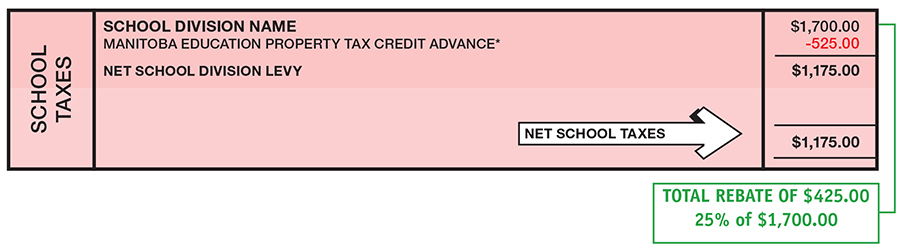

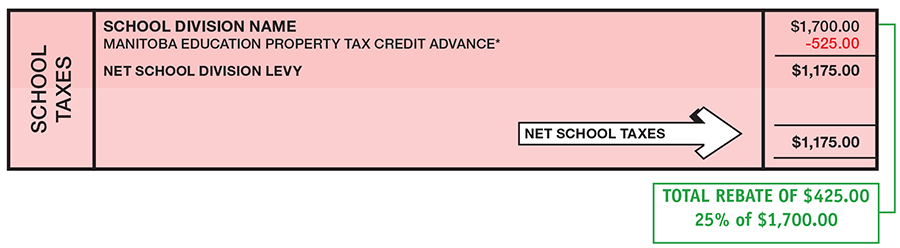

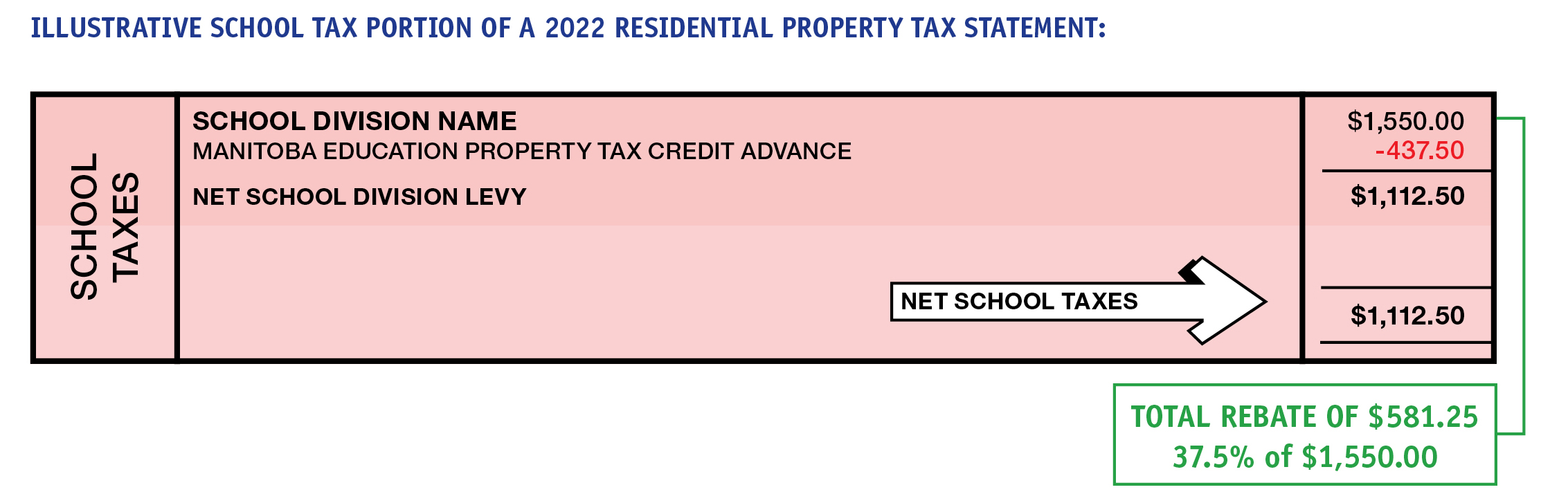

What Is The Manitoba Education Property Tax Credit Advance The Education Property Tax Credit EPTC is a Provincial Tax Credit for homeowners provided to offset the occupancy costs of property tax for homeowners payable in Manitoba The Education Property Tax Credit Advance is where the EPTC is applied directly to the municipal property tax statement for homeowners

Farm property owners are receiving a 50 per cent rebate of school taxes for 2024 applied directly to their property tax notice Other property owners will receive a 10 per cent rebate of the total school division special levy and education support levy for 2024 applied to their property tax notice With the Manitoba education property tax credit EPTC you might be able to claim up to 437 50 either on your municipal property tax statement or through your income tax return for your contribution to the school system

What Is The Manitoba Education Property Tax Credit Advance

What Is The Manitoba Education Property Tax Credit Advance

https://univerlist.com/media/images/blog/DSC04686.jpg

Province Of Manitoba Education Property Tax

https://www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

More Than 18M Unclaimed As Manitoba Education Property Tax Auto

https://i.cbc.ca/1.6482383.1654732519!/fileImage/httpImage/image.jpg_gen/derivatives/16x9_620/homes-property-tax-rebate-winnipeg.jpg

