What Is The State Sales Tax In Nc 830 rowsNorth Carolina has state sales tax of 4 75 and allows local

General Guidance for a Local Sales and Use Tax Rate Increase File Pay Total General State Local and Transit Rates Tax Rates Effective 10 1 2020 Historical Total General The North Carolina sales tax rate is 4 75 as of 2024 with some cities and counties adding a local sales tax on top of the NC state sales tax Exemptions to the North Carolina

What Is The State Sales Tax In Nc

What Is The State Sales Tax In Nc

https://files.taxfoundation.org/20181016125115/SBTCI-Sales.png

2021 Nc Standard Deduction Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

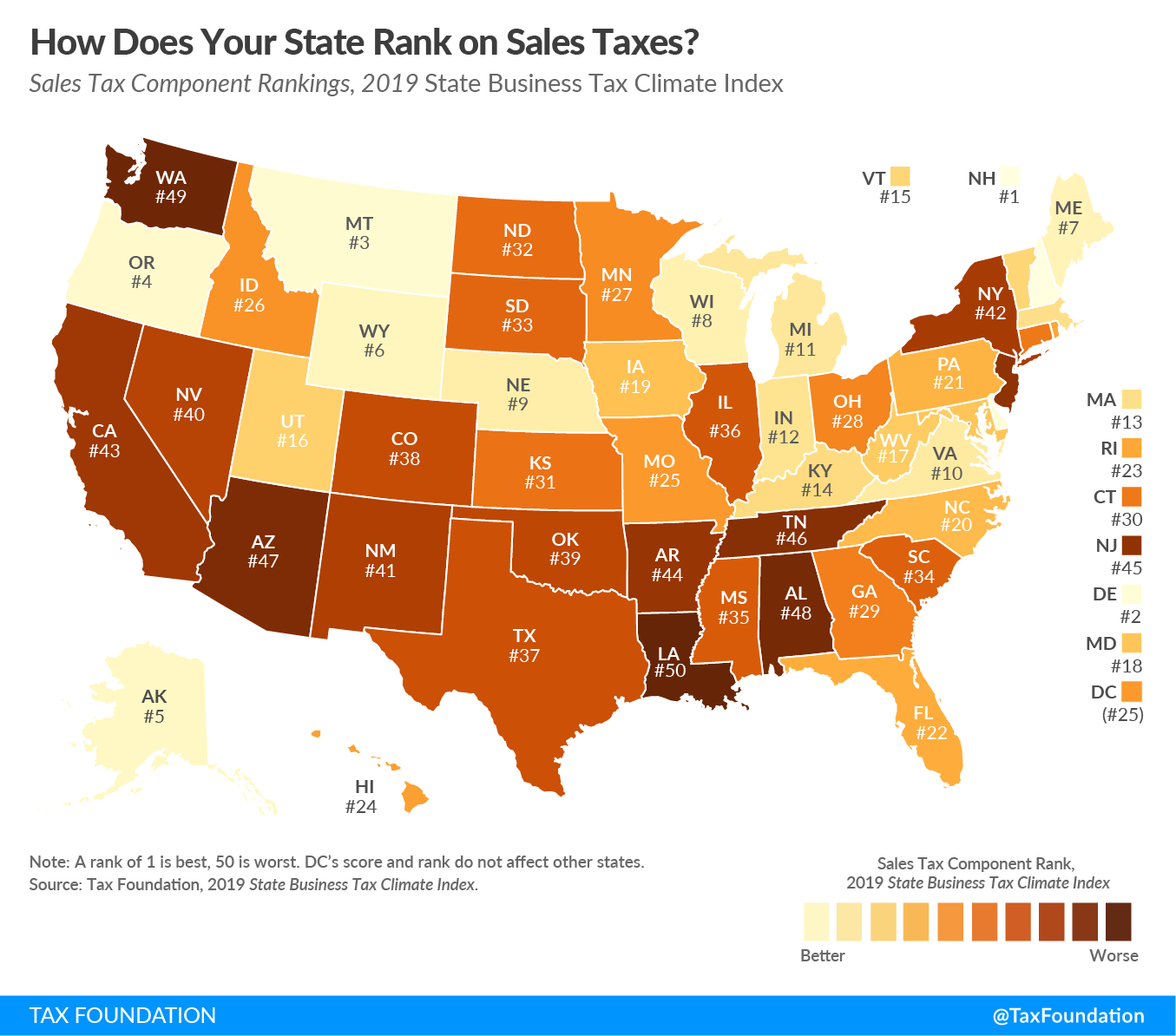

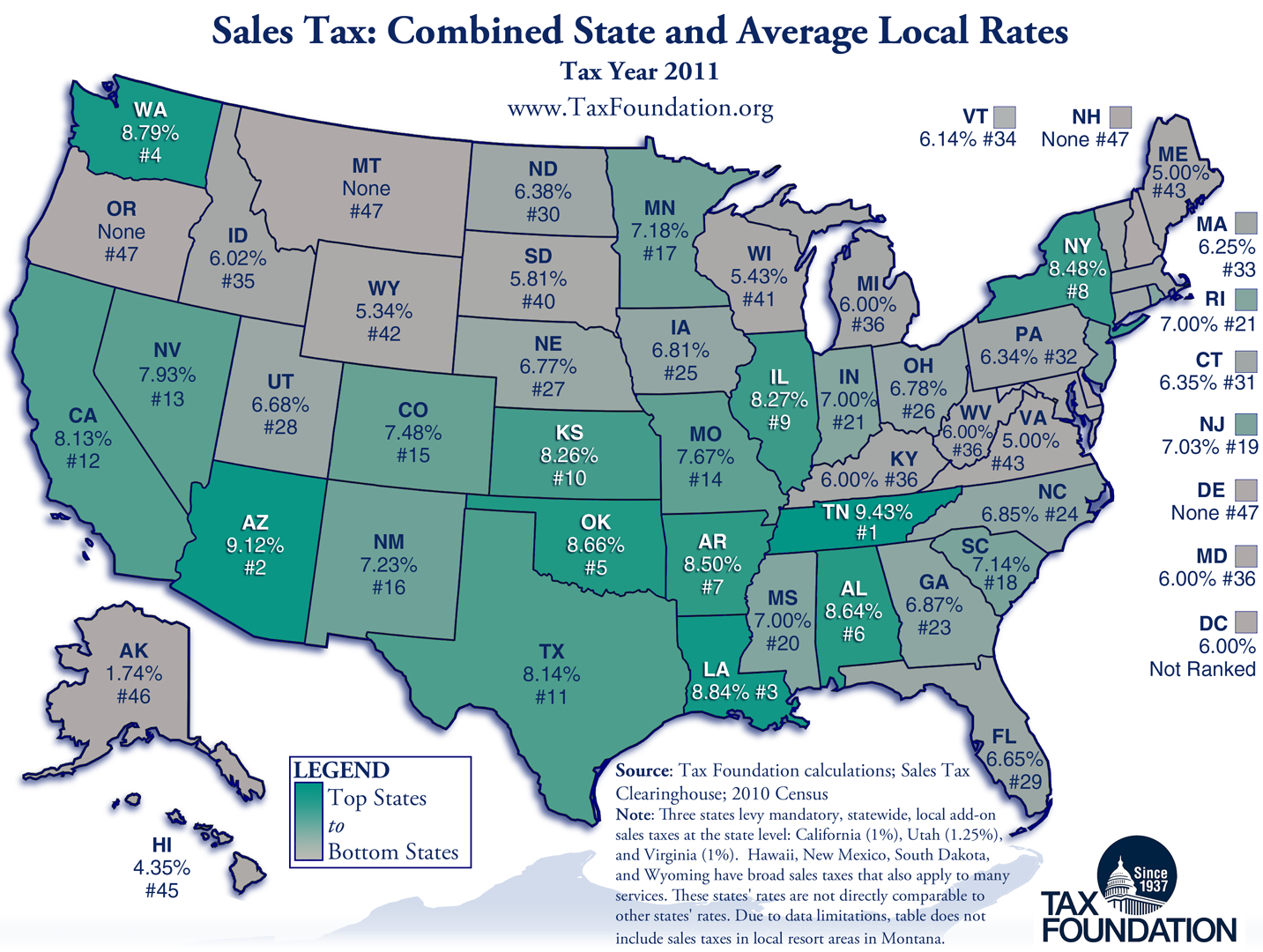

Sales Taxes Per Capita How Much Does Your State Collect

https://files.taxfoundation.org/20180912152946/SalesTaxesPerCapita-2018.png

The base state sales tax rate in North Carolina is 4 75 Local tax rates in North Carolina range from 0 to 2 75 making the sales tax range in North Carolina 4 75 to 7 5 The state sales tax rate in North Carolina is 4 750 With local taxes the total sales tax rate is between 6 750 and 7 500 North Carolina has recent rate changes

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services North Carolina first adopted a general state sales tax in 1933 and since that The North Carolina NC state sales tax rate is currently 4 75 Depending on local municipalities the total tax rate can be as high as 7 5

