What Is The Senior Standard Deduction For Tax Year 2023 The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or Section 63 c 2 provides the standard deduction for use in filing individual income tax returns See all standard deductions by year and legislative history

What Is The Senior Standard Deduction For Tax Year 2023

What Is The Senior Standard Deduction For Tax Year 2023

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

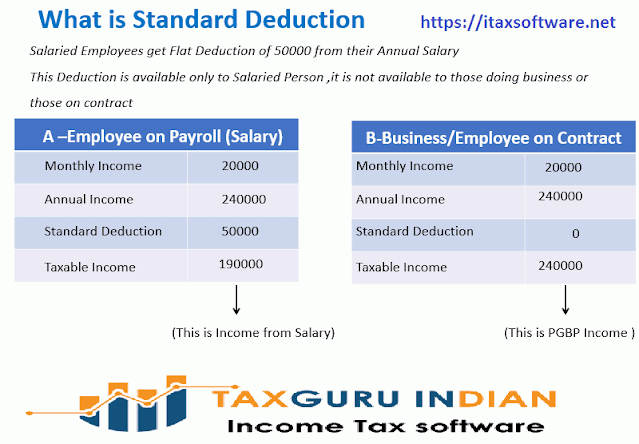

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

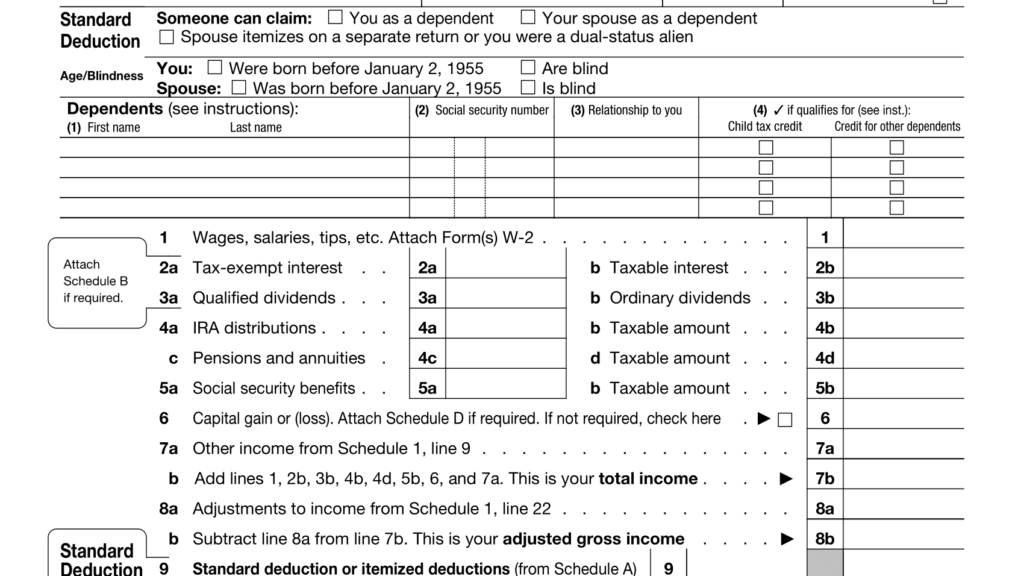

Standard deduction for seniors If you do not itemize your deductions you can get a higher standard deduction amount if you and or your spouse are 65 years old or older For 2024 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 14 600 Married filing jointly or Qualifying surviving

If you or your spouse were age 65 or older and or blind at the end of the year be sure to claim an additional standard deduction by checking the appropriate boxes for age or blindness on Form The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are and 22 650 for head of household

Download What Is The Senior Standard Deduction For Tax Year 2023

More picture related to What Is The Senior Standard Deduction For Tax Year 2023

New Income Tax Slabs 2023 24 How Much Standard Deduction Can Salaried

https://img.etimg.com/thumb/msid-97775581,width-640,resizemode-4,imgsize-436692/budget-2023-who-can-avail-of-the-standard-deduction-under-the-new-income-tax-regime.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

2021 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-2-1024x1024.png

The IRS has released the standard deduction amounts for the 2024 2025 tax year Find the new rates and information on extra benefits for people over 65 For example in the tax year 2023 if you re single and 65 you can add an extra 1 850 to your Standard Deduction bringing up the total to 15 700 And for 2024 the additional Standard Deduction for single seniors

The standard deduction is increased by 1 850 for any single filer who is age 65 or more at the end of 2023 and by the same amount for a single filer who is blind for a total increase of Standard deductions for 2023 Single 13 850 add 1 850 if age 65 or older Married Filing Separately 13 850 add 1 500 if age 65 or older Married Filing Jointly

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

https://finance.yahoo.com › news

The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are

https://www.kiplinger.com › taxes

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or

Exemption U s 16 Standard Deduction For The Financial Year 2021 22

Tax Rates Absolute Accounting Services

Standard Tax Deduction 2023 All You Need To Know

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

IRS Announces Tax Rates Standard Deduction Amounts And More For Tax

Standard Deduction 2020 Age 65 Standard Deduction 2021

Standard Deduction 2020 Age 65 Standard Deduction 2021

2021 Taxes For Retirees Explained Cardinal Guide

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

California Individual Tax Rate Table 2021 2022 Brokeasshome

What Is The Senior Standard Deduction For Tax Year 2023 - In this article we ll look into what the standard deduction entails for individuals over 65 in 2024 and 2025 how it differs from standard deductions for younger taxpayers and