What Is The Maximum Residential Energy Credit In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the However the maximum you can get was 500 which was a lifetime limit not an annual one Annual limits for individual types of qualifying alterations were also

What Is The Maximum Residential Energy Credit

What Is The Maximum Residential Energy Credit

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

What Is The Maximum Social Security Payment ClearMatch Medicare

https://images.prismic.io/clearmatchmedicare/a2fd46a5-5828-422a-ae0c-413aa7feac0b_What+Is+the+Maximum+Social+Security+Payment.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

The Energy Efficient Home Improvement Credit offers a credit of 10 of the cost of energy efficient uprades for a maximum of 500 for all years combined The Residential energy credit The residential energy credit is based on a percentage of the cost paid for eligible energy saving home improvements You must

This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The Residential Clean Also in 2022 the Residential Energy Efficient Property REEP credit was enhanced and renamed the Residential Clean Energy RCE credit The RCE credit

Download What Is The Maximum Residential Energy Credit

More picture related to What Is The Maximum Residential Energy Credit

What Is The Maximum Percentage Of My Assets My Partner Could Get YouTube

https://i.ytimg.com/vi/Pd0cZazuCkg/maxresdefault.jpg

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

What Is The Maximum Goodness That We Can Create Together

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/sites/53047/images/vVGoKBf8T1ONnUdr5M6X_file.jpg

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent The new credit increases from 10 to 30 of qualified energy efficient improvements and residential property expenses It also removes the 500 per person lifetime credit limit giving you the taxpayer a

The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit Here are the maximum amounts you can claim 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per

What Is The Ideal Age To Buy Life Insurance Best Insurance In

https://aggettainsurance.com/wp-content/uploads/2021/07/What-Is-the-Ideal-Age-to-Buy-Life-Insurance.jpg

Residential Energy Credits

https://s3.studylib.net/store/data/006798911_1-8dbaea070c2a9b8ca12d06e01b264101-768x994.png

https://rsmus.com/insights/tax-alerts/2023/IRS...

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of

https://www.irs.gov/credits-deductions/frequently...

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the

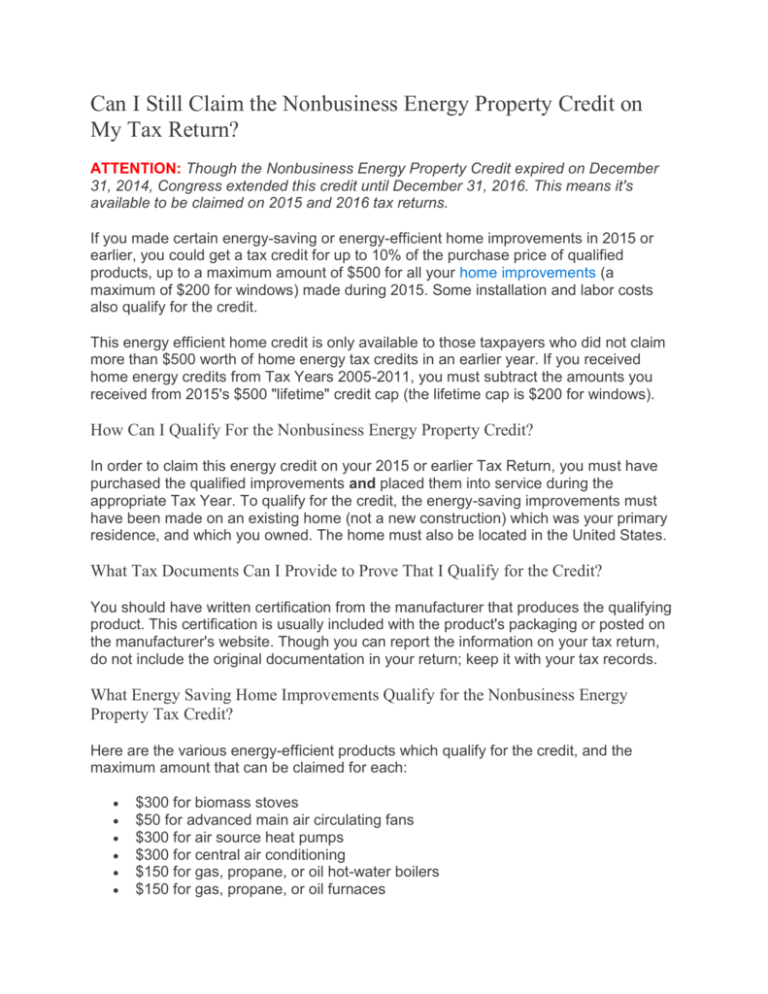

What Is The Credit Mix And How Does It Affect Your Credit Score

What Is The Ideal Age To Buy Life Insurance Best Insurance In

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Residential Energy Credit Application 2024 ElectricRate

What Is The Maximum Social Security Benefit In 2023

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

At 69 0 C What Is The Maximum Value Of The Reaction Quotient Q

What Is The Maximum Age For Personal Loan

What Is The Maximum Residential Energy Credit - This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The Residential Clean