What Is The Personal Tax Rate In The Netherlands Like most countries the Netherlands has a progressive tax structure when it comes to personal income tax That means the more you earn during the fiscal year 1

The Personal Income Tax Rate in Netherlands stands at 49 50 percent Personal Income Tax Rate in Netherlands averaged 53 30 percent from 1995 until 2023 reaching an all time high of 60 00 percent in 1996 and 31 rowsIncome tax in the Netherlands personal rather than corporate is regulated by

What Is The Personal Tax Rate In The Netherlands

What Is The Personal Tax Rate In The Netherlands

https://crixeo.com/wp-content/uploads/2023/03/rates.jpg

United Kingdom Withholding Tax Rate

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=gbrwtr&v=202304280946V20230410

The New G7 Minimum Corporate Tax Agreement Is A Game Changer

https://digitalpress.fra1.cdn.digitaloceanspaces.com/peqkany/2021/06/us-top-effective-corporate-tax-rates-graph.png

If you live in the Netherlands you are subjected to pay tax on your income Some of your expenditures may be tax deductible deductible items For tax purposes income is Tax brackets in the Netherlands vary depending on the type of income box 1 2 or 3 For box 1 tax on income from employment including home ownership there is a 37 07

What is the income tax rate in the Netherlands for 2023 The income tax in the Netherlands for 2023 is 36 93 between 0 73 071 and 49 50 between The Income tax rates and personal allowances in Netherlands are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Netherlands Tax Calculator 2021 The Dutch 30 Ruling for Expatriates

Download What Is The Personal Tax Rate In The Netherlands

More picture related to What Is The Personal Tax Rate In The Netherlands

Conroe ISD Trustees Adopt 2022 23 Budget Tax Rate Conroe ISD

https://www.conroeisd.net/wp-content/uploads/2022/09/Tax-Rate-History-22-23.png

Corporate Tax Rates In The Parents Countries Download Table

https://www.researchgate.net/profile/Wiji-Arulampalam/publication/268398519/figure/tbl3/AS:650040779472985@1531993207655/Corporate-tax-rates-in-the-parents-countries.png

https://minfin.com.ua/files/image/Top-Personal-Income-Tax-Rates-in-Europe-2023-Income-Tax-Rates-or-Individual-Income-Tax-Rates.png

In the Taxes on personal income section we explained that in the Netherlands personal income is divided into three types of taxable income which are taxed separately under You pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments The Tax and Customs Administration collects

Netherlands income tax is levied on three categories boxes of income Each box has its own rules to calculate taxable income its own tax rates and exemptions In general The Dutch tax ruling practice has a 30 year track record and has given many international groups clarity on their tax position when setting up successfully in the

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

https://i2.wp.com/www.westernstatesfinancial.com/uploads/1/8/7/0/18703714/2020-ca-tax-brackets-pic_orig.png

