What Is The Reimbursement Rate For Mileage In 2023 17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

Business standard mileage rate treated as depreciation is 26 cents per mile for 2019 27 cents per mile for 2020 26 cents per mile for 2021 26 cents per mile for 2022 and 28 The IRS has announced that the 2023 business standard mileage rate is increasing to 65 5 cents up 3 cents from the 2022 midyear adjustment of 62 5 cents

What Is The Reimbursement Rate For Mileage In 2023

What Is The Reimbursement Rate For Mileage In 2023

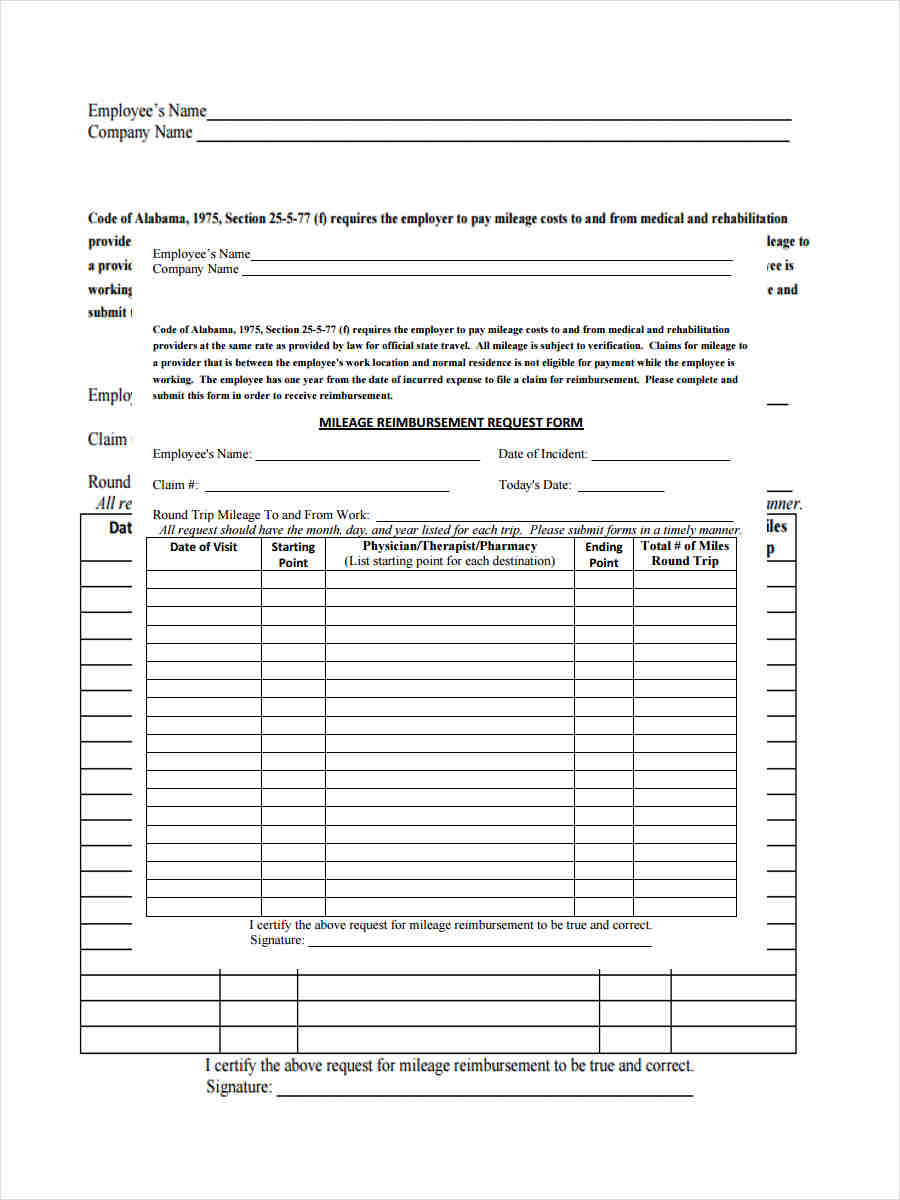

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-12-mileage-reimbursement-forms-in-pdf-ms-word-excel.jpg