Download What Is The State Sales Tax In Nc

More picture related to What Is The State Sales Tax In Nc

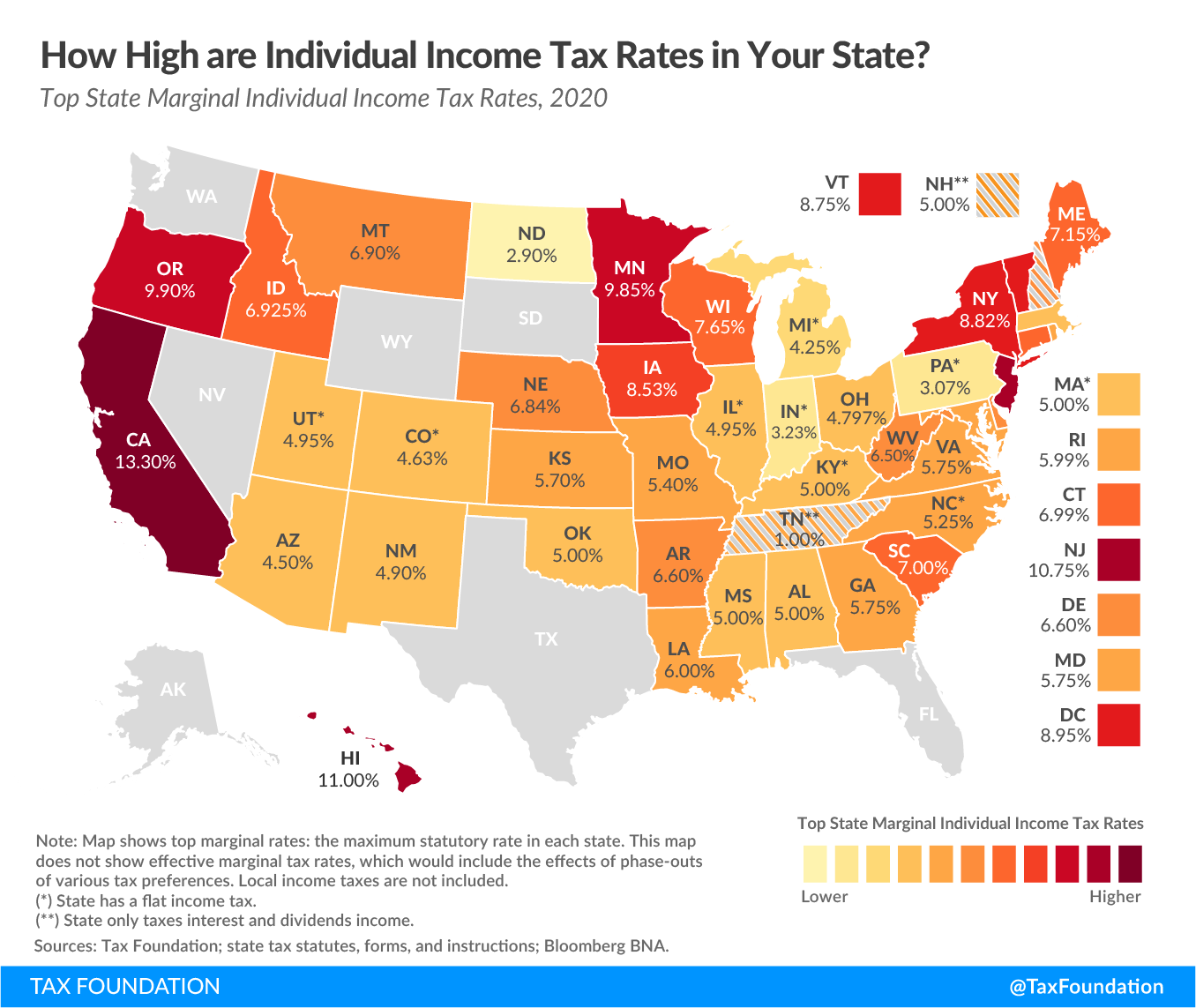

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Sales Tax Hike For Transportation A Regressive Unstable Funding Scheme

https://pagetwo.completecolorado.com/wp-content/uploads/2015/04/2015-02-24-18-53-15-0011.jpg

