What Is The Maximum Rate For Family Tax Benefit Part A The maximum rate of FTB Part A is payable where family income is equal to or less than the income free area for the relevant income year FTB Part A reduces by 20c for each

If your family s adjusted taxable income is 58 108 or less you may get the maximum rate of FTB Part A Families with an adjusted taxable income between The maximum rate per family for Family Tax Benefit B is 161 41 per fortnight when your youngest child is aged 0 5 years old and 112 56 when your youngest child is 5 18 years of age It s important to

What Is The Maximum Rate For Family Tax Benefit Part A

What Is The Maximum Rate For Family Tax Benefit Part A

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

Lodgment Reminder Family Tax Benefit Recipients Crest Accountants

https://www.crestaccountants.com.au/wp-content/uploads/2022/06/Lodgment-Reminder-Family-Tax-Benefit-Recipients-1060x628.png

What Is The Maximum Social Security Payment ClearMatch Medicare

https://images.prismic.io/clearmatchmedicare/a2fd46a5-5828-422a-ae0c-413aa7feac0b_What+Is+the+Maximum+Social+Security+Payment.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

Key facts Family Tax Benefit FTB is a government payment to help with the cost of raising children It is made up of 2 parts Part A and Part B You need to meet certain Multiple Birth Allowance Energy Supplement FTB Part A recipients also have to meet immunisation and or health check requirements link is external Find out more

The first test reduces the maximum rate of Family Tax Benefit Part A by 20 cents for each dollar above 51 903 The second test reduces the base rate of Family Tax The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A will

Download What Is The Maximum Rate For Family Tax Benefit Part A

More picture related to What Is The Maximum Rate For Family Tax Benefit Part A

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim The maximum FTB A rate for a dependent secondary student aged 16 19 years is 214 06 per fortnight pf and for a young person aged 18 21 years not a secondary student the

FTB Part A is paid at different rates depending on the individual s and their partner s 1 1 P 30 combined ATI 1 1 A 20 and the number and ages of eligible FTB Part A is paid at a maximum base rate of 1 529 35 per child per year FTB Part A supplement is an additional lump sum of 751 90 per child that is paid after

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

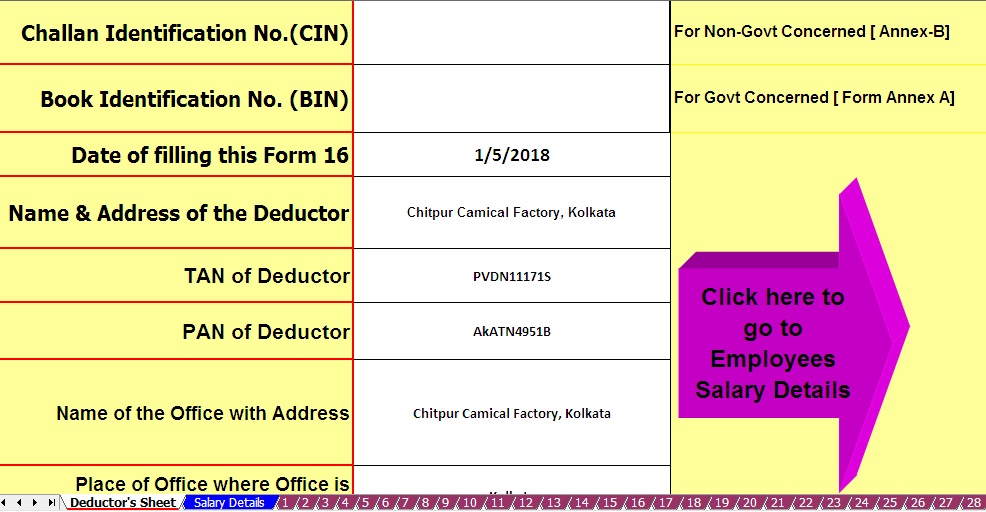

What Is The Maximum Income Tax You Can Save For The F Y 2019 20 With

https://1.bp.blogspot.com/-bY2h8_EOUUc/XKmpS70SapI/AAAAAAAAJDI/M-VgQ60lxBAsSuo98OCzqb5OUwJAMt8ZQCLcBGAs/s1600/Master%2Bof%2BForm%2B16%2BPart%2BB%2BPage%2B1.jpg