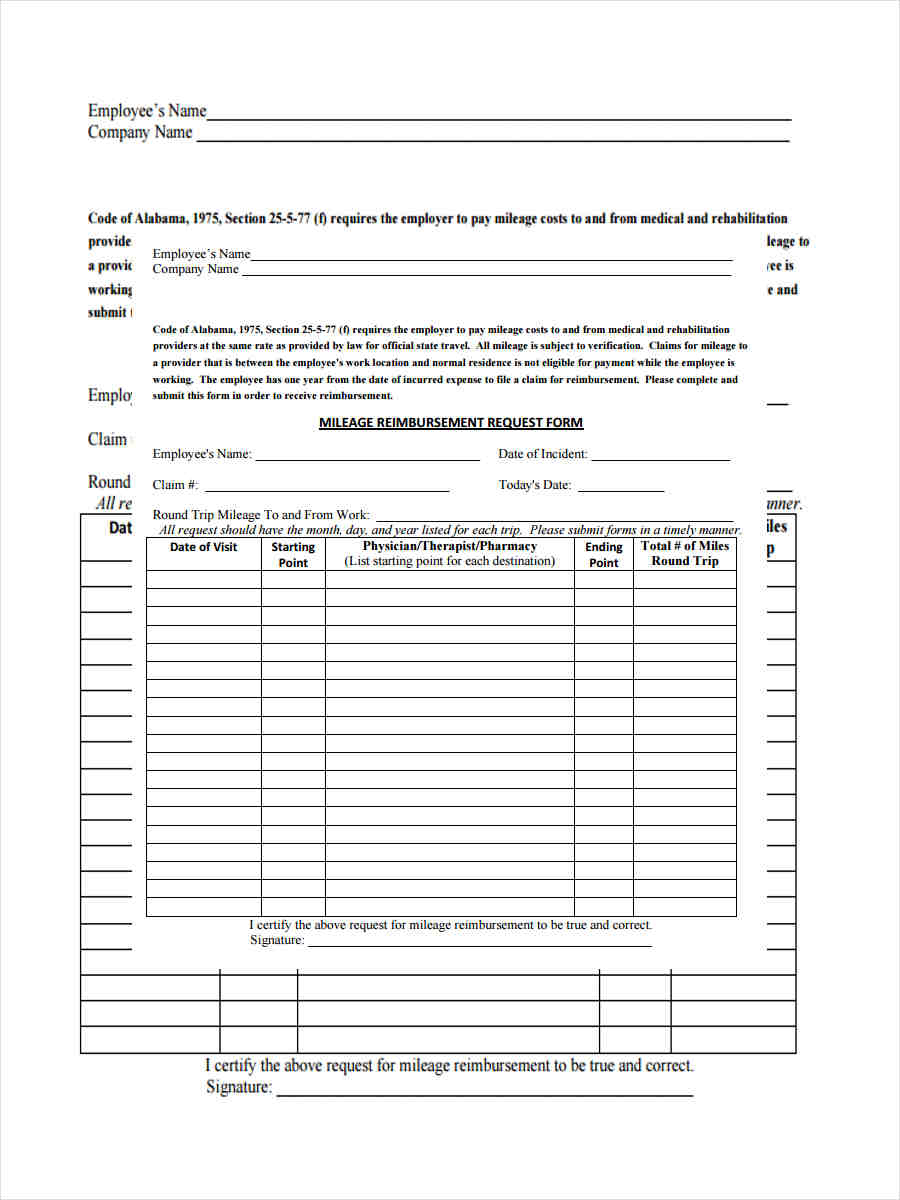

Wv Mileage Reimbursement Form With Attestation Fillable Printable

https://www.signnow.com/preview/58/810/58810479/large.png

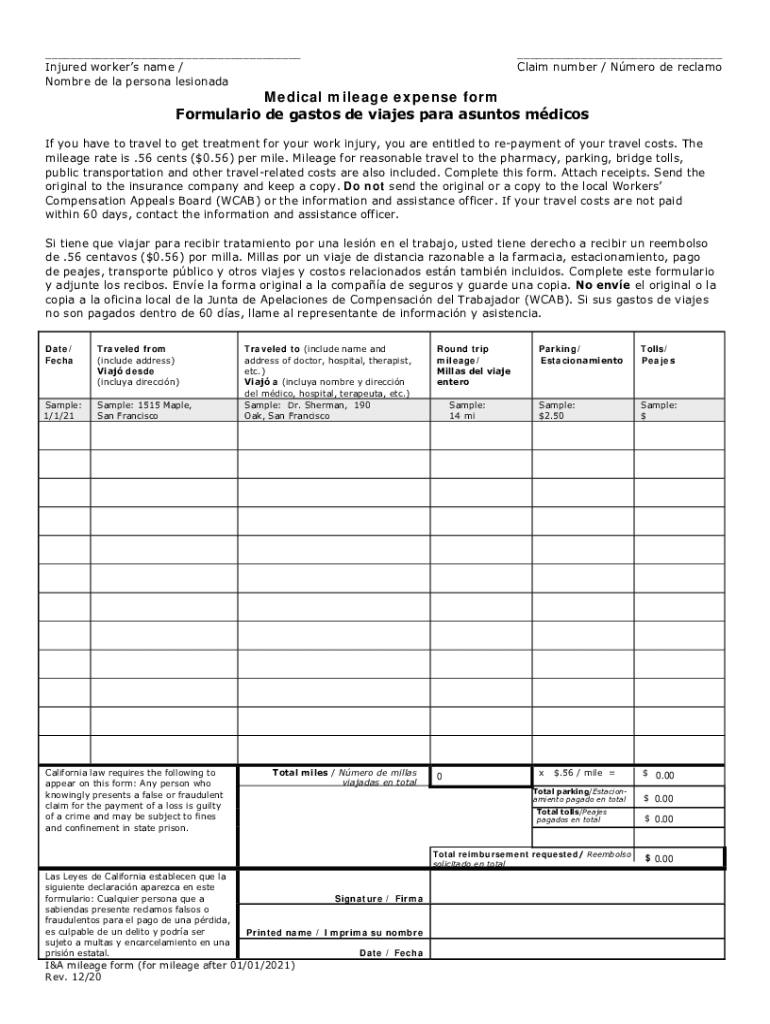

Mileage Reimbursement IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/mileage-reimbursement-form-in-word-and-pdf-formats-3.png

The IRS today issued an advance version of Notice 2023 3 providing the standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business charitable The 2023 rate for charitable use of an automobile is 14 cents per mile the same as in 2022 Standard mileage rates can be used instead of calculating the actual expenses that are deductible

Beginning on Jan 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 5 cents per mile driven for business use up The 2023 standard mileage rate will be 65 5 cents per mile up from 62 5 cents per mile last year The 2023 medical or moving rate will remain at 22 cents per