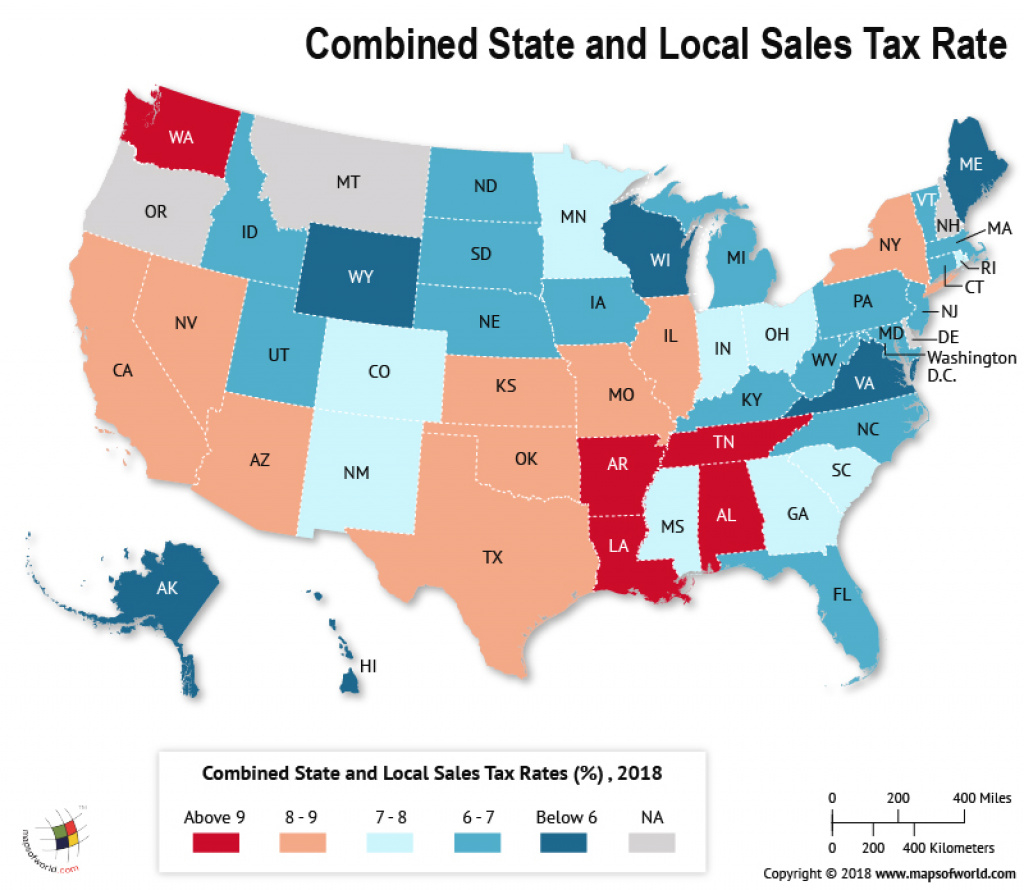

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

https://printablemapforyou.com/wp-content/uploads/2019/03/ranking-state-and-local-sales-taxes-tax-foundation-texas-sales-tax-map.png

The North Carolina state sales tax rate and use tax rate is 4 75 Should you collect sales tax on shipping charges in North Carolina North Carolina considers shipping charges to North Carolina s general state sales tax rate is 4 75 percent Certain items have a 7 percent combined general rate and some items have a miscellaneous rate

Sales and Use Tax Rates Tax Rates Charts Note If you are looking for additional detail you may wish to utilize the Sales Tax Rate Databases which are provided in a comma The state of North Carolina follows what is known as a Destination based sales tax policy This means that long distance sales within North Carolina are taxed

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Interchange Paid On Sales Tax In The US 2022

https://cmspi.com/media/jhnn4nrw/state-sales-tax-01.png

https://www.salestaxhandbook.com/north-car…

830 rowsNorth Carolina has state sales tax of 4 75 and allows local

https://www.ncdor.gov/sales-and-use-tax-rates

General Guidance for a Local Sales and Use Tax Rate Increase File Pay Total General State Local and Transit Rates Tax Rates Effective 10 1 2020 Historical Total General

To What Extent Does Your State Rely On Sales Taxes Upstate Tax

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Filing Taxes In North Carolina Expect These Changes This Year Wcnc

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax By State 2023 Wisevoter

When Did Your State Adopt Its Sales Tax Tax Foundation

When Did Your State Adopt Its Sales Tax Tax Foundation

Sales Tax By State Map Printable Map

States Without Sales Tax Sales Tax Data Link

Sales Taxes In The United States Wikipedia

What Is The State Sales Tax In Nc - The North Carolina NC state sales tax rate is currently 4 75 Depending on local municipalities the total tax rate can be as high as 7 5