What Is The Property Tax Exemption For Over 65 What is a senior property tax exemption Property taxes are complicated and make up a big chunk of homeownership costs What s worse is that the amount you owe annually can change

An exemption not exceeding 50 000 to any person who has the legal or equitable title to real estate maintains permanent residence on the property is 65 or older and whose When you turn 65 you become eligible for an additional standard deduction on top of the regular standard deduction However the amount of this

What Is The Property Tax Exemption For Over 65

What Is The Property Tax Exemption For Over 65

https://ca-times.brightspotcdn.com/dims4/default/b9a1a8a/2147483647/strip/true/crop/1080x891+0+0/resize/1200x990!/quality/80/?url=https:%2F%2Fcalifornia-times-brightspot.s3.amazonaws.com%2Fb2%2F99%2Fa7aaa0df42d9ae7b0e91d6cf921b%2Fla-me-vaccine-exemptions-dp-chinohills.jpg

What Is A Property Tax Exemption For Seniors And How To Get One

https://blondeandbalanced.com/wp-content/uploads/2023/12/Depositphotos_443402522_S.jpg

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

Certain property tax benefits are available to persons 65 or older in Florida Eligibility for property tax exemptions depends on certain requirements Information is available from Sometimes called the senior freeze property owners 65 and over reach what is known as the homestead tax ceiling This tax ceiling states that once you reach the age of 65

Property tax is an obligation you should continue to fulfil so long as you live on the property However if you are over 65 and or disabled and have an Over WHAT IS THE PROPERTY TAX EXEMPTION FOR OVER 65 With the November 2023 adoption of Senate Bill 2 the Texas homestead exemption for school taxes has increased to 100 000 and

Download What Is The Property Tax Exemption For Over 65

More picture related to What Is The Property Tax Exemption For Over 65

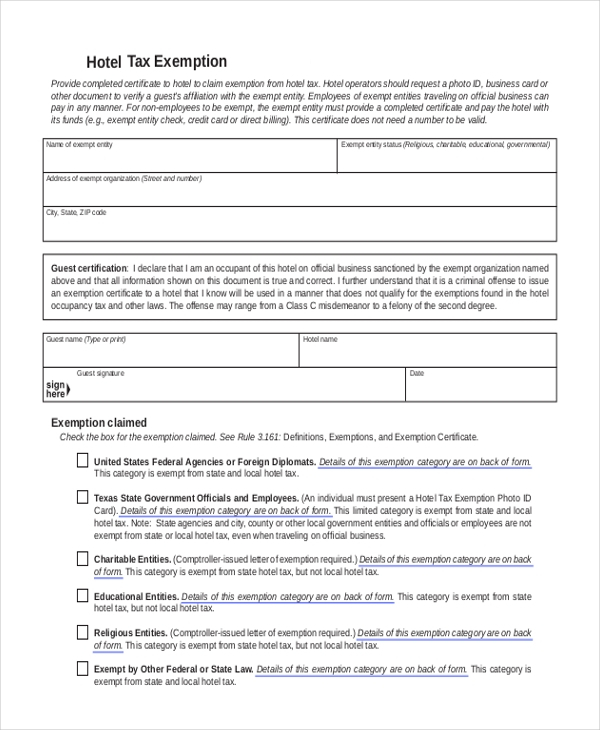

Tax Exempt Form Florida Hotel ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-ms-word-12.jpg

Tax Cuts Are Not The Problem ITR Foundation

https://itrfoundation.org/wp-content/uploads/2023/07/quote20.jpg

Sales Tax Campus Controller s Office University Of Colorado Boulder

https://www.colorado.edu/controller/sites/default/files/styles/large_wide_thumbnail/public/callout/taxexemption.png?itok=qxBDlZaj

Standard Deduction for Seniors If you do not itemize your deductions you can get a higher standard deduction amount if you and or your spouse are 65 years The Best States for Property Tax Breaks for Seniors Property tax exemptions reduce the taxable value of your home Some areas offer significant reductions

For seniors who are eligible the over 65 exemption can reduce their property tax bills by hundreds of dollars each year Combining the exemption with property tax protests and HOUSTON Texans who are age 65 or older or who are disabled as defined by law may postpone paying current and delinquent property taxes on their homes by

Fillable Original Application For Homestead And Related Tax Exemptions

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/fillable-original-application-for-homestead-and-related-tax-exemptions.png

Smithtown Town Board Approves Tax Exemption For Seniors Long Island

https://longislandmediagroup.com/wp-content/uploads/2023/03/taxbreaksenior.jpg

https://www.realtor.com/advice/finance/s…

What is a senior property tax exemption Property taxes are complicated and make up a big chunk of homeownership costs What s worse is that the amount you owe annually can change

https://floridarevenue.com/property/Documents/...

