What Is The Sales Tax In Boston Massachusetts The 6 25 sales tax rate in Boston consists of 6 25 Massachusetts state sales tax There is no applicable county tax city tax or special tax You can print a 6 25 sales tax table here For tax rates in other cities see Massachusetts sales taxes by city and county

The base state sales tax rate in Massachusetts is 6 25 Local tax rates in Massachusetts range from 6 25 making the sales tax range in Massachusetts 6 25 Find your Massachusetts combined state and The current total local sales tax rate in Boston MA is 6 250 The December 2020 total local sales tax rate was also 6 250

What Is The Sales Tax In Boston Massachusetts

What Is The Sales Tax In Boston Massachusetts

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

Proposed Massachusetts Sales Tax Cut

https://townsquare.media/site/920/files/2018/05/GettyImages-1605085.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

What Is The Sales Tax In Texas WorldAtlas

https://www.worldatlas.com/r/w1200/upload/41/72/bb/shutterstock-402316468.jpg

The current sales tax rate in Boston MA is 6 25 Click for sales tax rates Boston sales tax calculator and printable sales tax table from Sales Taxes The Boston Massachusetts sales tax is 6 25 the same as the Massachusetts state sales tax While many other states allow counties and other localities to collect a local option sales tax Massachusetts does not permit local sales taxes to be collected

This guide provides detailed information on sales tax in Boston Massachusetts We ll cover the differences between state county and city sales tax rates how to calculate sales tax in Boston and whether your business needs to collect sales tax The sales tax rate in Boston Massachusetts is 6 25 This figure is the sum of the rates together on the state county city and special levels For a breakdown of rates in greater detail please refer to our table below Boston has parts of it located within Middlesex

Download What Is The Sales Tax In Boston Massachusetts

More picture related to What Is The Sales Tax In Boston Massachusetts

Ocala Post Marion County Sales Tax Initiative

http://www.ocalapost.com/wp-content/uploads/2016/03/sales-tax.jpg

What Is The Sales Tax In Boston You In Boston

https://media.bizj.us/view/img/6653472/cash-register*1200xx3000-1688-0-133.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Combined with the state sales tax the highest sales tax rate in Massachusetts is 6 25 in the cities of Boston Worcester Springfield Quincy and Cambridge and 555 other cities Last updated October 2024 Automate sales tax calculations reporting and filing today to save time and reduce errors Up to date Boston sales tax rates and business information for 2024 Learn how to register collect taxes do returns file and more

Boston sales tax rate is 6 25 The total sales tax rate in Boston comprises only the state tax rate There are no additional sales taxes imposed by the county district or city The table below provides a breakdown of the sales tax rate by jurisdiction Boston Sales Tax The Massachusetts sales tax is 6 25 of the sales price or rental charge on tangible personal property including certain telecommunication services sold or rented in Massachusetts Sales tax is generally collected by the seller

Sales Tax By State 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2023/03/Sales-Tax-by-State.png

Massachusetts Sales Tax Guide

https://blog.accountingprose.com/hubfs/image-38.png#keepProtocol

https://www.salestaxhandbook.com/massachusetts/rates/boston

The 6 25 sales tax rate in Boston consists of 6 25 Massachusetts state sales tax There is no applicable county tax city tax or special tax You can print a 6 25 sales tax table here For tax rates in other cities see Massachusetts sales taxes by city and county

https://wise.com/us/business/sales-tax/…

The base state sales tax rate in Massachusetts is 6 25 Local tax rates in Massachusetts range from 6 25 making the sales tax range in Massachusetts 6 25 Find your Massachusetts combined state and