The Manitoba government has announced a multi year phased elimination of education property taxes as part of its commitment under the 2 020 Tax Rollback Guarantee All property classes are eligible to receive the new Education Property Tax Rebate including For the 2025 tax year the School Tax Rebate and Education Property Tax Credit and Advance will be replaced with a new Homeowners Affordability Tax Credit of up to 1 500 on principal residences

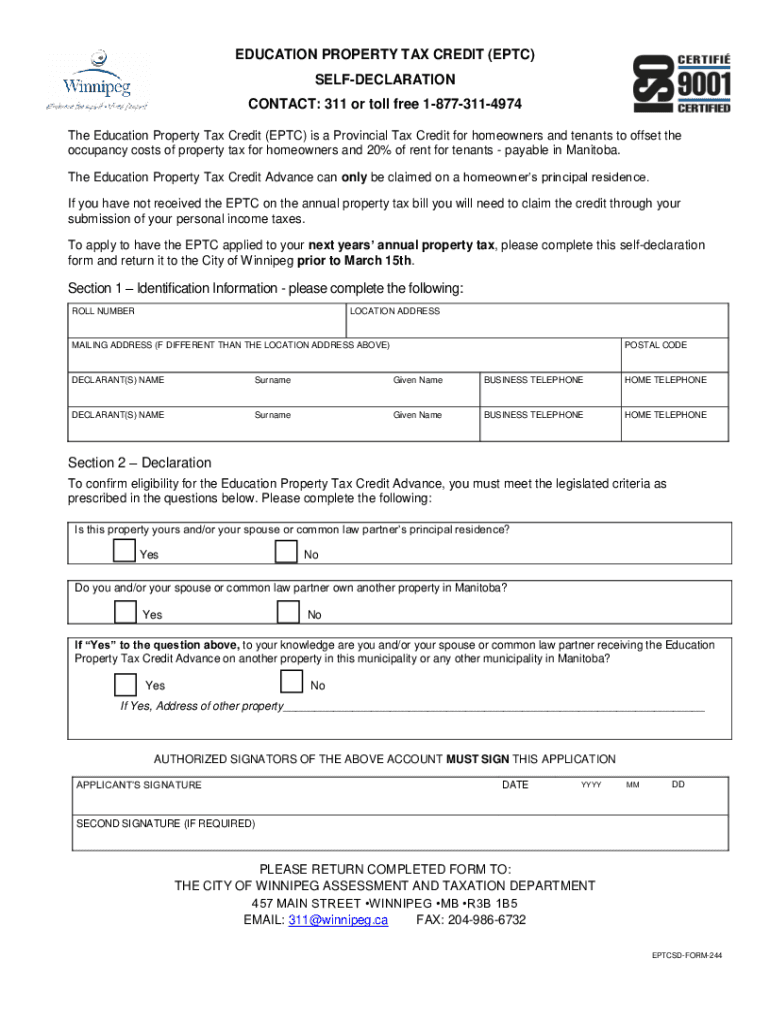

If you re a Manitoba property owner will you be better off with the education tax rebates and credits the PCs offered or the upcoming NDP property tax credit of up to 1 500 It s not as easy To be eligible for the Manitoba Educaon Property T ax Credit Advance the property must be your principal resi dence you must have occupied the residence as of January 1 2024 and you must not be receiving the credit for any other resi dences

Download What Is The Manitoba Education Property Tax Credit Advance

More picture related to What Is The Manitoba Education Property Tax Credit Advance

Manitoba

https://i.pinimg.com/originals/fb/19/7c/fb197ca138e9cafb21d03e7b52e020f7.png

Manitoba Maps Facts World Atlas

https://www.worldatlas.com/r/w1200-q80/upload/8c/c6/ff/mbz-01.png

Education Property Tax Cuts Worsen Income Inequality In Manitoba

https://policyalternatives.ca/sites/default/files/uploads/publications/reports/images/Screen Shot 2021-05-18 at 11.25.20 AM.png

The Manitoba government s 1 500 Homeowners Affordability Tax Credit will reduce or eliminate school taxes for 84 per cent of Manitoba homeowners Premier Wab Kinew and Finance Minister Adrien Sala announced today I hereby make application for the Manitoba Education Property Tax Credit Advance in accordance with the regulations to the Income Tax Act Manitoba This advance is to be credited to the taxes levied for the current year against the above described property

Education Property Tax Credit If you own your home and pay property taxes you could be eligible to save up to 350 00 for the 2024 tax year with the Manitoba government s Education Property Tax Credit EPTC What Is The Education Property Tax Credit EPTC The EPTC is a provincial tax credit in Manitoba that is designed to offset some of the school taxes paid by homeowners If you are a homeowner your credit will be directly applied to your municipal property tax statement

Manitoba Health Card Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/91/100091586/large.png