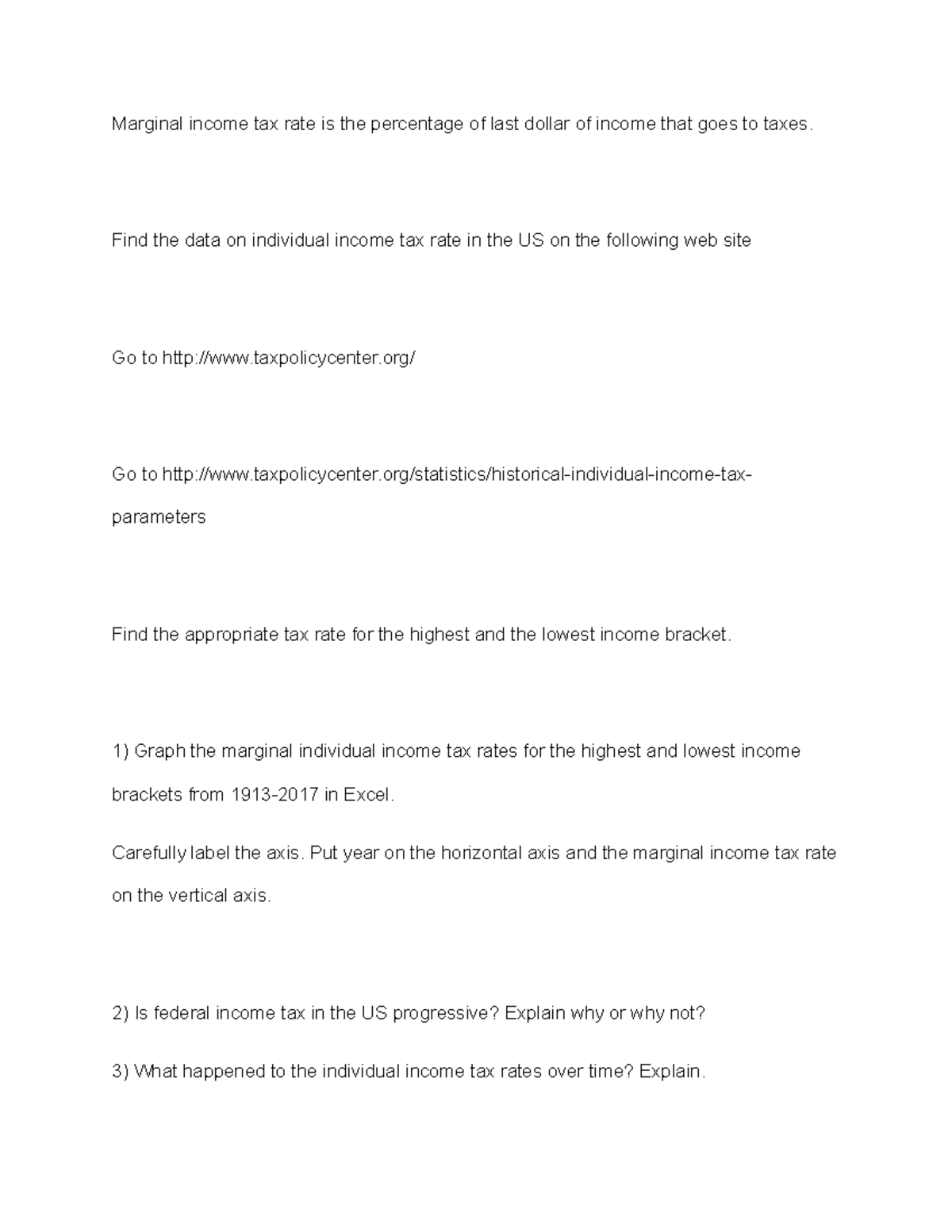

Journal 3 Marginal Income Tax Rate Is The Percentage Of Last Dollar

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6d21f75423e1a054981f7b8cf5760f97/thumb_1200_1553.png

https://www.expatica.com/nl/finance/taxes/...

Like most countries the Netherlands has a progressive tax structure when it comes to personal income tax That means the more you earn during the fiscal year 1

https://tradingeconomics.com/netherlan…

The Personal Income Tax Rate in Netherlands stands at 49 50 percent Personal Income Tax Rate in Netherlands averaged 53 30 percent from 1995 until 2023 reaching an all time high of 60 00 percent in 1996 and

