What Is The Salary Tax In New Jersey If you make 55 000 a year living in the region of New Jersey USA you will be taxed 10 434 That means that your net pay will be 44 566 per year or 3 714 per month Your average tax

The Income tax rates and personal allowances in New Jersey are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances Calculate your income tax in New Jersey and salary deduction in New Jersey to calculate and compare salary after tax for income in New Jersey in the 2025 tax year

What Is The Salary Tax In New Jersey

What Is The Salary Tax In New Jersey

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

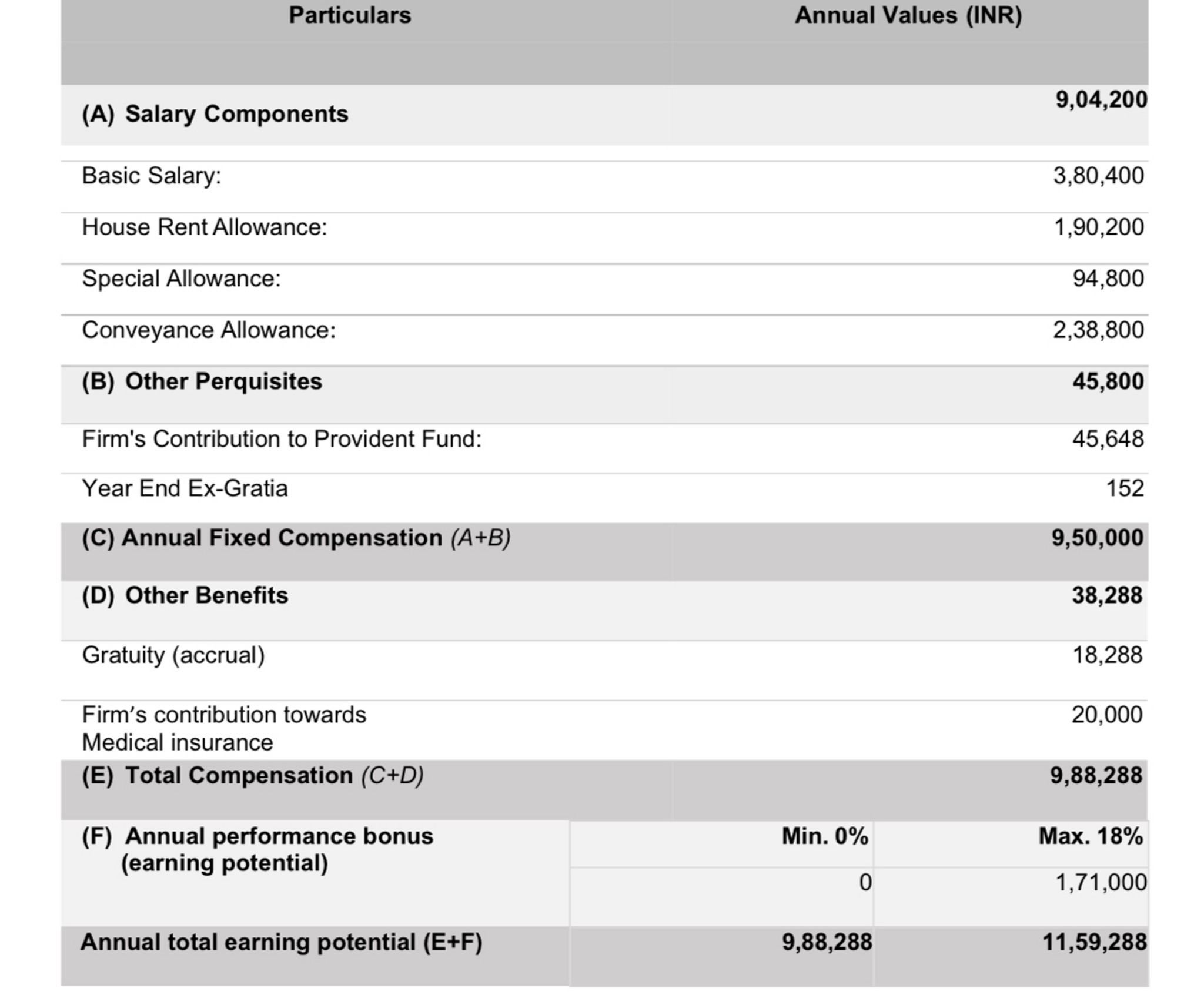

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

What Is The Salary Guide The Daily Illini

https://dailyillini.com/wp-content/uploads/2020/11/C3_Quad.jpg

Find out how much you ll pay in New Jersey state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger New Jersey state income tax rates range from 1 4 to 10 75 You pay more tax when you earn more State income taxes are calculated separately from federal income taxes If you re a New Jersey employee you ll also notice

