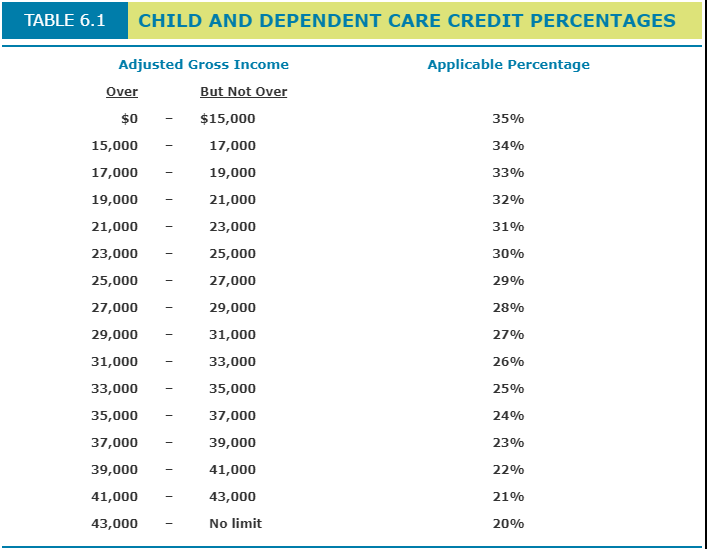

What Is The Maximum For Child Care Tax Credit Qualifying expenses range from 20 to 35 and your percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit in 2024 is One factor to

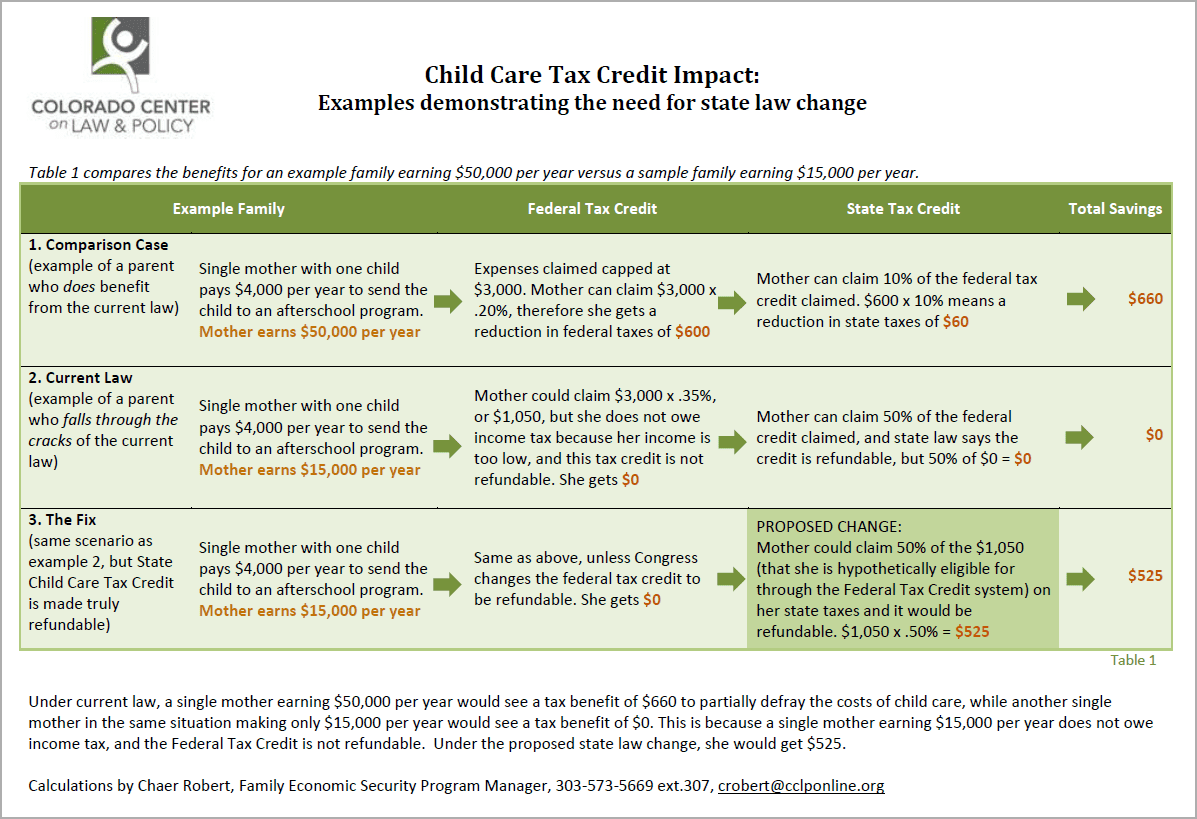

It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent This means that the maximum child and dependent care credit is 1 050 for one dependent or 2 100 for two or more dependents

What Is The Maximum For Child Care Tax Credit

What Is The Maximum For Child Care Tax Credit

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1080xN.3981264249_lgte.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two Currently the Child and Dependent Care Credit ranges from 20 to 35 of qualified expenses The percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit is The credit

Qualified taxpayers can claim 20 percent to 35 percent of care expenses up to a limit of 3 000 of expenses for one child or dependent and up to 6 000 for two or more For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could write off up to

Download What Is The Maximum For Child Care Tax Credit

More picture related to What Is The Maximum For Child Care Tax Credit

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit-800x534.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_1140xN.3736849859_31z4.jpg

Tax Credit Or FSA For Child Care Expenses Which Is Better

https://static.wixstatic.com/media/62b39d_9cd40e7758b749f88e3057d23a1a03f5~mv2.jpg/v1/fit/w_1000%2Ch_572%2Cal_c%2Cq_80/file.jpg

The value of the Child and Dependent Care Tax Credit varies depending on your income and eligible care expenses also known as work related expenses But there s a limit to how much What is the income limit for the child tax credit You may be eligible for the full child tax credit amount if your modified adjusted gross income is 400 000 or below married filing jointly

The maximum of the Daycare Credit is 1 050 for one dependent and 2 100 for two or more How is the Daycare Credit calculated The credit is calculated based on your However your income does determine the amount of credit you can receive up to a maximum of 3 000 per qualifying dependent child or individual or 6 000 for two or more

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/NINTCHDBPICT000653939782-7.jpg

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

https://www.kiplinger.com › taxes › child-and...

Qualifying expenses range from 20 to 35 and your percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit in 2024 is One factor to

https://www.irs.gov › publications

It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent

Indiana Lawmakers Consider Child Care Tax Credit For Employers Fox 59

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Calculate The Amount Of The Child And Dependent Care Chegg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

What Is The Phase Out For Dependent Care Credit Latest News Update

Dependent And Child Care Credits Tax Policy Center

Dependent And Child Care Credits Tax Policy Center

Fixing The Child Care Tax Credit EOPRTF CCLP

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Child Tax Credit Payments 06 28 2021 News Affordable Housing

What Is The Maximum For Child Care Tax Credit - Currently the Child and Dependent Care Credit ranges from 20 to 35 of qualified expenses The percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit is The credit