What Is The Sales Tax In North Carolina For Vehicles North Carolina assesses a 3 percent sales tax on all vehicle purchases according to CarsDirect This sales tax is known as the Highway Use Tax and it funds the improvement and maintenance

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 4 75 State rate plus applicable local rates sales and use tax rates in effect Includes the 0 50 transit county sales and use tax

What Is The Sales Tax In North Carolina For Vehicles

What Is The Sales Tax In North Carolina For Vehicles

https://slash2.salestaxusa.com/wp-content/uploads/North-Carolina-Sales-Tax.jpg

What Is The Sales Tax On The Sale Of A Florida Business Romy B Jurado

https://romyjurado.com/wp-content/uploads/2021/08/Sales-Tax-on-the-Sale-of-a-Florida-Business.png

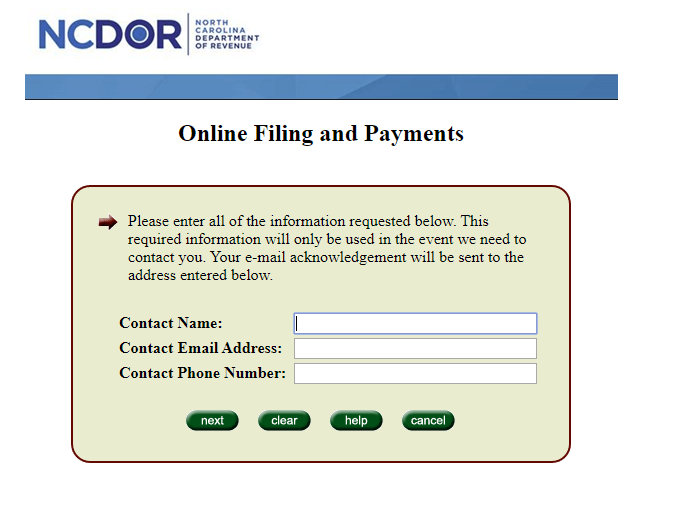

Paying State Income Tax In North Carolina Heard

https://support.joinheard.com/hc/article_attachments/4407473329559/Screen_Shot_2021-08-30_at_7.15.54_PM.png

North Carolina generally collects what s known as the highway use tax instead of sales tax on vehicles whenever a title is transferred Vehicles are also subject to property taxes which the N C Division of Motor Vehicles collects as Comparing the car tax by state can help you determine the most affordable locations to purchase a new vehicle On the other hand there are states like North Carolina and Hawaii that have relatively lower sales tax rates typically falling below 5

In North Carolina the state sales tax rate is 4 75 However there are additional local and county taxes that may apply when buying a car These can range from 2 to 3 which makes the combined sales tax for motor vehicles between 6 75 and 7 75 depending on your location The North Carolina Sales Tax Handbook provides everything you need to understand the North Carolina Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more

Download What Is The Sales Tax In North Carolina For Vehicles

More picture related to What Is The Sales Tax In North Carolina For Vehicles

What Is The Sales Tax In North Carolina 2022 YouTube

https://i.ytimg.com/vi/bZRsMfN5zYM/maxresdefault.jpg

What Is The Sales Tax In Texas WorldAtlas

https://www.worldatlas.com/r/w1200/upload/41/72/bb/shutterstock-402316468.jpg

Hecht Group The Highest Property Tax Rates And Median Home Values By

https://img.hechtgroup.com/1665458485869.jpg

In North Carolina car sales tax is a percentage of the vehicle s purchase price and is collected by the state Understanding the basics of car sales tax in North Carolina is important to ensure you are prepared for the additional costs of buying a car Calculating North Carolina State Auto Sales Tax If you ve purchased a new or used vehicle from a car dealer or a leasing company you will have to pay 3 percent of the purchase price of the vehicle less trade in credit

North Carolina has state sales tax of 4 75 and allows local governments to collect a local option sales tax of up to 2 75 There are a total of 460 local tax jurisdictions across the state collecting an average local tax of 2 222 Although the process of assessing annual vehicle property taxes may seem somewhat complex the NC vehicle sales tax is relatively straightforward The state government currently assesses a 3 percent sales tax rate calculated from the purchase price on all vehicles purchased from a dealer

What Is HST Harmonized Sales Tax

https://www.freshbooks.com/wp-content/uploads/2021/12/What-is-hst.jpg

4 Tips On Amended Sales Tax Returns CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/25115/sales_tax_1_.58de58fc9ed9f.png

https://www.caranddriver.com/research/a32812822/nc-car-sales-tax

North Carolina assesses a 3 percent sales tax on all vehicle purchases according to CarsDirect This sales tax is known as the Highway Use Tax and it funds the improvement and maintenance

https://www.salestaxhandbook.com/north-carolina/sales-tax-vehicles

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees

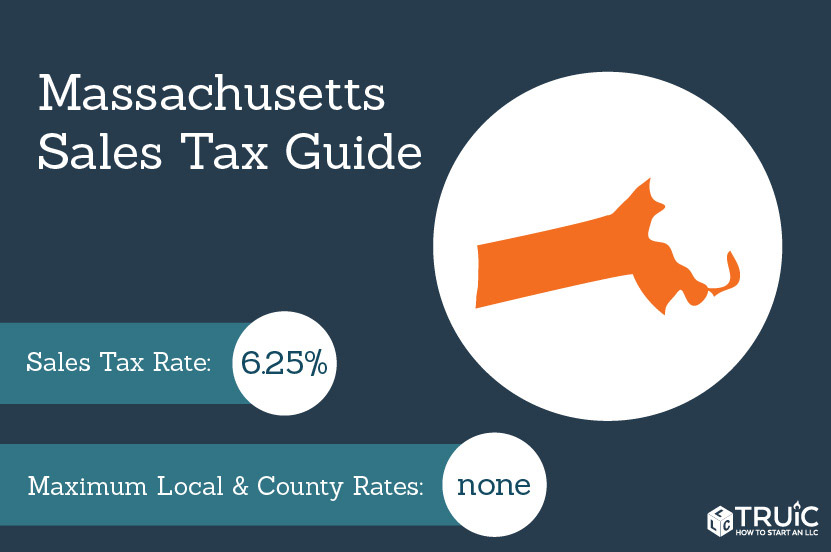

Massachusetts Sales Tax Small Business Guide TRUiC

What Is HST Harmonized Sales Tax

Sales Tax By State Here s How Much You re Really Paying Sales Tax

OUCH Alabama Has 4th Highest Combined Sales Tax Rate In The Country

HOW TO APPLY FOR THE TEXAS SALES TAX PERMIT 2020 Step By Step YouTube

Sales Tax In The US How To Deal With My Count Solutions

Sales Tax In The US How To Deal With My Count Solutions

North Carolina Tax Deed Basics State Overview YouTube

NY Sales Tax Chart

How To File And Pay Sales Tax In North Carolina TaxValet

What Is The Sales Tax In North Carolina For Vehicles - The North Carolina Sales Tax Handbook provides everything you need to understand the North Carolina Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more