What Is The Property Tax Exemption For Over 65 In California Proposition 19 approved by California voters in November 2020 brings significant changes to property tax relief for seniors Under this proposition seniors severely disabled persons and victims of wildfires or natural disasters can now move to a replacement home anywhere in California and avoid significant property tax increases if

California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled These exemptions Seniors aged 55 or older in California can take advantage of Proposition 60 90 a reappraisal exclusion program that offers property tax benefits This program is designed for seniors who are selling their current home and purchasing another home of

What Is The Property Tax Exemption For Over 65 In California

What Is The Property Tax Exemption For Over 65 In California

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

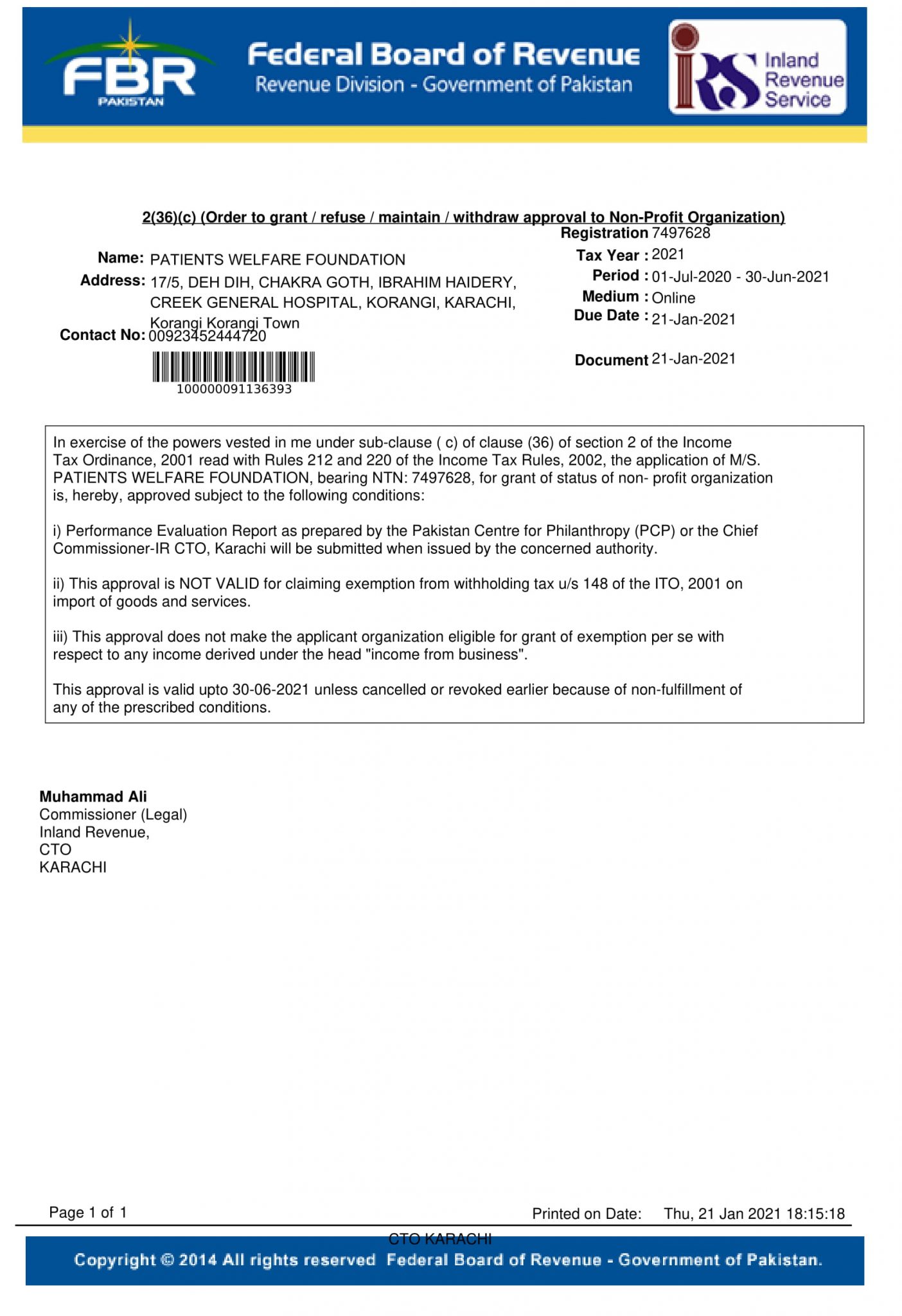

Tax Exemption Certificate SACHET Pakistan

http://sachet.org.pk/wp-content/uploads/2016/01/Exemption-236.jpg

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021-1404x2048.jpg

PROPERTY TAX SAVINGS TRANSFER OF PROPERTY TAX BASE TO REPLACEMENT PROPERTY AGE 55 AND OLDER The State Board of Equalization Taxpayers Rights Advocate Office is committed to helping California taxpayers understand property tax laws and be aware of exclusions and exemptions available to them A property tax exemption for seniors is a great benefit for homeowners 65 years of age or older Here s how to qualify for one in your state

Property Tax Aide features three California property tax relief programs Property Tax Postponement available for older residents and Homeowner s Property Tax Exemption available to all homeowners and the Base Year Value Transfer for Homeowners at least Age 55 or Disabled Proposition 19 To qualify for a Prop 19 tax base transfer a few criteria must be met First either the claimant or claimant s spouse must be age 55 or older when the original residence is sold Second the replacement residence must be purchased within two years either before or after the current residence is sold Third one of the transactions must

Download What Is The Property Tax Exemption For Over 65 In California

More picture related to What Is The Property Tax Exemption For Over 65 In California