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

https://img.hechtgroup.com/1662947805514.jpeg

https://assessment.winnipeg.ca/AsmtTax/English/Property/credit.stm

The Education Property Tax Credit EPTC is a Provincial Tax Credit for homeowners provided to offset the occupancy costs of property tax for homeowners payable in Manitoba The Education Property Tax Credit Advance is where the EPTC is applied directly to the municipal property tax statement for homeowners

https://www.gov.mb.ca/schooltaxrebate

Farm property owners are receiving a 50 per cent rebate of school taxes for 2024 applied directly to their property tax notice Other property owners will receive a 10 per cent rebate of the total school division special levy and education support levy for 2024 applied to their property tax notice

Property Tax Assessment Rural Municipality Of Piney

Manitoba Health Card Fill Out Sign Online DocHub

Manitoba Legislative Building Winnipeg

University Of Manitoba Canadian Universities Event

Tax Incentives What You Need To Know For Tax Season

Province Of Manitoba News Releases Canada And Manitoba Provide 7 5

Province Of Manitoba News Releases Canada And Manitoba Provide 7 5

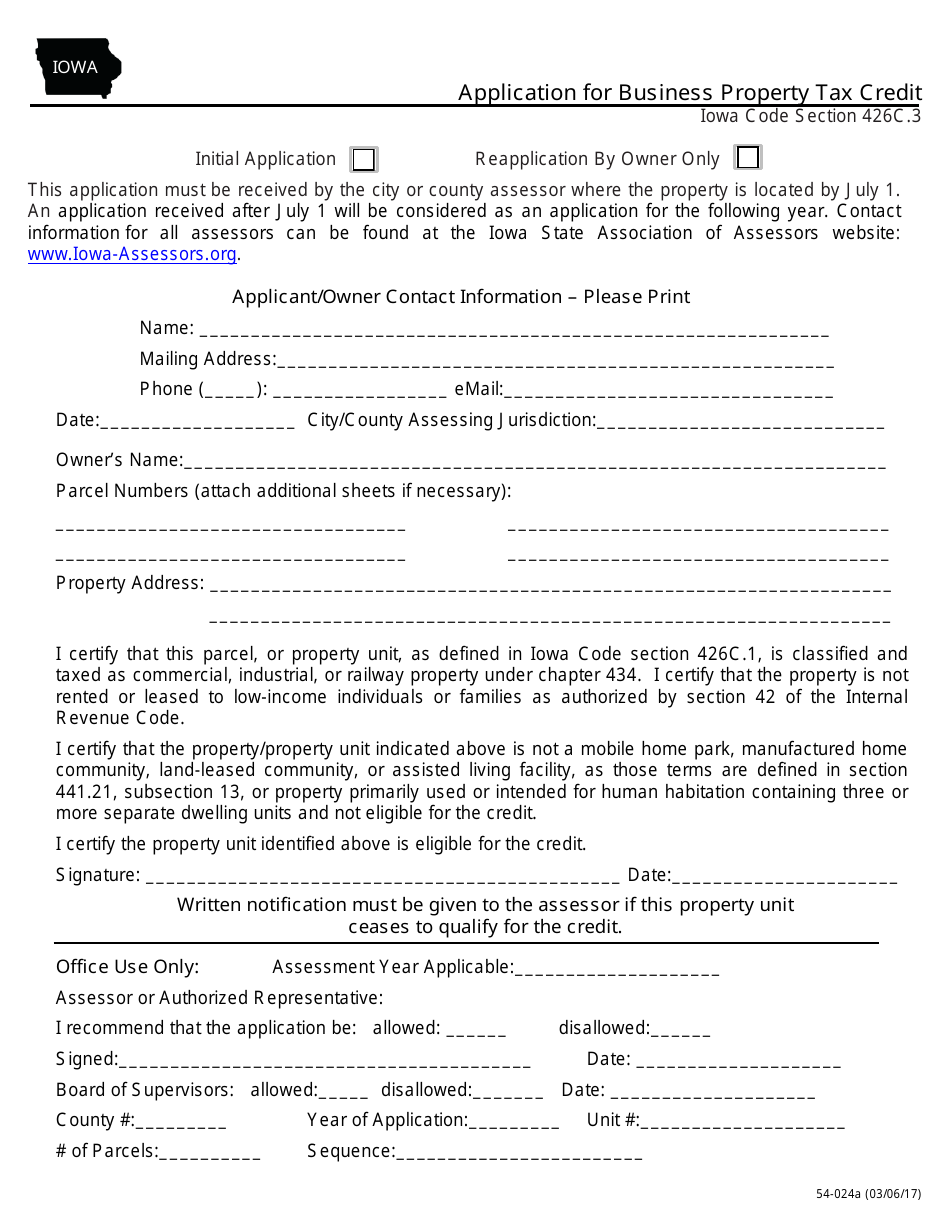

Form 54 024A Fill Out Sign Online And Download Fillable PDF Iowa

2023 Payroll Tax Calculator NicoeKennedi

Fillable Online Education Property Tax Credit EPTC Self Declaration

What Is The Manitoba Education Property Tax Credit Advance - If you re a Manitoba property owner will you be better off with the education tax rebates and credits the PCs offered or the upcoming NDP property tax credit of up to 1 500 It s not as easy