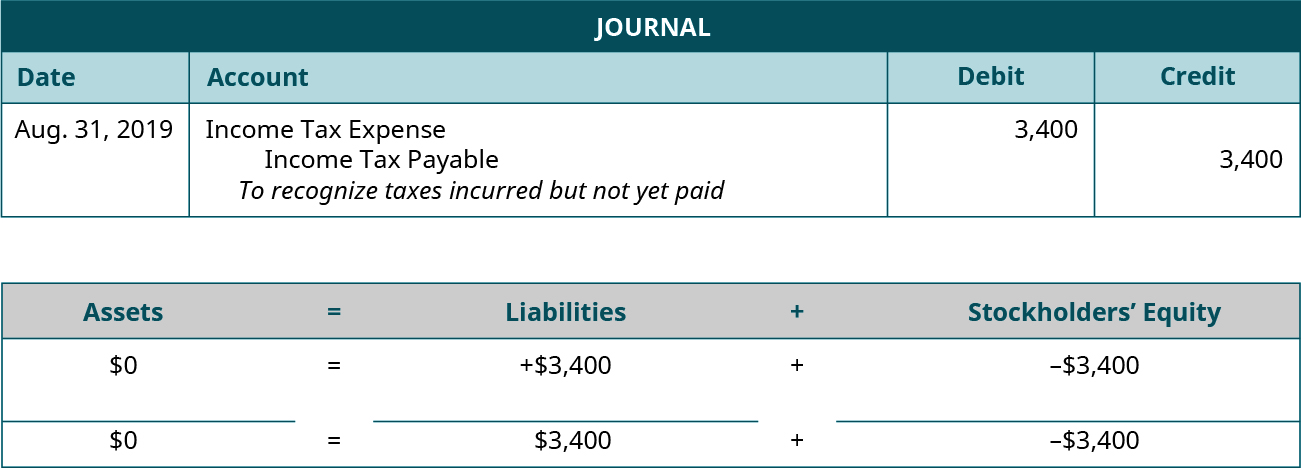

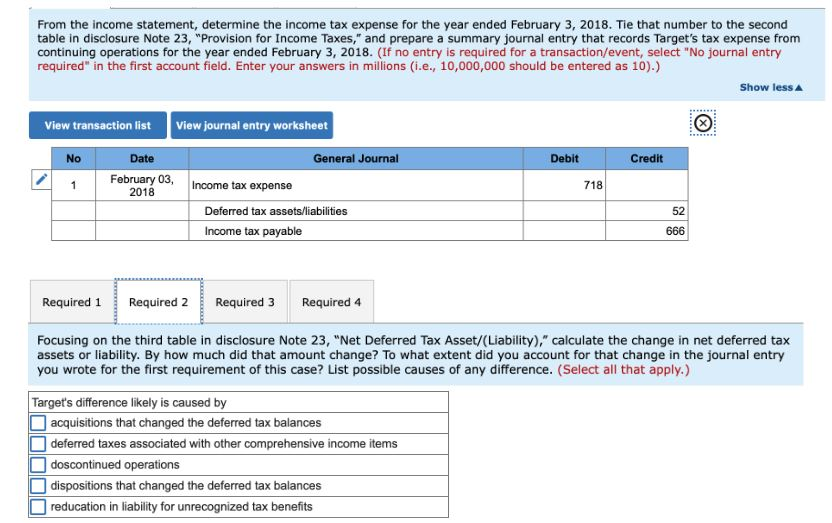

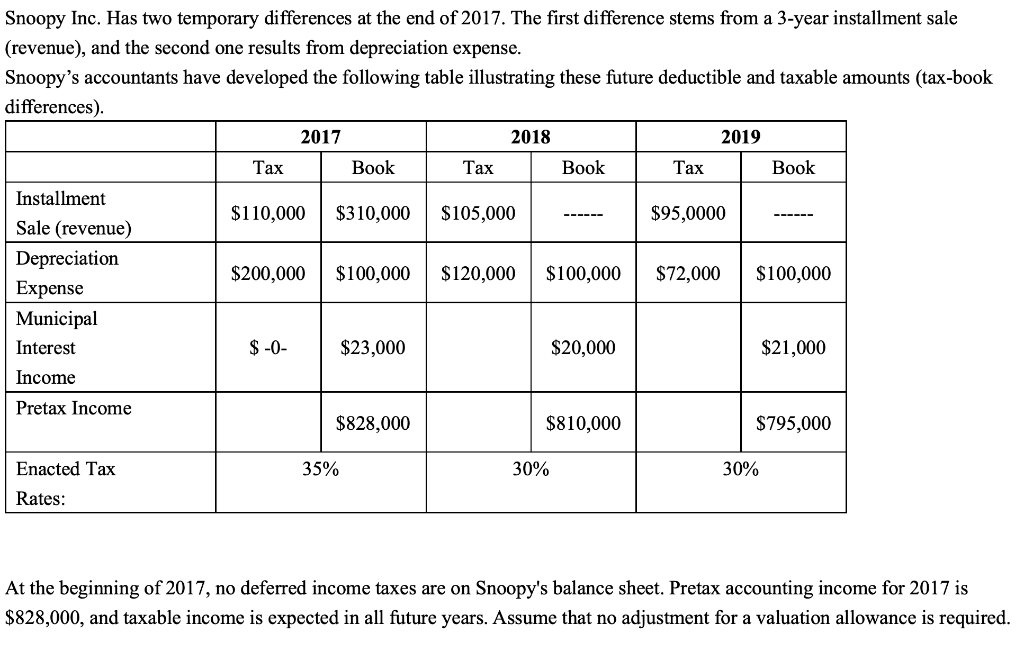

To record income tax expense you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable The income tax expense The accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period

What Is The Journal Entry For Income Tax Paid

What Is The Journal Entry For Income Tax Paid

https://media.geeksforgeeks.org/wp-content/uploads/20220513152536/IncomeTaxSol.PNG

Casual Journal Entry For Income Tax Payable Financial Statement

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/1.18.20.jpeg

Casual Journal Entry For Income Tax Payable Financial Statement

https://media.cheggcdn.com/media/3e2/3e2a3bd8-a537-40a7-b910-4a36b8ceff06/phpD5KuDz.png

Accrued income tax journal entry example shows how to record an estimated income tax expense due on profits of a business at the end of an accounting period The journal entry for the provision for income taxes involves two accounts income tax expense and income tax payable The income tax expense account is

Journal Entry for Income Tax GeeksforGeeks Last Updated 05 Apr 2023 Income Tax is paid by the business on the profit earned during the year Income Income taxes are determined by applying the applicable tax rate to net income of a business calculated in accordance with the accounting rules given in the tax

Download What Is The Journal Entry For Income Tax Paid

More picture related to What Is The Journal Entry For Income Tax Paid

Solved Accounting 7 Elder Helpers Lid Estimates Its Income Taxes At

https://www.coursehero.com/qa/attachment/12599654/

Income Tax Expense Unityqust

https://i.ytimg.com/vi/ItRa5S_WVIo/maxresdefault.jpg

Reversing Entries Accounting Example Requirements Explained

https://www.myaccountingcourse.com/accounting-cycle/images/adjusting-journal-entry-examples-5.jpg