State Sales And Corporate Income Tax Rates And Their Relative

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

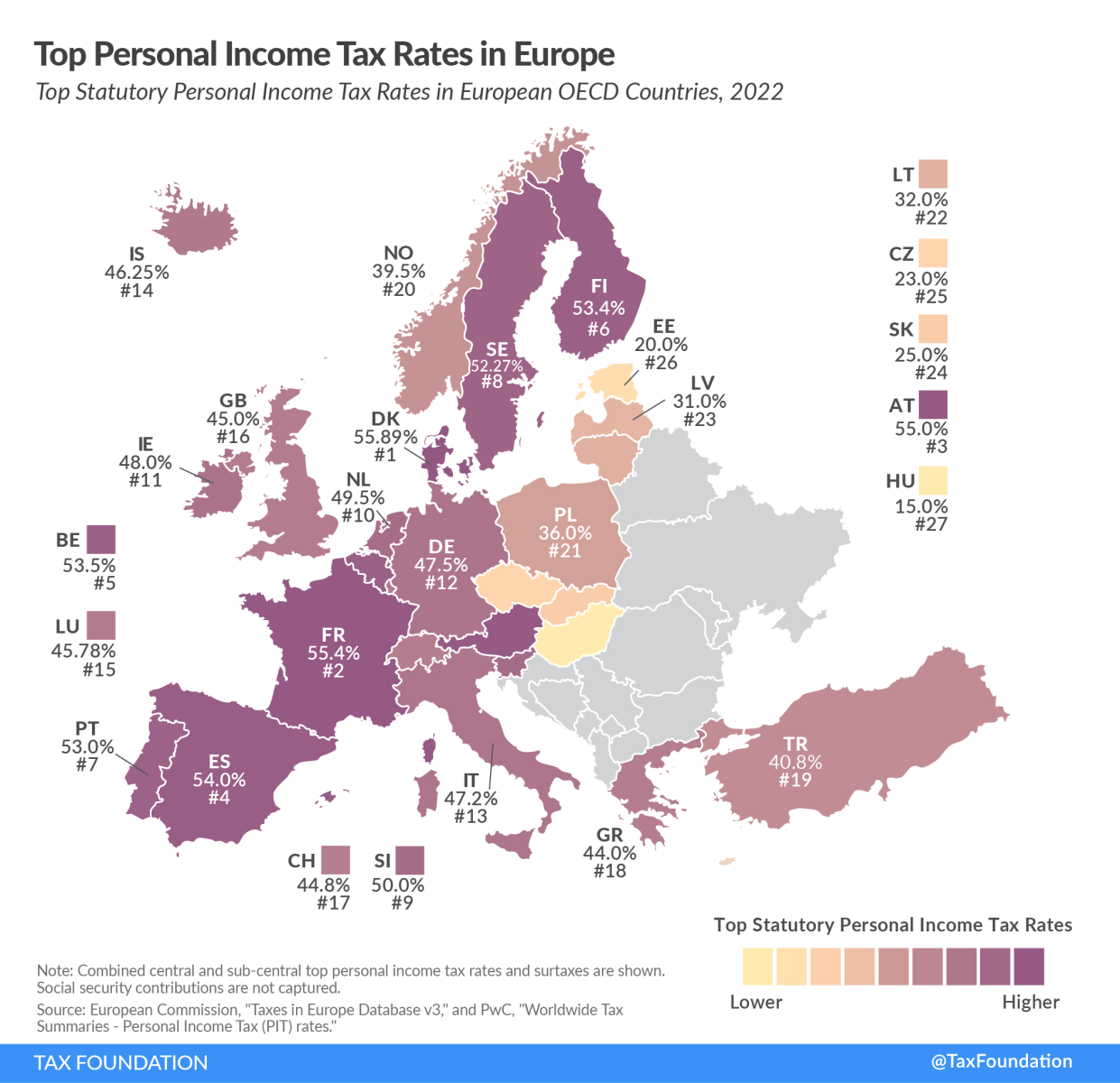

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Mandated Regional Business Income Tax Rates Download Table