Download What Is The Reimbursement Rate For Mileage In 2023

More picture related to What Is The Reimbursement Rate For Mileage In 2023

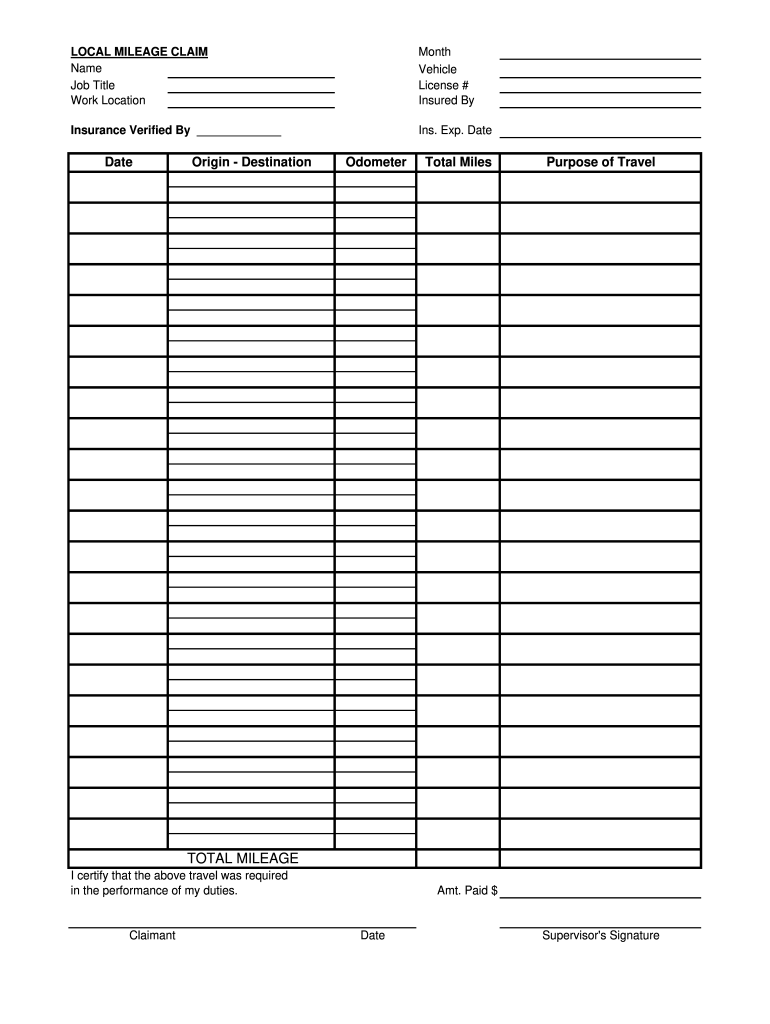

Free Mileage Log Templates Smartsheet 2022

https://www.smartsheet.com/sites/default/files/IC-Standard-Milage-Rates.jpg

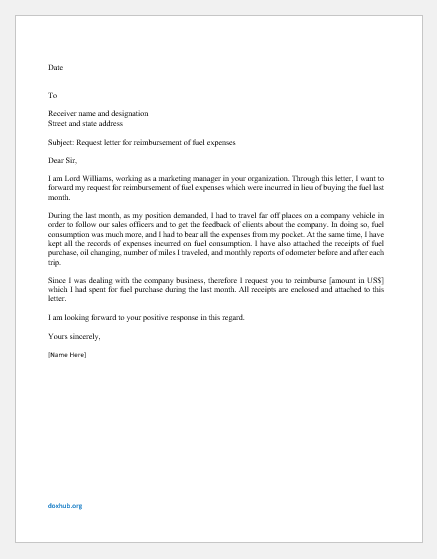

9 Reimbursement Request Letters For Various Reasons Document Hub

https://www.doxhub.org/wp-content/uploads/2020/07/Reimbursement-Request-Letter-for-Fuel-Expenses.png

2023 Standard Mileage Rates

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/HCM_mileage-rate-1012023.png

The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the second half of 2022 The IRS increased the optional standard mileage rate used to calculate the deductible costs of operating a vehicle for business to 65 5 cents per mile driven up 3

Here are the 2023 mileage reimbursement rates Business use 65 5 cents per mile This mileage rate for business increased by 3 cents from 62 5 cents per mile in 2022 Military moving 22 cents per mile As of Jan 1 the standard mileage rates are 65 5 cents per mile driven for business up 3 cents from the midyear rate increase 22 cents per mile driven for

