What Is The Standard Tax Deduction For 2022 Taxes There are two main types of tax deductions the standard deduction and itemized deductions The IRS allows you to claim one type of tax deduction but not both so you should choose whichever type of deduction gives you the biggest tax reduction Here are the 2022 standard deduction amounts for each filing status

These are the standard deduction amounts for tax year 2022 Married couples filing jointly 25 900 an 800 increase from 2021 Single taxpayers 12 950 a 400 increase from 2021 The standard deduction is below the line and is subtracted from a taxpayer s adjusted gross income AGI Typically taxpayers have two options Take the itemized deductions or take the

What Is The Standard Tax Deduction For 2022 Taxes

What Is The Standard Tax Deduction For 2022 Taxes

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

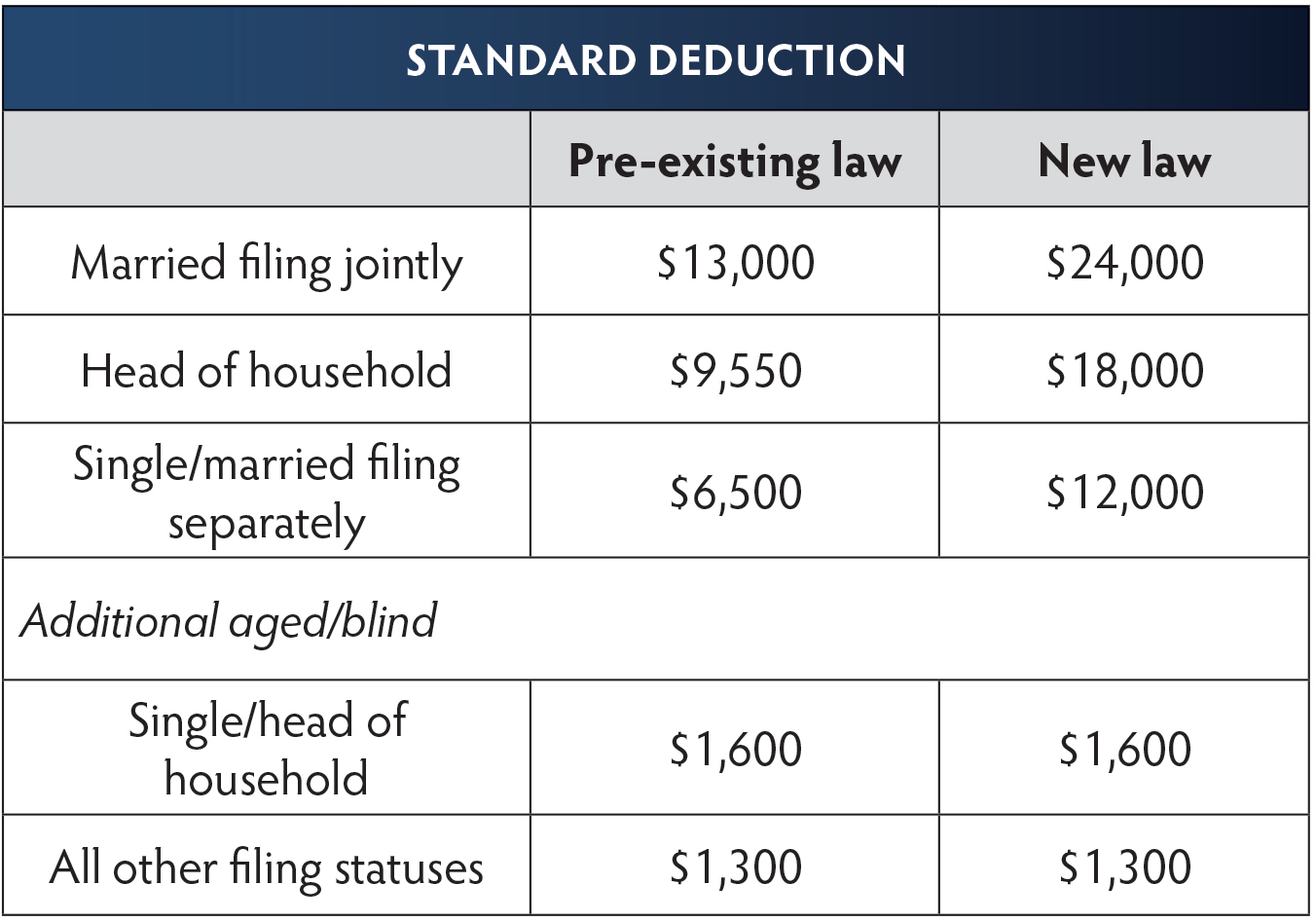

2020 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-1.jpg

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

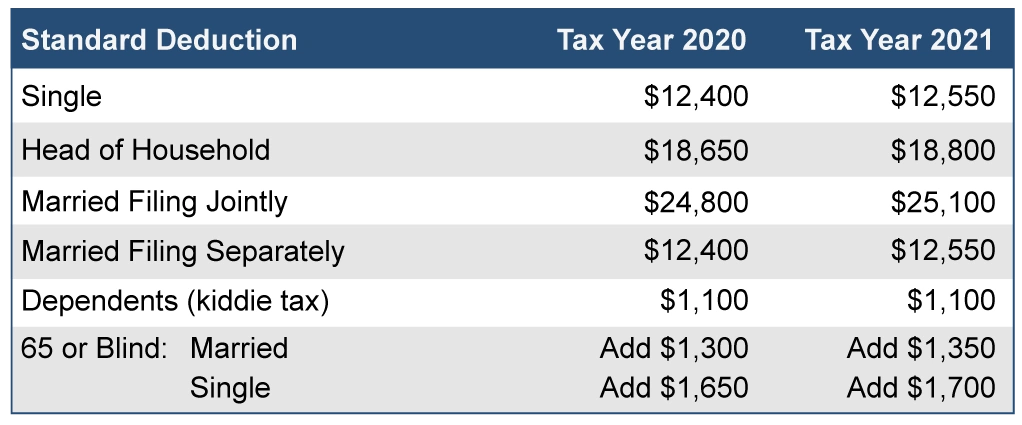

Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600 The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a

Topic no 551 Standard deduction The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income

Download What Is The Standard Tax Deduction For 2022 Taxes

More picture related to What Is The Standard Tax Deduction For 2022 Taxes

IRS Introduces New Tax Brackets Standard Deductions For 2022 WealthMD

https://wealthmd.net/wp-content/uploads/2021/12/2022-Tax-Chart-1024x390-1.jpg

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.ntu.org/Library/imglib/2021/11/2021-22-single-tax-brackets-2-.png