UK VAT Rate Accounting Finance Blog

U S Taxes Lower Than Other Developed Countries WealthMD

U S Taxes Lower Than Other Developed Countries WealthMD

Income Tax Guide 2022 Malaysia

How Can I Define Different Tax Policies And Tax Definitions Billwerk

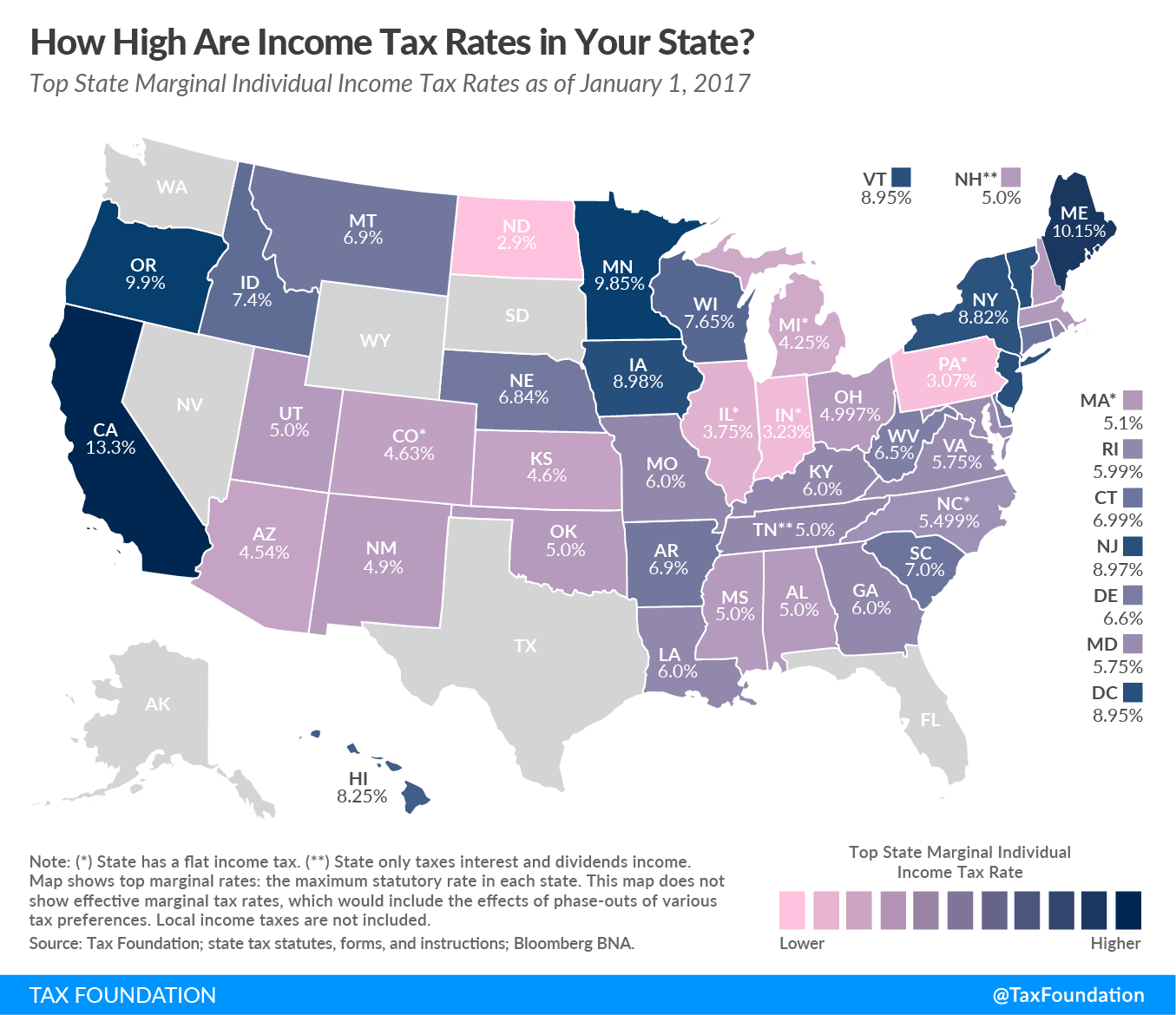

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

What Is The Personal Tax Rate In The Netherlands - The Income tax rates and personal allowances in Netherlands are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Netherlands Tax Calculator 2021 The Dutch 30 Ruling for Expatriates