2023 Standard Mileage Rates Released By IRS

https://www.hrmorning.com/wp-content/uploads/2023/01/2023MileageRates.png

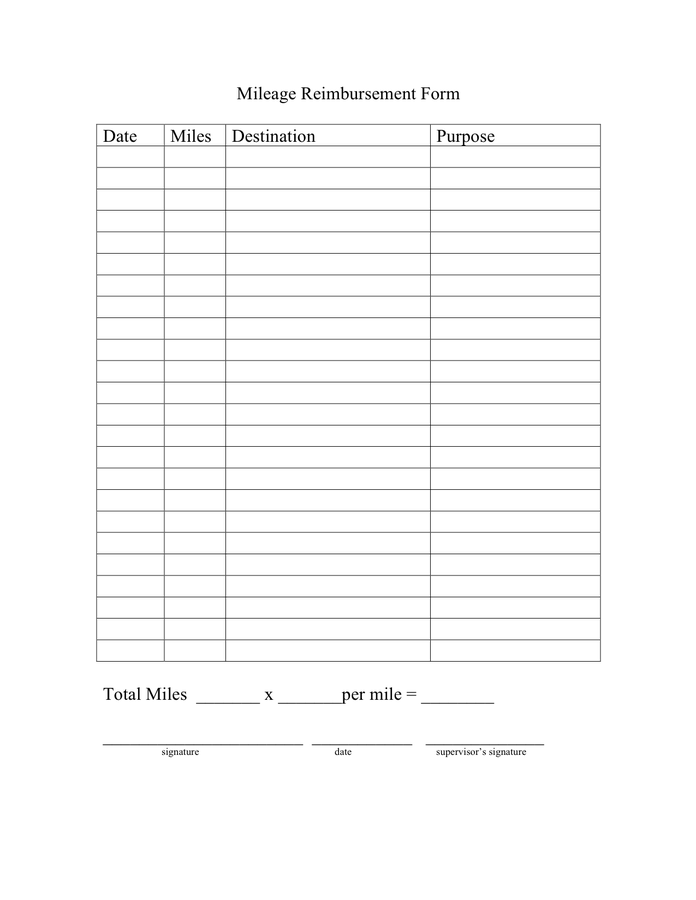

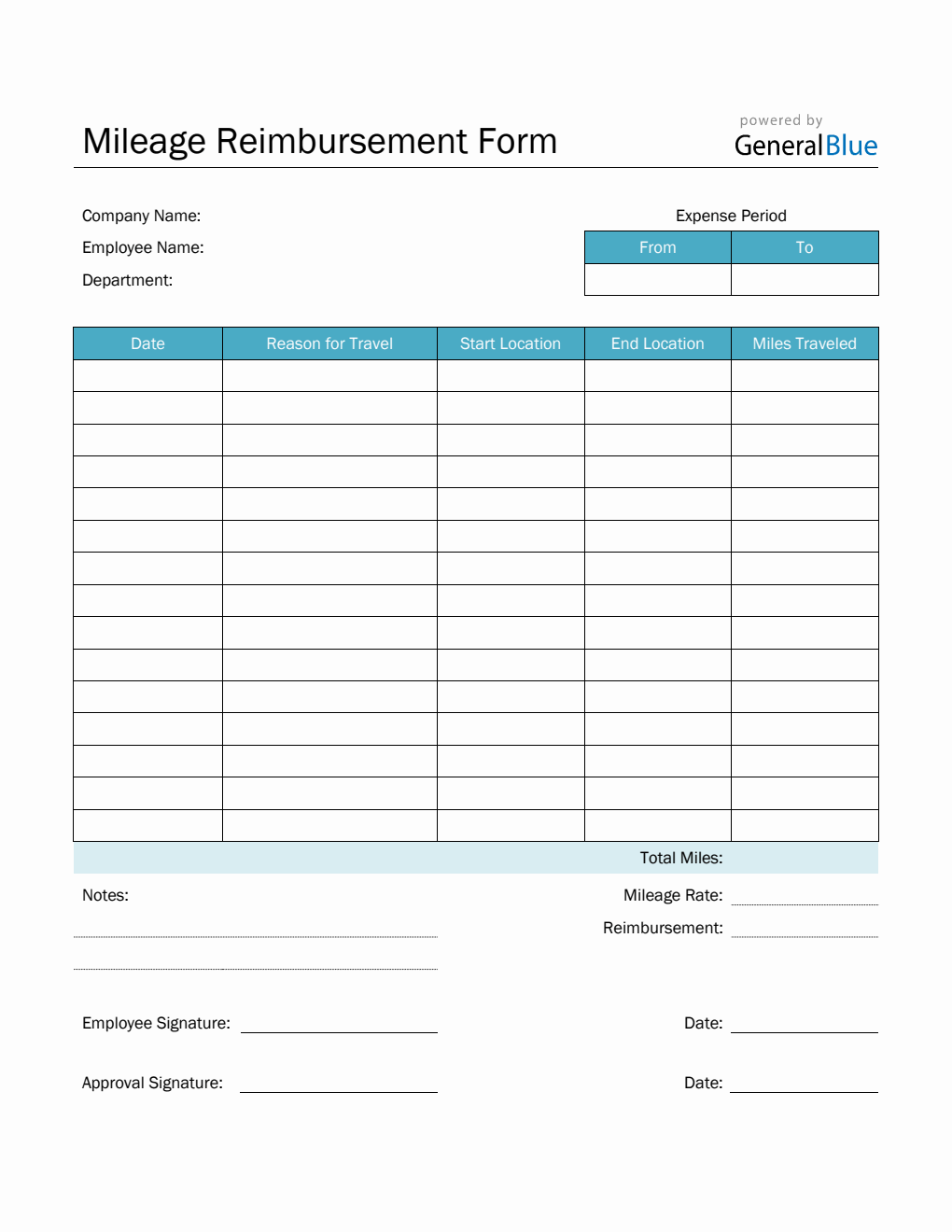

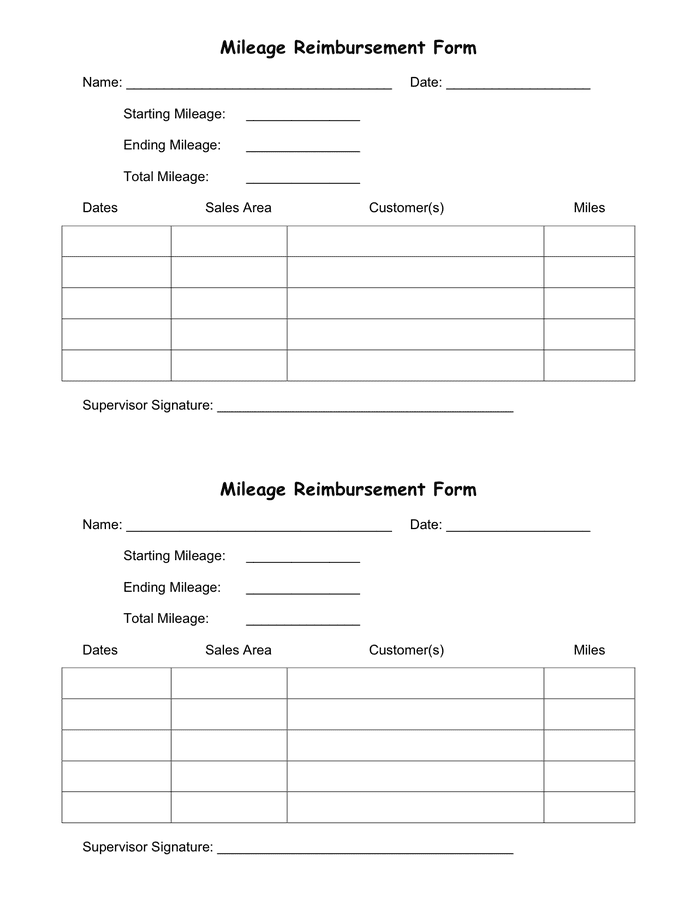

Mileage Reimbursement Form In PDF Basic

https://www.generalblue.com/mileage-reimbursement-form/p/tbm51rd9k/f/basic-mileage-reimbursement-form-in-pdf-md.png?v=99b37856fd604291698117ba17c0f966

https://www.irs.gov/tax-professionals/standard-mileage-rates

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

https://www.irs.gov/pub/irs-drop/n-23-03.pdf

Business standard mileage rate treated as depreciation is 26 cents per mile for 2019 27 cents per mile for 2020 26 cents per mile for 2021 26 cents per mile for 2022 and 28

Mileage Form PDF IRS Mileage Rate 2021

2023 Standard Mileage Rates Released By IRS

CA I A Mileage Form 2020 2022 Fill And Sign Printable Template Online

What Is A Mileage Reimbursement Form EXPLAINED YouTube

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

IRS Standard Mileage Rate 2023 Reimbursement Rules Rates

How To Calculate Mileage Claim In Malaysia Karen Rutherford

Mileage Reimbursement 2024 Washington State Harri Klarika

What Is The Reimbursement Rate For Mileage In 2023 - Beginning on Jan 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 5 cents per mile driven for business use up