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/IRS-Tax-exempt-Letter.png

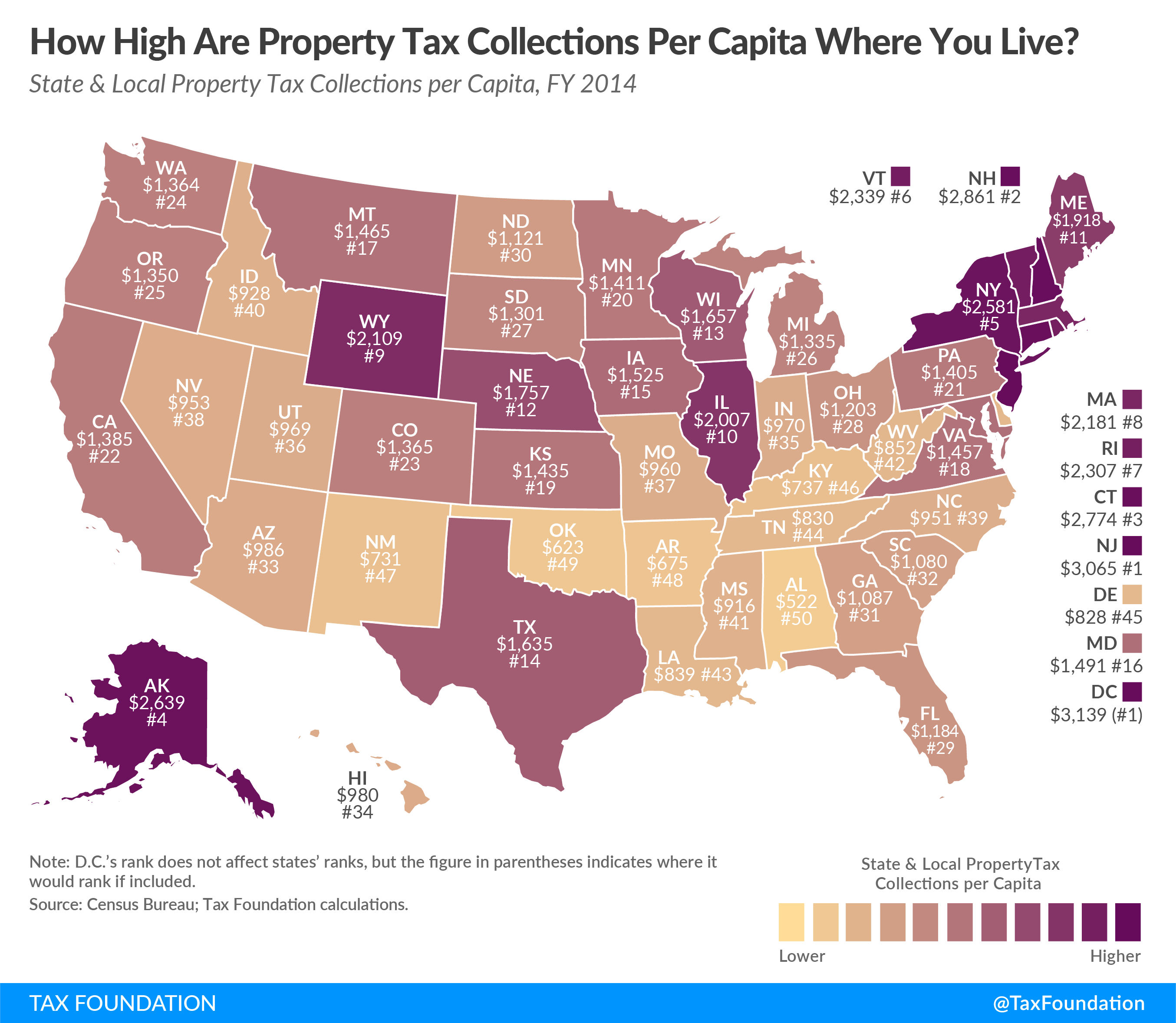

How High Are Property Tax Collections Where You Live Tax Foundation

https://files.taxfoundation.org/20170920170754/PropTaxesPerCap-01.png

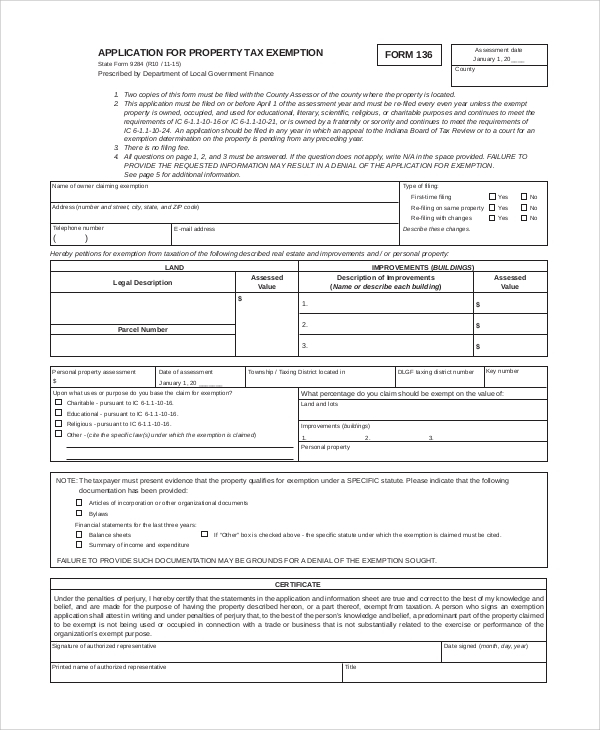

Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/11/44/11044386/large.png

The State Controller s Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 51 762 or less among other requirements Key Takeaway for 55 and older adults who want to move and keep their low property tax Prop 19 allows seniors 55 and older to move anywhere in California up to three times and keep their property tax basis

[desc-10] [desc-11]

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg?format=2500w

What Is A Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-29.jpg

https://seniorsite.org/resource/california-property-tax-relief-for...

Proposition 19 approved by California voters in November 2020 brings significant changes to property tax relief for seniors Under this proposition seniors severely disabled persons and victims of wildfires or natural disasters can now move to a replacement home anywhere in California and avoid significant property tax increases if

https://www.sfgate.com/business/networth/article/...

California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled These exemptions

