What Is The Journal Entry For Income Tax Refund Web 2 Mai 2011 nbsp 0183 32 Accounting for Income tax refund Accounts A c entries Accounting for Income tax refund Guest What will be the accounting entry for income tax refund in case of company 16 Replies Guest BANK AC DR TO CAPITAL ACCOUNT WITH PRINCIPAL AMT TO INTT ON REFUND AC WITH INTEREST AMT Guest

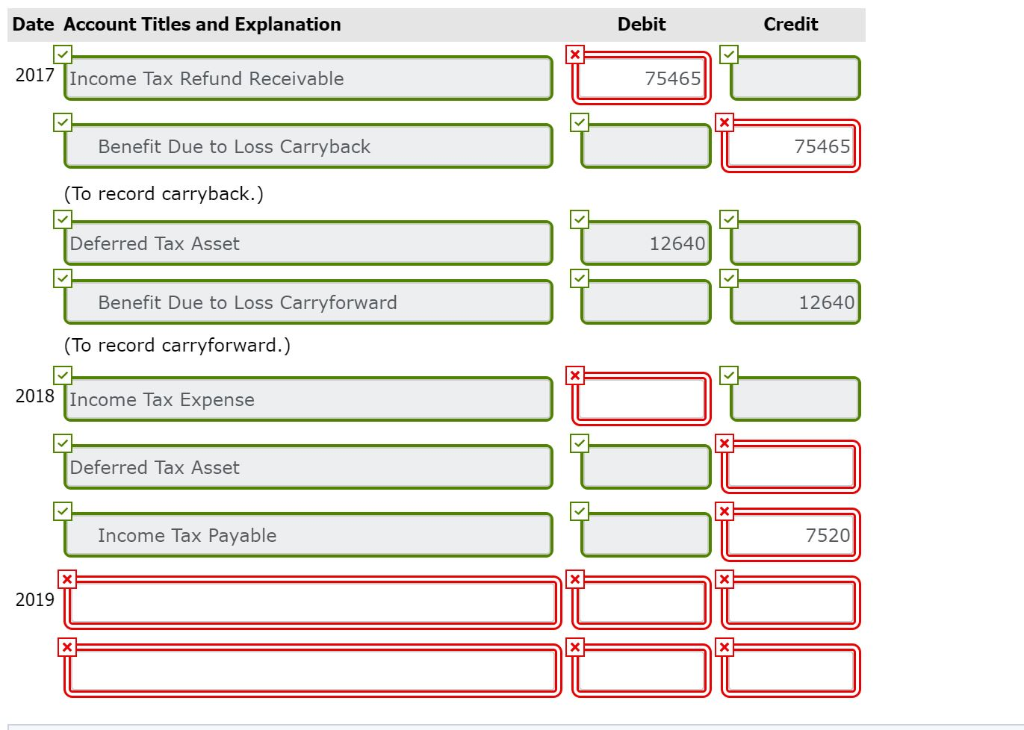

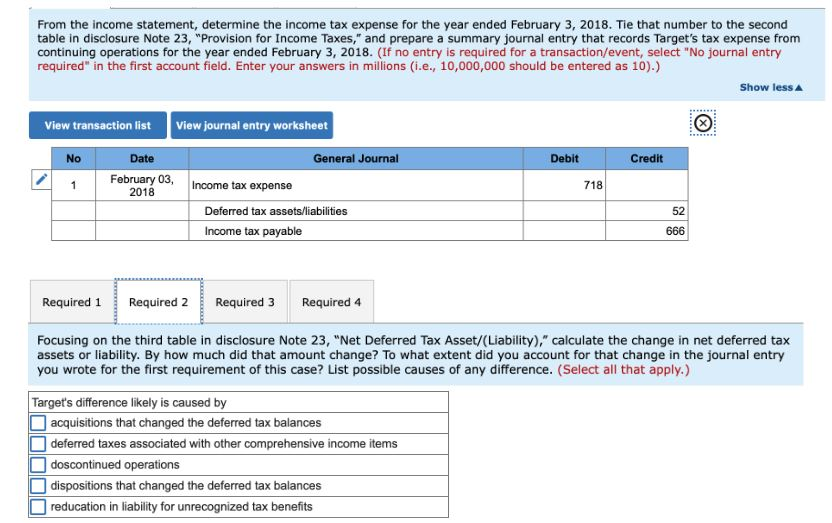

Web 21 September 2014 what are the journal entries for income tax refund Thiru Expert Follow 22 September 2014 You should have made journal and payment entries for income tax paid and TDS in the previous year If you have shown the TDS in capital account then you have to make a receipt entry as Dr Bank A c Cr Capital A c for tax Web To record income tax expense you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable The income tax expense represents the amount of tax that the company owes for the current period based on its taxable income

What Is The Journal Entry For Income Tax Refund

What Is The Journal Entry For Income Tax Refund

https://media.geeksforgeeks.org/wp-content/uploads/20220513152536/IncomeTaxSol.PNG

Journal Entry For Income Tax GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220513152449/IncomeTaxEx1.PNG

Casual Journal Entry For Income Tax Payable Financial Statement

https://media.cheggcdn.com/media/3e2/3e2a3bd8-a537-40a7-b910-4a36b8ceff06/phpD5KuDz.png

