What Is The Maximum Tax Deduction For Medical Expenses For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

What Is The Maximum Tax Deduction For Medical Expenses

What Is The Maximum Tax Deduction For Medical Expenses

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

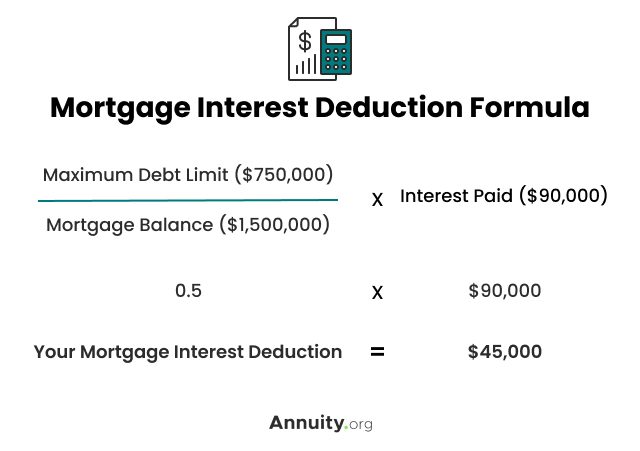

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 2 850

Table of Contents Are medical expenses tax deductible What medical expenses tax deductions can I claim What medical expenses are not deductible Can I deduct medical expenses for others on my taxes How much of my medical expenses can I deduct Do medical expense tax deductions only apply to costs incurred this year If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical expenses that exceed 7 5

Download What Is The Maximum Tax Deduction For Medical Expenses

More picture related to What Is The Maximum Tax Deduction For Medical Expenses

Enhanced Medical Expense Deductions

https://info.ongandcompany.com/hubfs/medical-tax-deduction.jpg#keepProtocol

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

What Is The Maximum Social Security Payment ClearMatch Medicare

https://images.prismic.io/clearmatchmedicare/a2fd46a5-5828-422a-ae0c-413aa7feac0b_What+Is+the+Maximum+Social+Security+Payment.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

Note You can deduct the portion of medical expenses that exceeds 7 5 of your adjusted gross income AGI for 2023 Related Information Can I deduct medical dental and vision expenses Where do I enter my medical expenses Can I deduct medical costs paid with HSA or MSA funds What self employed expenses can I deduct Was The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

You can deduct 6 250 of medical expenses as part of your itemized deductions The total itemized deductions need to exceed the standard deduction for the taxpayer s filing status For example a married filing jointly taxpayer needs to exceed 25 900 in itemized deductions for the medical expenses to be truly deductible Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total medical expenses

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

https://www.nerdwallet.com/article/taxes/medical-expense-tax-deduction

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

What Are The Top 10 Pre Tax Deduction List For Maximizing Savings In

Qualified Business Income Deduction And The Self Employed The CPA Journal

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

What Is The Standard Federal Tax Deduction Ericvisser

What Is The Standard Federal Tax Deduction Ericvisser

Can You Claim A Tax Deduction For Medical Expenses

Income Tax Deduction For Medical Treatment IndiaFilings

Income Tax Deductions For The FY 2019 20 ComparePolicy

What Is The Maximum Tax Deduction For Medical Expenses - Table of Contents Are medical expenses tax deductible What medical expenses tax deductions can I claim What medical expenses are not deductible Can I deduct medical expenses for others on my taxes How much of my medical expenses can I deduct Do medical expense tax deductions only apply to costs incurred this year