What Is The Maximum Section 179 Deduction Section 179 deduction dollar limits For tax years be ginning in 2023 the maximum section 179 expense de duction is 1 160 000 This limit is reduced by the amount by which the

What is the maximum Section 179 deduction you can make in one year The maximum Section 179 deduction any one business can claim can change each year as the IRS makes adjustments for inflation As of the For 2024 the maximum Section 179 deduction is 1 220 000 1 160 000 for 2023 In contrast bonus depreciation is limited to 80 percent for 2023 60 percent for 2024

What Is The Maximum Section 179 Deduction

What Is The Maximum Section 179 Deduction

https://qtemfg.com/wp-content/uploads/2020/10/2022-Section-179-deduction-example.jpg

Section 179 Deduction 2022 TopMark Funding

https://www.topmarkfunding.com/wp-content/uploads/2022/08/Section_179_Deduction_2022.jpg

Section 179 Deduction Calculator

https://le-cdn.hibuwebsites.com/f39dc588e2bf4b3a85d532f73a0f29f0/dms3rep/multi/opt/Section+179-1920w.jpg

The maximum amount you can elect to deduct for most section 179 property you placed in service in tax years beginning in 2022 is 1 080 000 according to the Internal Revenue Service IRS For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year

There s an annual dollar limit on what you can deduct for example in 2020 it s up to 1 040 000 unless total equipment investments for the year exceed a set amount You Under section 179 b 1 the maximum deduction a taxpayer may take in a year is 1 040 000 for tax year 2020 Second if a taxpayer places more than 2 000 000 worth

Download What Is The Maximum Section 179 Deduction

More picture related to What Is The Maximum Section 179 Deduction

Facts About The Section 179 Tax Deduction STEADfastIT IT MSP

https://managedserviceprovider.com/wp-content/uploads/2018/11/Section-179-Deductions.png

Section 179 And Its Benefits American Capital Group Inc Financing

https://finance.acgcapital.com/wp-content/uploads/2020/09/47410952_m-2.jpg

How Can You Take Advantage Of Section 179 Deduction

https://www.intelice.com/wp-content/uploads/Section-179-Deduction.jpg

The maximum Section 179 deduction of 1 160 000 for 2023 1 220 000 for 2024 is reduced dollar for dollar by the amount of Section 179 property purchased during the A few limits apply to the Section 179 deduction 1 The deduction starts to slip away after spending 2 700 000 For 2023 you can expense up to 1 160 000 of eligible property

The maximum Section 179 expense deduction is 1 160 000 It s reduced dollar for dollar for qualified expenditures more than 2 million The Section 179 deduction is limited to Limits of Section 179 Section 179 does come with limits there are caps to the total amount written off 1 220 000 for 2024 and limits to the total amount of the equipment

