What Is The Percentage Of Hst Tax In Ontario Currently the Harmonized Sales Tax is 13 in Ontario However Ontario provides a rebate on the 8 provincial portion of the HST on specific items through a

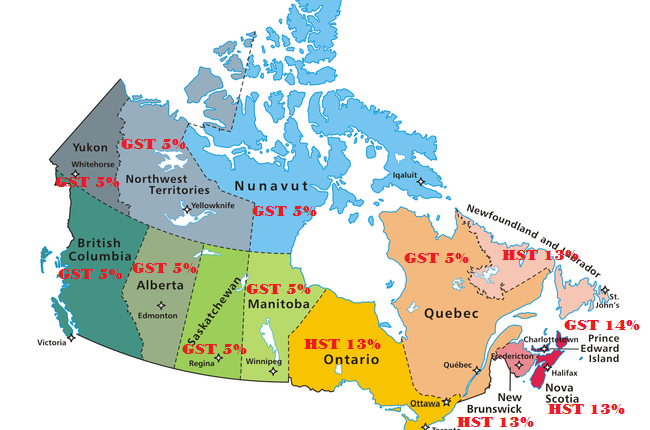

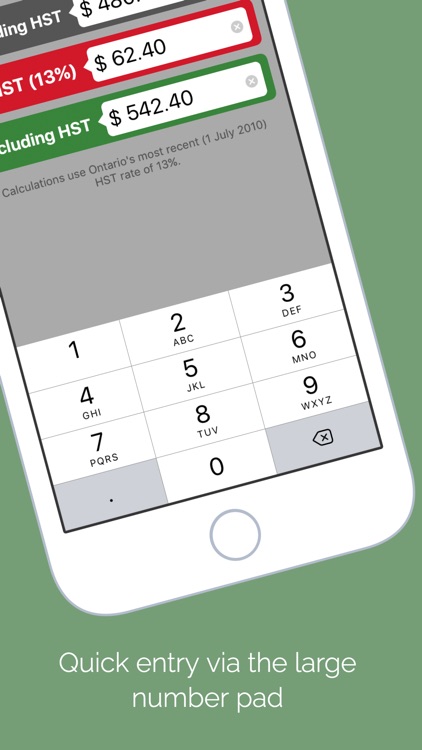

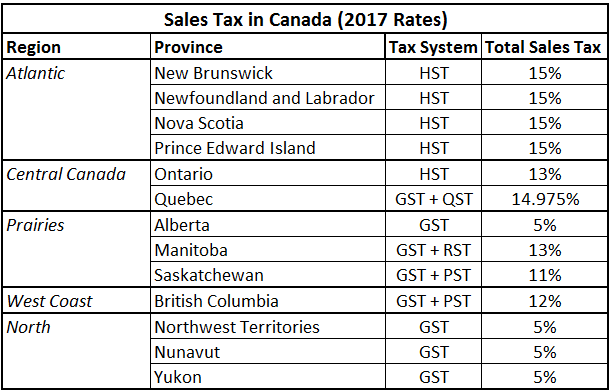

Calculate HST amount 13 in Ontario by putting either the after tax or before tax amount Check the GST and PST portion of HST Sales Tax Rates by Province There are three types of sales taxes in Canada PST GST and HST See below for an overview of sales tax amounts for each province and

What Is The Percentage Of Hst Tax In Ontario

What Is The Percentage Of Hst Tax In Ontario

http://www.mdtax.ca/wp-content/uploads/2016/02/Picture4-1.png

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law Firm

https://kalfalaw.com/wp-content/uploads/2021/09/Marginal-Tax-Rates-2020_Ontario.png

