What Is The Standard Deduction For Medical Expenses 2023 This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

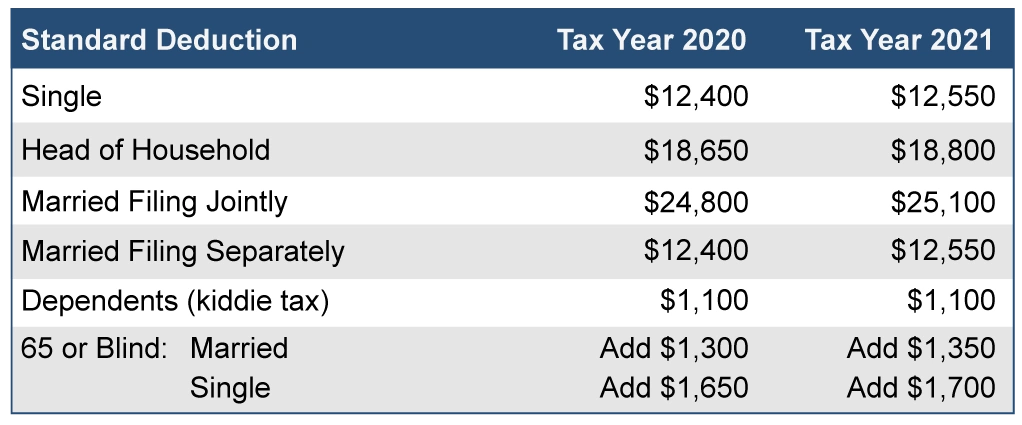

For 2023 the available standard deductions are as follows To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable contributions must be greater than your available standard deduction Yes medical expenses are still tax deductible in 2024 You can deduct the cost of medical and dental care for yourself your spouse and your dependents This deduction is available if you itemize The amount of the deduction is limited to the amount by which your unreimbursed medical expenses exceed 7 5 of your adjusted gross

What Is The Standard Deduction For Medical Expenses 2023

What Is The Standard Deduction For Medical Expenses 2023

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

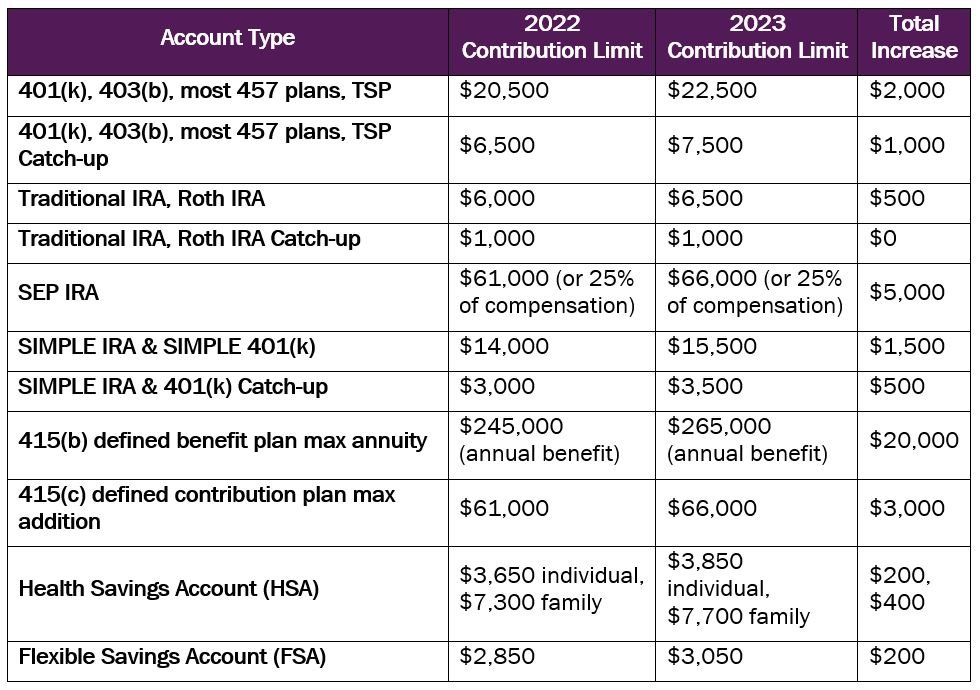

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction The standard deduction for taxpayers who don t itemize their deductions on Schedule A Form 1040 is higher for 2023 than it was for 2022 The amount depends on your filing status You can use the 2023 Standard Deduction Tables near the end of this publication to figure your standard deduction

What is the medical expense deduction If you itemize your deductions each year using Schedule A you might be able to deduct some of the medical including dental expenses you paid For the tax year 2023 which you ll file in 2024 the standard deduction limits are as follows Single or married filing separately 13 850 15 350 if they re at least 65 Married filing jointly or qualifying widow er 27 700

Download What Is The Standard Deduction For Medical Expenses 2023

More picture related to What Is The Standard Deduction For Medical Expenses 2023

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

2020 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-1.jpg

By William Perez Updated on January 12 2023 Reviewed by Eric Estevez In This Article View All Photo sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply Since 7 5 of 70 000 is 5 250 it means your first 5 250 in medical expenses cannot be deducted You can only claim expenses above that threshold So in this example with 8 000 in

Deductible medical expenses may include but aren t limited to the following Amounts paid of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners For those filing head of household the standard deduction will be 20 800 for tax year 2023 up 1 400 from 19 400 amount for tax year 2022 Taxpayers who are blind or at least age 65 can claim an additional standard deduction of 1 500 per person for 2023 up from the 1 400 in tax year 2022 or 1 850 if they are unmarried and not a

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

https://www.irs.gov/publications/p502

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

https://turbotax.intuit.com/tax-tips/health-care/...

For 2023 the available standard deductions are as follows To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable contributions must be greater than your available standard deduction

Tax Rates Absolute Accounting Services

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

2022 Federal Tax Brackets And Standard Deduction Printable Form

2023 Form 1040 Standard Deduction Printable Forms Free Online

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Should You Take The Standard Deduction On Your 2021 2022 Taxes

What Is The Alabama Standard Deduction For 2022 Support

What Is The Standard Deduction For 2021

2023 Standard Deduction The Berkshire Edge

What Is The Standard Deduction For Medical Expenses 2023 - What is the medical expense deduction If you itemize your deductions each year using Schedule A you might be able to deduct some of the medical including dental expenses you paid