Use this New Jersey State Tax Calculator to determine your federal tax amounts state tax amounts along with your Medicare and Social Security tax allowances In 2024 New Jersey employs a progressive state income tax system with rates ranging from 1 4 to 10 75 Updated on Dec 19 2024 Estimate your New Jersey state tax burden with our income tax calculator Enter your annual

Download What Is The Salary Tax In New Jersey

More picture related to What Is The Salary Tax In New Jersey

Philippine Salary Grade 2023 Philippine Go

https://philippinego.com/wp-content/uploads/2022/11/5-2.png

State Individual Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20210216163839/2021-state-income-tax-rates.-2021-state-individual-income-tax-rates.-States-with-no-income-tax.-2021-top-state-marginal-individual-income-tax-rates.png

Will New Jersey Be Tied For Highest Corporate Tax Rate Tax Foundation

https://files.taxfoundation.org/20180312103730/NJCIT2018-02.png

The New Jersey Paycheck Calculator is a powerful tool designed to help employees and employers in New Jersey accurately calculate the net take home pay after deductions such as federal and state taxes Social Security The calculator at the top of this page makes it simple for New Jersey employers to quickly process their employees gross pay net pay and deductions so you can cut paychecks with confidence But occasionally employers have

New Jersey net pay or take home pay is calculated by entering you re annual or per period salary as well as the relevant federal state and local W4 details in this free New Jersey paycheck calculator Where is your money going How much AARP s state tax guide on 2023 New Jersey tax rates for income retirement and more for retirees and residents over 50 Here s what to know whether you re a resident who s

How Are Income Taxes Calculated The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10-1.jpg

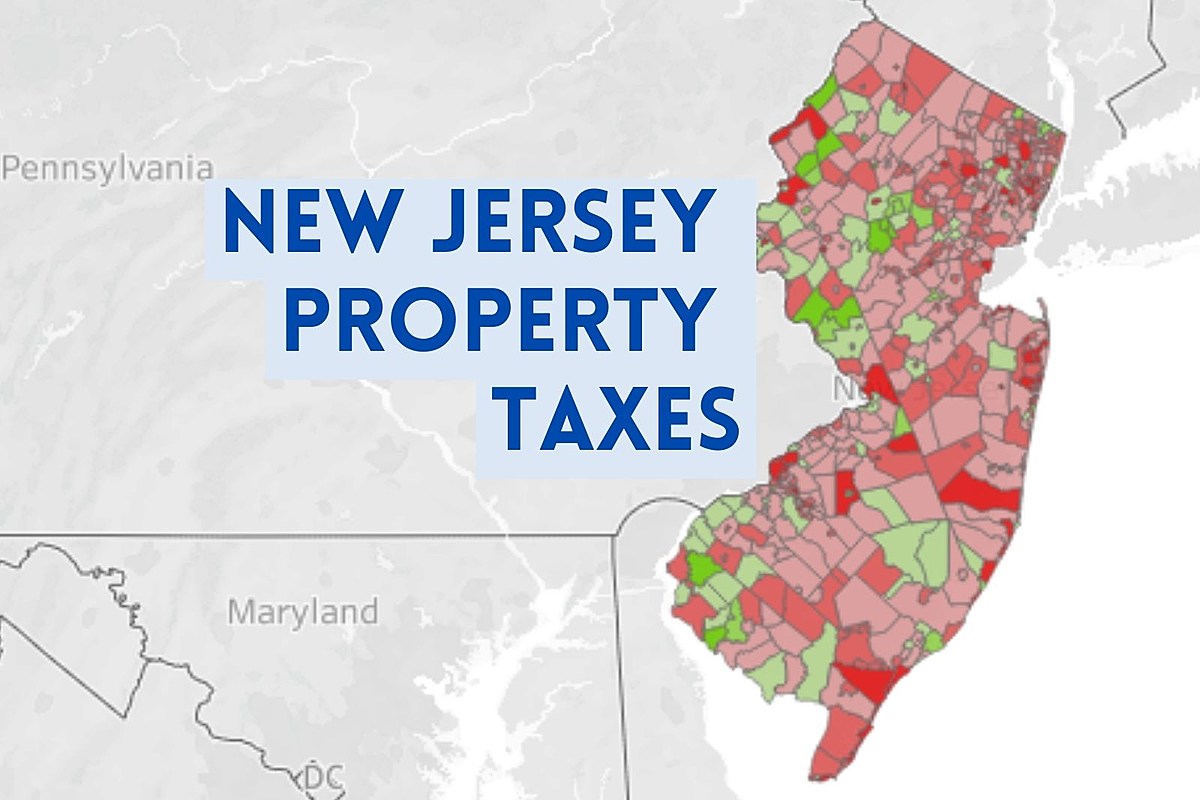

New Jersey Property Records Search Owners Title Tax And Deeds

https://infotracer.com/img/property/states/nj_04.jpg

https://www.talent.com › tax-calculator › New+Jersey

If you make 55 000 a year living in the region of New Jersey USA you will be taxed 10 434 That means that your net pay will be 44 566 per year or 3 714 per month Your average tax

https://nj-us.icalculator.com › income-tax-ra…

The Income tax rates and personal allowances in New Jersey are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