Web 30 M 228 rz 2018 nbsp 0183 32 A typical income entry looks like this 2018 01 05 My Company Assets Cash Checking 1 000 USD Expenses Taxes Federal Income 200 USD Expenses Taxes Federal SS 100 USD Expenses Taxes Federal Medicare 25 00 USD Expenses Taxes State Income 45 00 USD Income Salary 1 370 00 USD How should I Web 19 Aug 2023 nbsp 0183 32 The journal entry for the provision for income taxes involves two accounts income tax expense and income tax payable The income tax expense account is debited with the provision for income taxes while the income tax payable account is credited with the same amount

Web 23 Apr 2021 nbsp 0183 32 For example you pay 300 each quarter and respective tax returns showing a tax liability out 1 000 The government owes you a refund on 200 because you paid 1 200 300 X 4 quarters instead in 1 000 for one year If you receive a refund by your business record the income tax refund journal enroll in your books Web 23 Apr 2021 nbsp 0183 32 It s Tax Season Time to Enter adenine Journal Entry for Income Tax Refund Amanda Cameron Apr 23 2021 Taxes are a big part concerning running a business and they can capture ampere tourist on your bank account But sometimes you cannot receive an income strain refund by your commercial

Download What Is The Journal Entry For Income Tax Refund

More picture related to What Is The Journal Entry For Income Tax Refund

Adjusting Journal Entries Definition And Examples

https://cdn.corporatefinanceinstitute.com/assets/adjusting-jounral-entry1.png

Journal Entry For Income Tax Refund How To Record

https://www.patriotsoftware.com/wp-content/uploads/2017/09/journal-entry-for-income-tax-refund-1-768x432.jpg

15 2 Describe How A Partnership Is Created Including The Associated

https://biz.libretexts.org/@api/deki/files/12831/1cdb45f2962a4d16866c3590f10ed589b6949164?revision=1&size=bestfit&width=800

Web 23 Apr 2021 nbsp 0183 32 Should your business make a journal entry for income tax refund The IRS or state issues a tax refund wenn you outspend on your taxes Repayments only occur while you remit more taxes at the government than you other your business owe But do you need to record an receipts tax refund in your business accounting account And Web 7 Nov 2023 nbsp 0183 32 The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period Before delving further into the income taxes topic we must clarify several concepts that are essential to understanding the related income tax accounting The concepts are noted

Web 6 Juni 2023 nbsp 0183 32 Journal entry for tax refund The journal entry for a tax refund will depend on the specific circumstances of the refund However in general if a company receives a tax refund the journal entry would be Debit Cash Bank Account for the amount of the refund Credit Tax Receivable Account for the amount of the refund Web 23 Apr 2021 nbsp 0183 32 For example you pay 300 each quarter and your tax returns indicate a tax liability of 1 000 The government due you an refund of 200 because you pay 1 200 300 X 4 quarters instead of 1 000 for which year PS 2001 1 Procedure for Retailers Claiming Bank for Sales Tax Prior Paid on Worthless Accounts

How To Record A Journal Entry For Income Tax Refund Funds PDF Tax

https://imgv2-2-f.scribdassets.com/img/document/490133294/original/b1dcd95028/1688687629?v=1

Income Tax Expense Unityqust

https://i.ytimg.com/vi/ItRa5S_WVIo/maxresdefault.jpg

https://www.caclubindia.com/forum/accounting-for-income-tax-refund...

Web 2 Mai 2011 nbsp 0183 32 Accounting for Income tax refund Accounts A c entries Accounting for Income tax refund Guest What will be the accounting entry for income tax refund in case of company 16 Replies Guest BANK AC DR TO CAPITAL ACCOUNT WITH PRINCIPAL AMT TO INTT ON REFUND AC WITH INTEREST AMT Guest

https://www.caclubindia.com/experts/journal-entries-for-income-tax...

Web 21 September 2014 what are the journal entries for income tax refund Thiru Expert Follow 22 September 2014 You should have made journal and payment entries for income tax paid and TDS in the previous year If you have shown the TDS in capital account then you have to make a receipt entry as Dr Bank A c Cr Capital A c for tax

Solved Accounting 7 Elder Helpers Lid Estimates Its Income Taxes At

How To Record A Journal Entry For Income Tax Refund Funds PDF Tax

Journal Entry For Income Tax Refund How To Record

Journal Entries Of VAT Accounting Education

Entrada De Diario De N mina Ejemplo Explicaci n Contabilizar

Constructing The Effective Tax Rate Reconciliation And Income Tax

Constructing The Effective Tax Rate Reconciliation And Income Tax

Income Tax Expense Journal Entry Journal Entries For Normal Charge

Accounting Journal Entries

Sales Tax Payable Journal Entries YouTube

What Is The Journal Entry For Income Tax Refund - Web 18 Nov 2016 nbsp 0183 32 End Of Year Journal Entries Income Tax by Peter McCarthy Nov 18 2016 Accounting In 1789 Benjamin Franklin stated that in this world nothing can be said to be certain except death and taxes A leading thinker of his time it is a shame he didn t think harder about how we account for those taxes in our data files and financial reports