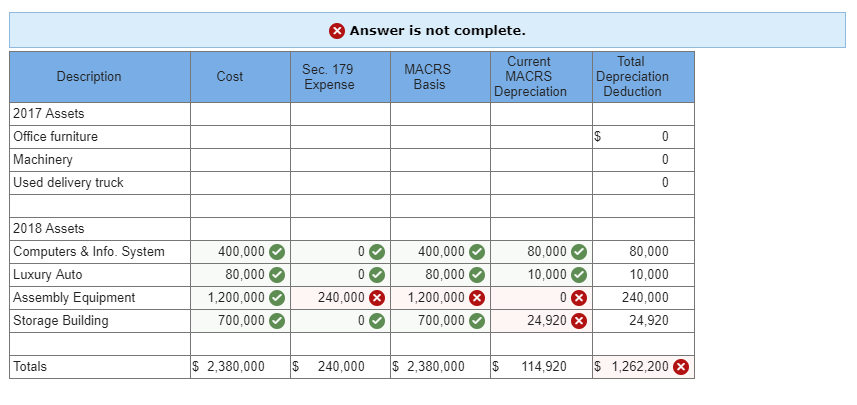

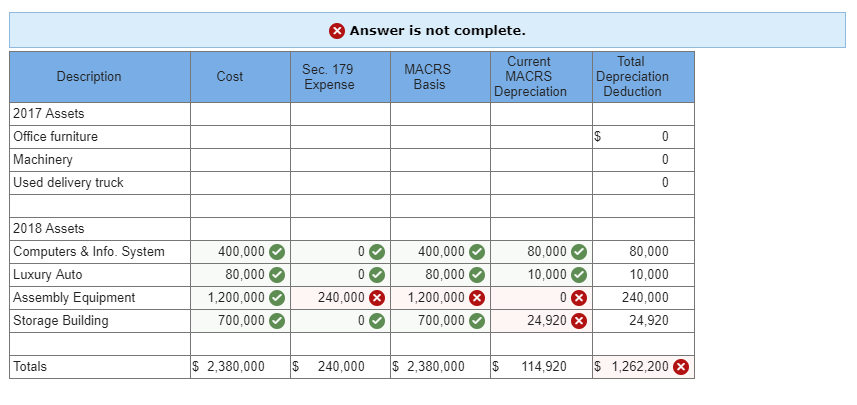

The Following Information Applies To The Chegg

https://media.cheggcdn.com/media/189/1896d7c6-ced2-4ed6-a8e4-1bf68e53ae65/phpgvhPjU.png

Section 179 Deduction 179 USA

https://kotaxusa.com/wp-content/uploads/2022/03/what-is-section-179.jpeg

https://www.irs.gov › pub › irs-pdf

Section 179 deduction dollar limits For tax years be ginning in 2023 the maximum section 179 expense de duction is 1 160 000 This limit is reduced by the amount by which the

https://www.thebalancemoney.com

What is the maximum Section 179 deduction you can make in one year The maximum Section 179 deduction any one business can claim can change each year as the IRS makes adjustments for inflation As of the

The Tax Break That Small Businesses Need To Know About Infographic

The Following Information Applies To The Chegg

Max Out On Section 179 Deduction

Solved Trish Himple Owns A Retail Family Clothing Store Her Chegg

Section 179 And What It Means For Your Small Business

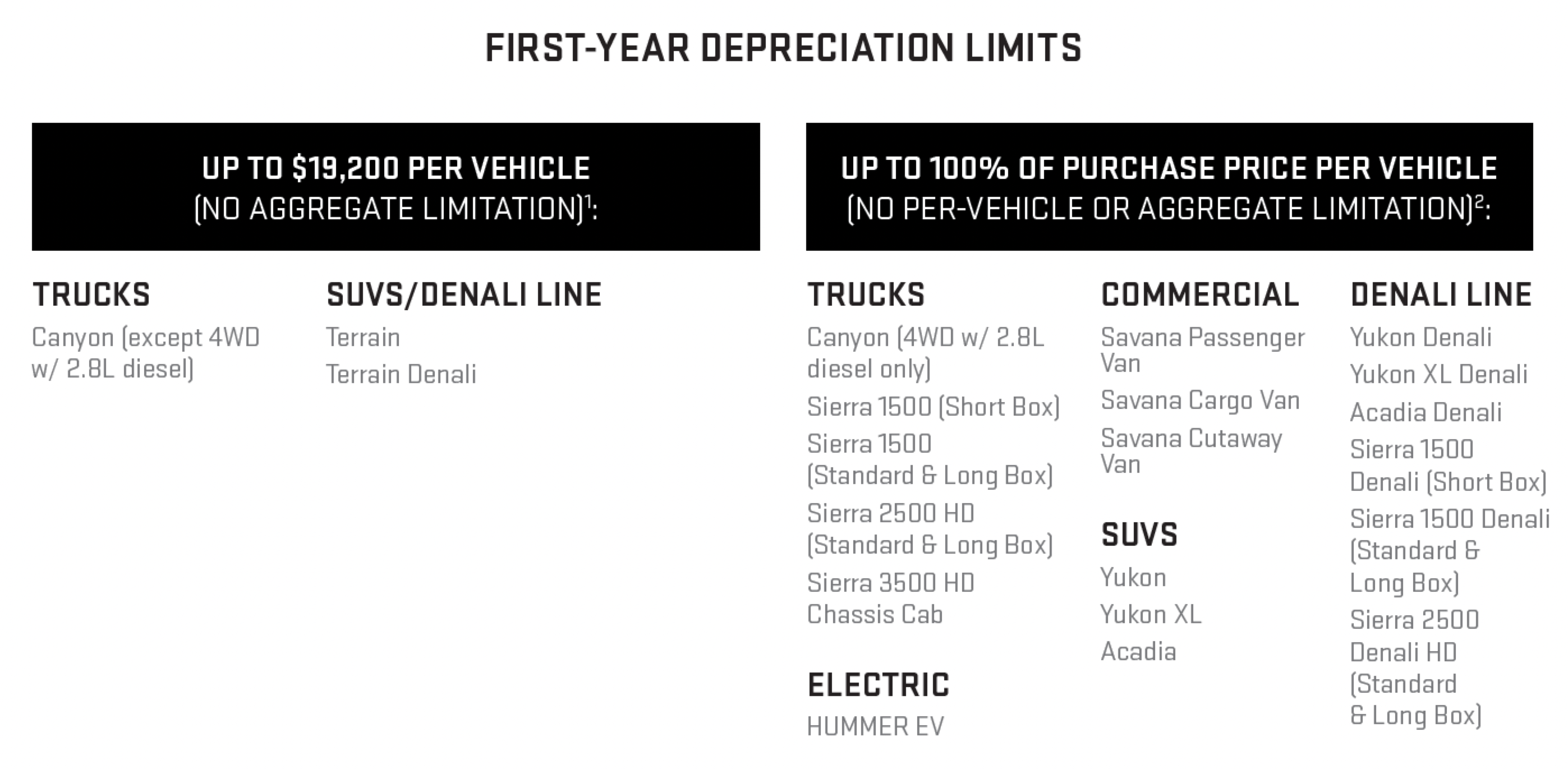

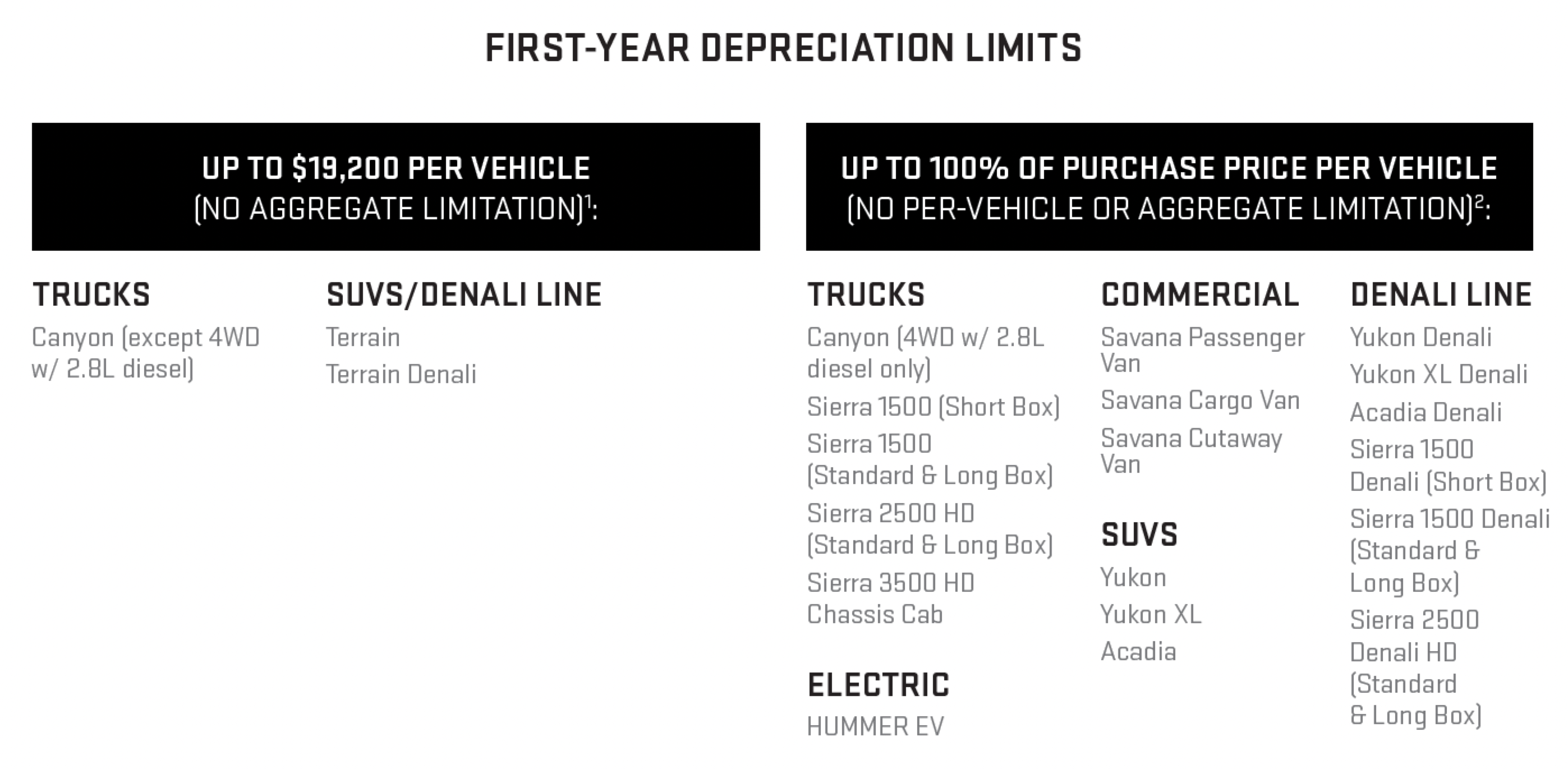

Understanding The Section 179 Deduction Coffman GMC

Understanding The Section 179 Deduction Coffman GMC

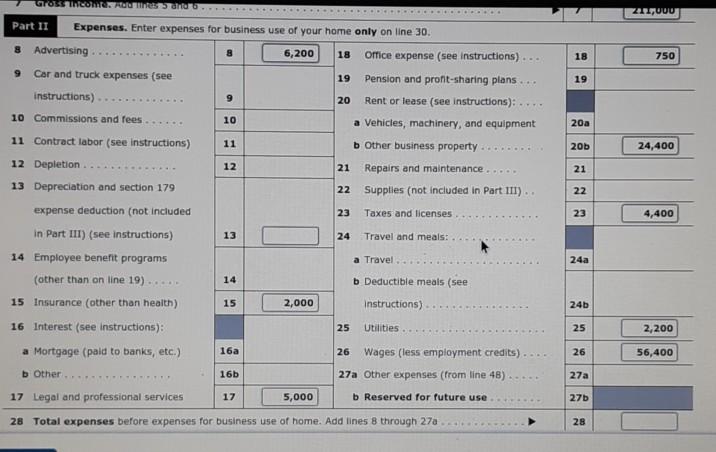

IRS Form 4562 Explained A Step by Step Guide

Section 179 Year End Tax Savings

Section 179 Deduction For Property Equipment Vehicles

What Is The Maximum Section 179 Deduction - There s an annual dollar limit on what you can deduct for example in 2020 it s up to 1 040 000 unless total equipment investments for the year exceed a set amount You