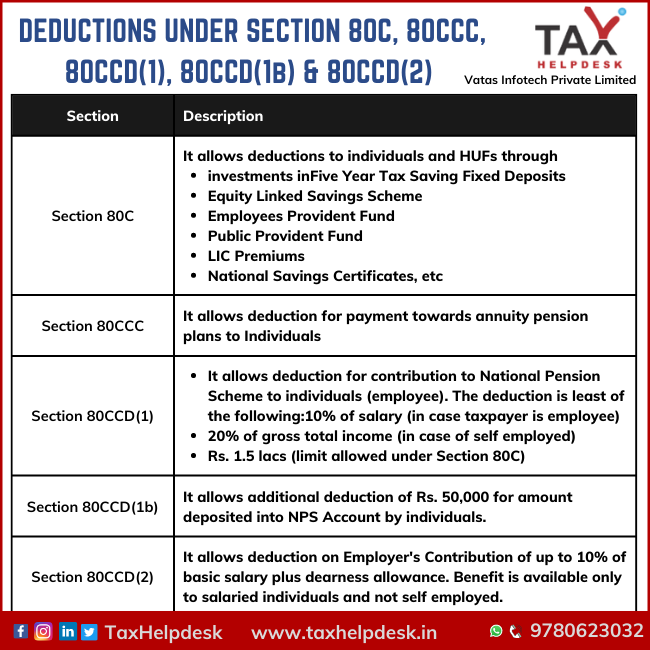

What Is The Maximum Exemption Under 80ccd The maximum limit for claiming deduction under Section 80CCD is 2 00 000 up to 1 50 000 can be claimed under Section 80CCD 1 and additional 50 000 can be claimed under Section 80CCD 1B

No the maximum deduction allowed under Sections 80C 80CCC and 80CCD put together is Rs 1 50 000 Over and above this limit a further An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus dearness allowance For self employed the limit for deduction is 20 of their income subject to Rs 1 5 lakh maximum limit of section 80C

What Is The Maximum Exemption Under 80ccd

What Is The Maximum Exemption Under 80ccd

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

What Is Dcps Nps Yojana Login Pages Info

https://www.basunivesh.com/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B-1280x720.jpg

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

Rs 2 lakhs is the 80CCD 2 maximum limit that can be claimed under the section It contains the additional deduction of Rs 50 000 that is available under 80CCD 1B Tax benefits that have How much tax is exempt from 80CCD The maximum deduction amount permitted by Section 80CCD is Rs 2 lakh which also takes into account the additional deduction of Rs

As per Sec 80CCE aggregate deduction u s 80C 80CCC and 80CCD 1 is restricted to maximum of Rs 1 50 000 Therefore in current regime Rs 90 000 is allowed u s Yes eligible individuals can claim tax benefits of a maximum of Rs 1 5 lakhs while reading both Section 80CCD 1 and 80CCD 2 together Who can claim Section 80CCD 2 deduction

Download What Is The Maximum Exemption Under 80ccd

More picture related to What Is The Maximum Exemption Under 80ccd

What Is The Legal Lending Limit InfoComm

https://www.infocomm.ky/wp-content/uploads/2022/10/1666731084.jpeg

Tax Exempt Tax Bind Consulting

https://taxbind.net/application/uploads/2018/09/tax-exempt.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

What is the maximum limit under section 80CCD As per section 80CCD 1 the maximum limit is 10 of the salary in case of an employee and 20 of the gross total income in any other case However the maximum limit Under Section 80CCD of the Income Tax Act a deduction is currently available for contributions made to the NPS The Finance Bill 2025 extends this benefit to contributions made to the NPS Vatsalya accounts of up to two minor children allowing parents or guardians to claim a deduction under Section 80CCD 1B for these contributions

Self employed individuals can claim an additional tax deduction of up to Rs 50 000 under Section 80 CCD 1B over and above the limit of Rs 1 5 lakh under Section 80 CCE The maximum tax deduction under Section 80CCD is as follows The maximum tax deduction allowed by Section 80CCD is 2 00 000 This sum includes an additional 50 000 deduction permitted by Section 80CCD 1B

Will Religious Exemptions Undercut COVID 19 Vaccines Mandates

https://www.gannett-cdn.com/presto/2021/07/29/PSPR/ccd88456-314b-4f7c-bd4a-19ff21715bcc-MercyVaxProtest086.jpg?crop=4587,2580,x1,y249&width=3200&height=1800&format=pjpg&auto=webp

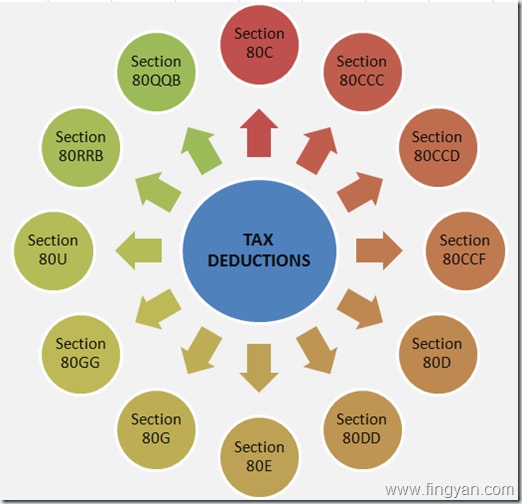

A Quick Look At Deductions Under Section 80C To Section 80U

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Section-80C-1.png

https://www.etmoney.com › learn › income-tax

The maximum limit for claiming deduction under Section 80CCD is 2 00 000 up to 1 50 000 can be claimed under Section 80CCD 1 and additional 50 000 can be claimed under Section 80CCD 1B

https://cleartax.in

No the maximum deduction allowed under Sections 80C 80CCC and 80CCD put together is Rs 1 50 000 Over and above this limit a further

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Will Religious Exemptions Undercut COVID 19 Vaccines Mandates

Exemptions Still Available In New Tax Regime with English Subtitles

7 Tax Provisions That Are Relevant To You Beyond Just Section 80C

Income Tax Deduction Under Section 80C To 80U FY 2022 23

How To Claim Section 80CCD 1B TaxHelpdesk

How To Claim Section 80CCD 1B TaxHelpdesk

Financial Hospital Timeline How To Plan Investing Financial

Open ended Semi structure Interview Questions Download Scientific

80CCD 1B Tax Exemption Explained Society Biz

What Is The Maximum Exemption Under 80ccd - Mr Anil is eligible to claim a standard deduction of Rs 75 000 from his salary under the new tax regime Further he is eligible to claim a deduction under Section 80CCD 2 for