Religious Exemption Samples

Illinois Tax Exempt Certificate Five Mile House

Taxact Online Fillable Tax Forms Printable Forms Free Online

Texas Sales Tax Exemption Certificate From The Texas Human Rights

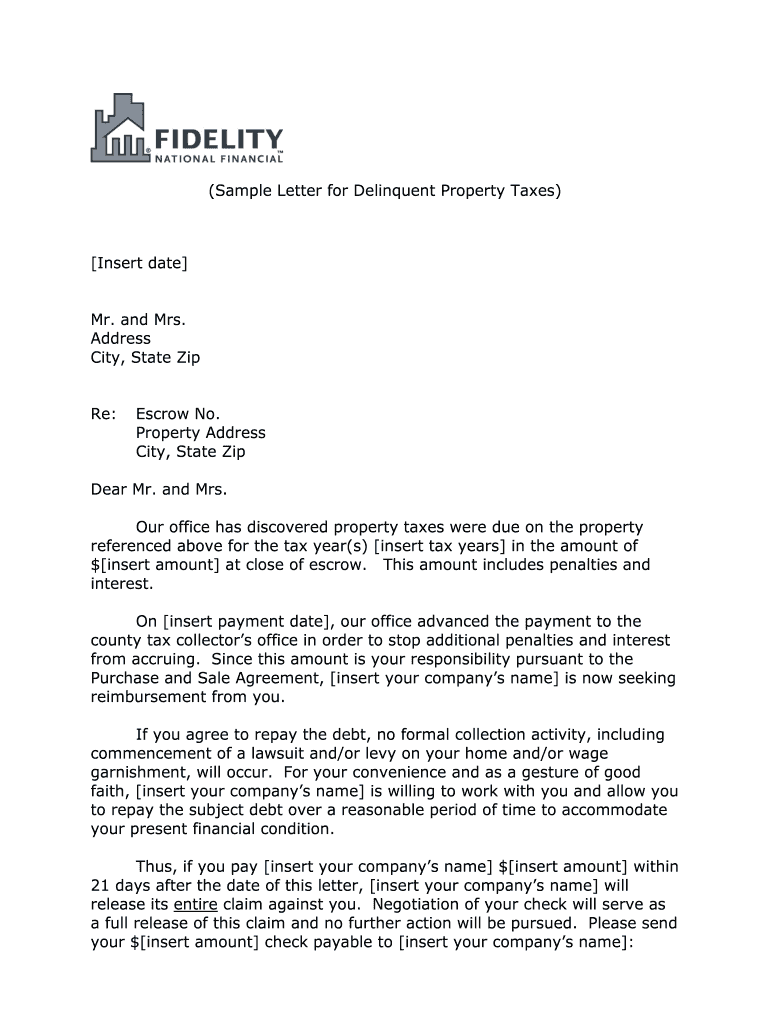

Delinquent Property Tax Letter Samples Fill Online Printable

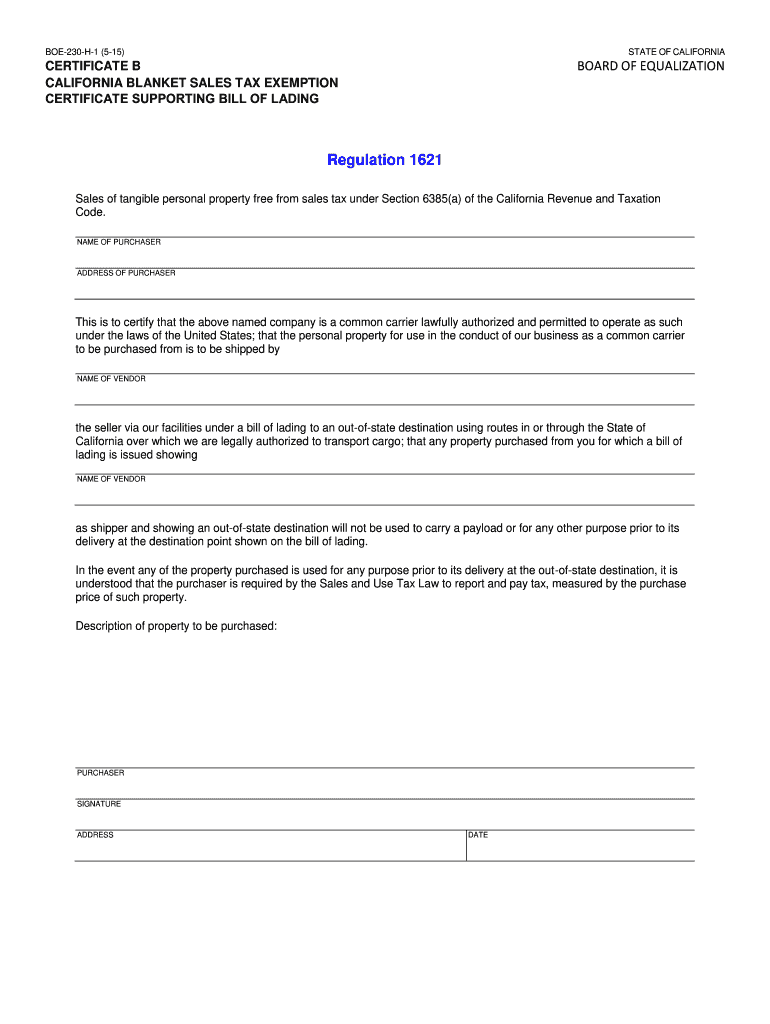

