What Is The Over 65 Property Tax Exemption In Montgomery County Texas Residents age 65 and older who already have a homestead exemption will now be able to claim a 50 000 exemption after the Montgomery County Commissioners Court approved raising it from 35 000

Mcad tx Over 65 Exemption A Texas homeowner qualifies for this county appraisal district exemption if they are 65 years of age or older This exemption is not automatic The homeowner can not claim a disability exemption if they claim an over 65 exemption

What Is The Over 65 Property Tax Exemption In Montgomery County Texas

What Is The Over 65 Property Tax Exemption In Montgomery County Texas

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

HECHO How To Fill Out Texas Homestead Exemption 2022 YouTube

https://i.ytimg.com/vi/WnvkhRQRJfU/maxresdefault.jpg

Montgomery County Considering Tax Exemption Increase To 50 000

https://s.hdnux.com/photos/01/12/07/77/19431385/8/rawImage.jpg

Over 65 exemption For homeowners 65 and older If you are over 65 when you die your surviving spouse if they are 55 or older will get your over 65 exemption Disability exemption For homeowners not their children who have a disability that would qualify for Social Security Disability benefits If you are a senior with a disability you Do seniors over 65 pay property taxes in Texas Yes seniors over 65 must pay property taxes in Texas However seniors over 65 can apply for an additional exemption from property taxes and they receive additional benefits The property tax rate is capped for senior and or disabled homeowners and they can apply to defer their

For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes The biggest question though is how will schools be able to recoup the expected loss in revenue How Much is the Texas Over 65 Tax Exemption All homeowners in Texas can apply for a standard residence homestead exemption that can relieve 40 000 of taxable property value Seniors in Texas can get an additional 10 000 Disabled homeowners also qualify for a 10 000 exemption

Download What Is The Over 65 Property Tax Exemption In Montgomery County Texas

More picture related to What Is The Over 65 Property Tax Exemption In Montgomery County Texas

Texas Homestead Tax Exemption Cedar Park Texas Living

https://cedarparktxliving.com/wp-content/uploads/2020/12/Homestead-Tax-Exemption-810x810.jpg

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

https://www.signnow.com/preview/479/105/479105302/large.png

How Much Is The Homestead Exemption In Houston Square Deal Blog

https://res.cloudinary.com/agiliti/image/upload/v1665312015/harris-cad-homestead-exemption-status.webp

Age 65 or older and disabled exemptions Individuals age 65 or older or disabled residence homestead owners qualify for a 10 000 residence homestead exemption for school taxes in addition to the 40 000 exemption for all homeowners 936 539 7897 Property Tax Frequently Asked Questions How may I contact the Montgomery County Tax Office When are tax statements mailed and due What if the information i e Name Address etc is wrong on my statement How do I get this corrected What do I do if I received a tax statement and my mortgage company

The Montgomery Central Appraisal Distict identifies property to be taxed determines its appraised value whether to grant exemptions the taxable owner and address and which taxing jurisdictions may tax the property Did you know that Texas property tax code makes special provisions for adults aged 65 or older According to Tax Code Section 11 13 c to qualify for the over 65 property tax exemption a property owner must be 65 or older and reside in the home as their principal residence

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

How To Apply For Over 65 Property Tax Exemption In Houston YouTube

https://i.ytimg.com/vi/utnCFvoAr1w/maxresdefault.jpg

https://communityimpact.com/houston/tomball...

Residents age 65 and older who already have a homestead exemption will now be able to claim a 50 000 exemption after the Montgomery County Commissioners Court approved raising it from 35 000

Texas Homestead Exemption Form Fill Out Printable PDF Forms Online

Jefferson County Property Tax Exemption Form ExemptForm

Hecht Group Vigo County Property Taxes Can Now Be Paid Online

Montgomery County Approves Property Tax Exemption Increase For

Hecht Group Vigo County Property Taxes Can Now Be Paid Online

How To File For Homestead Exemption In TX FOR FREE Harris County

How To File For Homestead Exemption In TX FOR FREE Harris County

Texas Property Tax Exemptions For Seniors Lower Your Taxes

:max_bytes(150000):strip_icc()/homestead-exemption-Final-be3088c622ec4605af6ec6729321c546.jpg)

