What Is The Maximum You Can Claim For Work Related Expenses An employee must submit any work related expense claims within a reasonable period of time after they happen The employee must pay back any

Help Frequently Asked Questions Education Work Related Expenses Education Work Related Expenses May I claim my job related education expenses If your total claim for work related expenses is more than 300 you must have written evidence to prove your claims Work related travel expenses include

What Is The Maximum You Can Claim For Work Related Expenses

What Is The Maximum You Can Claim For Work Related Expenses

https://images.prismic.io/clearmatchmedicare/a2fd46a5-5828-422a-ae0c-413aa7feac0b_What+Is+the+Maximum+Social+Security+Payment.png?auto=compress,format&rect=52,0,741,556&w=2000&h=1500

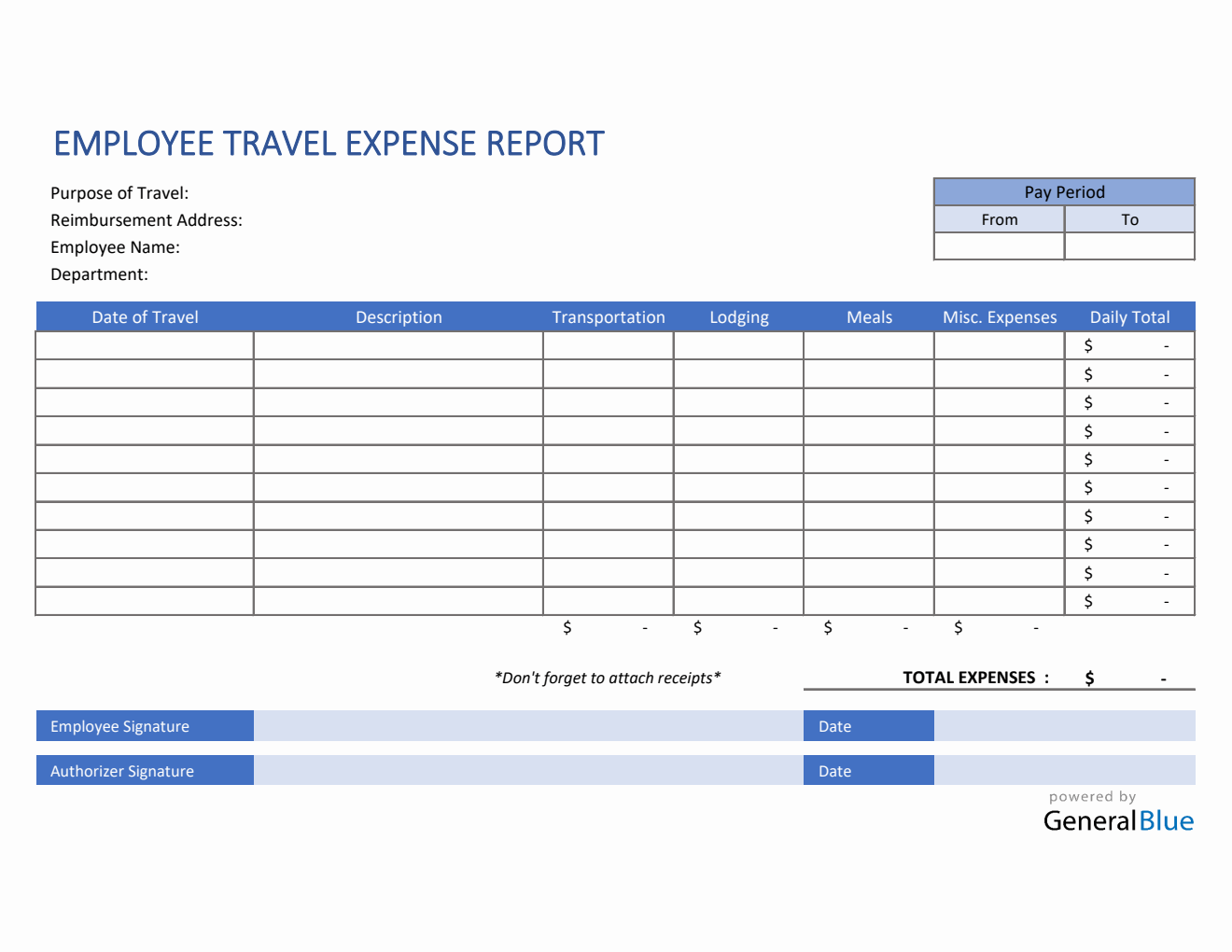

Excel Of Expense Claim Form Xlsx Wps Free Templates Hot Sex Picture

https://newdocer.cache.wpscdn.com/photo/20190822/468eb21a039146b7a06c76a652c95c70.jpg

Excel Travel Expense Template

https://www.generalblue.com/employee-travel-expense-report-template/p/tg8k76w7f/f/employee-travel-expense-report-template-in-excel-md.png?v=65abb8e5862c00d4d5828ef9e1e48237