Hawaii Sales Taxes Highest Per Capita In USA Hawaii Free Press

Sales Tax By State 2023 Wisevoter

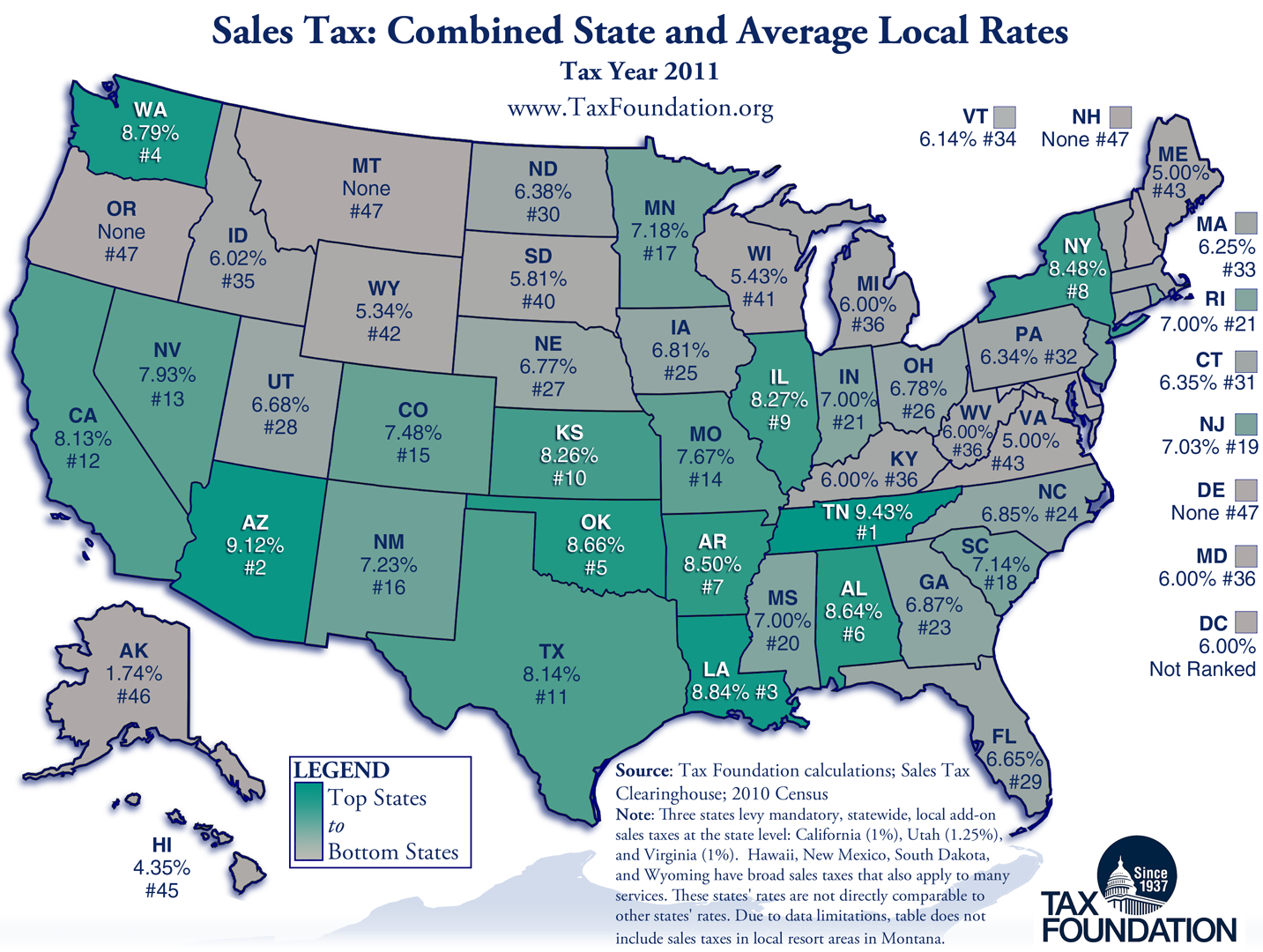

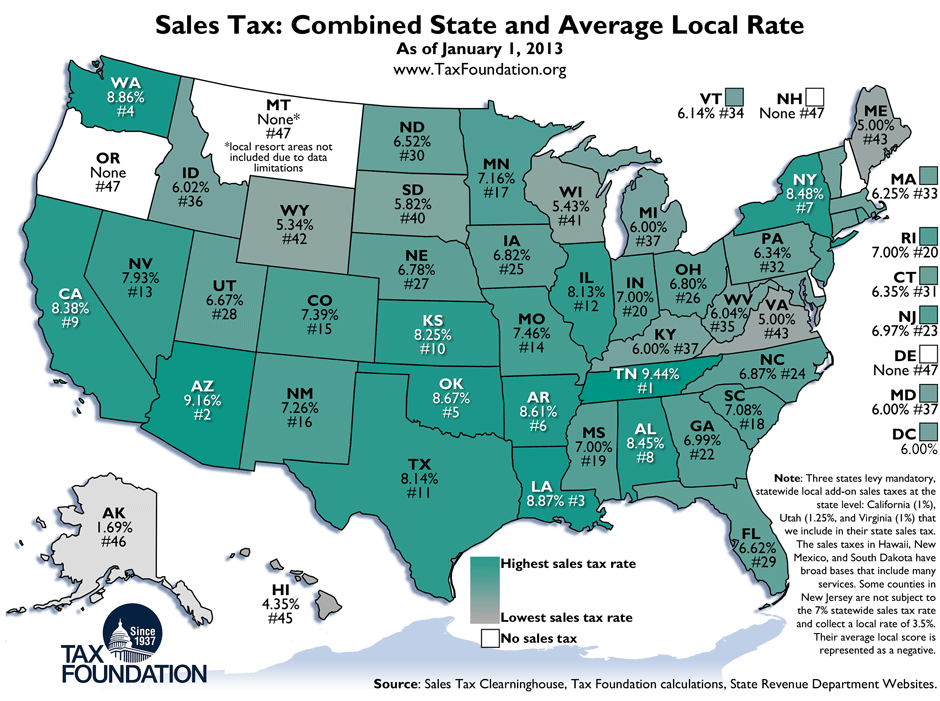

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

Massachusetts Sales Tax Guide For Businesses

What Is The Sales Tax In Boston You In Boston

What Is The Sales Tax In Boston You In Boston

NY Sales Tax Chart

Massachusetts State Tax GoldDealer

Weekly Map State And Local Sales Tax Rates 2013 Tax Foundation

What Is The Sales Tax In Boston Massachusetts - This guide provides detailed information on sales tax in Boston Massachusetts We ll cover the differences between state county and city sales tax rates how to calculate sales tax in Boston and whether your business needs to collect sales tax