What Is The Redundancy Tax Free Limit The tax free component for genuine redundancies for the 2022 23FY is Base Limit 11 591 Service amount 5 797 You can read more about the Tax free part

The 2019 20 tax free component of a genuine redundancy is 10 638 plus 5 320 for each complete year of service up to a maximum of 210 000 Work out your Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax free amount isn t part of

What Is The Redundancy Tax Free Limit

What Is The Redundancy Tax Free Limit

https://www.stackscale.com/wp-content/uploads/2022/09/georedundancy-stackscale.jpg

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/au/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

The tax free limit which changes every year is a base amount plus an amount for each complete year of service with your employer Any remaining genuine redundancy The tax free limit starts out as a whole dollar amount However you ll get an extra amount for each full year of service completed during your period of

2 Aug 2021 Hi What s the base amount and service amount for 2021 2022 I have been searching on ATO website but only 2020 2021 amount available Working out and Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

Download What Is The Redundancy Tax Free Limit

More picture related to What Is The Redundancy Tax Free Limit

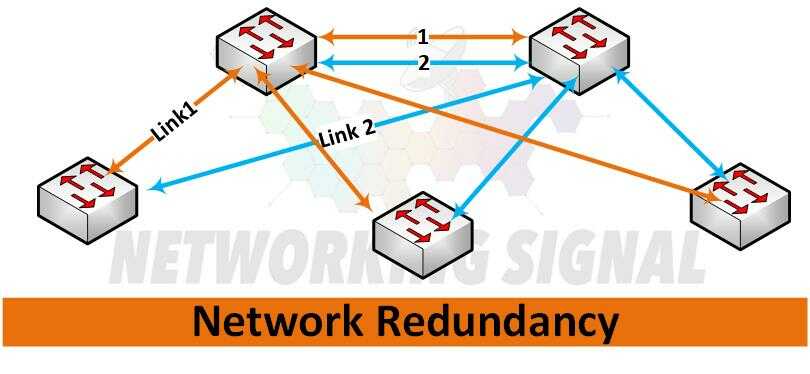

What Are Network Redundancy Its Benefits And How Does It Work

https://www.networkingsignal.com/wp-content/uploads/2022/11/what-are-network-redundancy-its-benefits-and-how-does-it-work_optimized.jpg

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

What Is The Principle Of Least Privilege

https://fieldeffect.com/hubfs/Blog-Thumb-What-is-the-principle-of-least-privilege.png

Lump sum D is used to report the tax free amount of a genuine redundancy or an early retirement scheme payment up to the tax free limit ETP Type R will be used for a When an employee s job is made redundant their employer may need to pay them redundancy pay also known as severance pay On this page Redundancy pay

Your redundancy pay will be based on a maximum of 20 years work For example if you ve worked at your job for 23 years you ll only get redundancy pay based on the last Up to 30 000 of redundancy pay is tax free Any non cash benefits that form part of your redundancy package such as a company car or computer will be given a cash value

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

https://i.ytimg.com/vi/YVQNoJvJlu4/maxresdefault.jpg

Is My Redundancy Payment Tax Free

https://media.licdn.com/dms/image/C5612AQGXzjMkY2xlhA/article-cover_image-shrink_600_2000/0/1520202043609?e=2147483647&v=beta&t=Q6xM_FRcmsT9WVPmYTYrbawpxcT9VrPygrcLNXAyDXg

https://community.ato.gov.au › question

The tax free component for genuine redundancies for the 2022 23FY is Base Limit 11 591 Service amount 5 797 You can read more about the Tax free part

https://www.ato.gov.au › individuals-and-families › ...

The 2019 20 tax free component of a genuine redundancy is 10 638 plus 5 320 for each complete year of service up to a maximum of 210 000 Work out your

What Is The Right Amount To Contribute What Is The Right Amount To

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

Tax On Redundancy Payments Davis Grant

What Tax Do I Pay On Redundancy Payments Accounting Firms

Do You Have To Pay Tax On Redundancy Payments CruseBurke

Dismissal Letter For Redundancy Template Rocket Lawyer Uk Free Hot

Dismissal Letter For Redundancy Template Rocket Lawyer Uk Free Hot

It Is So Important You Understand The Steps In The Redundancy Cycle

What Is Redundancy Definition And Meaning Market Business News

Termination Letter Redundancy Free Template Sample Lawpath

What Is The Redundancy Tax Free Limit - 2 Aug 2021 Hi What s the base amount and service amount for 2021 2022 I have been searching on ATO website but only 2020 2021 amount available Working out and