Taxes Payable By Individuals At Various Income Levels Ontario 2018

http://www.mdtax.ca/wp-content/uploads/2019/01/Personal-Tax-Payable-2018.png

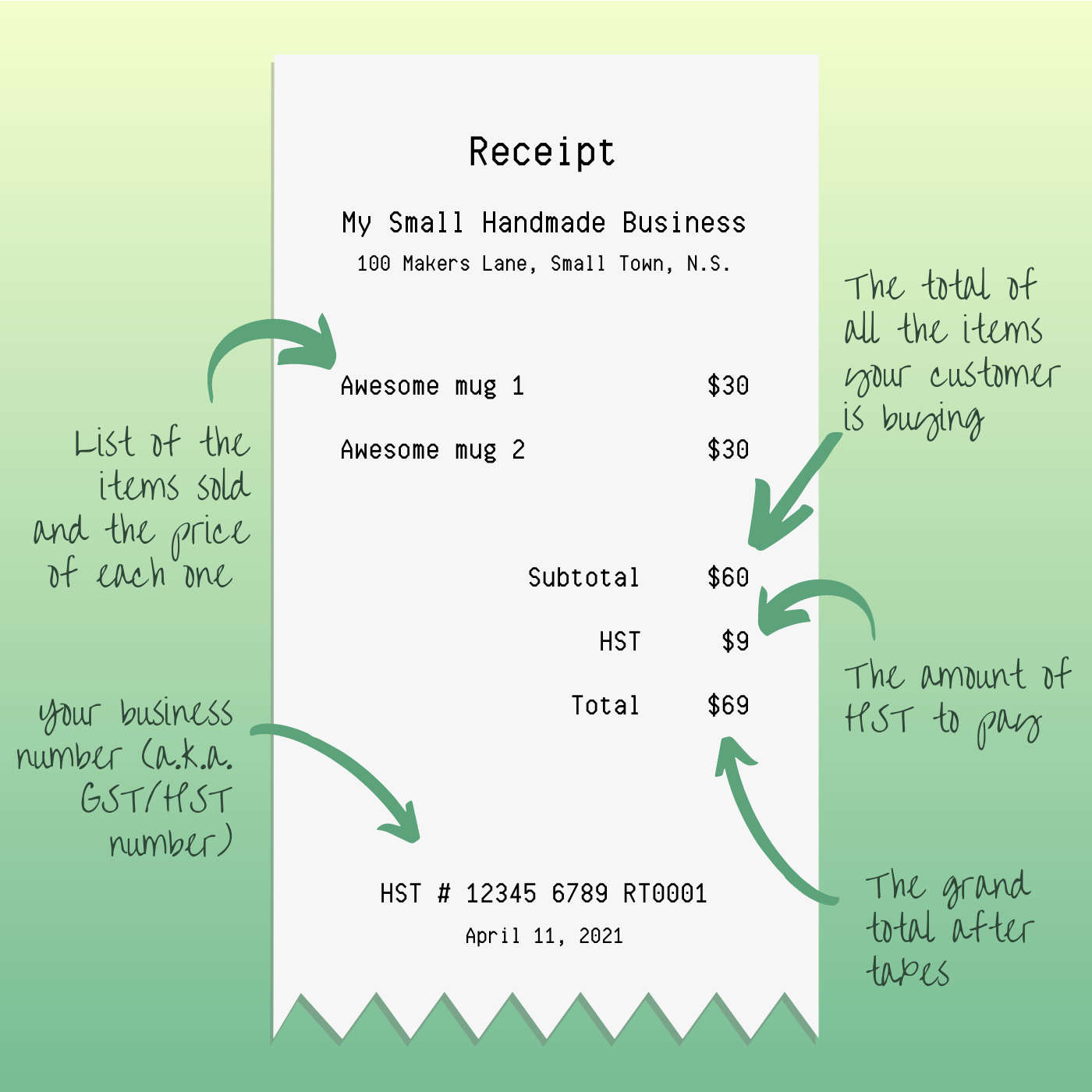

The HST rate is 15 in all participating provinces except Ontario where it is 13 The concept behind the HST was to streamline the recording and collection of federal and provincial sales How Much is HST in Ontario Currently the HST rate in Ontario is 13 Let s do some quick math If you sell a product for 100 you ll add 13 for HST So

Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly Current HST rates are listed What is HST Taxable in Ontario Consumers now have to pay 13 HST on all goods and services on which they previously paid 5 GST except for several items

Download What Is The Percentage Of Hst Tax In Ontario

More picture related to What Is The Percentage Of Hst Tax In Ontario

GST HST Rates Across Canada

http://sdvcllp.com/wp-content/uploads/2018/03/Canadian-Provincial-Tax-Map-2015-650x430.png

Personal Income Tax Brackets Ontario 2022 MD Tax

http://mdtax.ca/wp-content/uploads/2023/02/2022.png

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA ConnectCPA

https://static1.squarespace.com/static/57ea767f1b631b6858a999e2/t/58175ce39f7456c337869da5/1479165494387/GST+and+HST

The cumulative sales tax rate for 2024 in Ontario Canada is 13 This total rate simply consists of a Harmonized Sales Tax HST of 13 Sales Tax Breakdown For Ontario Calculate HST GST for all provinces in Canada Federal and provincial sales taxes for Ontario Quebec BC Alberta Manitoba Saskatchewan Nova Scotia

The following table shows the general rates of provincial sales taxes or HST for most purchases and provides links to the provincial or federal web sites regarding provincial Ontario s HST rate is 13 similar to New Brunswick and Newfoundland and Labrador Ontario committed to provide a refundable tax credit of up to 260 per adult or child in

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

http://dandelionwebdesign.com/wp-content/uploads/2012/05/canadian_provincial_taxes_full.jpg

Ontario Sales Tax Calculator HST GST PST By Chewy Applications

https://is4-ssl.mzstatic.com/image/thumb/Purple127/v4/b5/68/c7/b568c774-bb50-b11c-4af4-bd635399a9f8/pr_source.png/750x750bb.jpeg

https://www.ontario.ca/document/harmonized-sales-tax-hst

Currently the Harmonized Sales Tax is 13 in Ontario However Ontario provides a rebate on the 8 provincial portion of the HST on specific items through a

https://wowa.ca/calculators/ontario-hst-calculator

Calculate HST amount 13 in Ontario by putting either the after tax or before tax amount Check the GST and PST portion of HST

Pay 2999 In Toronto And 8878 In Windsor For A 500K House 2020

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

What s Taxable Under The Hst And What s Not ontario

How Much GST HST Do I Pay And Charge Per Province

Harmonized Sales Tax HST

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

The Basics Of Tax In Canada WorkingHolidayinCanada

A Beginner s Guide To Charging Sales Tax In Canada Everything Makers

Hecht Group The Harmonized Sales Tax HST In Canada

What Is The Percentage Of Hst Tax In Ontario - Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly Current HST rates are listed