What Is The New Tax Credit For Seniors In Maryland There s also a Senior Tax Credit for residents aged 65 or older whose federal adjusted gross income does not exceed certain limits Social Security benefits

Senior Tax Credit New for tax year 2022 Residents who are at least 65 on the last day of the tax year may be eligible for a nonrefundable tax credit of up to 1 000 Filing Status The agreement includes tax relief for retirees 65 and older making up to 100 000 in retirement income and married couples making up to 150 000 in

What Is The New Tax Credit For Seniors In Maryland

What Is The New Tax Credit For Seniors In Maryland

https://i.ytimg.com/vi/8wEkBOSzMtc/maxresdefault.jpg

Earned Income Tax Credit Now Available To Seniors Without Dependents

https://assets-global.website-files.com/5daf3d101c624dc1e85b5fe3/6228af6ab920ee0cd578c4f1_Earnedincometaxcredit_88eba54ea7cede988522b3ba130d480e_2000.png

Spahealthy

https://d2hg8ctx8thzji.cloudfront.net/spahealthy.net/wp-content/uploads/2020/04/TaxCreditForSeniors-975x650.jpg

This law creates a nonrefundable tax credit that offsets Maryland state income tax for a resident who is 65 years of age or older and whose federal The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe Detailed EITC guidance for Tax Year 2022

Maryland Gov Lawrence J Hogan Jr R and legislative leaders have reached a deal on a plan that would provide 1 86 billion in tax relief over the next five The new tax break for people age 65 and older has an income cap granting a 1 000 break on tax bills for single people earning 100 000 or less and a 1 750 tax break on bills for

Download What Is The New Tax Credit For Seniors In Maryland

More picture related to What Is The New Tax Credit For Seniors In Maryland

Home Renovation Tax Credit For Seniors Understanding The Benefits And

https://www.whosdreamhome.com/wp-content/uploads/2023/07/1a529fe05724ac2f79c0848f36174377-1.png

Tax Credit For Seniors Who Volunteer YouTube

https://i.ytimg.com/vi/-xJ9iXR-klU/maxresdefault.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

A massive 1 86 billion tax relief package brokered by Maryland Gov Larry Hogan and Democratic lawmakers would send up to 1 750 to senior citizens and slash taxes on family essentials Retiree Income Tax Credit Among those bills is Senate Bill 405 which would provide a tax credit against the state s retiree income tax Retirees 65 years old and older that make up to 100 000

AARP Maryland however wants to change this perception starting with a tax break for seniors Starting in tax year 2022 residents who are at least 65 on the last The credit is not refundable so people who owe less than 1 000 in taxes would not see any cash back In total about 80 of Maryland seniors will see a tax

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

When Can You Claim The Federal Tax Credit For Electric Cars OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.zagconsultgroup.com/blog/maryland...

There s also a Senior Tax Credit for residents aged 65 or older whose federal adjusted gross income does not exceed certain limits Social Security benefits

https://www.marylandtaxes.gov/forms/Personal_Tax...

Senior Tax Credit New for tax year 2022 Residents who are at least 65 on the last day of the tax year may be eligible for a nonrefundable tax credit of up to 1 000 Filing Status

Hecht Group Senior Citizens In Maryland May Be Eligible For A

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

20 Property Tax Credit For Montgomery County Homeowners Ages 65 Who

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

Maryland Tax Credits For Retirees Gallant Financial Planning

Maryland Tax Credits For Retirees Gallant Financial Planning

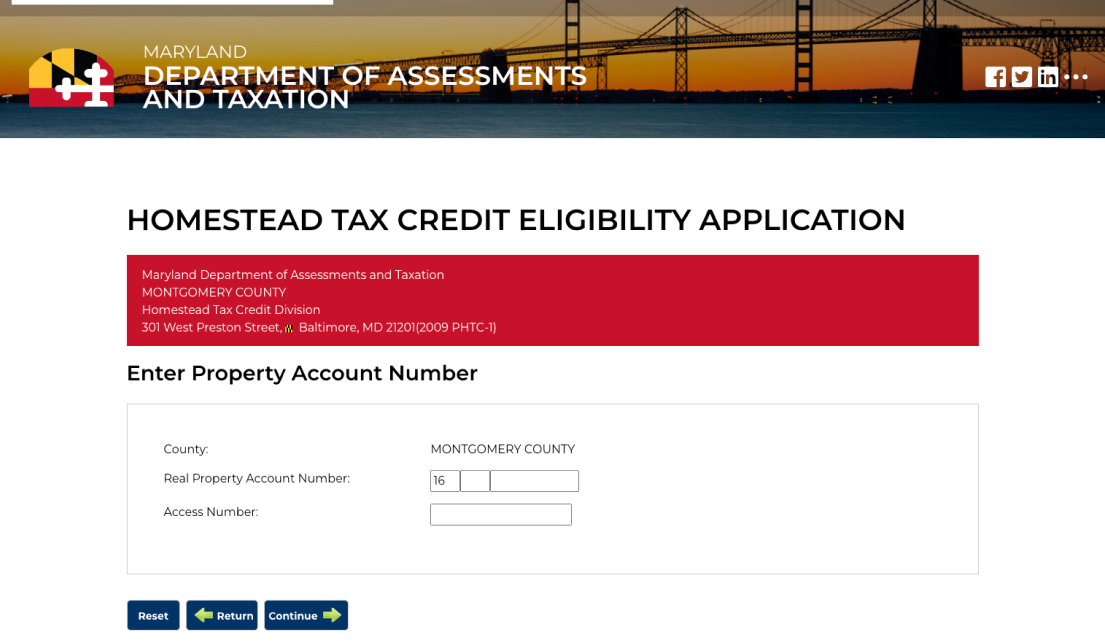

Homestead Tax Credit

Earned Income Tax Credit For Households With One Child 2023 Center

Ontario Newsroom

What Is The New Tax Credit For Seniors In Maryland - The following updates have been made to Maryland s tax code for tax year 2023 Subtractions Additions and Credits New Subtractions from Income One new