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married individuals filing separately While not life changing every bit helps The new standard deduction for married couples in 2022 will be 25 900 Likewise the maximum contribution to a flexible spending account FSA for

The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a If you can be claimed as a dependent on someone else s tax return your standard deduction for 2022 is limited to the greater of 1 150 or your earned income plus 400 up to the amount of

2020 Tax Deduction Amounts And More Heather

https://specials-images.forbesimg.com/imageserve/5dc2fc6eca425400073c2a95/960x0.jpg?fit=scale

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

https://www.irs.com/en/2022-federal-income-tax...

There are two main types of tax deductions the standard deduction and itemized deductions The IRS allows you to claim one type of tax deduction but not both so you should choose whichever type of deduction gives you the biggest tax reduction Here are the 2022 standard deduction amounts for each filing status

https://money.usnews.com/money/personal-finance/...

These are the standard deduction amounts for tax year 2022 Married couples filing jointly 25 900 an 800 increase from 2021 Single taxpayers 12 950 a 400 increase from 2021

How To Calculate Taxes With Standard Deduction Dollar Keg

2020 Tax Deduction Amounts And More Heather

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Tax Rates Absolute Accounting Services

What Is The Standard Deduction For 2021

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Standard Deduction 2020 Self Employed Standard Deduction 2021

What Is The Standard Tax Deduction For 2022 Taxes - Topic no 551 Standard deduction The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness