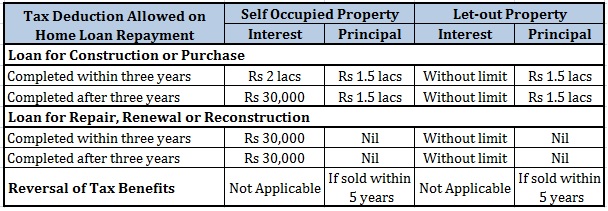

What Is The Maximum Tax Benefit On Home Loan How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2

The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before Home Loan Tax Benefits under Section 80C Section 80C pacts with the principal amount deductions Individuals can claim tax deductions up to a maximum of

What Is The Maximum Tax Benefit On Home Loan

What Is The Maximum Tax Benefit On Home Loan

https://i.ytimg.com/vi/5gn1a64n6jQ/maxresdefault.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

While tax deductions reduce your taxable income tax credits decrease your tax bill dollar for dollar making it valuable for qualified homeowners Here are some key What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2

If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use

Download What Is The Maximum Tax Benefit On Home Loan

More picture related to What Is The Maximum Tax Benefit On Home Loan

Home Loan Tax Benefits Interest On Home Loan Section 24 And

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

What Is The Maximum Social Security Payment ClearMatch Medicare

https://images.prismic.io/clearmatchmedicare/a2fd46a5-5828-422a-ae0c-413aa7feac0b_What+Is+the+Maximum+Social+Security+Payment.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction of For Self Occupied or Vacant Property A maximum amount of up to Rs 2 lakh can be claimed as housing loan interest deductions i e If the interest paid is less than Rs 2

The Section 80C of Income Tax Act allows home loan borrowers to claim income tax deduction of upto Rs 1 5 lakh on the principal amount repaid during the year There are Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

https://housing.com/news/home-loans-…

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2

https://www.nerdwallet.com/article/taxes/mortgage...

The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Income Tax Benefits On Home Loan Loanfasttrack

20151209 Tax Benefits On A Home Loan Personal Finance Plan

The Electric Car Tax Credit What You Need To Know OsVehicle

Income Tax Saving Calculator On Home Loan ONCOMIE

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Here s Everything You Need To Know About Tax Benefit On Home Loan

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

What Is The Maximum Tax Benefit On Home Loan - What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2