How Are Income Taxes Calculated The Tech Edvocate

What Is Property Tax In New Jersey PRFRTY

What Is The Salary Structure Of DXC There Basic P Fishbowl

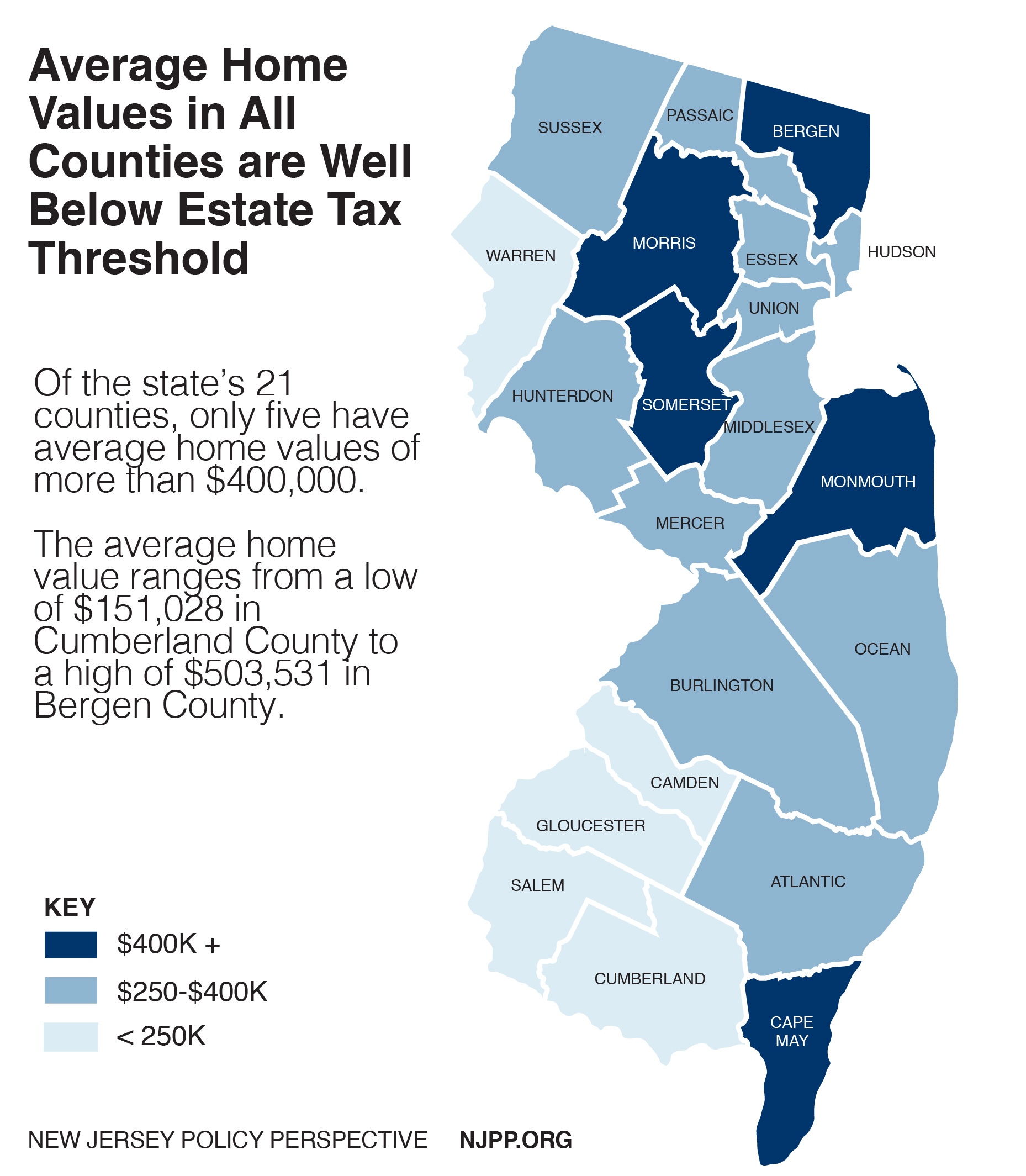

Fast Facts New Jersey s Average Home Values Are Well Below Estate Tax

2022 Tax Brackets

2022 Tax Brackets

How Has Been The Salary Hikes In EY India This Tim Fishbowl

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan s

30

What Is The Salary Tax In New Jersey - Use this New Jersey State Tax Calculator to determine your federal tax amounts state tax amounts along with your Medicare and Social Security tax allowances