Actualizar 83 Imagen Senior Citizen Property Tax Exemption Texas

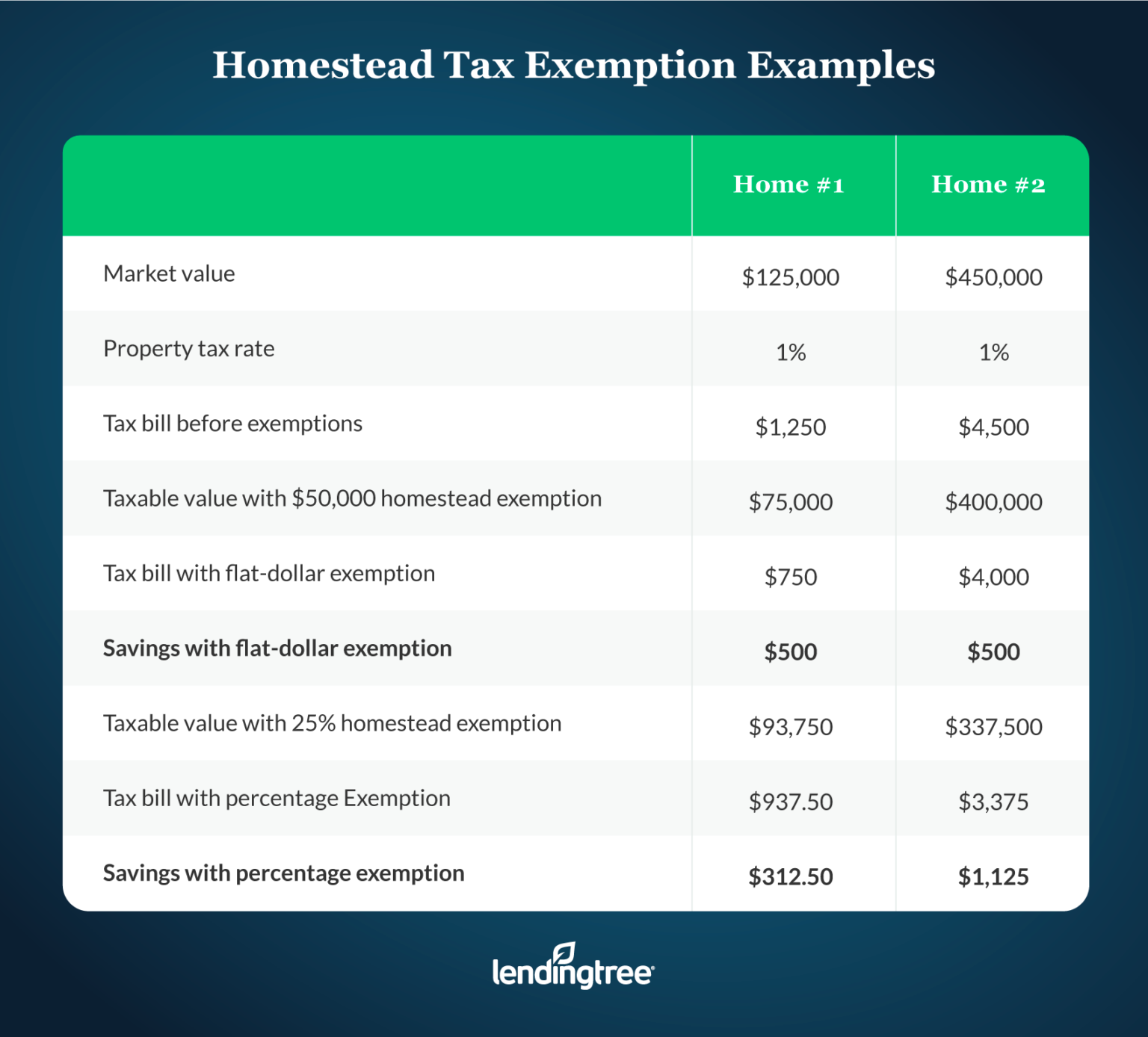

What Is A Homestead Exemption And How Does It Work LendingTree

What Is The Over 65 Property Tax Exemption In Montgomery County Texas - Over 65 exemption For homeowners 65 and older If you are over 65 when you die your surviving spouse if they are 55 or older will get your over 65 exemption Disability exemption For homeowners not their children who have a disability that would qualify for Social Security Disability benefits If you are a senior with a disability you