An exemption not exceeding 50 000 to any person who has the legal or equitable title to real estate maintains permanent residence on the property is 65 or older and whose

Application Letter For Change Of Name In Property Tax Bill Name

Fillable Original Application For Homestead And Related Tax Exemptions

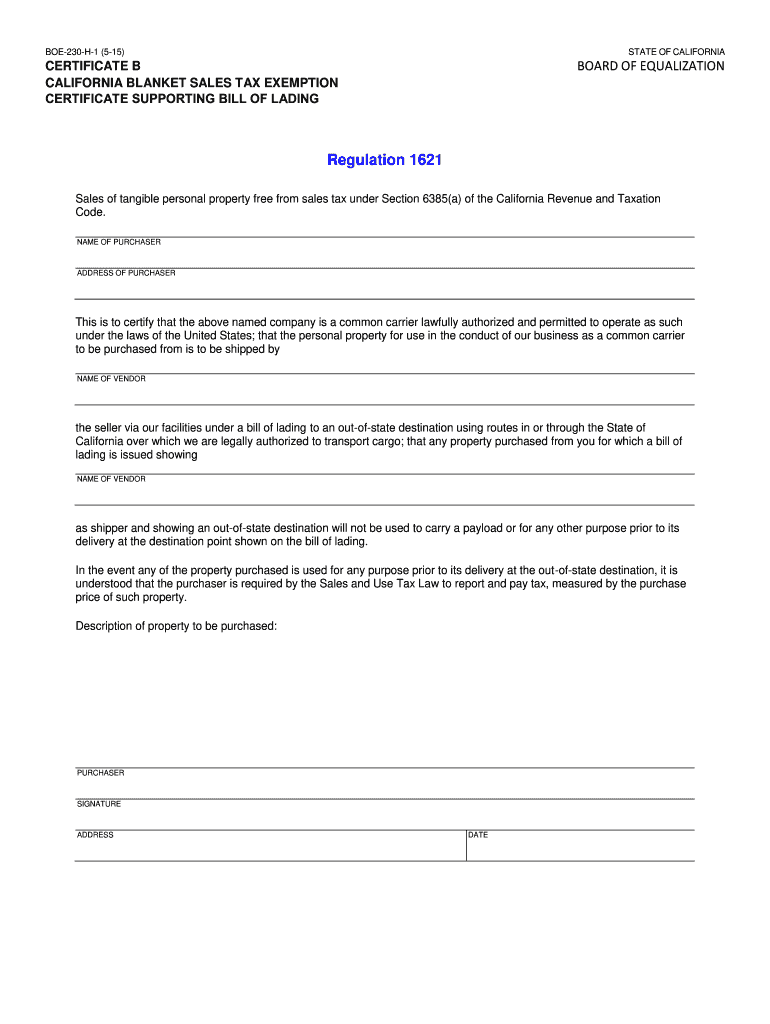

California Tax Exempt Form 2020 Fill And Sign Printable Template

Tax Exemption Form For Veterans ExemptForm

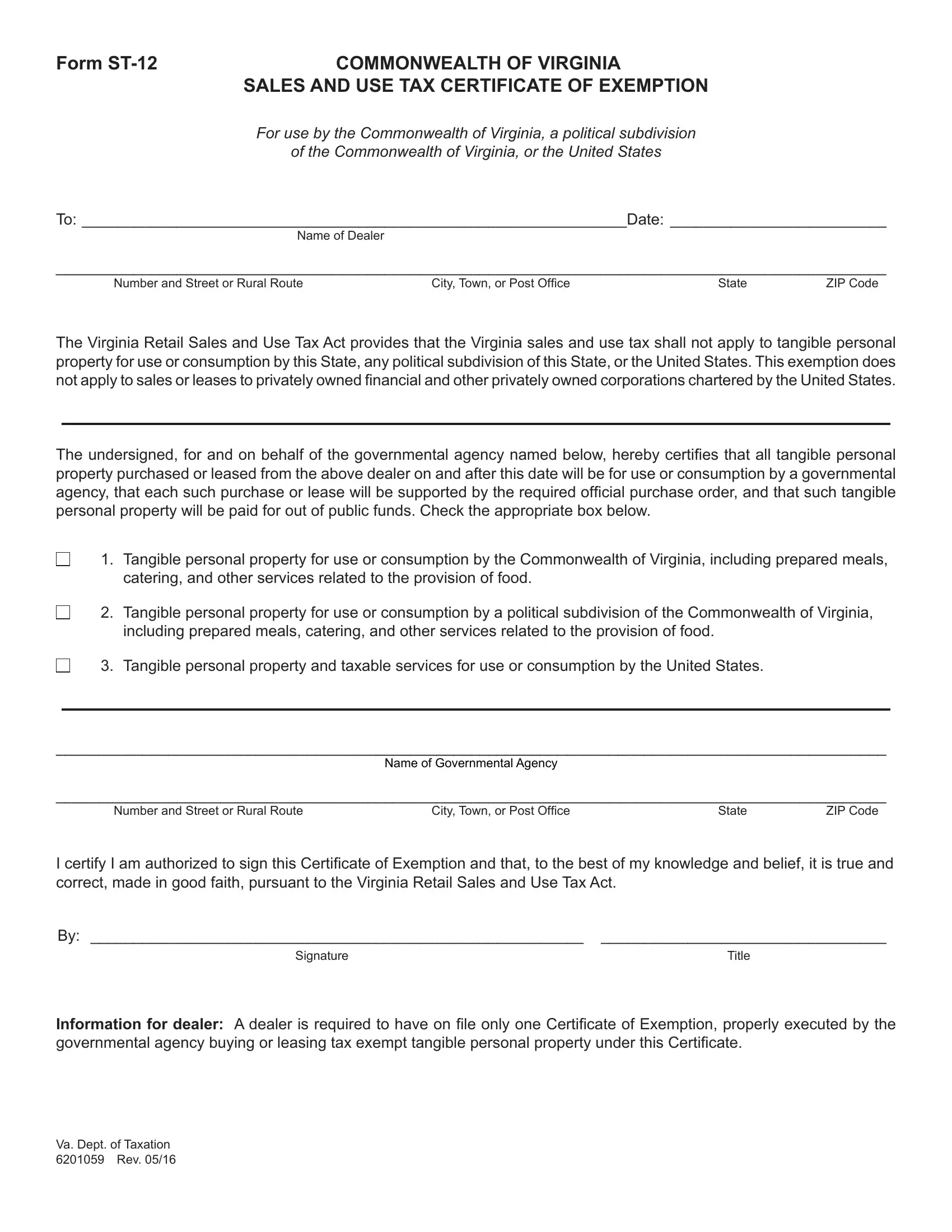

Virginia Sales Tax Exemption PDF Form FormsPal