Guide to what is Income Tax Accounting We explain it with the key terms used with example journal entries advantages disadvantages A payroll journal entry is an accounting method to control gross wages and compensation expenses Discover best practices to manage and record your payroll

The journal entry for income tax payable is a debit to the income tax expense account and a credit to the income tax payable account Learn how to Expecting an income tax refund for your business You may need to record a journal entry for income tax refund Find out more here

![]()

How To Correctly Post Your Salary Journal

http://blog.siliconbullet.com/files/257/images/how-to-correctly-post-your-salary-journal.jpg

Sales Journal With Vat Explained With Examples Otosection

https://i0.wp.com/ytimg.googleusercontent.com/vi/0BYVxBlxRQI/maxresdefault.jpg?resize=650,400

https://www.accountingcapital.com/journal-entries/...

Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows Step 1 When Tax is Paid Paying tax via the bank Step 2 When Adjustment of

https://accountingtitan.com/financial-reporting/...

To record income tax expense you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable The income tax expense

Journal Entry For Income Tax Paid By Cheque Davistakey1939 Davis

How To Correctly Post Your Salary Journal

Income Tax Expense Journal Entry Journal Entries For Normal Charge

Utilities Payable Balance Sheet Financial Statement Alayneabrahams

Entrada De Diario De N mina Ejemplo Explicaci n Contabilizar

Solved How Do I Complete The Journal Entries For 2021 And The Partial

Solved How Do I Complete The Journal Entries For 2021 And The Partial

Accounting Journal Entries

Sales Tax Payable Journal Entries YouTube

Solved Prepare The Journal Entry To Record Income Tax Chegg

What Is The Journal Entry For Income Tax Paid - What is the entry for provision of income tax We all know the general formula for the income tax provision current tax expense or benefit deferred tax