What Is The Tax Credit For A Pellet Stove THE FEDERAL 25C TAX CREDIT ON WOOD AND PELLET STOVES CAN SAVE YOU UP TO 2000 How so With the August 16 2022 signing of the Inflation Reduction Act IRA a new

The Federal Biomass Stove 25 C Tax Credit is also known as the Wood and Pellet Heater Investment Tax Credit It s a financial incentive for anyone who installs a highly efficient heating system Beginning in 2023 consumers buying highly efficient wood stoves pellet stoves pellet stove inserts or larger residential biomass heating systems may be eligible to claim a

What Is The Tax Credit For A Pellet Stove

What Is The Tax Credit For A Pellet Stove

https://cdn.shopify.com/s/files/1/0111/6880/9018/articles/Tax_Credit_2021_800x.jpg?v=1625851065

Eco Friendly Range Of Pellet Stoves For The Modern Home

https://cdn.decoist.com/wp-content/uploads/2016/06/Closer-look-at-Curve-Ductable-pellet-stove.jpg

All The Details On The Pellet And Wood Stove Tax Credit Energy Center

https://energycentermanhattanpool.com/wp-content/uploads/2022/07/All-the-Details-on-the-Pellet-and-Wood-Stove-Tax-Credit-1536x864.jpg

As of January 1 st 2023 the new IRS tax code of Sec 25 C allows for a tax credit of up to 30 of the total purchase price and cost of installation of any qualifying pellet stoves with an annual cap of 2 000 Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

Beginning in 2023 consumers buying highly efficient wood or pellet stoves will be able to claim a 30 tax credit capped at 2 000 annually The credit is for appliances installed The Wood Stove Tax Rebate provides homeowners with a financial incentive to purchase and install highly efficient wood or pellet stoves This tax rebate is calculated based on the total cost of the

Download What Is The Tax Credit For A Pellet Stove

More picture related to What Is The Tax Credit For A Pellet Stove

Stove Packages Wood And Pellet Stove Tax Credit

https://oregonwoodstovetaxcredit.com/wp-content/uploads/2022/10/Tax-Credit-Wood-Stove-Package.jpg

Tax Return Options What You Need To Do Now

https://nextventured.com/wp-content/uploads/2020/09/Untitled-1.jpg

Freestanding Pellet Stoves Valley Fire Place Inc

https://images.squarespace-cdn.com/content/v1/53d929d7e4b061e5cde38953/1593533621487-7LVFD3T8441LSFPQK6BA/ke17ZwdGBToddI8pDm48kBpjRO-lExpaTDbNvFBHasJ7gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1UdpT__51d7Ri8R28zNzq37c1l2Jh8DJSFAiJGSeaNoBMYZLJbSswdFBd3g10QNUNwA/Foxfire+Pellet+Stove+2.jpg

Beginning in 2021 if you purchase and install a wood or pellet stove or larger residential biomass heating system with a Thermal Efficiency Rating of at least From January 1 2023 through December 31 2032 taxpayers who install qualifying wood and pellet stoves will receive a 30 tax credit that is capped at 2 000 annually based on the full cost of the unit including

The Inflation Reduction Act of 2022 changed the wood and pellet heater tax credit for calendar years 2023 2032 This federal tax credit covers 30 percent of purchase AND Any customer who has purchased and installed a wood and pellet stove as of January 1 2023 through December 31 2032 will be qualified to claim a 30 tax credit

Pellet Stove Installation Part 2 YouTube

https://i.ytimg.com/vi/4IVHbXlbUDg/maxresdefault.jpg

Tax Form For Self Employed

https://financepart.com/wp-content/uploads/2022/11/Tax-Form-For-Self-Employed.jpg

https://welovefire.com/stoves/the-2024-fed…

THE FEDERAL 25C TAX CREDIT ON WOOD AND PELLET STOVES CAN SAVE YOU UP TO 2000 How so With the August 16 2022 signing of the Inflation Reduction Act IRA a new

https://vanderwallbros.com/understanding-t…

The Federal Biomass Stove 25 C Tax Credit is also known as the Wood and Pellet Heater Investment Tax Credit It s a financial incentive for anyone who installs a highly efficient heating system

Federal Solar Tax Credits For Businesses Department Of Energy

Pellet Stove Installation Part 2 YouTube

Real Estate Agent Inflation Protection

Tax Credit Pellet Stove Information Take Advantage December 2016

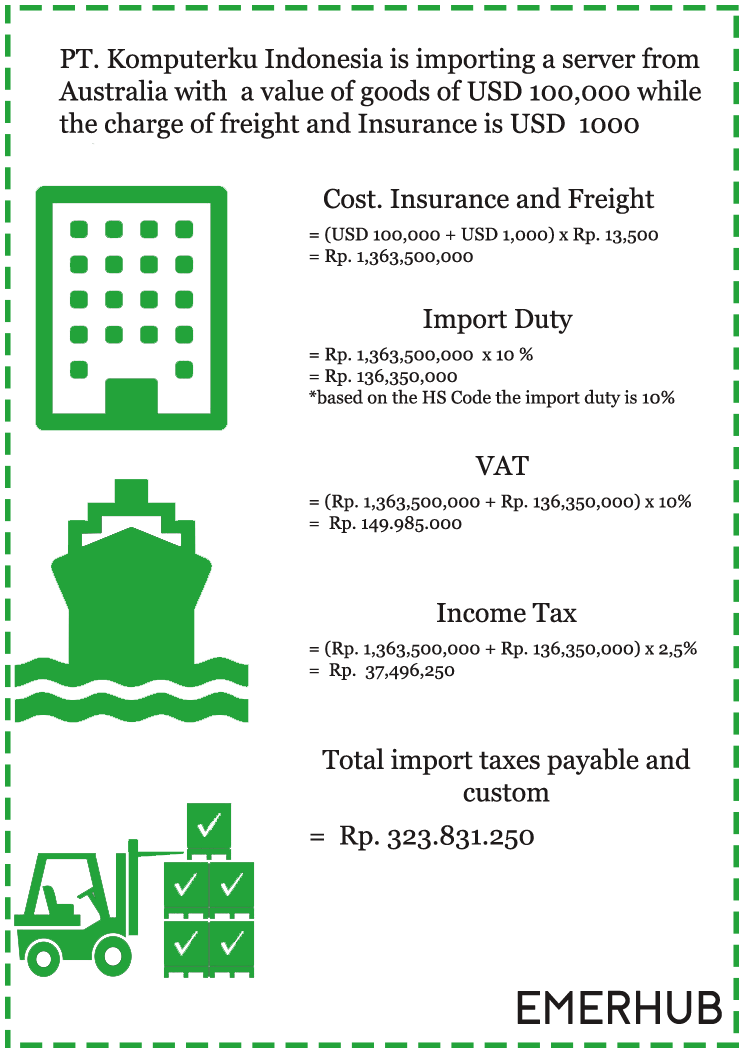

Import Tax Calculator Tax Withholding Estimator 2021

Intro To Econ Macro Topic 8 Fiscal Policy Revision Cards What Is The

Intro To Econ Macro Topic 8 Fiscal Policy Revision Cards What Is The

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credit 2016 For Wood And Pellet Stoves Inserts Pellet Stove

10 Vital Points To Consider When Choosing A Pellet Stove For Your Home

What Is The Tax Credit For A Pellet Stove - What is the Pellet and Wood Stove Tax Credit This legislation provides a significant tax credit for the purchase of qualifying wood and pellet stoves that are highly