Kansas Lawmakers Adopt Property Tax Break For Restaurant Child Care

Kansas Lawmakers Adopt Property Tax Break For Restaurant Child Care

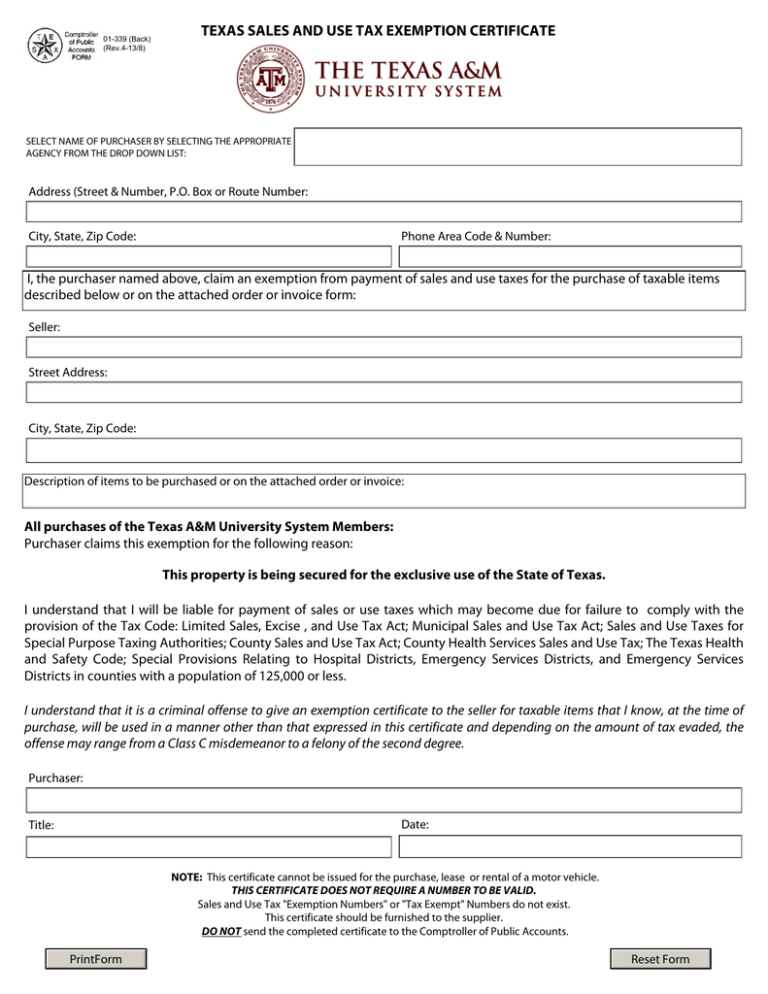

2023 Sales Tax Exemption Form Texas ExemptForm

Section 7E Of The Income Tax Ordinance 2001

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

What Is The Property Tax Exemption For Over 65 - WHAT IS THE PROPERTY TAX EXEMPTION FOR OVER 65 With the November 2023 adoption of Senate Bill 2 the Texas homestead exemption for school taxes has increased to 100 000 and