Basic rules Record keeping for work related expenses Advance expenditure Allowances Decline in value of a depreciating asset Where to go next The maximum amount of work related expenses you can take into account for purposes of the credit is 8 000 if you have one qualifying person and

You may be able to deduct the cost of work related education expenses paid during the year if you re A self employed individual An Armed Forces reservist A If you had 10 000 in eligible home related expenses you could claim up to 2 500 in deductions The direct method has no maximum deduction limit making it

Download What Is The Maximum You Can Claim For Work Related Expenses

More picture related to What Is The Maximum You Can Claim For Work Related Expenses

Allowable Expenses For A Limited Company What To Claim

https://www.business4beginners.co.uk/wp-content/uploads/2020/12/Allowable-Expenses-For-A-Limited-Company-That-You-Can-Claim.jpg

How To Create A Simple Expenses Claim Form Template Free Sample

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Find Out If You Are Due A Tax Refund For Work Expenses

https://www.nibusinessinfo.co.uk/sites/default/files/styles/social/public/2023-05/BN_work-related-expenses.jpg?itok=si9s_5oL

If you claim 60 and pay tax at a rate of 20 in that year the amount you are entitled to is 12 20 of 60 If your claim is for the current tax year HM Revenue and Customs Car Work related Expenses If you use a personal car for trips between two jobs or sites on the same day and you have not kept a logbook you can claim deduction using cents

You can claim work related deductions if you paid for the work related item from your personal account you can claim the expense A tax agent can help Key takeaways The ATO s new ruling sheds light on what travel expenses employees can and cannot claim Travel between work locations neither of which are

Can I Claim Back VAT Small Business UK

https://smallbusiness-staging.s3.amazonaws.com/uploads/2016/06/1-1329-1568x1176.jpg

Does The Age Of Your Article Affect Its News Box Visibility

https://newsdashboard.com/wp-content/uploads/2023/02/yir-4-2.png

https://www.freshbooks.com/hub/expenses/work-related-expenses

An employee must submit any work related expense claims within a reasonable period of time after they happen The employee must pay back any

https://www.irs.gov/.../education-work-related-expenses

Help Frequently Asked Questions Education Work Related Expenses Education Work Related Expenses May I claim my job related education expenses

Don t Get Caught Out By Expenses The Perks You Can t Put On The Business

Can I Claim Back VAT Small Business UK

6 Working From Home Deductions You Can Claim BOX Advisory Services

Are My Social Security Benefits Taxable Calculator

Business Expenses What Can You Claim

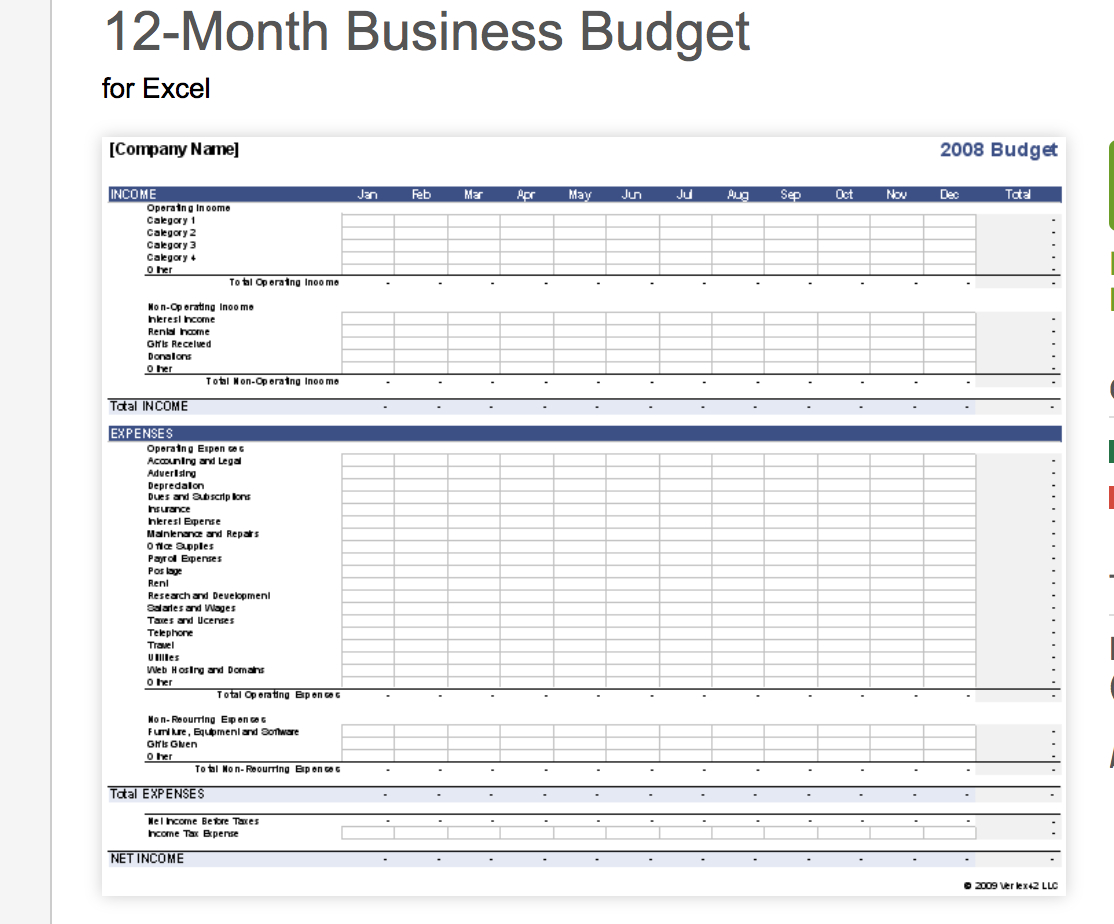

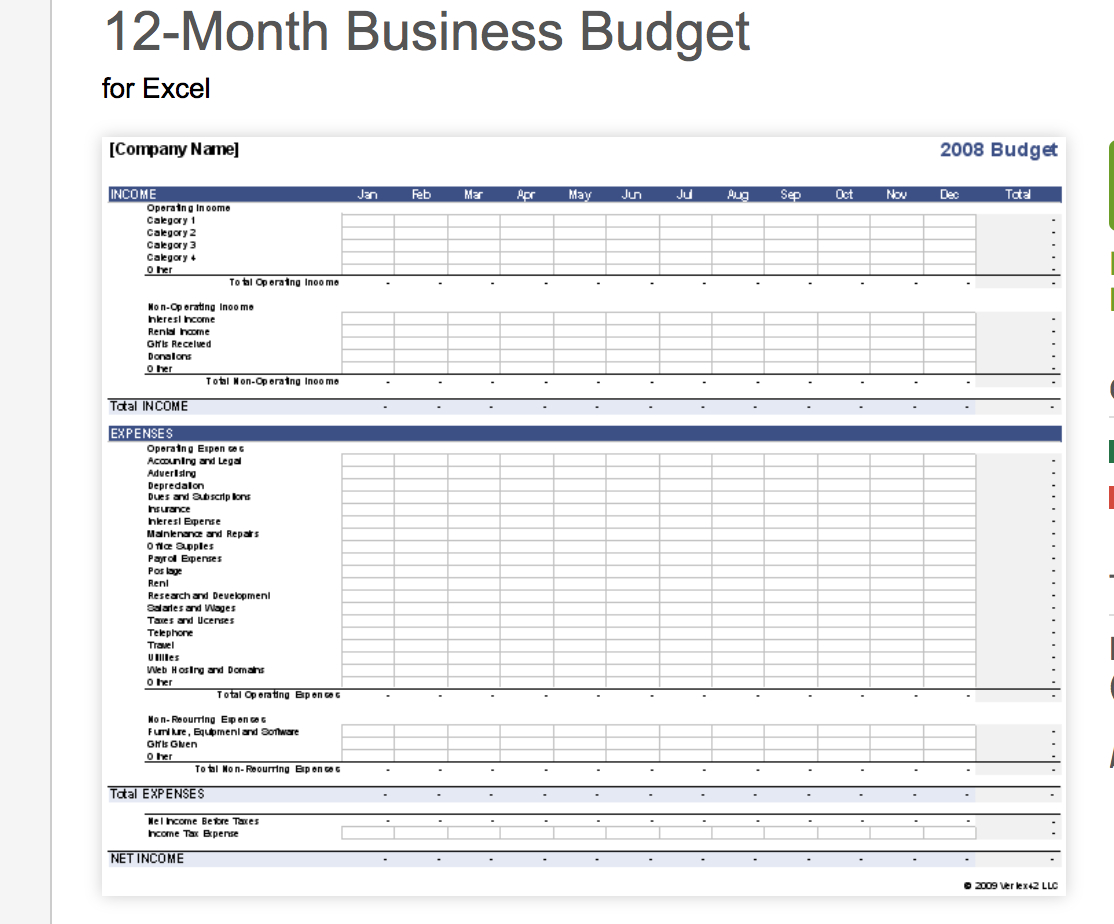

Work Expenses Spreadsheet Template Intended For 7 Free Small Business

Work Expenses Spreadsheet Template Intended For 7 Free Small Business

A Singaporean s Guide How To Claim Income Tax Deduction For Work

Umbrella Company Business Costs Expenses Explained

Image Result For Hair Salon Expenses Printable Business Tax

What Is The Maximum You Can Claim For Work Related Expenses - The tax relief will reduce the amount of tax you pay For example if you claim a flat rate expense of 60 and pay tax at a rate of 20 in that year you will pay 12 less