https://guides.dss.gov.au/family-assistance-guide/3/6/1

The maximum rate of FTB Part A is payable where family income is equal to or less than the income free area for the relevant income year FTB Part A reduces by 20c for each

https://www.careforkids.com.au/blog/family-tax-benefit-part-a-and-part-b

If your family s adjusted taxable income is 58 108 or less you may get the maximum rate of FTB Part A Families with an adjusted taxable income between

Strategy C2 Financial David McGee Loans

Family Tax Benefit PART A PART B Care For Kids

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

What Is The Maximum Age For Personal Loan

Settlement Guide How To Access Family Payments That Are Available In

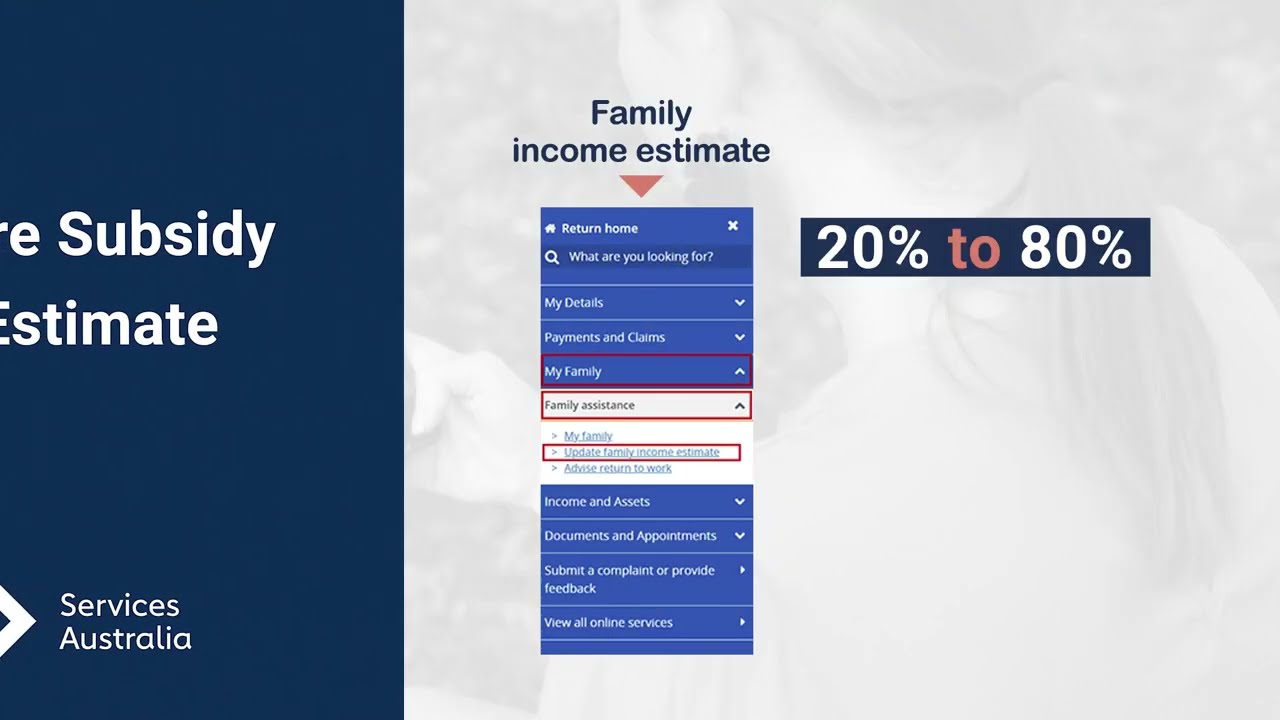

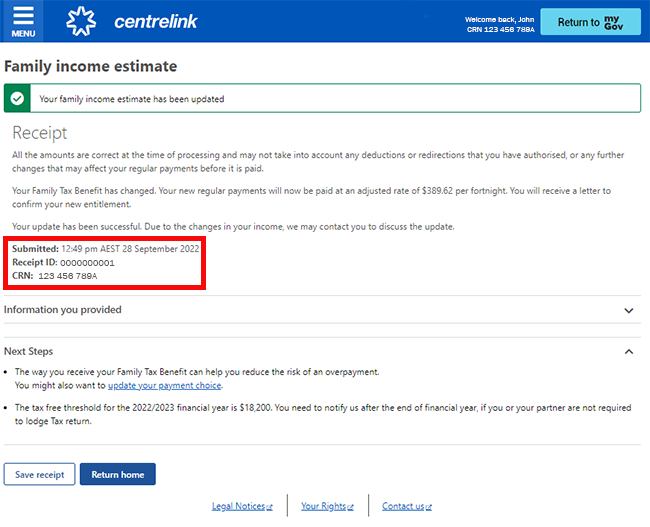

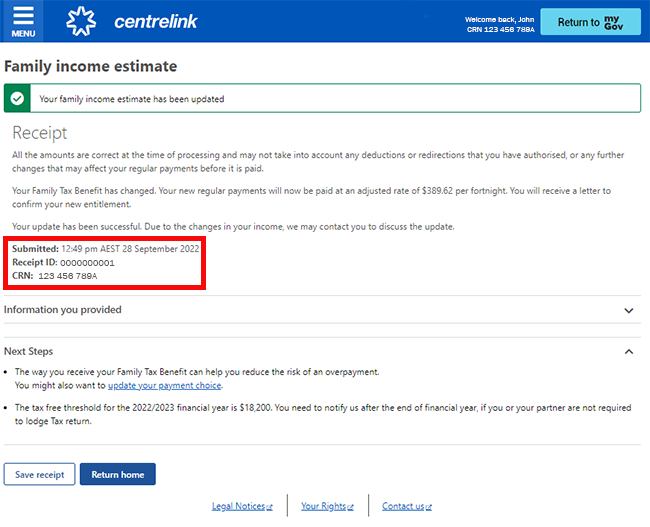

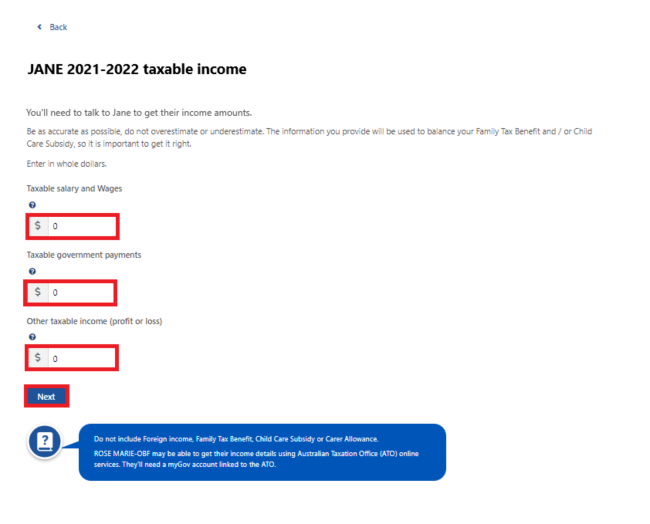

Centrelink Online Account Help Update Your Family Income Estimate And

Centrelink Online Account Help Update Your Family Income Estimate And

Calculating Social Security Taxable Income TaxableSocialSecurity

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Family Tax Benefit Part A Base Rate Tax Walls

What Is The Maximum Rate For Family Tax Benefit Part A - The first test reduces the maximum rate of Family Tax Benefit Part A by 20 cents for each dollar above 51 903 The second test reduces the base rate of Family Tax