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

California Tax exempt Form 2023 ExemptForm

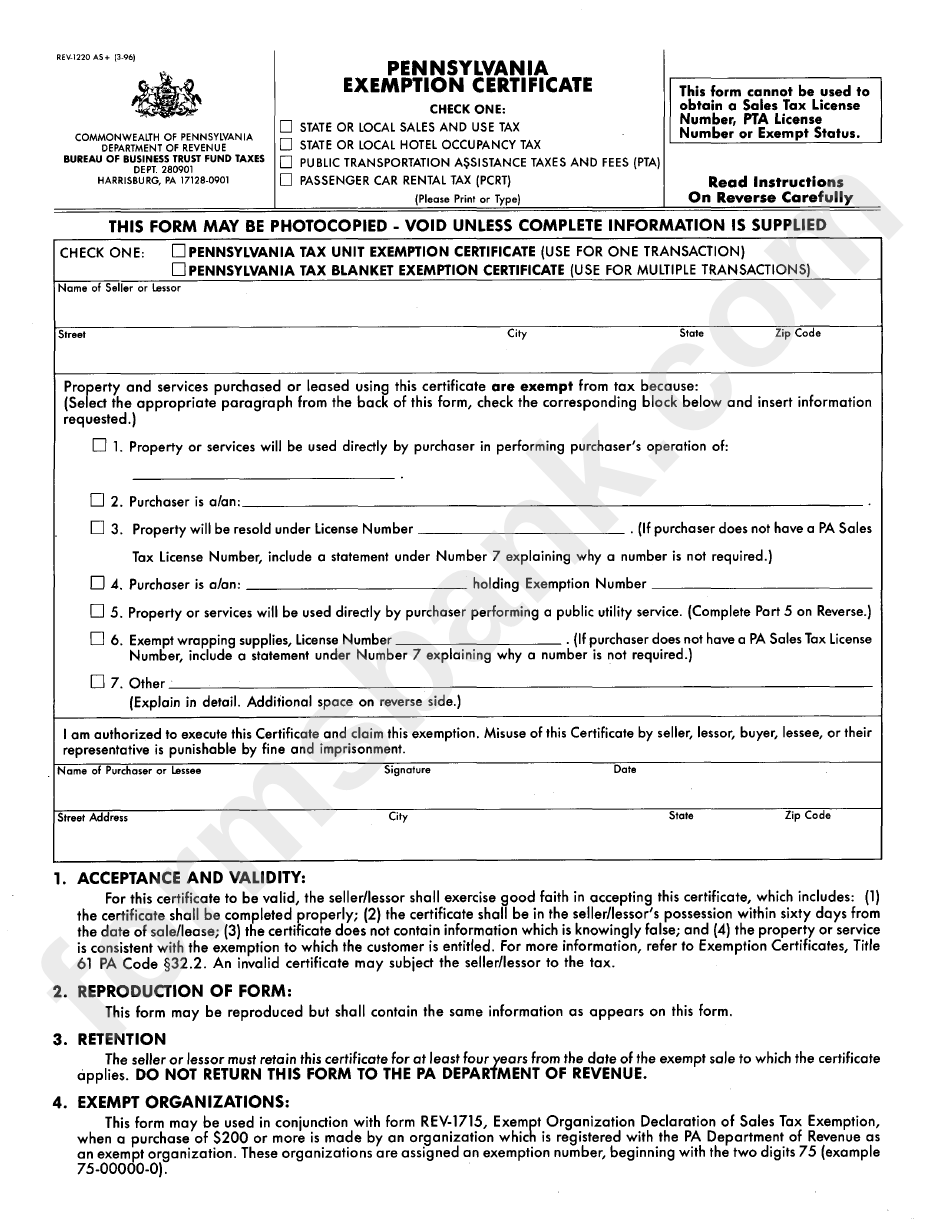

Pa Tax Exempt Form Printable Printable Forms Free Online

Looking For Sample Letter For Tax Amnesty For Motor Vehicle Taxes In

What Is The Property Tax Exemption For Over 65 In California - [desc-13]